AiPrise

10 min read

October 9, 2025

Understanding Web3 KYC for Secure Online Identity

Key Takeaways

The Web3 ecosystem has reached a significant milestone, with Web3 wallets reaching over 200 million users globally as of 2024. This explosive growth brings both opportunities and challenges for identity verification in decentralized environments.

As traditional Know Your Customer (KYC) processes struggle to adapt to Web3's decentralized nature, innovative Web3 KYC solutions are emerging to bridge the gap between regulatory compliance and user privacy.

Understanding how Web3 KYC works is essential for businesses looking to operate securely in the decentralized web while maintaining trust and compliance.

Key Takeaways

- Web3 KYC ensures secure, compliant user interactions in decentralized environments like DeFi and crypto.

- It gives users control over their identity data, enhancing privacy compared to traditional KYC systems.

- Blockchain technology provides secure, tamper-proof identity verification, reducing fraud risks.

- Aiprise simplifies the integration of Web3 KYC solutions for businesses, ensuring compliance and security.

- The future of identity verification in Web3 is decentralized, offering greater transparency and trust.

Historical Evolution of Web3 KYC

The development of Web3 KYC has progressed over several decades, from paper-based systems to the decentralized solutions we see today.

Traditional KYC: Early Days (Pre-2000s)

- Paper-Based Verification: Initially, KYC was done through physical documents like passports and utility bills. This process was slow and manual, often taking days to complete.

- Banking Expansion (1990s-2000s): As the financial industry expanded, formal KYC procedures became necessary, especially to comply with anti-money laundering (AML) regulations.

Digital KYC: Automation Begins (Early 2000s)

- Digitization of KYC (2000s): With the rise of the internet, KYC processes moved online, enabling faster document submission and verification through digital means.

- Biometric & Video Verification (2001s to 2010s): By the 2010s, technologies like facial recognition, video conferencing, and fingerprint scanning were introduced, improving verification speed and security.

Web3 KYC: The Decentralized Revolution (2014-Present)

- Blockchain and Web3 Emergence (2014): With the launch of Bitcoin in 2008 and the rise of blockchain-based technologies, identity management began to shift toward decentralized solutions.

- Privacy-Focused Solutions: Technologies like zero-knowledge proofs (ZKPs) emerged, offering secure verification of identity without revealing personal details, responding to growing privacy concerns.

Present Day: Web3 KYC’s Growing Role (2020s-Present)

- Widespread Adoption: By the mid-2020s, Web3 KYC began being adopted in decentralized finance (DeFi) platforms, cryptocurrency exchanges, and blockchain-based apps for enhanced security and regulatory compliance.

- Regulatory Evolution (2020s): As Web3 technologies mature, regulators are working to establish frameworks that support secure and compliant Web3 KYC practices.

Having traced the arc of Web3 KYC's evolution, let's now cut to the core: What is it, and how does it fundamentally break from traditional identity checks?

What is Web3 KYC?

Web3 KYC represents a fundamental shift from traditional centralized identity verification to decentralized, user-controlled identity management systems. Where conventional KYC relies on centralized, third-party verification, Web3 KYC offers a paradigm-changing alternative: it uses blockchain to put users in full control, allowing them to own and share their identity data selectively.

