AiPrise

13 min read

December 15, 2025

Top 10 KYC Failure Reasons and Their Solutions for 2025-26

Key Takeaways

KYC failures are a growing concern across industries, especially as fraud strategies become more sophisticated. In 2024 alone, U.S. consumers reported losing over $12.5 billion to scams and fraud, a 25% increase year-on-year.

Globally, fraud now eats up nearly 8% of business revenue, with TransUnion estimating $534 billion in losses over the past year.

As fraudsters exploit weak KYC systems using synthetic identities, deepfakes, and automation, the cost of failed identity verification keeps rising.

This blog outlines the top reasons for KYC failure, explores how they impact compliance and customer experience, and provides actionable solutions that businesses can implement to strengthen their verification process in 2025–26.

Key Takeaways

- KYC failure is rising: Poor-quality documents, manual workflows, and outdated systems leave businesses exposed to fraud and compliance risks.

- Fraud tactics are changing: Synthetic identities, deepfakes, and AI-driven manipulation make traditional verification methods insufficient.

- Process matters: Complicated onboarding, technical glitches, and missing data increase failure rates and frustrate customers.

- Global compliance is critical: International KYC and CDD regulations shape verification standards; gaps can trigger penalties and reputational damage.

- AI-driven solutions work: Platforms like AiPrise unify identity verification, fraud detection, and risk scoring to reduce KYC failure, speed onboarding, and protect businesses globally.

What Is KYC Failure and Why Does It Matter?

KYC failure occurs when a customer’s identity cannot be successfully verified during the onboarding process. This usually happens due to poor-quality documents, incorrect information, technical errors, or strict compliance rules that flag genuine users as suspicious.

When a verification attempt fails, the customer cannot move forward, leading to delays, drop-offs, and compliance risks for the business.

KYC failure has a serious impact on businesses. It can:

- Increase fraud & risk scoring: Failed checks may allow suspicious users or fraudulent identities to slip through weaker verification layers.

- Slow down onboarding: Customers often drop off when they have to resubmit documents or repeat multiple verification steps.

- Create compliance gaps: Incomplete or failed checks can lead to violations of AML, KYB (Know Your Business), and KYC (Know Your Customer) regulations, resulting in penalties.

- Harm user experience: Frequent failures frustrate customers, affecting trust and conversion rates.

When businesses address these issues early, they can reduce friction, improve accuracy, and stay compliant across global regulations.

This is where AiPrise makes KYC effortless and secure. With a single platform, you can verify customer identities, detect fraud, and stay compliant globally, all in real time. Try One Click KYC now.

To see how these failures happen, let’s examine the major causes of KYC failure and ways to address them.

