AiPrise

6 mins read

September 2, 2025

Anti Money Laundering (AML) Law: A Complete Guide

.png)

Key Takeaways

Did you know a single overlooked transaction can cost a business more than half a million dollars? In FY23, 1,132 money laundering cases were reported, with a median loss of $566,530, showing just how high the stakes are.

Anti-money laundering (AML) laws are designed to help businesses detect, prevent, and report suspicious activities. They provide a framework that safeguards organizations from both financial loss and reputational damage.

This guide breaks down key AML regulations, practical compliance strategies, and essential tools to help you combat fraud. Read on to discover how your business can strengthen its AML measures and stay fully audit-ready.

Quick Look:

- Anti-money laundering laws help businesses detect suspicious activities, prevent financial crime, and maintain regulatory compliance.

- AML regulations evolved globally, with frameworks like FATF recommendations guiding institutions across multiple jurisdictions.

- Key AML components include KYC, CDD, suspicious activity reporting, record-keeping, and staff training.

- Emerging technologies like AI, ML, and blockchain improve risk detection capabilities.

- Following best practices and integrating reliable AML solutions strengthens compliance and protects business reputation.

What Is Anti-Money Laundering And Why Is It Important?

When someone earns money through illegal activities, like embezzlement, bribery, or insider trading, they often try to hide their origin to make it look legitimate. This process, known as money laundering, allows them to use the funds without drawing attention from authorities.

Anti-money laundering (AML) helps financial institutions detect, monitor, and report these suspicious transactions. AML procedures are designed to track both the source and movement of funds, preventing illegal money from entering the financial system. This allows financial institutions to comply with regulations, including counter-financing of terrorism (CFT).

Implementing AML procedures is critical for businesses, as it helps you:

- Stay compliant with federal and state regulations, avoiding penalties.

- Protect your brand reputation and shareholder value.

- Reduce costs tied to fines, employee oversight, IT systems, and risk exposure.

Also Read: What Is the Difference Between Smurfing and Structuring in Money Laundering?

Historical Evolution Of Anti-Money Laundering Law

AML regulations in the U.S. began with the Bank Secrecy Act of 1970. It required financial institutions to report cash deposits over $10,000, collect account owner information, and maintain transaction records.

The 1980s brought laws targeting drug trafficking, followed by the 1990s’ focus on surveillance improvements. In the 2000s, the Patriot Act expanded AML measures to curb terrorist financing.

Today, banks, brokers, and other financial entities must conduct due diligence and report suspicious transactions. Key requirements include:

- A written AML compliance policy approved by senior management.

- Oversight by a dedicated AML compliance officer.

- Comprehensive monitoring of customer accounts and transactions.