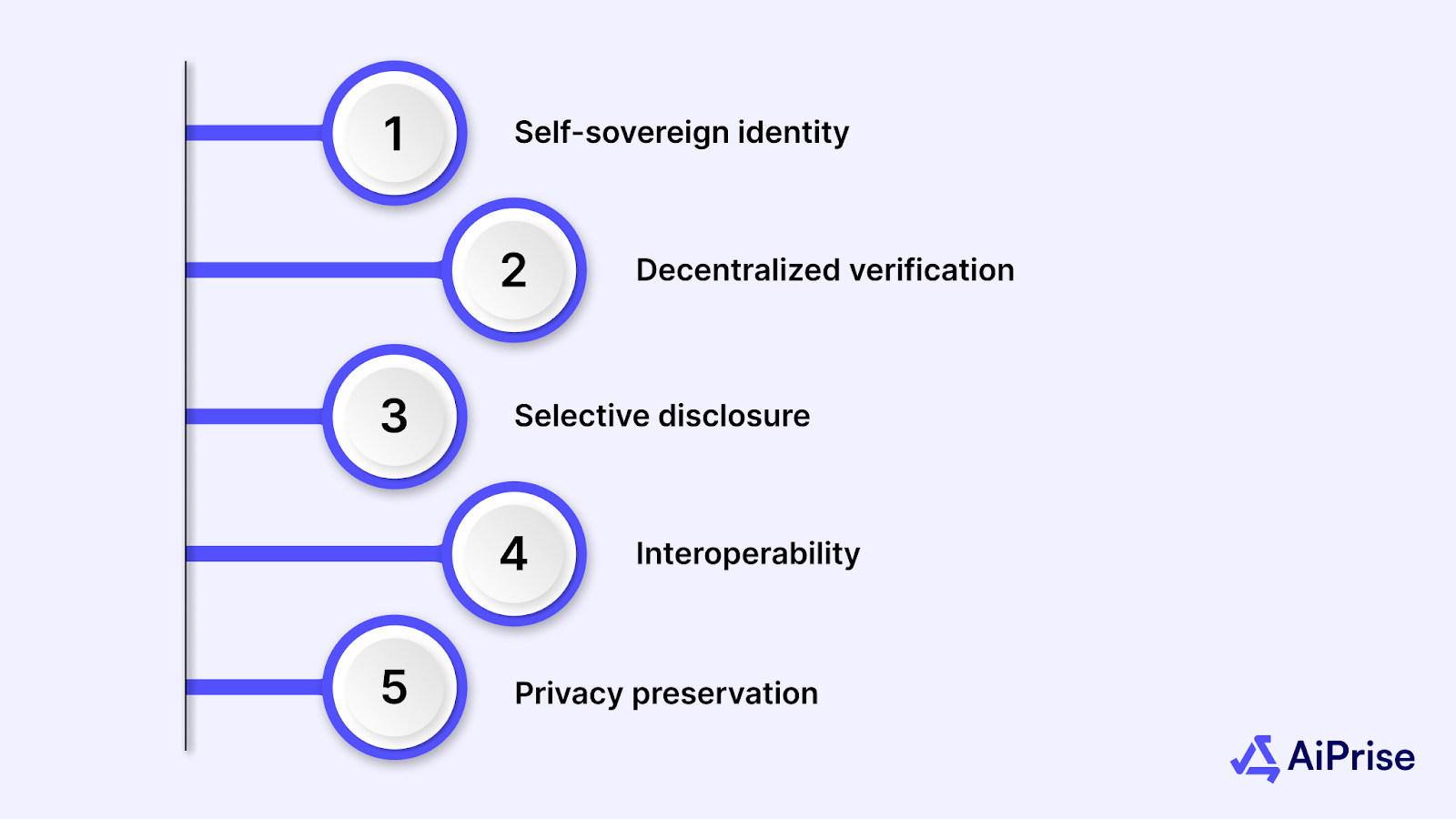

Key Characteristics of Web3 KYC:

- Self-sovereign identity: Users maintain complete control over their personal data.

- Decentralized verification: Identity proofs are stored on blockchain networks.

- Selective disclosure: Users can share only the necessary information for specific transactions.

- Interoperability: Identity credentials work across multiple platforms and services.

- Privacy preservation: Advanced cryptographic techniques protect user data.

This approach addresses the growing demand for privacy-focused identity solutions while meeting regulatory requirements for customer identification and risk assessment.

Key Differences Between Web3 KYC and Traditional KYC

Web3 fundamentally transforms identity verification by moving control from centralized institutions to the user-controlled digital trust, as mentioned in the table below:

Now that we’ve explored how Web3 KYC differs from traditional systems and its core features, it’s important to understand why it’s not just a regulatory requirement, but a critical tool for Web3 brands themselves.

As decentralized platforms continue to grow, Web3 brands face unique challenges when it comes to maintaining security, trust, and compliance. Let’s look at why implementing KYC is essential for these brands to thrive in the evolving Web3 ecosystem.

Why Web3 Brands Need KYC?

With the rapid growth of Web3, particularly in sectors such as cryptocurrency and decentralized finance (DeFi), the industry is facing mounting challenges related to trust, security, and regulatory compliance.