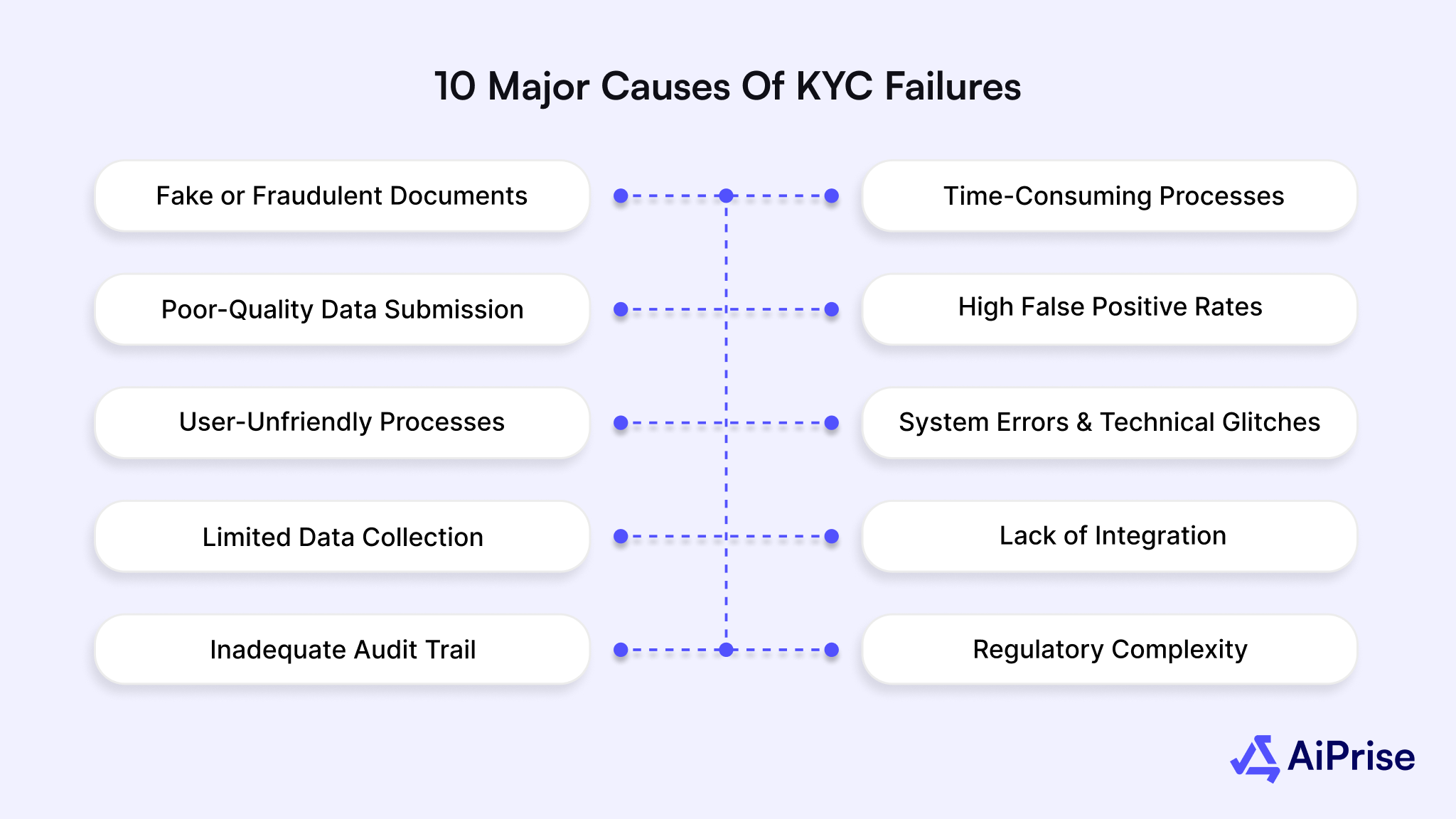

10 Major Causes of KYC Failures and Practical Solutions

KYC failures are often the result of gaps in identity verification, flawed workflows, or outdated compliance practices.

As fraud tactics grow more sophisticated and regulations change, businesses must reinforce their verification systems to avoid compliance breaches and financial risks.

Here are 10 common reasons for KYC breakdowns, along with practical solutions to help businesses stay compliant and secure.

1. Fake or Fraudulent Documents

Businesses today are dealing with a sharp rise in high-quality forged documents and synthetic identities. Fraudsters now use advanced editing tools to mimic government IDs, alter metadata, and create digital copies that appear entirely authentic to basic verification systems.

Why This Causes KYC Failure:

- Manual reviews or simple OCR tools often miss subtle edits or tampering.

- Verification systems fail to detect manipulated fonts, metadata changes, or synthetic document images.

- Forged documents can slip through onboarding without triggering alerts.

What Makes It Worse:

- AI-powered editing tools generate clean, realistic ID copies that hide manipulation.

- Synthetic identity kits are easily accessible online.

- Professionally built document templates bypass first-level verification checks.

How to Fix This Effectively:

- You can address this by using an AI-driven document verification system that checks metadata, identifies fake IDs, validates security features, and performs liveness detection during capture.

- Pair this with automated cross-checks against trusted databases to confirm authenticity.

- Add this layer at the earliest stage of onboarding so high-risk files are flagged immediately.

- Route suspicious submissions to a manual review queue, and retrain your detection models regularly with new fraud patterns to keep accuracy strong.

Also Read: Principles, Assessment, And Strategies In Fraud Risk Management

2. Manual and Time-Consuming Processes

Many institutions still depend heavily on manual workflows for identity verification, which slows onboarding, creates inconsistencies, and increases the risk of human errors.

Why This Causes KYC Failure:

- Slow review cycles allow risk signals to slip by unnoticed.

- Teams get overwhelmed during peak onboarding periods and rush through checks.