Global Regulations On AML

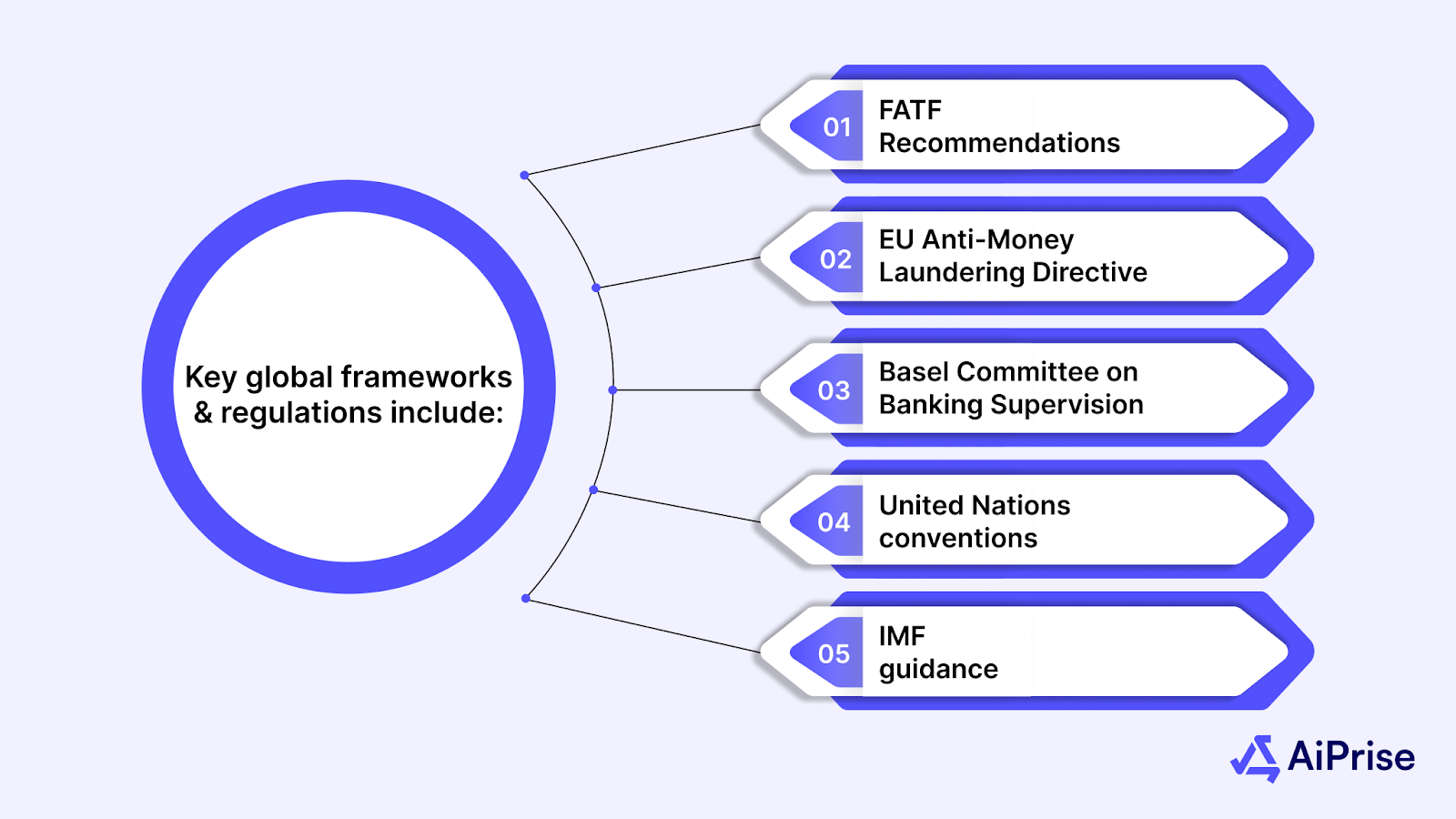

There is global cooperation to stop money laundering, with several organizations working to establish common anti-money laundering laws. The Financial Action Task Force (FATF), created in 1989, sets international AML standards followed in over 190 jurisdictions.

Key global frameworks and regulations include:

- FATF Recommendations: Cover customer due diligence, transaction monitoring, reporting suspicious activity, and cross-border cooperation.

- EU Anti-Money Laundering Directive (AMLD): Establishes AML/CFT obligations for all EU member states and is regularly updated.

- Basel Committee on Banking Supervision: Offers detailed guidance on identifying and verifying customer identities for banks.

- United Nations conventions: Include provisions against money laundering linked to drug trafficking, organized crime, and political corruption.

- IMF guidance: Encourages member countries to adopt international norms to combat terrorist financing effectively.

While these global frameworks set the standard for compliance, it’s equally important to understand how money laundering actually takes place in practice.

