AiPrise

12 mins read

July 31, 2025

Addressing KYC Challenges in Fragmented Identity Verification

Key Takeaways

Fraud in the financial sector is evolving rapidly, fueled by advances in artificial intelligence and increasingly sophisticated tactics. An AuthenticID report reveals a staggering 32% increase in AI-powered fraud incidents, with 46% of financial institutions experiencing a rise in deepfake-related fraud attempts over the past year. These alarming trends expose a critical vulnerability in modern Know Your Customer (KYC) processes: fragmented identity signals.

When customer identity data is scattered across disparate platforms and inconsistent sources, KYC systems struggle to create complete, accurate profiles. This fragmentation creates significant blind spots, undermining fraud prevention efforts and heightening compliance risks.

In turn, businesses face costly operational inefficiencies, regulatory penalties, and degraded customer trust.

In this blog, we will unpack the nature of fragmented identity signals within KYC, explore the operational and security challenges they introduce, and discuss effective strategies to unify and strengthen the identity verification process.

Key Takeaways

- Fragmented identity signals occur when identity data is scattered across different sources, making it difficult to verify and maintain accurate customer profiles.

- This fragmentation leads to increased fraud risks, compliance challenges, and a poor customer experience due to delays and errors in identity verification.

- Overcoming these challenges requires using AI-driven solutions, automating processes, and integrating data from multiple trusted sources to ensure accurate and real-time verification.

- AiPrise helps businesses streamline their KYC process by unifying data sources and offering scalable, automated verification solutions.

Understanding Fragmented Identity Signals

KYC fragmented identity signals refer to incomplete, inconsistent, or disconnected pieces of identity data that businesses rely on for verifying customer identities. These signals can come from multiple sources, such as online profiles, physical documentation, and biometric data. Often, these signals fail to align or provide a consistent picture of an individual’s or a business's identity.

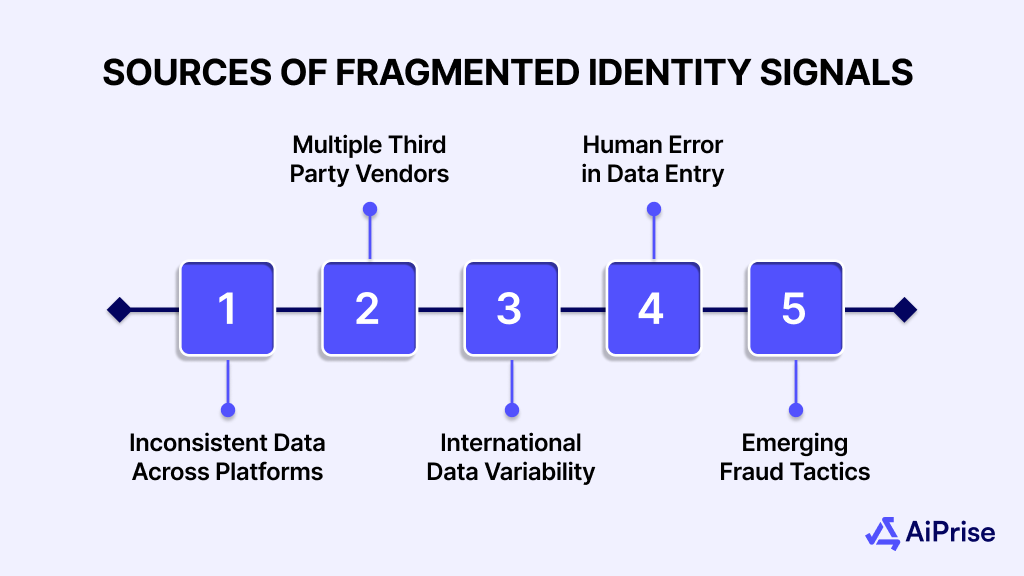

Some common sources of fragmented identity signals include:

- Inconsistent Data Across Platforms

Data about an individual might be stored differently across various systems, making it challenging to match and validate the information correctly. For example, a person's address might be spelled slightly differently on different platforms, or a name could be listed with different abbreviations or titles.

