AiPrise

16 mins read

July 9, 2025

3 Essential Components of KYC

Key Takeaways

Suspicious Activity Reports (SARs) filed by financial institutions surged to 4.6 million in FY 2023, highlighting a steady rise in financial crime and the growing sophistication of illicit activity. This trend signals a clear need for stronger Know Your Customer (KYC) practices that can keep pace with evolving threats. As regulatory expectations intensify, financial institutions must strike a careful balance between strict compliance and seamless customer experience.

KYC requirements form the first line of defense, helping institutions detect and prevent money laundering, fraud, and other financial crimes. However, the challenge lies in implementing systems that are both thorough and user-friendly.

This guide explores the three essential components of an effective KYC program: Customer Identification Program (CIP), Customer Due Diligence (CDD), and Ongoing Monitoring. Together, these pillars build a strong foundation for risk-based compliance while supporting secure and scalable business growth.

TL;DR

- KYC's 3 Pillars: CIP, CDD, and Ongoing Monitoring are essential defenses against financial crime.

- Beyond Compliance: Strong KYC builds trust, improves efficiency, and offers a competitive edge.

- Tech-Powered: Automation, AI, and biometrics enhance KYC accuracy and speed.

- Adaptive and Foundational: KYC is crucial for AML and must evolve to combat new threats.

Understanding KYC: More Than Just Compliance

Know Your Customer (KYC) extends beyond simple regulatory exercises. At its core, it focuses on verifying customer identities and assessing associated risks to prevent money laundering, terrorism financing, and fraud before they penetrate your systems.

The economic impact of inadequate KYC measures can be devastating. TD Bank's record-breaking $3.09 billion penalty in 2024 for systemic AML compliance failures demonstrates the severe consequences of non-compliance. Understanding the distinction between KYC and Anti-Money Laundering (AML) is crucial for compliance professionals. While KYC focuses on identity verification and risk assessment, AML encompasses broader transaction monitoring and investigation activities.

What are KYC Requirements?

KYC requirements are regulatory mandates that financial institutions must follow to verify customer identities and assess risks. The core objectives remain consistent globally, but enforcement varies by region.

United States

- Patriot Act (2001)

- Intelligence Reform & Terrorism Prevention Act (2004)

- Anti-Money Laundering Act (2020)

- The Financial Crime Enforcement Network (FinCEN) maintains updated regulations.

United Kingdom

- Terrorism Act (2000)

- Proceeds of Crime Act (2002)

- Money Laundering, Terrorist Financing and Transfer of Funds Regulations (2017)

European Union

- Fifth Anti-Money Laundering Directive (5AMLD)

- Sixth Anti-Money Laundering Directive (6AMLD)

These regulations ensure financial institutions implement proper safeguards against money laundering and terrorist financing. Compliance protects both institutions and the broader financial system from criminal exploitation.

What Industries Need KYC?

Know Your Customer (KYC) regulations are critical across a wide range of sectors where verifying customer identity is essential for compliance and fraud prevention. The following industries rely heavily on KYC protocols:

- Banking and Financial Services: Includes banks, credit unions, and lenders that use KYC to prevent money laundering and financial fraud.

Fintech Companies and Digital Wallets: Platforms like mobile banking apps and digital wallets require KYC to ensure secure, compliant transactions. - Cryptocurrency Exchanges and Platforms: Must verify user identities to comply with global anti-money laundering regulations and reduce fraud risks.

- Insurance Providers: Use KYC to confirm policyholder identities, assess risk accurately, and prevent fraudulent claims.

- Real Estate and Property Management Firms: Implement KYC to monitor high-value transactions and reduce money laundering exposure.

- Legal and Accounting Services: Verify client identities to ensure regulatory compliance and avoid facilitating illicit financial activities.

- Investment and Brokerage Firms: Conduct KYC to understand client risk profiles and prevent misuse of financial markets.

- Online Gaming and Gambling Platforms: Require identity and age verification to prevent underage access and meet regulatory obligations.

Also read: KYC regulations in APAC

Component 1: Customer Identification Program (CIP)

The Customer Identification Program forms the foundation of your KYC framework, establishing the critical first step in verifying customer identities. CIP requirements stem directly from Section 326 of the USA PATRIOT Act, which mandates that financial institutions develop comprehensive programs to verify customer identities before establishing accounts or relationships.

Your CIP must collect and verify specific customer information:

- Full legal name from government-issued ID

- Date of birth (or incorporation date for entities)

- Residential or business address.