In 2024, cryptocurrency scammers have stolen an estimated $2.2 billion from crypto platforms, with a significant portion of this activity continuing to occur within the DeFi space. High-profile breaches and hacks have exposed vulnerabilities, raising concerns about the security and stability of Web3 platforms. These ongoing issues highlight the urgent need for effective KYC and AML measures to protect users and ensure regulatory compliance.

Scams in Web3

To rebuild trust and establish credibility, Web3 brands must take proactive steps to protect users from scams and fraudulent activities. This is where KYC and AML regulations become essential tools for Web3 businesses, helping to safeguard investors and users from falling victim to industry-wide fraud.

Some of the most common types of scams in Web3 include:

- Wash Trading: This occurs when a trader buys and sells an asset to themselves in order to create a false impression of liquidity and trading volume. In fact, a 2019 report by Bitwise claimed that 95% of the spot trading volume on CoinMarketCap was fabricated.

Also, on Ethereum, 58% of NFT trades were found to be wash trades, damaging the credibility of the platforms involved.

- Fake Digital Assets: As digital assets and collectibles (such as virtual land or clothing) gain popularity, scammers are exploiting the growing interest in the metaverse to swindle unsuspecting buyers.

Fraudsters can take advantage of Web3’s open nature to present fake digital assets as legitimate, leading to significant financial losses for investors.

Building Credibility through KYC

For Web3 platforms, implementing a robust KYC process is no longer optional. For Web3 to build credibility and ensure regulatory compliance, it's essential to have a safer, more transparent environment. This is achieved through KYC and AML practices, which verify user identities to combat fraud, reduce illegal activities, and restore trust in the ecosystem.

Suggested read: What Is KYC In Crypto Security And Compliance, And Why Does It Matter?