Such variations create fragmented identity signals that increase the risk of errors, redundant checks, and delays during the KYC process. This challenge is common in organizations with multiple data repositories or disconnected systems handling identity information. - Multiple Third-Party Vendors

Businesses often rely on various vendors for different parts of the verification process, such as document scanning, biometrics, and watchlist screening. When these systems don’t communicate effectively, it results in fragmented signals that are hard to reconcile and may lead to delays or inaccuracies in identity verification.

Moreover, managing multiple vendors compounds operational complexity, including handling varying data formats, disparate compliance certifications, and differing update cycles for regulatory requirements. Lack of integration also raises security concerns because data flows across multiple channels, potentially increasing the attack surface for fraudsters targeting weaker links. - International Data Variability

Identity data standards and regulations differ significantly across borders. For instance, while one country may issue a national ID with specific required fields, another might rely on passports or driver’s licenses that capture different data points. This variance can result in fragmented identity signals when verifying global customers.

For example, Germany requires a live video interview as part of identity verification, Brazil mandates CPF validation against federal databases, India uses Aadhaar for eKYC, and the UK commonly includes proof of address as a mandatory element in the onboarding flow. Such diverse regulatory and data requirements complicate creating a consistent verification process across markets. - Human Error in Data Entry

Manual input of identity data often introduces mistakes such as typos, incorrect fields, or inconsistent formatting. These inaccuracies fragment identity signals and increase the difficulty of verifying customers accurately. The risk grows with large data volumes or when onboarding speed is prioritized, ultimately delaying the KYC process and raising the chance of compliance issues. - Emerging Fraud Tactics

Fraudsters often exploit fragmented identity signals by using synthetic or manipulated data, which can easily slip through verification systems if the signals aren't properly cross-checked. This poses a significant risk to businesses as they attempt to rely on fragmented data for identity verification.

This vulnerability highlights the need for integrated, multi-layered verification systems that can detect and counter sophisticated fraud tactics effectively.

The fragmented nature of identity data can significantly delay the verification process, frustrating customers and possibly leading to abandonment of the process. In the context of global markets, this becomes even more complicated, as differing formats, regulations, and systems complicate the reconciliation of data sources.

That's why it becomes essential that you are aware of the challenges that come with fragmented identity verification.