- Government-issued ID number (e.g., SSN or Tax ID)

The verification process extends beyond simple data collection. You must implement reliable methods to confirm that the information provided is accurate and belongs to the person or entity requesting services. This typically involves cross-referencing multiple databases and employing document authentication technologies.

Verification Methods and Documentation

Modern CIP implementation utilizes various verification approaches to ensure accuracy and compliance. Document scanning technologies can authenticate government-issued IDs, while database consultations cross-reference customer information against reliable sources. Your institution must maintain comprehensive records of every verification method used, creating an audit trail that demonstrates due diligence to regulators.

The verification model often follows the "maker/checker" or dual control system. This approach requires one person to initiate the verification process (L1 maker) and another to review and approve the results (L2 checker). External auditing supplements these internal checks, ensuring that your CIP processes maintain their integrity over time.

Handling Complex Cases

Not every customer fits standard verification parameters, necessitating flexible approaches that strike a balance between compliance and the needs of legitimate customers.

Non-US persons may lack traditional forms of identification. This necessitates alternative verification methods, which include the following:

- Use reference checks from existing financial relationships.

- Validate identity through third-party data providers.

- Accept consular documents for foreign nationals.

- Request extra documents to confirm identity and legitimacy.

Executive oversight plays a crucial role in ensuring the effectiveness of CIP. Your board of directors must approve CIP documentation, ensuring that identity verification processes receive appropriate attention at the highest organizational levels.

Compliance Consequences

The penalties for CIP failures can be severe, both financially and reputationally. Regulatory sanctions often include monetary fines, consent orders, and enhanced oversight that can disrupt normal business operations. More importantly, inadequate CIP processes create vulnerabilities that criminals can exploit, potentially exposing your institution to far greater losses than regulatory penalties.

Integration of CIP into your daily operations requires comprehensive staff training and ongoing quality assurance. Your compliance culture must emphasize accuracy and thoroughness in identity verification, recognizing that shortcuts in this area can have lasting consequences.

Also read: What is a Customer Identification Program (CIP)?

Component 2: Customer Due Diligence (CDD)

Customer Due Diligence represents the analytical heart of your KYC program, where you assess and manage the risks associated with each customer relationship. CDD requirements extend beyond identity verification to encompass understanding your customers' financial behaviors, business activities, and potential exposure to economic crime.

Risk Assessment and Profiling

Effective CDD begins with a comprehensive risk assessment that categorizes customers into low-, medium-, or high-risk classifications. This risk-based approach enables you to allocate compliance resources efficiently, ensuring that higher-risk relationships receive the appropriate level of scrutiny.

Your risk assessment should consider multiple factors:

- The source of funds and wealth must be verified.

- Consider the client's geographic location and related risks.

- Assess business activities and industry-specific exposure.

- Review expected transaction patterns and account behavior.

- Evaluate the ownership structure and its level of complexity.

The Risk-Based Approach (RBA) tailors your due diligence measures to each customer's unique risk profile. This methodology aligns with regulatory expectations while avoiding the inefficiencies of one-size-fits-all approaches.

Three Tiers of Due Diligence

While U.S. regulations don't formally define due diligence tiers, most institutions implement a tiered approach that matches scrutiny levels to risk assessments.

- Basic Due Diligence: For standard, low-risk customers; involves ID checks and basic risk assessment.

- Simplified Due Diligence: For very low-risk entities (e.g., government bodies), minimal info beyond standard ID checks.

- Enhanced Due Diligence (EDD): For high-risk customers, includes detailed financial reviews and source of funds.

- EDD may require senior approval, site visits, and extra documents for complex ownership structures.

- EDD also involves more frequent updates and ongoing monitoring.

For B2B relationships, your KYC system must navigate different regulatory requirements across jurisdictions. Key components for entity-level onboarding include validating company registrations through sources such as the SEC EDGAR for U.S. entities or Companies House for U.K. companies, verifying Ultimate Beneficial Owners (UBOs), and conducting adverse media checks.

AML Integration and Monitoring

Your CDD processes must integrate seamlessly with broader AML compliance efforts. This includes continuous monitoring of customer profiles and transaction patterns, senior management involvement in high-risk approval decisions, comprehensive documentation of all due diligence activities, and staff training to ensure consistent application of risk-based policies.

