AiPrise

7 min read

September 23, 2025

Understanding the Digital Asset Anti-Money Laundering Act 2023

Key Takeaways

The rise of digital assets has made compliance a growing challenge for businesses in the crypto space. Illicit addresses received $40.9 billion in cryptocurrency in 2024, highlighting the increasing risk of financial crimes. As regulatory pressure builds, staying compliant is a constant concern for businesses.

For crypto platforms and financial institutions, the complexity of digital transactions and the threat of penalties create a problematic situation. Understanding and meeting the latest compliance standards is essential to protecting your business from risk and reputational harm.

In this blog, we'll explore the Digital Asset Anti-Money Laundering Act (DAAMLA) of 2023. We'll discuss its provisions, the challenges it brings, and how to stay compliant while reducing risk.

Key Takeaways:

- The DAAMLA Act aims to extend anti-money laundering (AML) regulations to digital asset businesses.

- Key provisions include new compliance requirements for wallet providers, miners, and crypto kiosks.

- Businesses will need to enhance monitoring systems and implement stricter KYC protocols.

- Global coordination efforts are pushing for unified crypto regulations and standards.

- AiPrise offers tools to simplify compliance and reduce operational costs.

The Digital Asset Anti-Money Laundering Act (DAAMLA): Key Provisions and Legal Foundation

The DAAMLA (S.2669) was introduced in the Senate on July 27, 2023, and remains at the "Introduced" stage. With hearings held on October 26, 2023, January 11, 2024, and February 1, 2024, the bill is still under consideration.

If enacted, the DAAMLA would amend the Bank Secrecy Act (BSA) to include digital asset businesses and network participants, subjecting them to stricter compliance requirements.

The bill is framed as a response to the growing risks of illicit finance, including money laundering, ransomware, and terrorism financing, all linked to digital assets. It seeks to close regulatory gaps, applying the same compliance standards used by traditional financial institutions to the rapidly growing digital asset space.

Here's a summary of the key provisions of the DAAMLA and their potential impact on digital asset businesses:

If enacted, these provisions would impose significant new regulatory burdens on digital asset businesses. Compliance with AML/CFT obligations would become mandatory, and companies would need to adopt enhanced monitoring systems to detect illicit activities.

Also Read: Navigating KYC, AML, and Identity Verification in the USA

Now that we've explored the DAAMLA's key provisions, let's consider the operational implications that businesses might face in adapting to these requirements.

Managing the Operational and Compliance Implications

The introduction of the DAAMLA would mark a fundamental shift in how digital asset businesses operate. Moving from a largely self-regulated space to one with clearly defined compliance obligations would present several operational challenges.

One of the most pressing challenges is incorporating traditional compliance mechanisms, such as KYC and AML procedures, into decentralized systems. This presents significant operational hurdles, particularly given the pseudonymous and decentralized nature of many digital assets.

Key challenges include:

- Incorporating KYC & AML into Decentralized Systems: Ensuring identity verification while maintaining the anonymity and decentralization that characterize many blockchain networks will require creative solutions.

- Managing Talent and Resource Gaps: As the demand for compliance professionals grows, many businesses may find it challenging to recruit talent with the necessary expertise to navigate the new regulatory environment.

- Scaling Compliance Processes: As businesses expand, the need for automated processes to monitor transactions, verify identities, and report suspicious activity becomes critical.

- RegTech Adoption: To meet the new requirements, businesses will likely need to adopt AI-driven compliance solutions that can handle large volumes of transactions in real-time.

To build a strong compliance foundation, it's essential to follow a structured framework that will guide your business through this complex environment.

