AiPrise

15 mins read

June 26, 2025

Navigating KYC, AML and Identity Verification in the United Kingdom

.png)

Key Takeaways

In the digital age, the UK’s financial sector faces mounting pressure to protect itself from fraud, money laundering, and identity theft. With billions of pounds lost to financial crimes each year, businesses must ensure robust identity verification processes are in place to remain compliant with ever-evolving regulations.

The UK, a global financial hub, has strict requirements for Know Your Customer (KYC), Anti-Money Laundering (AML), and identity verification. But meeting these requirements doesn’t have to be daunting.

In this blog, we’ll explore how UK businesses can streamline KYC, AML, and identity verification processes, ensuring both compliance and security. We’ll also highlight key statistics that emphasize the importance of adopting these measures in today’s high-risk environment.

Why KYC, AML, and Identity Verification Matter in the UK

The UK has long been a target for fraudulent activities due to its prominent role in the global economy. Here’s a quick look at some alarming statistics:

These statistics underline why KYC, AML, and identity verification are vital in protecting businesses from financial crimes, regulatory fines, and reputational damage. Adopting the right tools to meet these regulations is no longer a choice but a necessity.

Now, let’s explore how businesses in the UK can effectively manage these regulations while maintaining a smooth customer experience.

Understanding KYC, AML, and Identity Verification

To effectively manage KYC, AML, and identity verification, it's crucial to understand what each of these terms entails:

- KYC (Know Your Customer): KYC refers to the process of verifying customers' identity. Businesses collect essential information, such as names, addresses, and government-issued IDs, to ensure that they are dealing with legitimate clients. This process helps mitigate fraud and ensure compliance with anti-money laundering laws.

- AML (Anti-Money Laundering): AML refers to the set of policies and procedures designed to detect and prevent money laundering. The primary goal is to prevent criminals from using financial institutions for illegal activities like money laundering or terrorism financing. AML tools continuously monitor transactions for suspicious activity.

- Identity Verification: This is the core process that allows businesses to confirm the authenticity of their customers’ identities. Using technologies like biometric verification, document verification, and machine learning, businesses can ensure that they’re working with real people, not fraudsters.

Understanding these concepts sets the foundation for appreciating how identity verification has developed over time. Let’s take a look at the historical evolution of verification processes in the UK and how they have shaped today’s compliance framework.

Historical Evolution of Verification in the UK

The UK’s approach to identity verification and financial compliance has evolved significantly over the past decades. Historically, identity checks were manual and paper-based, relying heavily on physical documents and face-to-face verification. These early methods were often slow and prone to human error, limiting their effectiveness in preventing fraud.

In response to rising financial crimes and globalization, the UK introduced stronger regulatory frameworks in the 1990s and early 2000s:

- The Proceeds of Crime Act 2002 and the Money Laundering Regulations 2007 were key milestones, mandating stricter KYC and AML controls for financial institutions. These laws required businesses to implement customer due diligence and enhanced verification procedures, marking a shift toward more formalized compliance.

- With the rise of digital technology, the UK further modernized its verification processes. The introduction of electronic identity verification (eIDV), biometrics, and advanced data analytics transformed KYC and AML efforts. These innovations enabled faster and more accurate identity checks, thereby improving the ability to detect and prevent financial crime in an increasingly digital economy.

Today, the UK continues to refine its regulatory landscape to keep pace with evolving threats. Recent regulations focus on integrating artificial intelligence, machine learning, and real-time data sharing to enhance identity verification and compliance while balancing user privacy.

To understand current practices, it’s important to explore the regulatory framework that governs KYC, AML, and identity verification in the UK.

The Regulatory Landscape for KYC, AML, and Identity Verification in the UK

In the UK, the regulatory environment surrounding KYC and AML is strict, and businesses must adopt the latest measures to avoid hefty fines. The Financial Conduct Authority (FCA) and Her Majesty’s Revenue and Customs (HMRC) both oversee businesses’ compliance in this domain, ensuring adherence to international and domestic guidelines.

The following are the key regulations in the UK:

- The Financial Services and Markets Act 2000 (FSMA): This act regulates financial services and markets across the UK. It empowers the FCA to supervise firms, enforce compliance with AML and KYC standards, and protect the integrity of the financial system.