Cross-border considerations add complexity to your CDD requirements. Different jurisdictions may have varying requirements for due diligence, beneficial ownership disclosure, and ongoing monitoring. Your system must be modular and API-driven to effectively integrate with various international data sources.

Component 3: Ongoing Monitoring

Ongoing Monitoring extends your KYC requirements beyond initial customer onboarding to cover the entire lifecycle of customer relationships. This continuous oversight helps you detect changes in customer behavior that may indicate increased risk or suspicious activity.

Lifecycle Management

Your ongoing monitoring program must observe customer activities throughout their relationship with your institution. This involves analyzing regular transaction patterns to identify deviations from established profiles that may signal previously unknown risks or suspicious behavior.

Proactive risk management through ongoing monitoring enables early detection of potential issues before they escalate into compliance violations or financial losses. Your monitoring systems should flag significant changes in transaction volumes, geographic patterns, or business activities that don't align with customer profiles.

Risk-Based Monitoring Strategies

The intensity and frequency of your monitoring should correspond to customer risk levels. High-risk customers, including Politically Exposed Persons (PEPs) and entities with complex ownership structures, require more detailed and frequent reviews than low-risk customers.

Your monitoring strategy should address multiple dynamic risk factors to ensure comprehensive oversight. Here are its key elements:

- Changes in transaction frequency and volume.

- Shifts in geographic transaction patterns.

- Entry into new jurisdictions.

- Evolution or expansion of business activities.

- Modifications to beneficial ownership structures.

- Appearance in adverse media or involvement in regulatory actions.

Customer friction concerns highlight the importance of implementing monitoring systems that maintain security without creating unnecessary obstacles for legitimate customers. Your approach should be sophisticated enough to distinguish between genuine business evolution and potentially suspicious changes.

Technology Integration and Adaptive Monitoring

Effective ongoing monitoring depends on advanced technology, coordinated internal systems, and the ability to adapt to evolving risks. Here are the key elements to consider:

- Use automation and real-time analytics to handle complex customer data efficiently.

- Enable seamless collaboration between compliance, legal, and business teams to assess risks holistically.

- Maintain clear, auditable records of all monitoring activities to ensure regulatory transparency.

- Be prepared to demonstrate monitoring efforts during audits and regulatory reviews.

- Continuously update your program to respond to emerging threats and new criminal tactics.

- Provide regular employee training to recognize evolving red flags.

- Foster a risk-aware culture that supports vigilance without disrupting legitimate operations.

Also read: What is KYC? A Simple Guide for Beginners

KYC's Critical Role in AML Compliance

KYC requirements form the foundation for comprehensive Anti-Money Laundering compliance programs, providing identity verification and risk assessment capabilities that enable effective transaction monitoring and detection of suspicious activity. Without robust KYC processes, AML programs lack the customer knowledge necessary to identify potentially illicit activities.

OFAC sanctions screening adds another layer of complexity to KYC requirements, particularly for institutions handling cross-border transactions. Your KYC programs must integrate sanctions list screening and maintain current awareness of prohibited parties and jurisdictions. This integration becomes especially critical as private funds, venture capital firms, and other non-traditional financial entities face increasing expectations to adopt robust KYC protocols.

The distinction between KYC and AML often confuses compliance professionals, but understanding their relationship is crucial. While KYC focuses on identity verification and risk assessment, AML encompasses broader transaction monitoring and investigation activities. Both components work together to create comprehensive financial crime prevention programs that support law enforcement efforts in tracking and dismantling criminal networks.

Automation: The Future of KYC Processes

Manual KYC processes present significant challenges for modern financial institutions, including prolonged processing times, increased human error risks, and customer friction during onboarding. As customer volumes and regulatory complexities grow, these limitations become unsustainable.

Fortunately, technology solutions are revolutionizing KYC. Biometrics, facial recognition, and AI-driven data analysis enable automated systems to cross-check identification against multiple databases rapidly.

This automation delivers critical benefits:

- Enhanced Customer Experience: Provides seamless, secure onboarding, reducing delays and abandonment rates while meeting compliance.

- Improved Accuracy and Reduced Error: Minimizes human error and enhances verification precision.

- Scalability: Easily accommodates growing customer bases without proportional increases in staffing or infrastructure costs.

- Data Protection: Offers enhanced security through features such as encryption and access controls, which are vital for ensuring data privacy compliance.

- Cost Efficiency: Reduces direct processing costs and enables the reallocation of human resources to strategic tasks, thereby cutting remediation expenses through early fraud detection.