Challenges Posed by Fragmented Identity Verification

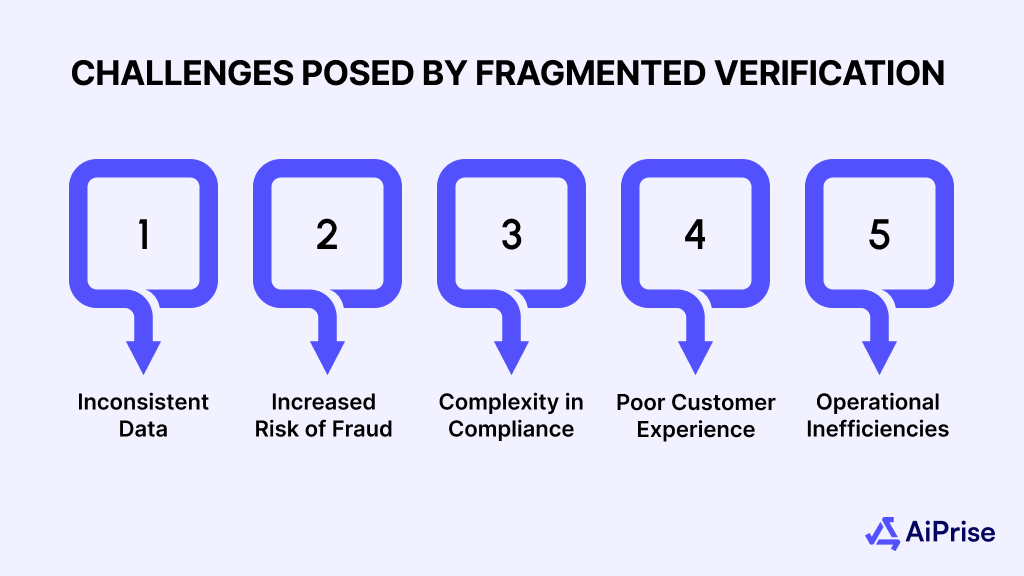

Fragmented identity signals create significant hurdles for businesses when it comes to managing KYC processes. They complicate the ability to verify customer identities accurately and efficiently, and can lead to multiple challenges as mentioned below:

- Inconsistent and Outdated Data

Identity data often comes from diverse sources, with each using different formats, standards, and validation criteria. This inconsistency can lead to mismatched data and errors in verification. Moreover, much of the data may be outdated, making it hard for businesses to ensure that their KYC processes reflect current, accurate information.

Stale or inaccurate data could lead to false positives, where legitimate customers are flagged for further review simply because the data they provided doesn't match outdated records. - Increased Risk of Fraud and Identity Theft

The more fragmented the identity signals, the higher the likelihood of fraudulent activities slipping through the cracks. Fraudsters can manipulate incomplete or inconsistent data to create synthetic identities or evade detection. This poses a significant risk, especially when businesses fail to cross-reference the fragmented signals effectively.

Fragmented identity verification processes can inadvertently provide gaps for criminals to exploit, especially when businesses rely on static, less dynamic data sources. - Complexity in Global Compliance

Global KYC requirements are diverse, with each jurisdiction having its own rules, regulations, and data requirements. For example, some countries require face matching or liveness checks, while others rely on document scans or database lookups. Fragmented identity data complicates efforts to comply with these varied requirements.

Inconsistent identity signals across regions or data providers make it difficult to create a streamlined process that can meet both local and international standards. This increases the operational burden on businesses and often results in delays or failure to meet compliance standards. - Poor Customer Experience and Increased Friction

Fragmented identity verification creates friction for customers. When systems fail to sync properly, legitimate customers can face delays or even fail to pass verification altogether. This leads to frustration, especially when manual reviews are required to clear up discrepancies.

The result is a poor user experience that can cause customers to abandon the verification process entirely. This is particularly harmful in industries like fintech, where ease of onboarding is critical to customer acquisition. - Operational Inefficiencies and Increased Costs

Fragmented identity verification systems require businesses to use multiple vendors or technologies, each with its own data model. This creates additional complexity, as companies need to maintain various integrations, contracts, and compliance systems. This fragmentation drives up costs and increases the operational overhead of managing identity verification across multiple platforms.

Without a unified system, businesses also face challenges in assessing and reporting on KYC outcomes, making audits and performance analysis more difficult. Let's explore how you, as a business, can overcome the challenges of a fragmented identity.

How Businesses Can Overcome Fragmented Identity Signals

Fragmented identity signals can create numerous challenges for businesses, but there are effective strategies and technologies available to mitigate these issues. By integrating advanced solutions, businesses can improve the accuracy and efficiency of their identity verification processes, while reducing the risk of fraud and enhancing customer experience.