Key Technologies Used in Web3

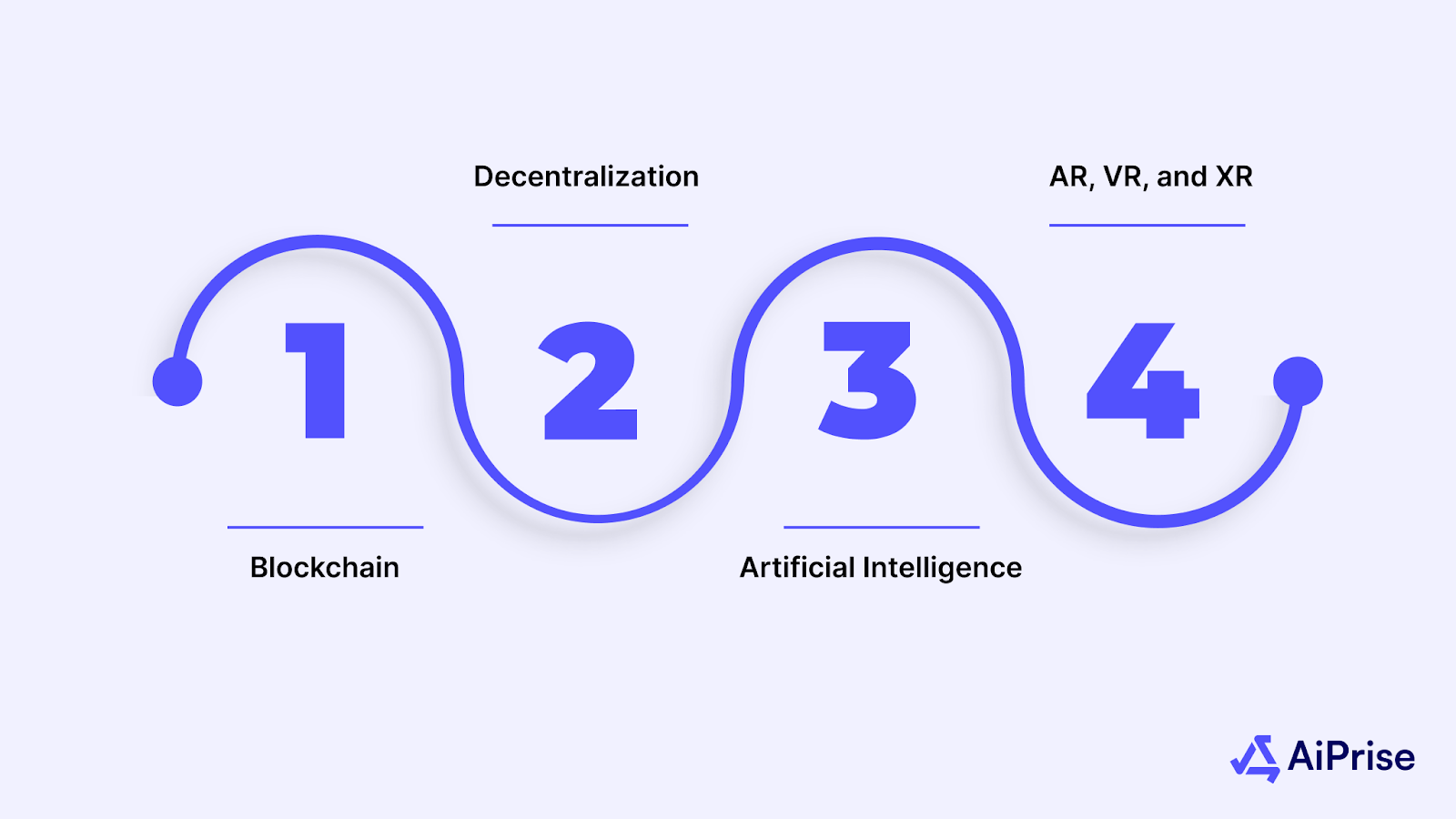

Web3 is built on several transformative technologies that are changing how we interact with the digital world. These key technologies include:

- Blockchain: The backbone of Web3, providing security, transparency, and immutability for transactions and data storage.

- Decentralization: Unlike Web2, which relies on centralized entities, Web3 distributes control across networks, returning data ownership and decision-making power to the users.

- Artificial Intelligence (AI): AI works with smart contracts to enhance decision-making processes and automate decentralized systems.

- AR, VR, and XR: Augmented, virtual, and mixed reality technologies are transforming how we interact with the metaverse, creating more immersive and engaging experiences.

Now, closely observe why Web3 KYC is such a critical element for securing online identity in the decentralized world.

Why Web3 KYC is Important for Secure Online Identity

As we've seen, Web3 KYC offers a revolutionary shift in identity verification. But why is it becoming increasingly crucial for secure online identity management? Let’s explore the key reasons:

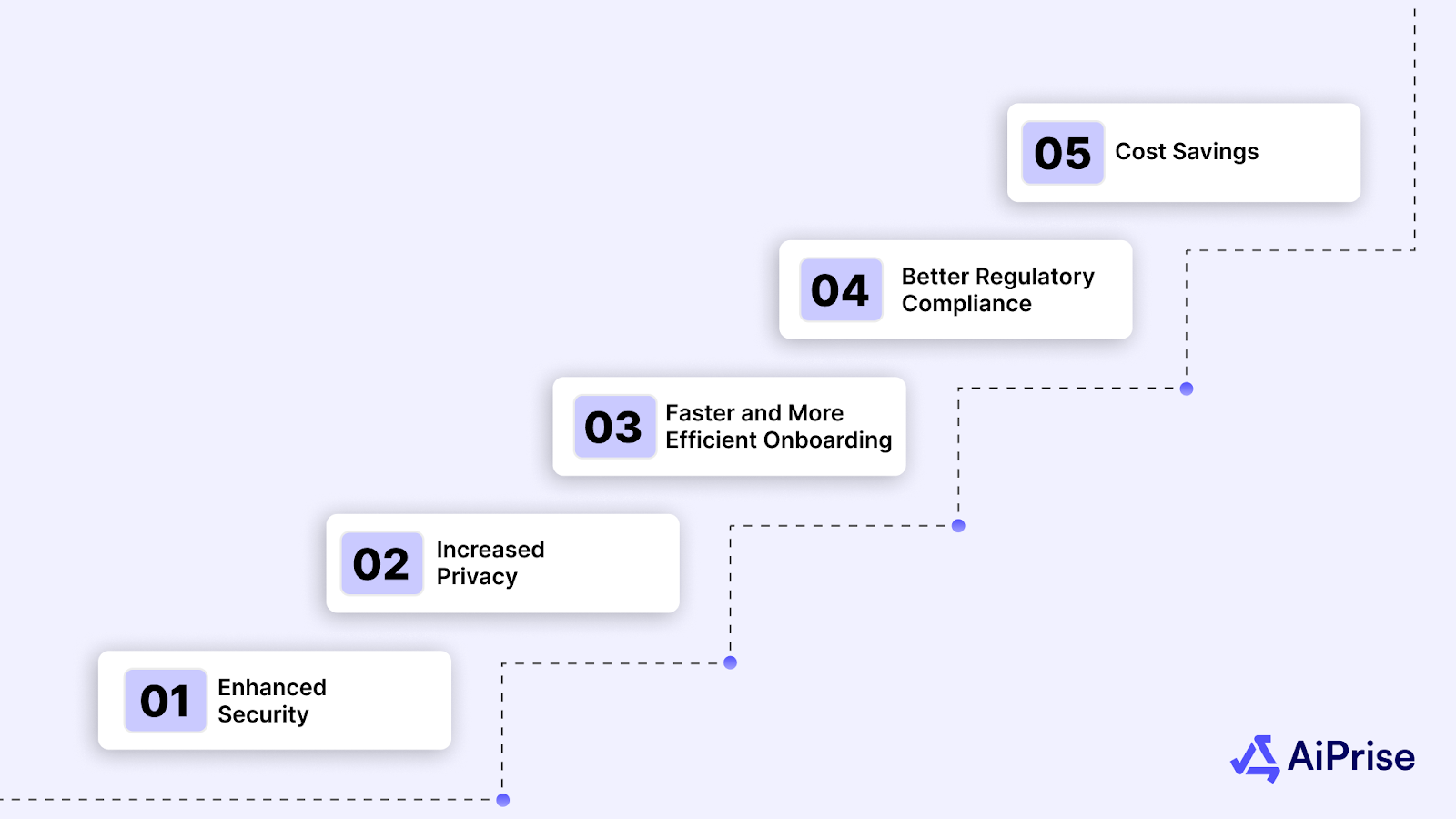

1. Enhanced Security

- Decentralized Systems: Unlike traditional KYC, which relies on centralized databases, Web3 KYC utilizes blockchain, eliminating single points of failure and reducing the risk of large-scale data breaches.

- Immutable Blockchain Records: Data recorded on the blockchain cannot be tampered with, ensuring a higher level of security for users’ identities.

2. Increased Privacy

- User Data Ownership: Web3 KYC places the control of identity data in the hands of users rather than corporations. This means individuals can choose which information to share and when.

- Zero-Knowledge Proofs (ZKPs): This cryptographic method enables users to prove their identity without revealing sensitive data, offering enhanced privacy for online transactions.

3. Faster and More Efficient Onboarding

- Instant Verification: Web3 KYC streamlines the verification process using blockchain and smart contracts, enabling near-instant identity confirmation.

- Global Access: Users can onboard across platforms worldwide without having to go through lengthy verification processes each time, making Web3 KYC ideal for international businesses.

4. Better Regulatory Compliance

- Built-in Compliance Tools: Web3 KYC can automatically comply with regulations like Anti-Money Laundering (AML) and General Data Protection Regulation (GDPR), with blockchain providing transparent audit trails.

- Real-Time Validation: Blockchain ensures that KYC data is always up to date and verifiable, allowing for continuous regulatory compliance.

5. Cost Savings

- Reduced Operational Costs: By automating identity verification, Web3 KYC significantly lowers the costs associated with traditional systems, such as paper-based verification and third-party services.

- Lower Fraud Risks: Blockchain’s transparency and immutability reduce the likelihood of fraud, leading to fewer resources spent on fraud detection and prevention.

Understanding the benefits is only the first step; let’s now examine the major implementation challenges for Web3 KYC and explore practical solutions.

Implementation Challenges for Web3 KYC and Solutions

Despite its advantages, Web3 KYC implementation faces several challenges that organizations must address to ensure successful deployment.

Technical Complexity

Challenge: Integrating blockchain technology and cryptographic systems requires specialized expertise.

Solutions:

- Partner with experienced Web3 identity providers

- Invest in team training and development

- Use established frameworks and standards

- Implement phased rollout approaches

Regulatory Uncertainty

Challenge: Evolving regulatory landscape creates compliance uncertainty.