- Identity assessments vary from one reviewer to another, leading to inconsistent outcomes.

What Makes It Worse:

- Spreadsheet-driven workflows that require constant manual updates.

- Systems that cannot communicate or sync data in real time.

- Limited team capacity for detailed high-risk evaluations.

How to Fix This Effectively:

- You can solve this by automating repetitive ID checks, sanctions screening, exception handling, and case routing through a unified workflow system.

- A centralized dashboard helps track verification progress and ensures consistent processing.

- Integrate every step of the KYC process into a single connected flow so reviews move smoothly without manual handoffs.

- Provide quick training sessions to help teams transition comfortably to automated processes and maintain efficiency during the shift.

3. Incomplete or Poor-Quality Data Submission

Organizations struggle with stalled onboarding because customers upload unclear images, skip required fields, or submit details that don’t match their documents. These gaps interrupt verification and increase failure rates.

Why This Causes KYC Failure:

- Blurry or partially visible images make it difficult for systems to read and extract information.

- Missing inputs lead to repeated back-and-forth requests.

- Incorrect or inconsistent data triggers unnecessary alerts.

What Makes It Worse:

- Platforms without instant validation allow poor uploads to move forward.

- Users aren’t guided on how to take proper document photos.

- Glare, shadows, and low-resolution camera quality reduce document clarity.

How to Fix This Effectively:

- Combine this with smart form prompts that immediately point out missing or incorrect details.

- Include on-screen guidance through examples or tips so users know exactly how to upload acceptable documents.

- You can improve this by adding real-time quality checks that detect glare, blur, and framing issues while auto-cropping the document.

- Give users the option to retry uploads in the same session to avoid unnecessary drop-offs and maintain a smooth onboarding journey.

4. High False Positive Rates

KYC screening systems often generate too many alerts, overwhelming compliance teams and making it difficult to focus on genuinely risky customers. This situation slows down onboarding and increases the risk that real threats may be overlooked.

Why This Causes KYC Failure:

When low-risk alerts consume time and resources, teams may miss actual warning signs. Continuous alert fatigue can reduce consistency in risk assessment and increase the likelihood of errors.

What Makes It Worse:

- Static, rule-based systems often flag harmless activity, creating unnecessary work.

- Outdated watchlists fail to capture emerging risks.

- Systems that do not incorporate behavioral insights tend to produce inefficient risk scores.

How to Fix This Effectively:

- You can address this issue by implementing adaptive, machine learning–driven risk models that adjust scoring based on customer behavior and historical trends.

- A tiered alert system should prioritize genuinely risky cases while automating the handling of low-risk alerts.

- Regularly fine-tune alert thresholds and incorporate analyst feedback to improve model accuracy and reduce false positives continually.

5. Complicated and User-Unfriendly Processes

Onboarding processes that are confusing or difficult to use can cause users to abandon the workflow, submit incorrect information, or repeatedly make errors. These issues reduce conversion rates and compromise the effectiveness of KYC procedures.

Why This Causes KYC Failure:

- Complex forms can confuse customers and result in incomplete or inaccurate submissions.

- Lengthy verification steps increase the likelihood of users abandoning the process.

- Poorly designed interfaces may lead to incorrect document uploads and further delays.

What Makes It Worse:

- Non-responsive designs on mobile devices frustrate users and create additional obstacles.

- Asking for the same information multiple times increases friction and user dissatisfaction.

- A lack of guidance or support during onboarding leaves users unsure about the correct steps to follow.

How to Fix This Effectively:

- You can address these challenges by designing a mobile-first onboarding flow with clear, step-by-step instructions.

- Integrate auto-fill features from scanned documents to reduce manual entry errors.

- Conduct usability tests to ensure the process is intuitive, display only essential fields at each stage, and provide live chat or automated support for users who encounter difficulties.

6. System Errors and Technical Glitches

Technical failures can disrupt the entire KYC process, leading to incomplete submissions, lost data, and delays that affect KYC compliance process and customer experience.

Why This Causes KYC Failure:

Server downtime interrupts verification, preventing users from completing onboarding. API failures can halt data retrieval from key systems. Glitches may corrupt customer records or result in missing information.

What Makes It Worse:

- Legacy systems often struggle to handle high volumes of verifications.