Benefits of KYC Beyond Compliance

KYC verification delivers substantial value beyond fulfilling regulatory requirements, offering benefits that directly support business growth and operational efficiency.

- Fraud Prevention: Deters identity theft, money laundering, and other financial crimes, preventing significant losses and reputational damage.

- Brand Enhancement and Trust: Robust compliance builds credibility with customers, partners, and regulators, fostering competitive advantages for business development and market expansion. This is especially valuable for entering new markets or establishing international partnerships.

- Global Market Access: Comprehensive KYC programs facilitate correspondent banking relationships, entry into new jurisdictions, and seamless service to customers across multiple countries.

- Reinforced Operational Excellence: By streamlining processes and enabling precise risk allocation, KYC contributes to sustained operational efficiency and long-term profitability.

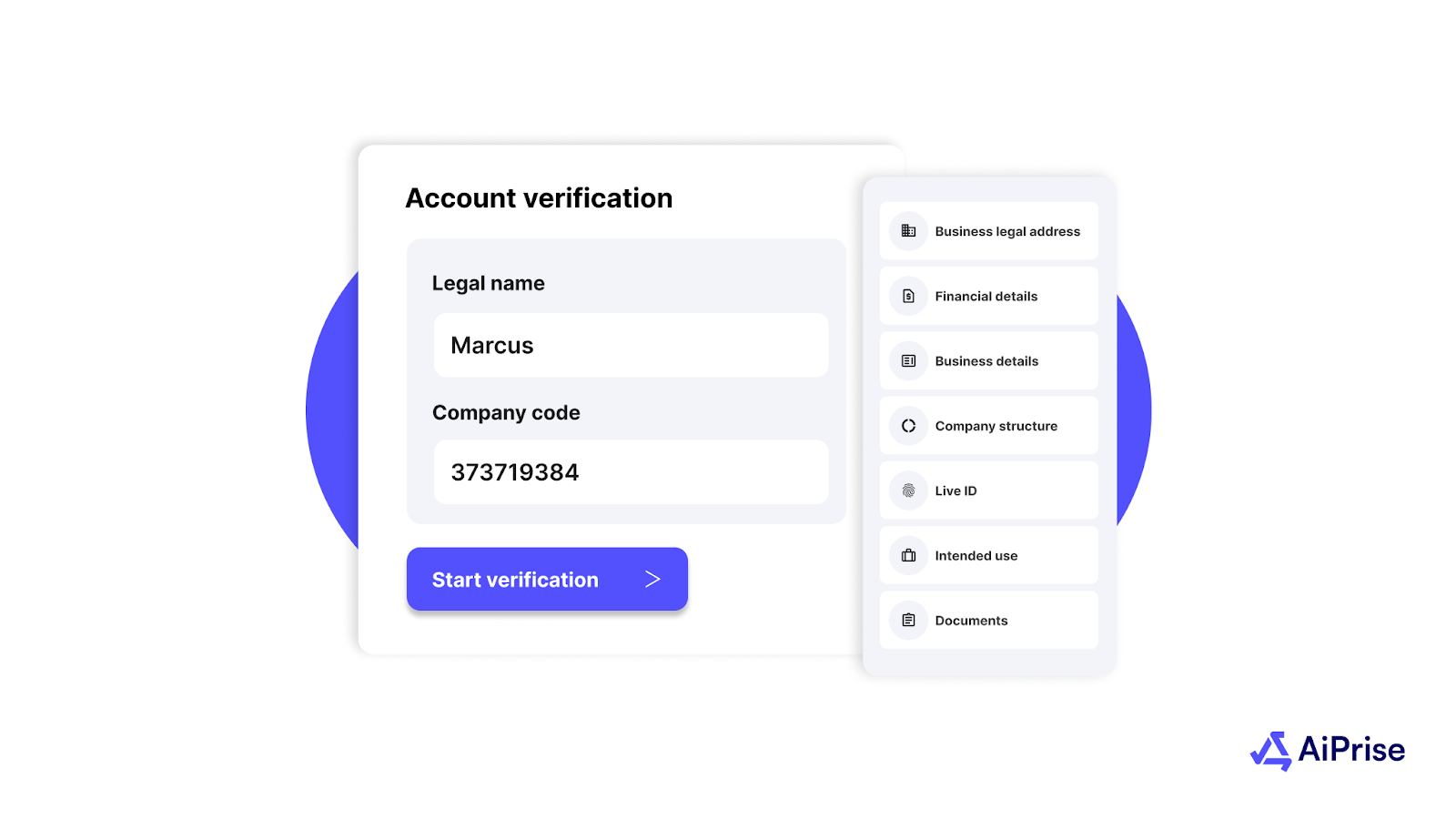

How AiPrise Helps with the KYC process

AiPrise offers AI-powered identity verification solutions that help streamline your KYC compliance while maintaining strong security standards.

