12 min read

May 28, 2025

Navigating KYC, AML and Identity Verification in Israel

Key Takeaways

For businesses operating in Israel, compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations is a critical component of daily operations. As one of the world's leading financial hubs, Israel has implemented stringent regulatory frameworks designed to prevent money laundering, terrorist financing, and other financial crimes.

These regulations require businesses to verify customers' identities, monitor transactions for suspicious activities, and report certain transactions to authorities.

This blog will explore Israel's specific regulatory environment, including key requirements, challenges, and best practices for ensuring full compliance. Let’s understand how businesses can follow these regulations to thrive in Israel’s dynamic market.

Key AML Regulations in Israel

Israel has implemented a robust legal framework to combat money laundering and terrorist financing, ensuring the security and integrity of its financial system. The core legislation for Anti-Money Laundering (AML) in Israel is the Prohibition on Money Laundering Law (PMLL). This is complemented by the Terror Financing Prevention Law.

These laws are designed to align Israel with international standards and obligations set by organizations like the Financial Action Task Force (FATF). Under these regulations, businesses are required to report suspicious activities, maintain records of financial transactions, and conduct customer due diligence (CDD) procedures.

Companies must identify and verify their clients' identities, monitor transactions for signs of illegal activity, and report large or suspicious transactions to the Israel Money Laundering and Terror Financing Prohibition Authority (IMPA).

These regulations cover a wide range of industries, from banking and insurance to real estate and fintech. Compliance with AML laws is crucial for maintaining business integrity and preventing criminal activity such as money laundering and terrorist financing.

Historical Evolution of Verification in Israel

Israel’s identity verification methods have evolved significantly over time, shaped by legal, security, and technological advancements. The country’s verification systems have adapted to meet changing needs, from post-independence challenges to modern digital security solutions.

Early Years (1948–1970s)

After Israel's founding in 1948, identity documents were introduced to manage its population. The Teudat Zehut (Identity Card) became the official ID by the 1950s, initially including ethnic markers. These markers were removed later following privacy and equality reforms.

Technological Integration (Mid-2000s Onwards)

In the mid-2000s, Israel added biometric data, including fingerprints and facial scans, to identity documents. This improved security and reduced fraud risks, aligning Israel with global identity verification standards.

Regional and Legal Context

East Jerusalem residents have a unique permanent residency status with separate verification processes. Palestinians in the West Bank and Gaza follow a different ID system. Security checks at checkpoints are common, while the 2011 Supreme Court ruling required police to have reasonable suspicion to demand identification, balancing security with privacy.

Future Directions

Israel is moving toward digital integration of biometric IDs in government services, often requiring SMS confirmation. Palestinians in East Jerusalem face “center of life” assessments to maintain residency, with ongoing legal concerns.

Israel's AML Compliance Framework

Israel’s AML compliance framework ensures businesses effectively prevent and detect financial crimes. The main components of this framework are:

- Prohibition on Money Laundering Law (PMLL): This is the core regulation for preventing money laundering and terrorism financing in Israel.

- Israel Money Laundering and Terror Financing Prohibition Authority (IMPA): The regulatory body that oversees compliance with AML laws, provides guidelines, and enforces penalties for non-compliance.

- AML Compliance Programs: Businesses must implement comprehensive programs that include:

- Risk assessments to identify potential vulnerabilities.

- Customer Due Diligence (CDD) to verify client identities and assess risks.

- Monitoring systems to track and detect suspicious activities.

- Enhanced Due Diligence (EDD): For high-risk clients (e.g., politically exposed persons or clients from high-risk countries), businesses must perform more detailed checks.

- Compliance Officers: Designated personnel responsible for ensuring that AML compliance procedures are followed and that businesses meet regulatory requirements.

Israel’s AML framework is designed to align with global standards, ensuring the country remains secure from financial crimes while building trust in its financial system.