Solutions:

- Engage with regulatory bodies early in the process

- Build flexible systems that can adapt to new requirements

- Maintain traditional KYC capabilities during transition periods

- Monitor regulatory developments across relevant jurisdictions

User Adoption Barriers

Challenge: Users may be unfamiliar with Web3 concepts and hesitant to adopt new systems.

Solutions:

- Provide comprehensive user education and support

- Design intuitive interfaces that abstract technical complexity

- Offer gradual migration paths from traditional systems

- Demonstrate clear benefits and value propositions

Interoperability Issues

Challenge: Different Web3 identity systems may not work together seamlessly.

Solutions:

- Adopt open standards like W3C DIDs and Verifiable Credentials

- Build bridges between different blockchain networks

- Participate in industry consortiums and standardization efforts

- Design systems with interoperability as a core requirement

To bridge this gap between challenge and adoption, you need a specialized solution partner like Aiprise. Let's understand how their seamless Web3 KYC solutions are helping businesses unlock the potential of this new digital frontier.

Aiprise’s Role in Web3 KYC

As businesses work within the complexities of Web3 KYC, they need a partner that offers seamless, secure, and scalable solutions. Aiprise plays a crucial role in helping businesses implement effective Web3 KYC processes that ensure compliance, privacy, and security for both users and platforms.