Streamlined Identity Verification

Our platform simplifies the verification process for both you and your customers:

- One-Click KYC: Verify customers using just an ID number and a selfie.

- Global Document Support: Accept local ID cards and passports from 200+ countries.

- Real-Time Processing: Get instant verification results for immediate onboarding.

Advanced Fraud Prevention

Multiple security layers help detect and prevent fraudulent activities:

- Multi-Layer Security: Combine document verification with phone, email, and device intelligence checks.

- Risk-Based Decisioning: Use customizable rules to flag high-risk applications while fast-tracking legitimate users.

- Ongoing Monitoring: Receive automated alerts for suspicious activity throughout the customer lifecycle.

Discover how AiPrise's coverage across 200+ countries can strengthen your risk assessment processes while ensuring global compliance standards.

Compliance Made Simple

Our tools are designed to help you meet regulatory requirements:

- Regulatory Alignment: Stay compliant with local and international regulations.

- Audit Trail Management: Maintain comprehensive records for regulatory reporting.

- AI-Powered EDD Reports: Generate Enhanced Due Diligence reports automatically.

Scalable Integration

Connect seamlessly with our flexible platform:

- Single API Access: Connect to 100+ data sources worldwide through one integration.

- Customizable Workflows: Design verification flows that match your business requirements.

- Fallback Providers: Maintain high uptime with automatic failover to backup verification sources.

AiPrise supports verification across 200 countries, helping you expand your reach while adapting to changing regulatory requirements.

Conclusion

The three essential components of KYC—Customer Identification Program, Customer Due Diligence, and Ongoing Monitoring—work in concert to build comprehensive defenses against financial crime while simultaneously supporting legitimate business growth. Success in modern finance hinges on understanding their interconnected nature and the strategic value they deliver beyond basic regulatory compliance.

Future-focused organizations recognize that KYC requirements will continuously evolve as criminal tactics advance and regulators respond. Embracing continuous improvement and adaptation in your KYC processes is key to staying ahead of emerging threats and maintaining operational efficiency. Ultimately, robust KYC programs are foundational elements of organizational success in the dynamic financial landscape.

Ready to enhance your KYC compliance program with AiPrise? Discover how our comprehensive identity verification solutions can elevate your compliance, improve customer experience, and boost operational efficiency across all key components of KYC. Schedule Your Demo with AiPrise today.

FAQs (Frequently Asked Questions)

1. What are the main KYC requirements for banks in the United States?

Banks must comply with the Bank Secrecy Act and USA PATRIOT Act, verifying customer identities (CIP), assessing risk (CDD), and monitoring transactions. They also identify beneficial owners and report foreign accounts under FATCA.

2. How do CIP, CDD, and ongoing monitoring work together?

CIP confirms identity, CDD evaluates risk from financial and business activities, and Ongoing Monitoring tracks transactions for consistency. Together, they help block financial crimes such as money laundering.

3. What's the difference between KYC and AML compliance?

KYC verifies identities and assesses risk. AML encompasses broader aspects, including KYC, transaction monitoring, and reporting, to prevent money laundering.

4. How can automation improve KYC processes without compromising security?

Automation utilizes AI and OCR to expedite verification and minimize errors, while biometric checks and real-time fraud detection enhance security.

5. What are the consequences of non-compliance with KYC regulations?

Non-compliance can result in fines (e.g., $700 million for Commonwealth Bank in 2018), legal action, reputational harm, and regulatory penalties.

6. How often should ongoing monitoring be conducted?

It's continuous—more frequent for high-risk customers (such as PEPs) and less frequent for low-risk customers—to identify changes in risk.

7. What information is typically collected during the CIP process?

CIP gathers name, date of birth, address, and ID number (e.g., SSN or passport), verified with documents like a driver's license.

8. How does CDD help in assessing customer risk?

CDD collects data on wealth sources, businesses, and transactions to assess risk and determine the level of monitoring required.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

.jpeg)

.jpg)

.jpeg)

.png)

.png)