- Weak monitoring systems fail to detect issues early, prolonging downtime.

- Unstable integrations between third-party tools increase the risk of errors and inconsistencies.

How to Fix This Effectively:

- You can overcome these challenges by adopting a cloud-based verification infrastructure with high uptime reliability.

- Implement error monitoring dashboards and automated API testing to catch problems before they escalate.

- Perform load and stress tests before scaling, maintain version control across all connected tools, and set up automated alerts for quick response to technical issues

7. Limited Data Collection for Risk Assessment

Relying solely on basic identity details rarely gives a complete understanding of a customer’s risk. Businesses need richer insights from multiple sources to effectively spot suspicious activity and prevent fraud.

Why This Causes KYC Failure:

Minimal data results in weak risk scoring, making it harder to identify high-risk individuals. Subtle patterns of suspicious behavior remain unnoticed. Fraudsters can exploit shallow profiling to bypass verification.

What Makes It Worse:

- Systems that gather only static personal information miss critical dynamic signals.

- Device intelligence, geolocation data, and behavioral patterns are often not analyzed.

- Continuous monitoring of user activity is frequently absent.

How to Fix This Effectively:

- Address this by incorporating risk enrichment using IP addresses, devices, behavior patterns, and location data.

- Track transaction activity over time to uncover anomalies.

- Merge structured and unstructured data sources and implement ongoing, privacy-compliant monitoring with enrichment APIs to get a comprehensive risk profile.

Also Read: 17 Tips For Identity Theft Protection And Prevention

8. Lack of Integration With Global Databases

Cross-border customer verification becomes difficult when businesses lack access to comprehensive and current international datasets. This gap can expose companies to compliance risks and missed fraud detection opportunities.

Why This Causes KYC Failure:

Using outdated lists increases the chance of overlooking sanctioned individuals or high-risk entities. Fraud patterns originating abroad may go undetected. Verification across multiple jurisdictions can remain fragmented and inconsistent.

What Makes It Worse:

- Relying on local or regional databases limits the scope of checks.

- Manual updates slow down the screening process and can introduce errors.

- Systems that fail to synchronize internally create gaps in verification coverage.

How to Fix This Effectively:

- Integrate global sanctions, PEP, and criminal record databases along with cross-border fraud intelligence systems.

- Use APIs that automatically refresh data to maintain accuracy in real time.

- Regularly verify data consistency across internal systems and periodically evaluate database providers to ensure full and reliable coverage.

9. Inadequate Audit Trail and Data Management

Maintaining thorough and tamper-proof records is critical for compliance audits. Gaps in record-keeping can expose businesses to regulatory penalties and operational risks.

Why This Causes KYC Failure:

Fragmented storage can result in lost or misplaced documents. Missing logs make it difficult to demonstrate regulatory adherence. Weak access controls create potential security vulnerabilities.

What Makes It Worse:

- Reliance on paper-based verification slows down processes and increases errors.

- Data scattered across multiple systems lacks cohesion.

- Manual record-keeping is inconsistent and prone to mistakes.

How to Fix This Effectively:

- Implement a centralized system with secure document storage and timestamped logs.

- Apply role-based access controls to protect sensitive information.

- Automate document storage and logging, identity proofing, conduct regular audits to ensure data integrity, and establish clear retention policies for compliance teams.

10. Regulatory Complexity and Frequent Policy Changes

The financial and digital identity sectors are constantly evolving, and regulations can change rapidly. Businesses that fail to keep their KYC procedures up to date risk non-compliance and operational setbacks.

Why This Causes KYC Failure:

Internal workflows may become outdated. Teams might unintentionally follow old procedures. Multi-country operations can encounter conflicting regulatory requirements.

What Makes It Worse:

Lack of centralized rule management slows adaptation. Delayed internal updates leave teams behind on compliance. Limited compliance resources make it difficult to track all changes effectively.

How to Fix This Effectively:

- Use systems that automatically update rule libraries to reflect the latest regulations.

- Configure KYC requirements according to the specific market or jurisdiction.

- Appoint a compliance lead to monitor regulatory changes, conduct periodic audits, and maintain standardized SOPs with version control.

Secure your onboarding process and reduce KYC failures with AiPrise, a reliable AI-powered verification platform. Start verifying identities accurately and efficiently today.