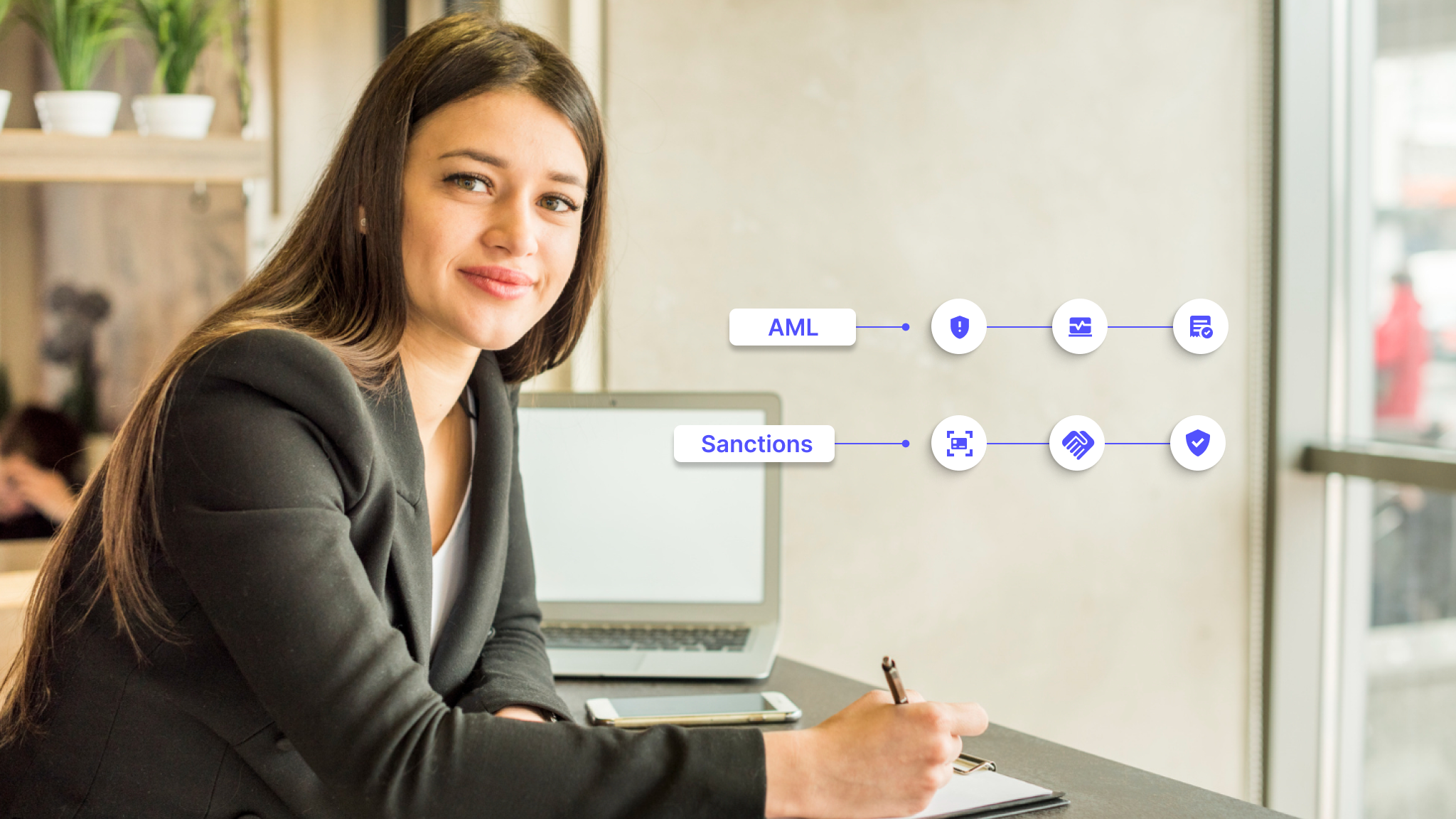

How Aiprise Supports Web3 KYC Implementation

- Advanced Web3 KYC Solutions: Aiprise provides robust Web3 KYC services that integrate directly into decentralized platforms. Their solutions are designed to handle both small-scale and enterprise-level needs.

- Built-in Compliance: By partnering with Aiprise, businesses can ensure they stay compliant with global regulations such as AML and GDPR, with it’s built-in compliance features.

- Seamless User Experience: Aiprise focuses on delivering a user-friendly interface that abstracts the complexities of blockchain technology, allowing businesses to offer their users a smooth and intuitive verification process.

- Decentralized Identity Verification: Aiprise’s solutions use decentralized identity management, meaning users control their data and can selectively disclose only the necessary information.

Key Features of Aiprise’s Web3 KYC Solutions

- Self-Sovereign Identity (SSI): Users maintain full control of their identity data, allowing for greater privacy and compliance with data protection regulations.

- Automated KYC Verification: Aiprise uses blockchain and smart contracts to streamline KYC verification, reducing the time and cost traditionally associated with manual checks.

- Cross-Platform Interoperability: Aiprise’s KYC solutions are compatible with multiple blockchain networks, ensuring businesses can operate across various platforms without the need for re-verification.

Conclusion

As the Web3 ecosystem continues to evolve, Web3 KYC is becoming an essential tool for securing online identities and ensuring compliance in decentralized environments. Utilizing blockchain technology, Web3 KYC not only enhances security, privacy, and efficiency but also provides businesses with a way to stay compliant with ever-changing regulations.

With platforms like Aiprise, businesses can implement seamless and scalable Web3 KYC solutions that empower users to control their own data, reduce fraud risks, and create trust in the rapidly expanding Web3 space.

As Web3 adoption grows, embracing effective KYC processes will be key to building secure, trustworthy, and user-centric platforms.

Ready to implement KYC for your Web3 businesses? Book a Demo with Aiprise today and discover how our solutions can help you build a secure and compliant Web3 platform.

Frequently Asked Question(FAQs)

1. What is KYC verification in Web3?

KYC verification in Web3 is the process of verifying a user's identity using decentralized systems like blockchain. It allows users to control their data while ensuring secure and compliant interactions within Web3 platforms.

2. Does Web3 need KYC?

Yes, Web3 needs KYC to ensure compliance with regulations, reduce fraud, and protect users. It helps verify identities, especially in sectors like decentralized finance (DeFi) and cryptocurrencies, ensuring a trustworthy environment.

3. Why is KYC important in crypto & Web3?

KYC is crucial in crypto and Web3 to comply with Anti-Money Laundering (AML) regulations and prevent fraud. It builds trust and credibility, ensuring safe transactions and fostering wider adoption of decentralized technologies.

4. What is KYC verification & why is it important?

KYC verification is the process of confirming a user’s identity to prevent fraud and ensure regulatory compliance. It’s important because it protects businesses and users from financial crimes, ensuring secure transactions.

5. How can Web3 KYC improve security?

Web3 KYC improves security by decentralizing data storage through blockchain, ensuring that personal information is less vulnerable to breaches. It uses cryptographic methods like zero-knowledge proofs (ZKPs) to verify identity without exposing sensitive details.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

.jpeg)

.jpg)

.jpeg)

.png)

.png)