Required IDs for KYC in Israel

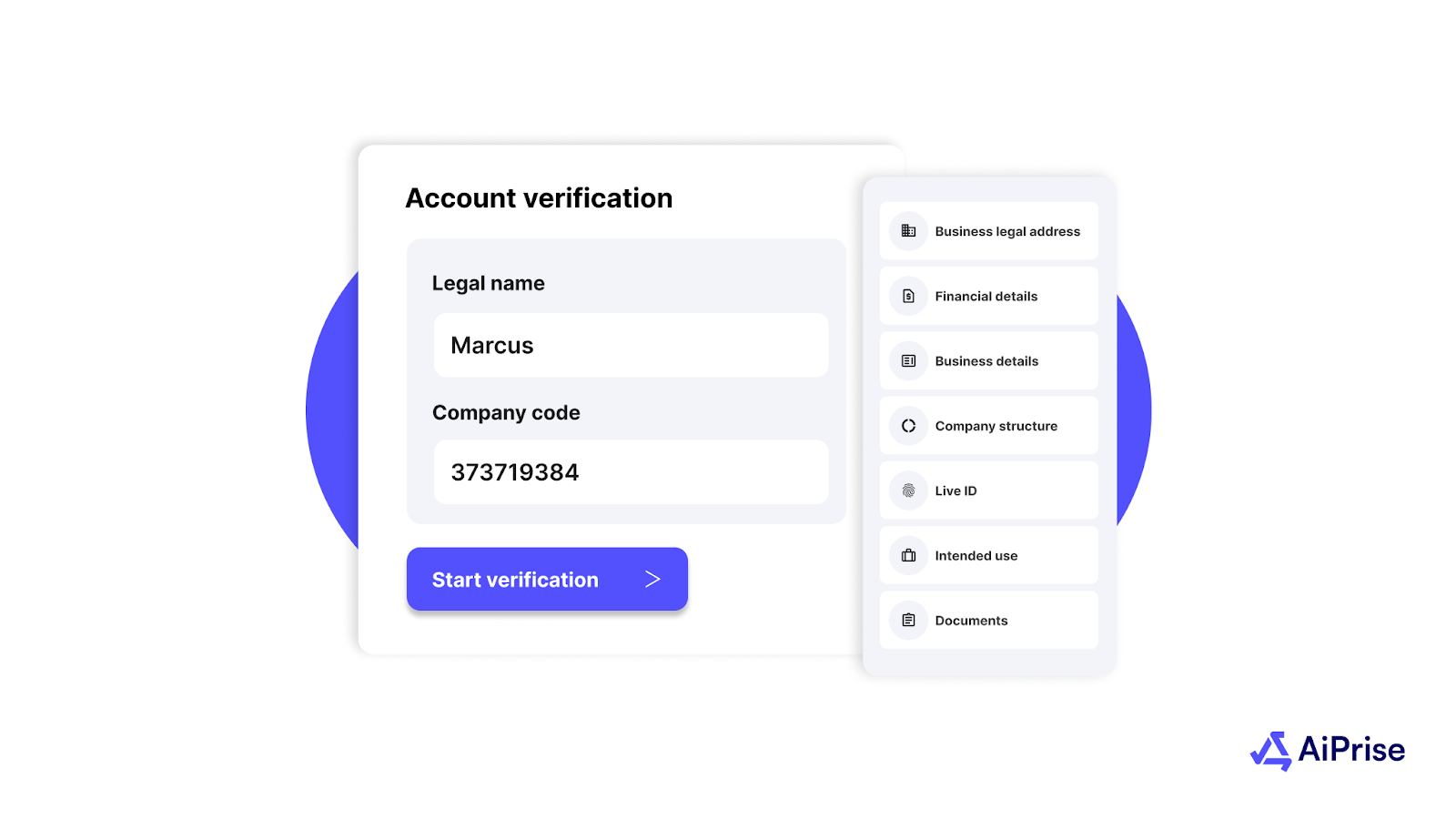

To implement KYC (Know Your Customer) procedures in Israel, businesses must verify their clients' identities using appropriate documents. The required IDs vary based on the customer type and transaction risk. Commonly required documents include:

- National ID Card (Teudat Zehut): This is the primary ID for Israeli citizens, containing personal details and a unique ID number.