Stages Of Money Laundering

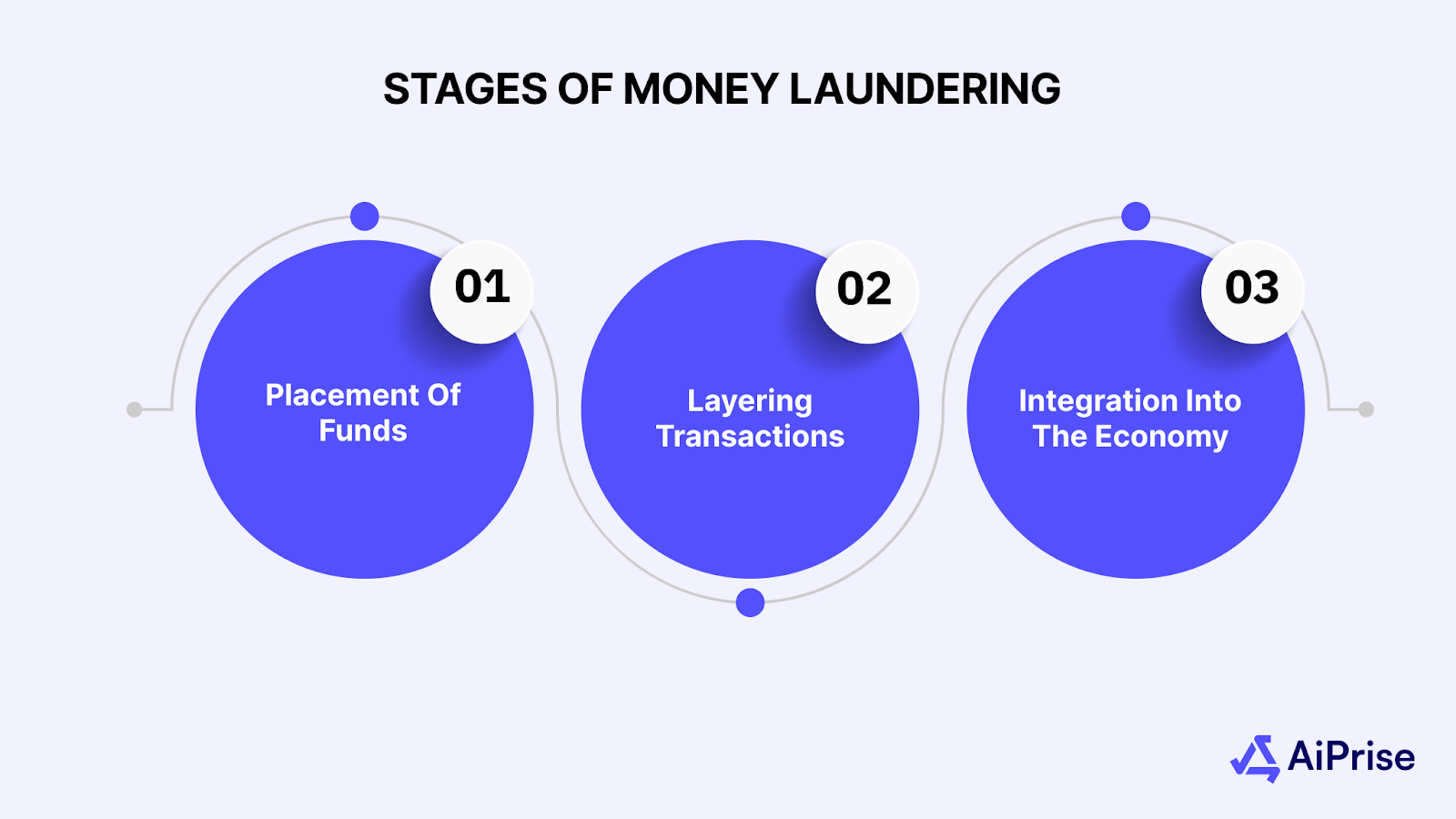

Money laundering usually happens in three stages. Each stage adds a layer of complexity, making it harder to trace the money back to its criminal source. These are:

1. Placement of Funds

Illicit money enters the financial system through deposits, false invoices, payments to cash businesses, or offshore transfers. These methods attempt to hide the origin of funds.

2. Layering Transactions

Criminals then separate these funds from their source to hide the source of money. This may include converting funds, moving them across accounts, or disguising ownership through shell companies.

3. Integration into the Economy

Laundered funds re-enter the economy through legitimate-looking transactions. They may appear as real estate investments or luxury assets, enabling criminals to increase their wealth undetected.

By the time funds reach the integration stage, they often appear legitimate and are difficult to trace back to their criminal origins. To counter these risks, AML laws focus on specific components that help financial institutions detect, monitor, and prevent suspicious activities.

Also Read: Understanding FRAML: Integrating Fraud Prevention and Anti-Money Laundering Operations

Key Components Of Anti-Money Laundering Laws

Anti-money laundering laws are built around several core elements that strengthen financial oversight. These requirements help businesses maintain transparency and reduce exposure to financial crime.

Customer Due Diligence (CDD)

CDD involves collecting and verifying customer information to ensure accuracy. Some customers may be flagged as high-risk, such as politically exposed individuals or those exposed to corruption.

For high-risk customers, enhanced due diligence is necessary. This includes additional monitoring and deeper investigations to confirm that all provided information is legitimate.

Suspicious Activity Reporting (SAR)

SAR requires institutions to report unusual or suspicious transactions. This may include large cash deposits, frequent transfers to high-risk regions, or inconsistent customer data.

Reports must be submitted promptly, reviewed by compliance officers, and sent to the relevant authorities to ensure timely investigation and action.

Know Your Customer (KYC)

KYC requirements ensure you know exactly who you are dealing with. Institutions collect valid documentation such as ID proof and addresses. This creates a transparent profile that helps organizations spot unusual activity quickly.

Effective KYC reduces the risk of financial crime by ensuring that institutions can trace the source of funds and detect suspicious customer behavior.