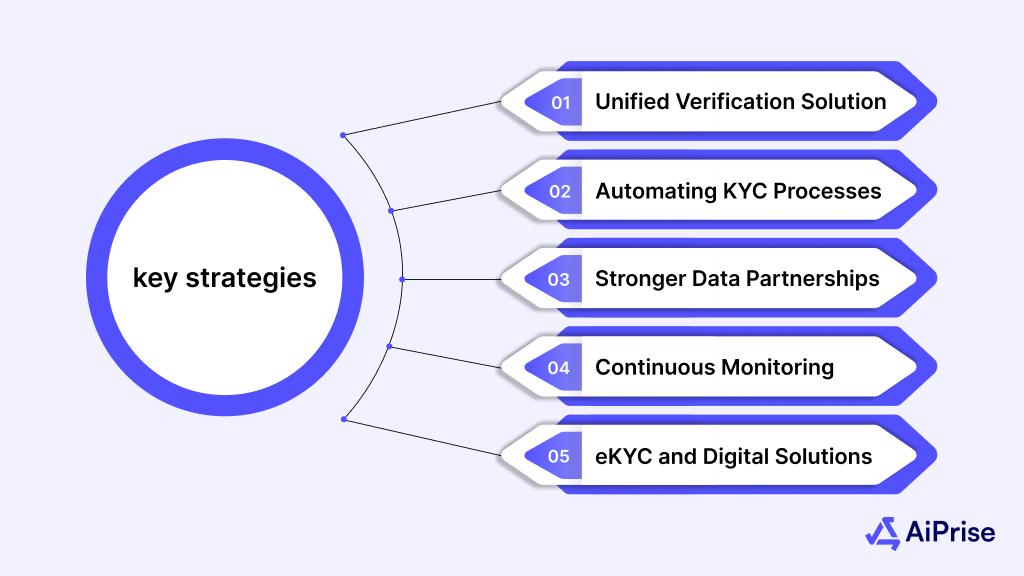

Here are some key strategies for overcoming fragmented identity signals:

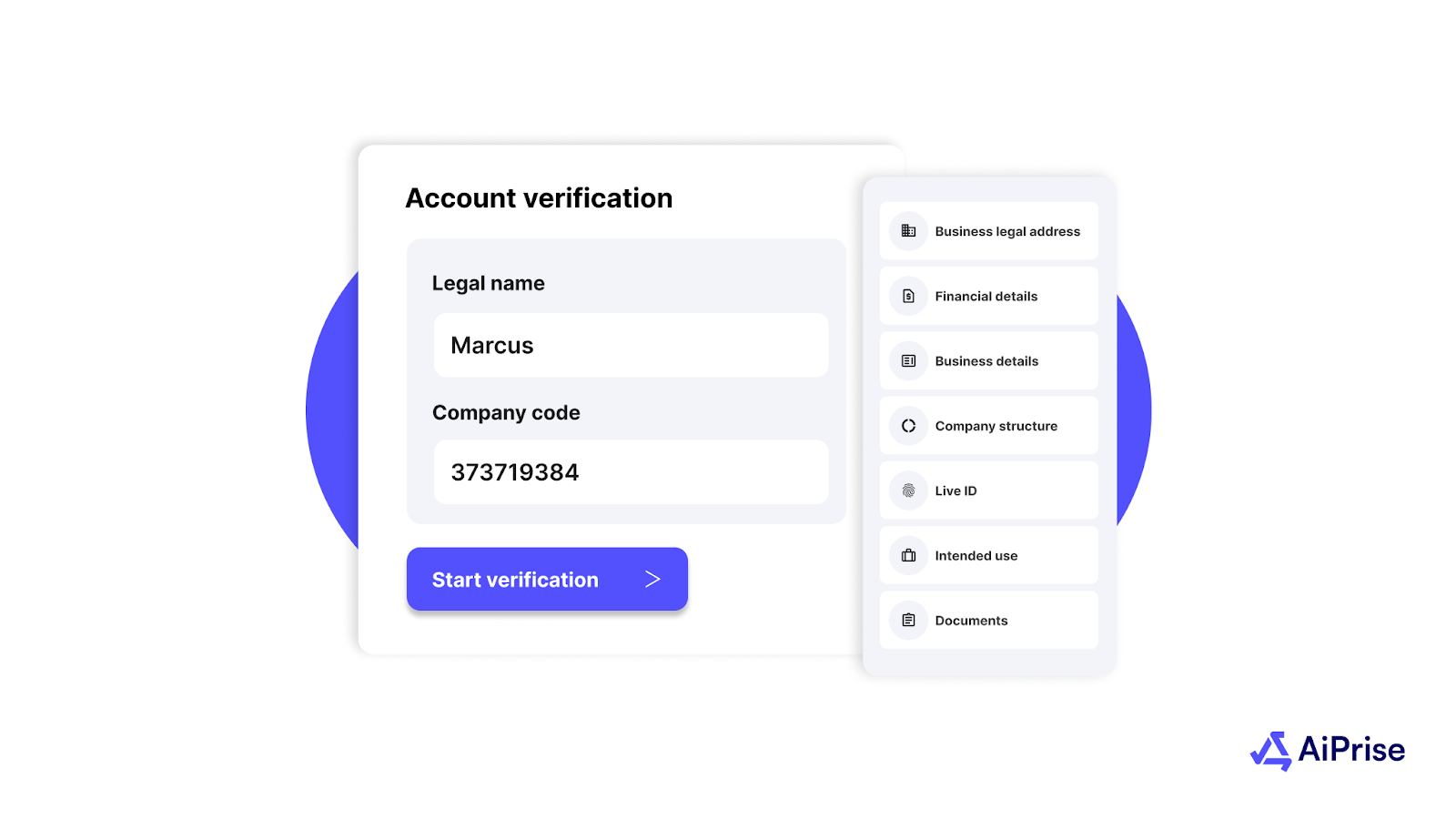

- Using Unified Identity Verification Solutions

One of the most effective ways to address fragmented identity signals is by integrating unified identity verification solutions. These platforms consolidate data from multiple trusted sources, providing a complete, consistent view of the customer's identity.

By using a centralized platform to verify identity signals, businesses can ensure they are working with accurate, up-to-date data that is cross-checked across different regions and sources. This approach significantly reduces the risk of errors and false positives, while simplifying the compliance process. - Automating KYC Processes

Automation plays a crucial role in overcoming the inefficiencies of fragmented identity verification. With the help of AI and machine learning, businesses can streamline the verification process by automatically analyzing and matching identity data in real time. These technologies reduce the need for manual review, speed up customer onboarding, and improve the consistency of verification outcomes.

Automated systems can also handle complex identity checks, such as matching biometric data or verifying documents, more efficiently and accurately than traditional methods. - Building Stronger Data Partnerships

To combat fragmented data, businesses should partner with reliable data providers who offer comprehensive, real-time access to identity data. By working with trusted vendors, businesses can ensure that they are using the most accurate and relevant data available for identity verification.

Collaborating with a broad range of data sources helps businesses create a more complete identity profile, reducing the chances of gaps in verification and increasing overall accuracy. - Implementing Continuous Monitoring

KYC is not a one-time process. It is an ongoing monitoring of customer identities, which is essential for detecting fraud and ensuring long-term compliance. By implementing real-time monitoring systems, businesses can continuously track changes in customer identity signals and flag suspicious activity as it occurs.

This ongoing monitoring helps businesses maintain an up-to-date view of their customers' identities, even as data sources evolve or change. Additionally, it enables businesses to respond quickly to emerging risks and regulatory updates, improving their ability to stay compliant in a dynamic environment. - Adopting eKYC and Digital Solutions

Transitioning from traditional KYC methods to eKYC (electronic KYC) can significantly improve the efficiency of identity verification processes. Unlike manual document uploads and physical verification, eKYC allows businesses to digitally verify identities in real time, using biometric checks, live data sources, and structured data parsing.

This method reduces friction, ensures faster processing times, and minimizes human error. Moreover, eKYC solutions can be easily configured to comply with local regulations, ensuring that businesses can meet compliance requirements across multiple jurisdictions without the operational burden of managing fragmented data sources.

This is exactly what AiPrise brings to the table.