To fully understand KYC failure, it’s essential to consider international rules and regulations that shape verification standards.

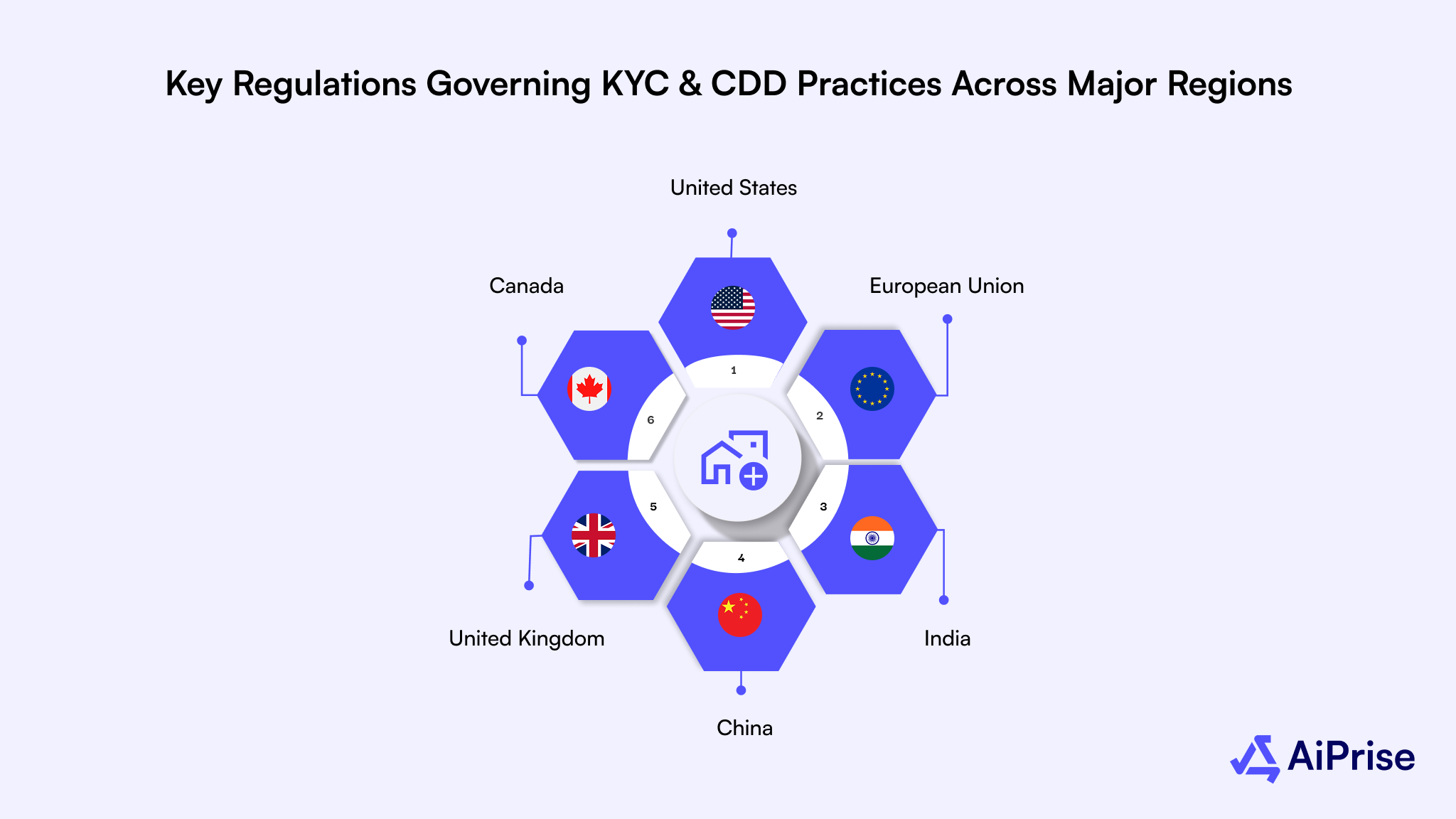

How International KYC Rules Impact KYC Failure?

International regulations on KYC and CDD play a major role in preventing KYC failure. When businesses do not follow these rules, they face higher risks of failed verification, compliance breaches, financial penalties, and reputational damage.