AML Training and Auditing

Your staff is your first line of defense. Regular training ensures they understand regulations and how to escalate concerns. Audits test the effectiveness of your systems. They highlight gaps, confirm compliance, and keep your AML program strong over time.

This ensures that your business maintains an active approach against financial crime while spot gaps before they become major issues.

Record Keeping

AML laws require businesses to hold on to documents such as transaction records, identity data, and monitoring reports. These must be kept for 5-7 years.

Good record-keeping creates a clear audit trail. It allows regulators and investigators to trace suspicious funds and spot emerging patterns of fraud.

Also Read: AML Compliance And Checks For Cross-Border Payments

How Technology Is Shaping AML Compliance?

As financial systems evolve, so do money laundering techniques. New technologies such as cryptocurrency and fintech have made transactions faster but more vulnerable to misuse.

- RegTech Automation: Tools now automate manual AML processes, reducing staff workload and improving the speed and accuracy of suspicious activity detection.

- AI and Machine Learning: These technologies analyze large datasets to identify unusual patterns and flag potential financial crimes efficiently.

- Blockchain Transparency: A decentralized, tamper-proof ledger provides a secure record of transactions, making illicit activity easier to trace and increasing overall transparency.

These technologies convert AML compliance from a manual burden into an actionable growth.

Best Practices To Stay AML Compliant

Following the anti-money laundering law needs planning and a proactive approach. The right steps help your organization stay aligned with regulations.

- Strong Internal Controls: Assign a compliance officer, set clear rules, and perform regular audits. Make reporting easy so suspicious transactions are detected quickly and accountability is clear.

- Regular Risk Checks: Review your organization’s risks and update AML policies often. This ensures procedures cover new threats, regulatory changes, and emerging patterns of financial crime.

- Train Staff and Talk to Regulators: Give employees regular AML training so they know their duties. Stay in touch with regulators to remain updated and adjust your practices as needed.

- Get Expert Help: Work with AML service providers like Aiprise for independent assessments. They help find gaps, implement best practices, and strengthen compliance without overloading your team.

Strengthening compliance often requires the right technology. AiPrise helps bridge that gap.

How AiPrise Supports Secure KYC and AML Practices?

AiPrise offers advanced KYC, KYB, and AML solutions to help businesses verify identities and prevent fraudulent activity efficiently. By combining AI and machine learning, the platform ensures that customer and business information is accurate and trustworthy.

Key features include:

- Real-Time Identity Verification: Instantly confirm customer and business identities using AI-powered checks and reliable global data sources.

- AML Monitoring & Risk Scoring: Detect suspicious activity, monitor transactions, and assign risk scores to support proactive compliance.

- Regulatory Compliance Support: Aligns with global AML standards to help institutions meet reporting and record-keeping obligations.

- Integration & Automation: Easily integrates with existing systems to streamline verification processes, reduce manual workload, and improve operational efficiency.

- Global Coverage: Verifies identities and businesses across multiple jurisdictions, providing a consistent and reliable approach for cross-border operations.

AiPrise makes identity checks easier, helps prevent fraudulent activity, and keeps your business and clients secure.

Final Thoughts

Anti-money laundering law is crucial for protecting businesses and the financial system. Using tools like KYC, CDD, and AML monitoring, institutions can detect suspicious activity, prevent illegal transactions, and reduce risks from organized crime or terrorist financing. Strong compliance helps maintain trust with customers and partners.

AiPrise provides organizations with AI-driven KYC and AML solutions to detect risks early and stay compliant with evolving regulations. Book A Demo to see how these solutions can strengthen your compliance efforts.

FAQ’s

1. What is the anti-money laundering law?

Anti-money laundering (AML) law comprises regulations that require financial institutions to detect, prevent, and report activities involving illegally obtained funds. It ensures that criminals cannot disguise illicit money as legitimate.

2. What is an example of anti-money laundering?

A bank conducting thorough KYC checks and reporting unusually large cash deposits to authorities is an example of AML in practice. These measures help prevent money from criminal sources from entering the financial system.

3. Can you report someone for money laundering?

Individuals or businesses can report suspected money laundering to relevant authorities, such as financial intelligence units or law enforcement agencies. This can be through designated reporting channels like Suspicious Activity Reports (SARs).

4. What are suspicious transactions in money laundering?

Suspicious transactions are financial activities that appear unusual, inconsistent, or lack a clear legitimate purpose. Examples include sudden large transfers, frequent payments to high-risk regions, or inconsistent customer information.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

.png)

.png)