- The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017: These regulations provide detailed requirements for customer due diligence, transaction monitoring, and reporting to prevent money laundering and terrorist financing. The 2019 amendments incorporated the EU’s 5th AML Directive into UK law.

- The Proceeds of Crime Act 2002: This legislation defines criminal offenses related to money laundering and mandates that businesses report suspicious activities to authorities.

- FCA Handbook, JMLSG Guidance, and HM Treasury Notices: These provide practical guidelines and best practices to help firms meet their AML obligations effectively.

The UK’s law enforcement rigorously monitors all sectors under AML regulations. This includes finance, crypto businesses, gambling, real estate, the art trade, and more. Non-compliance can lead to substantial fines, as seen recently with Metro Bank, which was fined nearly £17 million by the FCA for inadequate AML controls between 2016 and 2020. Starling Bank faced a £29 million fine for similar reasons just a month earlier. These cases highlight the critical importance of robust AML frameworks.

Multiple agencies work together to regulate and enforce AML compliance:

- Financial Conduct Authority (FCA): The primary AML regulator, overseeing financial institutions such as banks, crypto firms, and financial services providers. The FCA also investigates money laundering offenses across industries.

- Her Majesty’s Revenue and Customs (HMRC): Enforces AML laws across various sectors, including trusts and company service providers.

- Serious Fraud Office (SFO) and National Crime Agency (NCA): Collaborate in investigating and prosecuting financial crimes.

- Industry-specific regulators: For example, the Gambling Commission supervises AML compliance within gambling and betting platforms.

Failing to meet KYC and AML standards can lead to severe consequences, such as:

- Fines or penalties from regulators.

- Damage to reputation, leading to loss of clients and trust.

- Legal actions for failing to prevent financial crimes.

Challenges Faced by UK Businesses

Despite the clear regulatory guidelines, UK businesses encounter several hurdles when implementing KYC, AML, and identity verification procedures:

- Data Privacy and Security Concerns: Handling sensitive customer data while complying with data protection laws like the General Data Protection Regulation (GDPR) is complex. Businesses must implement stringent cybersecurity measures to protect this data.

- Cross-border Challenges: With global clients, businesses must adapt to varying identity standards and verification processes. Different countries may have distinct identification practices, adding complexity to the verification process for international customers.

- Constantly Evolving Regulations: The regulatory landscape is fluid, with frequent updates and new compliance requirements. Staying informed about changes in KYC/AML regulations and ensuring that your system is always up-to-date can be challenging.

- Balancing Compliance with User Experience: Lengthy verification procedures can discourage customers from completing transactions. Therefore, businesses must find a balance between stringent compliance processes and smooth user experiences to maintain conversions.

Another significant hurdle is maintaining a balance between strict verification processes and delivering a positive customer experience. Lengthy, cumbersome verification procedures can frustrate potential clients, leading to lost business opportunities.

These challenges underscore the importance of finding reliable, automated solutions that allow businesses to stay compliant while minimizing friction for customers.

How to Navigate KYC, AML, and Identity Verification in the UK?

Implementing effective KYC, AML, and identity verification processes can be challenging, but it’s essential for the success and security of businesses in the UK.

Here’s how to effectively go through these processes:

Implement Automated KYC and AML Solutions

Adopting automated KYC and AML tools helps businesses streamline and expedite identity verification and transaction monitoring. These tools use AI and machine learning to analyze customer data, flagging suspicious activities in real time and reducing human error. Automating the process also improves the efficiency of customer onboarding and ongoing due diligence.

Real-time Identity Verification

Modern identity verification solutions use biometric authentication (such as facial recognition or fingerprint scans), document verification, and AI to provide a highly accurate and secure means of verifying customer identities. This ensures that only legitimate users can access sensitive financial systems.

Stay Updated with Regulatory Changes

As the regulatory environment constantly changes, businesses must ensure they stay compliant by keeping abreast of updates to KYC and AML regulations. This can be done by subscribing to regulatory newsletters, using compliance platforms, or partnering with industry experts who monitor regulatory shifts.