Understanding these global standards helps companies avoid errors that often lead to KYC failure and ensures their onboarding process stays compliant.

Below are key regulations that influence how KYC and CDD must be handled across major regions.

1. United States

The Bank Secrecy Act (BSA) and the USA PATRIOT Act require strict Customer Identification Programs and detailed due diligence. Failure to follow these rules commonly results in KYC failure, high penalties, and mandatory reporting actions.

2. European Union

The Fourth and Fifth Anti Money Laundering Directives focus on enhanced checks for high-risk customers, including PEPs and beneficial owners. Missing these checks is a major cause of KYC failure for businesses operating in EU regions.

3. India

The RBI Master Direction on KYC outlines rules for customer verification, including the use of V CIP for remote onboarding. Inaccurate document checks or gaps in V CIP procedures often lead to KYC failure for financial institutions.

4. China

China’s Anti-Money Laundering Law requires financial institutions to verify identities and maintain detailed transaction records. Incomplete data storage or weak due diligence can create a compliance KYC failure.

5. United Kingdom

The Money Laundering Regulations 2017 require businesses to verify customer identities and assess the purpose of each business relationship. Failure to verify beneficial owners or risk profiles commonly leads to KYC failure.

6. Canada

The Proceeds of Crime and Terrorist Financing Act requires KYC procedures, ongoing monitoring, and mandatory reporting to FINTRAC. Missing suspicious activity reports or weak monitoring workflows often result in KYC failure.

How AiPrise Can Help Prevent KYC Failure?