- Passport: For foreign nationals, a passport (including the photo page and visa details) is required for verification.

- Driver’s License: Accepted when accompanied by supporting documents, like a utility bill for address verification.

- Utility Bills or Bank Statements: Used to verify a client’s address, with recent bills (within three months) from electricity, water, or gas services.

- Corporate Documents: For businesses, documents such as a Certificate of Incorporation, Articles of Association, and proof of business address are required.

These documents ensure compliance with KYC regulations and help businesses assess client risks, preventing fraud, money laundering, and terrorist financing.

Implementing KYC Protocols in Israel

In Israel, businesses are required to adhere to strict Know Your Customer (KYC) protocols to verify their clients' identities and ensure they are not involved in illicit activities. KYC plays a critical role in preventing money laundering, fraud, and terrorist financing.

Key aspects of implementing KYC protocols in Israel include:

- Identity Verification: Businesses must verify the identity of individuals and entities they engage with. This includes collecting key information such as names, addresses, and identification numbers. Documents typically used for verification include government-issued IDs, passports, and utility bills.

- Risk-Based Approach: KYC procedures must be tailored to the level of risk associated with each customer. Higher-risk customers (e.g., politically exposed persons or foreign nationals) require Enhanced Due Diligence (EDD), which involves a deeper level of verification and scrutiny.

- Ongoing Monitoring: KYC is not a one-time process. Businesses must continuously monitor customer transactions for suspicious activity and update records regularly to ensure ongoing compliance.

- Compliance with Local and International Standards: While Israel has its own set of regulations, businesses must also adhere to global KYC standards, particularly those set by the Financial Action Task Force (FATF) and the EU's 4th Anti-Money Laundering Directive.

A well-implemented KYC in Israel safeguards businesses from legal/reputational risks and ensures compliance with local/international regulations.

Challenges in KYC and AML Implementation

Implementing KYC and AML protocols in Israel presents a unique set of challenges that businesses must overcome to ensure compliance. These challenges stem from regulatory complexities, technological barriers, and the diverse nature of Israel’s market.

Below are some of the key hurdles companies face when meeting Israel’s KYC and AML requirements:

- Complex Regulatory Landscape: Israel's regulatory environment is dynamic and can be difficult to manage, especially for international businesses. The requirements set by local authorities, such as the Israel Money Laundering and Terror Financing Prohibition Authority (IMPA), may differ from international standards, creating confusion for businesses operating in multiple jurisdictions.

- Data Privacy Concerns: Balancing compliance with KYC and AML regulations while ensuring the protection of customer data is a delicate task. Israel's strict data protection laws, in line with global regulations like GDPR, require businesses to maintain a high level of security and transparency when handling sensitive customer information.

- Diverse Customer Base: Israel is home to a diverse population, including various ethnic groups and international residents. Verifying the identities of these individuals can be complicated, particularly when customers provide documentation from foreign countries or regions with different standards of identity verification.

- Technological Barriers: Many businesses struggle with integrating advanced technologies that can streamline KYC and AML processes. Legacy systems may not support the automation needed for efficient customer verification and transaction monitoring, leading to delays and inefficiencies.

- High Compliance Costs: For smaller businesses, implementing comprehensive KYC and AML programs can be resource-intensive. Compliance with Israel’s regulations may require substantial investment in staff, training, and technology, which can be a financial burden for some companies.

Despite these challenges, businesses can mitigate risks by adopting advanced compliance solutions that automate processes, enhance data security, and provide access to real-time regulatory updates.

Consequences of Non-compliance

Failing to comply with Israel's KYC and AML regulations can have severe consequences for businesses. Non-compliance can lead to legal, financial, and reputational damage that may disrupt operations and damage customer trust.

Some of the key risks associated with non-compliance include:

- Fines and Penalties: Israel’s regulatory authorities, like the Israel Money Laundering and Terror Financing Prohibition Authority (IMPA), impose heavy fines for non-compliance, which can escalate based on the severity of the violation.