Implement Multi-Factor Authentication (MFA)

To add an extra layer of security to the verification process, businesses should implement multi-factor authentication (MFA). This ensures that access is granted only after validating the user’s identity through multiple methods, such as passwords, mobile authentication, or biometrics.

Simplify the User Experience

KYC and AML processes should be thorough but user-friendly. Businesses should reduce friction during the onboarding process by allowing users to complete their verification quickly and easily. Integrating intuitive, mobile-friendly interfaces with real-time customer support ensures a seamless and positive customer experience.

For example, automated identity verification solutions use AI and machine learning to verify customer information in real time, making the onboarding process much faster and more accurate. Similarly, advanced AML tools can monitor transactions continuously, flagging any suspicious activities that could indicate money laundering or fraud.

By integrating these advanced technologies, businesses can improve their compliance, reduce risk, and provide a seamless customer experience.

Benefits of Effective KYC, AML, and Identity Verification

By ensuring that KYC and AML processes are robust, businesses in the UK can enjoy the following benefits:

How AiPrise Simplifies AML and Identity Verification in the UK

AiPrise offers a powerful, unified platform designed to optimize KYC, AML, and identity verification for businesses operating in the UK’s highly regulated environment. Our solution leverages advanced AI and machine learning technologies to automate complex compliance tasks while ensuring accuracy and security. Here are the key benefits of using AiPrise:

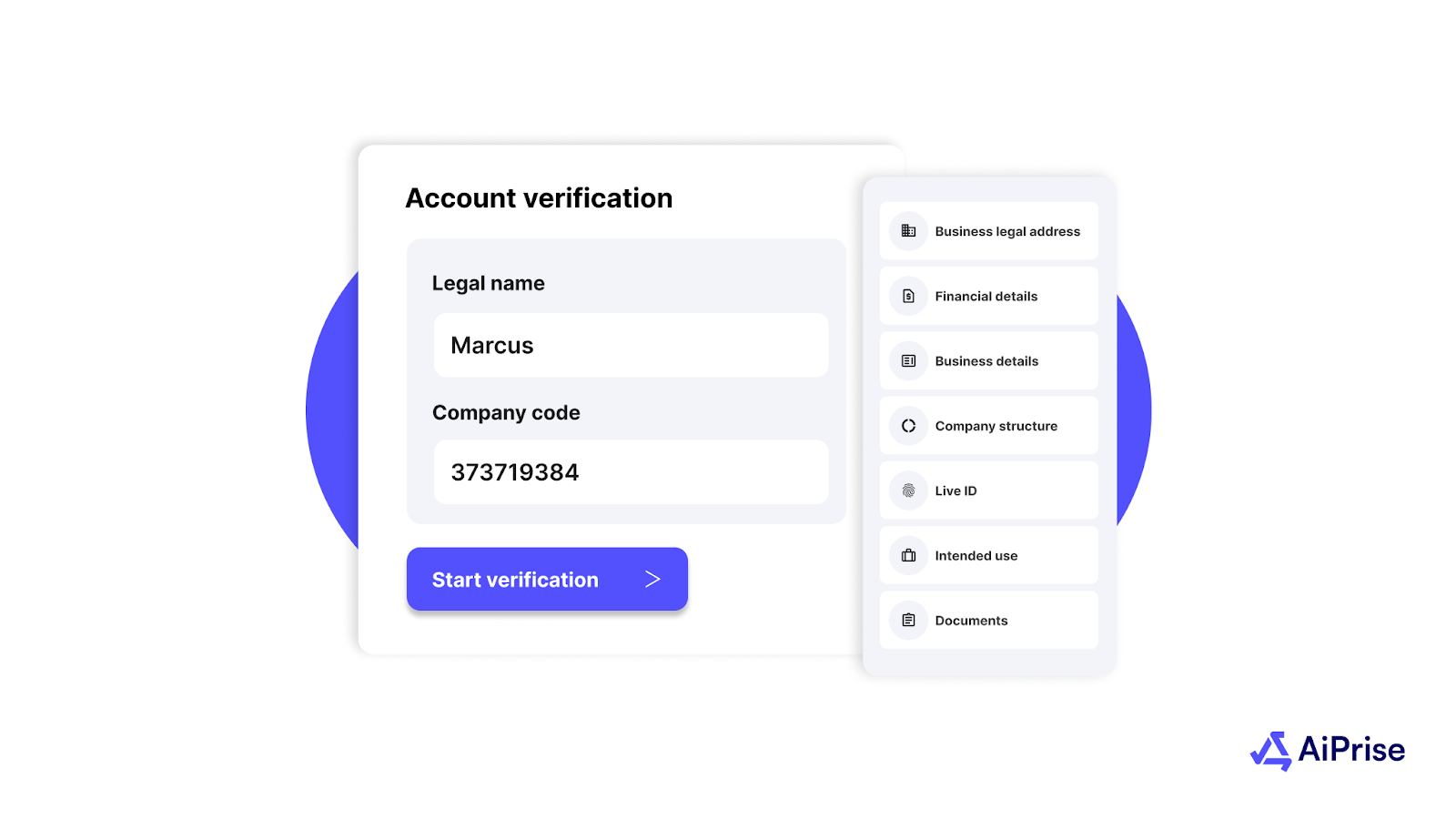

- Comprehensive Verification: AiPrise integrates multiple global and local data sources, allowing seamless identity verification that meets UK regulatory standards, including biometric checks and document authentication.

- Real-Time AML Monitoring: Our platform continuously monitors transactions against updated sanctions lists, politically exposed persons (PEP) databases, and watchlists, helping businesses detect suspicious activities early.

- Regulatory Compliance: AiPrise stays current with evolving UK AML and KYC regulations, ensuring your business remains compliant and avoids costly fines.

- Scalable and Flexible: Whether you’re a startup or a large enterprise, AiPrise’s scalable architecture adapts to your business needs, supporting growth and changes in regulatory demands.

- Improved Customer Experience: By automating verification processes and reducing manual checks, AiPrise helps businesses onboard customers quickly while maintaining high security and compliance standards.

With AiPrise, UK businesses can confidently manage the complexities of AML and identity verification, reduce operational burdens, and focus on growth.

Conclusion

Navigating the complex world of KYC, AML, and identity verification in the UK is crucial for businesses looking to safeguard themselves from financial crimes and maintain compliance. By adopting automated solutions and staying up-to-date with regulatory changes, businesses can reduce fraud risk, improve operational efficiency, and enhance customer trust.

As financial crimes continue to evolve, businesses must be proactive in implementing cutting-edge tools to protect themselves and their customers.

Get a Free Demo with AiPrise today to learn how we can help you streamline your KYC and AML processes with advanced, automated solutions designed for the modern regulatory landscape.

Frequently Asked Questions (FAQs)

1. What is KYC, and why is it important in the UK?

KYC (Know Your Customer) is the process of verifying the identity of customers to prevent fraud and financial crimes. In the UK, it is mandatory for businesses to follow strict KYC regulations to comply with AML laws and protect against money laundering and identity theft.

2. How does AML protect UK businesses?

AML (Anti-Money Laundering) policies help detect and prevent money laundering and terrorist financing by monitoring suspicious transactions and ensuring customer due diligence. This protects businesses from legal risks and reputational damage.

3. Which UK bodies regulate KYC and AML compliance?

The Financial Conduct Authority (FCA) and Her Majesty’s Revenue and Customs (HMRC) are the primary regulators, supported by the Serious Fraud Office (SFO) and National Crime Agency (NCA). Industry-specific regulators, like the Gambling Commission, also oversee AML compliance in their sectors.

4. What are the penalties for non-compliance with AML regulations in the UK?

Penalties can include hefty fines, legal action, reputational damage, and loss of business licenses. Recent examples include multi-million-pound fines for major banks failing AML controls.

5. How can businesses balance AML compliance with a smooth customer experience?

Automating KYC and AML processes using advanced technologies like AI and biometrics helps reduce onboarding friction while maintaining regulatory compliance and security.

6. What role does AiPrise play in UK KYC and AML compliance?

AiPrise provides an advanced platform that automates identity verification and AML monitoring using AI and global data integration, helping businesses comply efficiently while enhancing customer experience.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

.jpeg)

.jpg)

.jpeg)

.png)

.png)

.png)