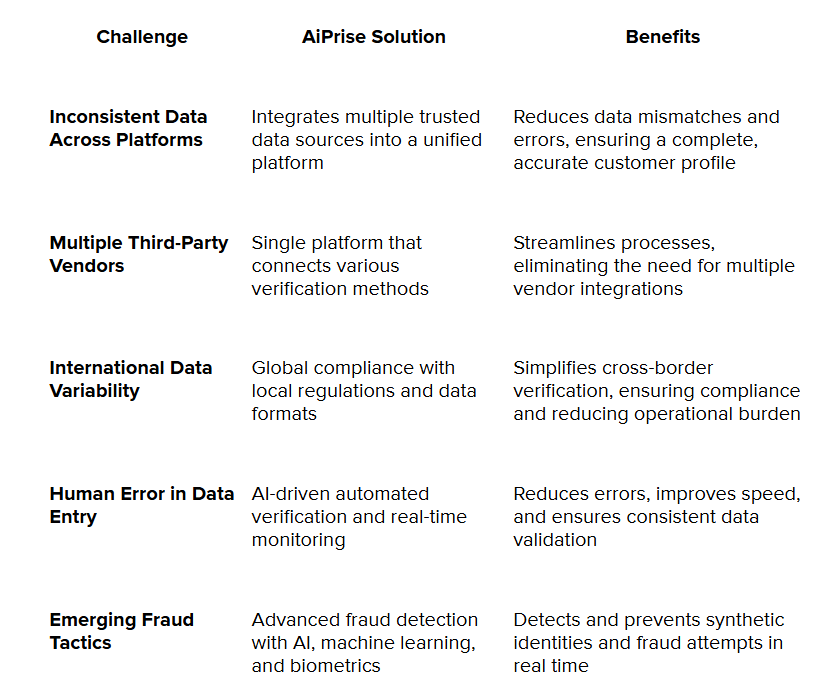

How AiPrise Solves the Challenges of Fragmented Identity Signals

AiPrise helps businesses streamline their KYC processes by unifying fragmented identity signals, ensuring accurate, real-time verification across multiple data sources. With AI-driven automation, global compliance capabilities, and seamless integration, AiPrise empowers businesses to:

- Reduce operational inefficiencies by eliminating the need for multiple vendors and manual processes

- Improve fraud detection through advanced machine learning and data analytics

- Enhance customer experience with faster, frictionless onboarding and verification

- Simplify compliance by ensuring adherence to local and global regulations, in real time

By using AiPrise, businesses can efficiently address fragmented identity signals, improving both operational efficiency and customer satisfaction while mitigating fraud and compliance risks.

Here is a quick way to know how AiPrise Addresses Fragmented Identity Signals

Conclusion

In an increasingly digital world, KYC fragmented identity signals present a growing challenge for businesses looking to ensure compliance and mitigate fraud risks. With the right technology and strategies, businesses can overcome these challenges and build a more secure, efficient, and scalable KYC process.

AiPrise provides the tools and solutions needed to address fragmented identity signals, ensuring businesses stay compliant while enhancing the customer experience.

To discover how AiPrise can streamline your KYC verification process and help you tackle fragmented identity signals, Book A Demo today.

FAQs

1. What are fragmented identity signals in KYC?

Fragmented identity signals refer to inconsistent, incomplete, or disconnected data points collected from various sources, making it difficult to create a comprehensive and accurate identity profile for verification.

2. How do fragmented identity signals affect KYC?

These fragmented signals can lead to errors in verification, increased fraud risk, regulatory compliance challenges, and a poor customer experience due to slow or failed verification processes.

3. Can automated KYC solutions address fragmented identity data?

Yes, automated KYC solutions, especially those powered by AI and machine learning, can effectively analyze and cross-reference fragmented identity data in real time, improving accuracy, speed, and reducing manual intervention.

4. Why is global compliance important for KYC?

Global compliance is critical because KYC regulations vary by country, and businesses must adhere to local rules to avoid penalties and maintain a trusted, secure relationship with customers worldwide.

5. How does AiPrise help address fragmented identity signals?

AiPrise integrates with multiple trusted vendors, offers global compliance, and uses AI-driven automation to provide accurate, real-time identity verification. This approach helps businesses overcome fragmented data and streamline their KYC processes.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

Speed Up Your Compliance by 10x

Automate your compliance processes with AiPrise and focus on growing your business.

.jpeg)

.jpg)

.jpeg)

.png)

.png)