- Legal Actions: Companies may face legal sanctions, including restrictions on operations, suspension of licenses, or even a ban from operating in Israel.

- Reputational Damage: Non-compliance can damage a business's reputation, erode customer trust, and result in a loss of clients and business opportunities.

- Increased Scrutiny: Non-compliant businesses often face heightened audits and regulatory scrutiny, diverting resources and impacting operational efficiency.

- Operational Disruptions: Failing to comply can lead to interruptions in business activities, affecting day-to-day operations and overall business continuity.

To avoid these risks, businesses must adopt effective KYC and AML protocols and stay updated on regulatory changes.

Simplified Reporting, Audit Trails, and Data Security

Ensuring compliance with Israel’s KYC and AML regulations requires accurate reporting, secure data management, and the ability to maintain detailed audit trails. Businesses must have robust systems in place to meet these requirements:

- Automated Reporting: Efficient reporting systems help businesses generate the required compliance reports quickly, ensuring accuracy and reducing manual errors. This is crucial for adhering to regulatory timelines and maintaining compliance with local and international laws.

- Audit Trails: Maintaining a comprehensive audit trail is essential for tracking customer interactions, transactions, and compliance actions. These records provide transparency and accountability, which are vital during audits or investigations by regulatory bodies.

- Data Security: Protecting sensitive customer data is a top priority. Israel's data protection laws, along with global privacy regulations such as GDPR and CCPA, require businesses to implement strong security measures to prevent data breaches and ensure privacy.

AiPrise offers automated tools that simplify compliance reporting, secure data storage, and create transparent audit trails, making it easier for businesses to stay compliant and reduce risks.

Conclusion

Businesses must stay compliant to avoid legal, financial, and reputational risks. With the right strategies in place, companies can meet regulatory requirements while protecting their operations from the potential consequences of non-compliance.

Businesses can thrive in Israel's dynamic market by understanding the regulatory landscape, implementing effective KYC and AML protocols, and ensuring proper reporting, audit trails, and data security.

Adopting advanced compliance solutions helps streamline these processes, mitigate risks, and maintain a strong reputation in the industry.

Why wait? Book a Demo today to explore how AiPrise can help streamline your compliance efforts and ensure you meet all regulatory requirements with ease.

Frequently Asked Questions (FAQs)

- How can I verify a customer’s identity in Israel?

To verify a customer’s identity in Israel, businesses must collect essential information such as name, address, and government-issued IDs like passports or utility bills. AiPrise offers automated tools to simplify this verification process, making it faster and more accurate.

- What is the process to e-verify a customer in Israel?

E-verification involves electronically validating customer details using digital IDs and secure databases. This process speeds up KYC and ensures accuracy. AiPrise provides automated e-verification solutions, simplifying the process and ensuring compliance with Israeli regulations.

- What are the requirements for AML compliance in Israel?

AML compliance in Israel involves reporting suspicious transactions, conducting Customer Due Diligence (CDD), and maintaining detailed transaction records. AiPrise offers automated AML solutions to streamline compliance and improve efficiency.

- What are the penalties for non-compliance with KYC and AML regulations in Israel?

Non-compliance with KYC and AML regulations in Israel can lead to fines that range from thousands to millions of shekels, depending on the severity of the violation. Companies may also face legal actions, operational disruptions, and reputational damage. AiPrise helps ensure businesses remain compliant to avoid these costly penalties.

Linkedin Snippet

Is your business navigating Israel’s complex KYC and AML regulations?

As one of the world’s leading financial hubs, Israel has stringent rules to prevent financial crimes like money laundering and terrorist financing. For businesses, compliance with these regulations is critical to avoid hefty fines, legal consequences, and reputational damage. In this blog, we dive into Israel’s regulatory environment, key compliance requirements, and the best practices for staying secure.

Don’t risk falling behind. Book a Demo today to discover how AiPrise can simplify your KYC/AML compliance and keep your business secure in Israel’s dynamic market.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

.jpeg)

.jpg)

.jpeg)

.png)

.png)

.png)

.png)