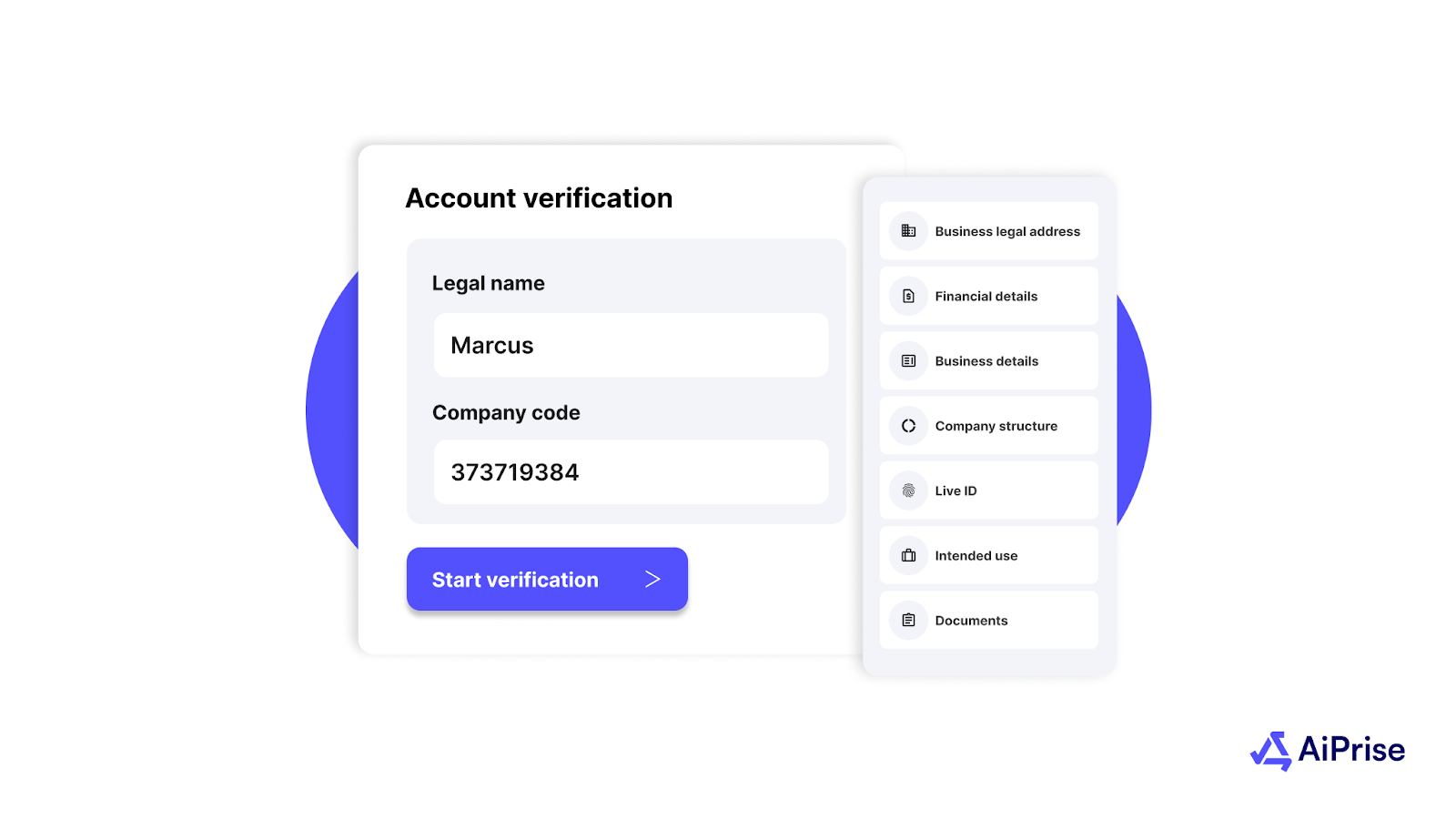

AiPrise helps businesses reduce KYC failure by delivering fast, accurate, and automated verification. With AI-powered checks across KYC, KYB, and AML, companies can avoid common errors that lead to failed onboarding, fraud risks, and compliance issues.

- Global Document Verification: AiPrise verifies 12,000 plus global ID documents in under 30 seconds and spots forged, expired, or tampered documents. These issues are among the most common causes of KYC failure.

- Liveness Verification: Spoofing attempts and deepfake attacks often trigger automated KYC failure. AiPrise uses liveness checks to confirm real user presence and block fraudulent submissions.

- 1:N Face Match: Duplicate accounts and synthetic identities are major contributors to KYC failure. AiPrise identifies and stops these issues by matching each face across your entire database.

- Watchlist Screening: Missing a PEP or sanctions match can lead to serious AML and KYC failure. AiPrise screens users against global watchlists and adverse media in real time to spot high-risk profiles.

- Fraud and Risk Scoring: Undetected fraud signals can cause post-onboarding KYC failure. AiPrise uses AI-based scoring to highlight unusual patterns and risky behaviour early.

- Step Up KYC: Inconsistent verification levels often create regulatory KYC failure. AiPrise supports risk-based workflows that switch between basic checks, advanced checks, or enhanced due diligence based on user risk.

- Case Management: Slow reviews and manual handling increase operational KYC failure. AiPrise automates case tracking, reviews, and escalation to keep the onboarding process smooth and timely.

Final Thoughts

KYC failures are more than simple process mistakes; they can weaken your defense against financial crimes. When verification steps are missed or customer details are inaccurate, the risks increase, and compliance gaps begin to surface.

By addressing these failure points and strengthening your KYC workflow, you improve security, protect your reputation, and maintain the trust your customers place in your business.

Do not let verification errors or compliance issues expose your organization to unnecessary risks. With our advanced KYC solutions, you can streamline screening, fix gaps, and maintain full regulatory compliance. Book A Demo to learn how our technology can reinforce your verification process and safeguard your business.

FAQs

1. What causes most KYC failures?

Most KYC failures happen due to poor-quality documents, incorrect information, system errors, or strict verification rules that flag genuine users as suspicious.

2. Is document quality the main reason for KYC failure?

Yes, low-quality or unclear documents are one of the most common reasons. Blurry images, glare, cut-off text, or expired IDs often lead to automatic rejection.

3. How does automation help reduce KYC failure rates?

Automation reduces manual errors, improves accuracy, and ensures faster decision-making. It also helps detect fraud using AI-based checks that older systems often miss.

4. Do KYC failures affect onboarding success?

Yes, frequent KYC failures increase drop-offs during onboarding. Users become frustrated when they have to resubmit documents or repeat verification steps.

5. Can businesses prevent KYC failures with better tools?

Yes, adopting advanced KYC systems with real-time validation, fraud detection, and global data coverage helps businesses reduce failure rates and improve verification success.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

Speed Up Your Compliance by 10x

Automate your compliance processes with AiPrise and focus on growing your business.

.jpeg)

.jpg)

.jpeg)

.png)

.png)