Also Read: Exploring The Key Benefits Of Regtech Solutions

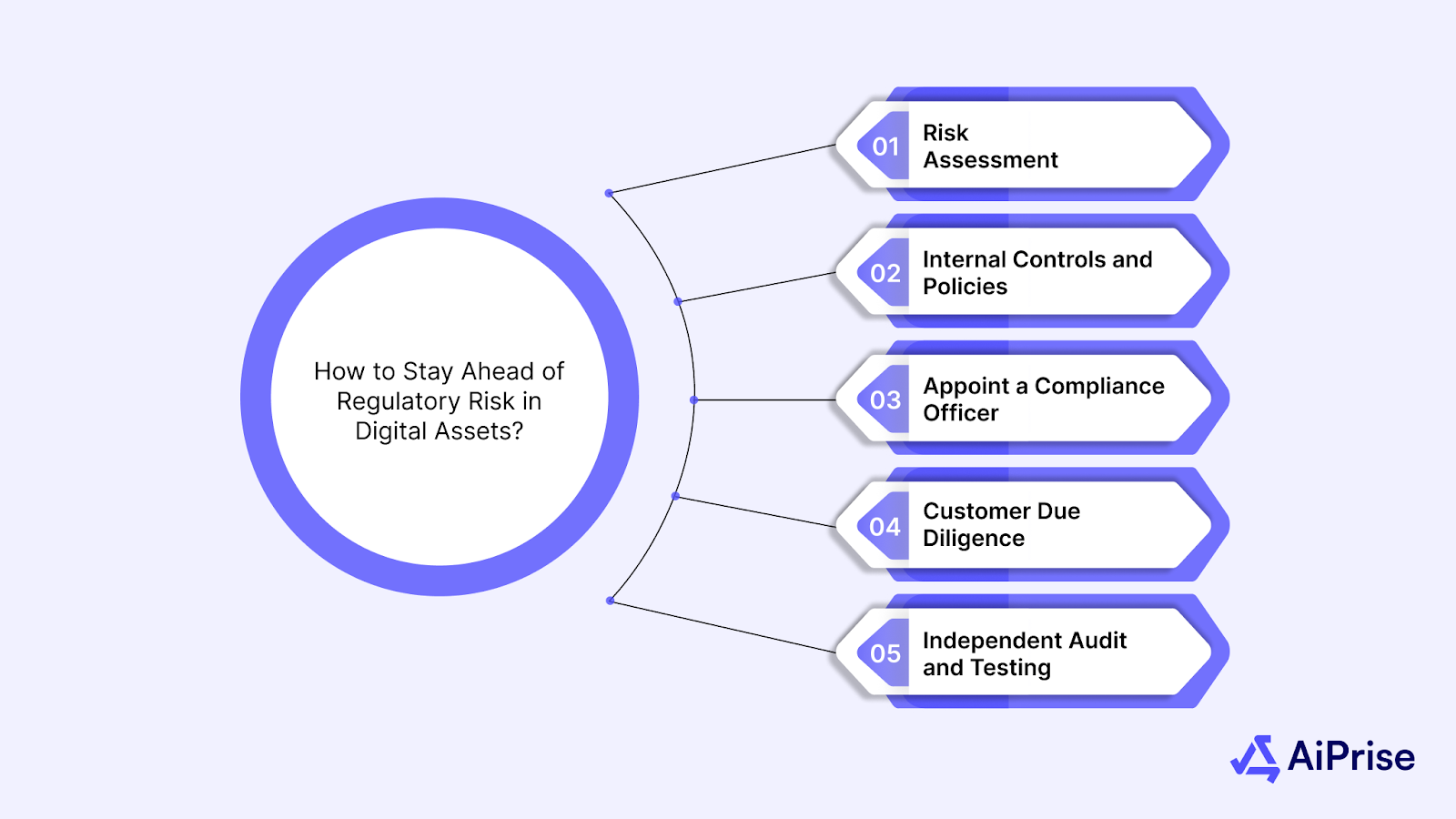

How to Stay Ahead of Regulatory Risk in Digital Assets?

To meet DAAMLA requirements, digital asset businesses should adopt a proactive, strategic approach to compliance. Building a robust framework demands a solid understanding of the regulatory environment and the adoption of technology-driven solutions.

Here's a framework for approaching compliance under the DAAMLA:

- Risk Assessment: Begin by assessing the specific risks your business faces in terms of money laundering and terrorist financing. A comprehensive risk analysis will help prioritize compliance efforts.

- Internal Controls and Policies: Establish clear policies and controls for customer screening, transaction monitoring, and reporting. These should be tailored to the specific risks of the digital asset industry.

- Appoint a Compliance Officer: A senior officer should be responsible for overseeing compliance, liaising with regulators, and ensuring that the organization meets all regulatory obligations.

- Customer Due Diligence (CDD): Implement strong KYC procedures, including identity verification and screening against sanctions lists. For higher-risk customers, Enhanced Due Diligence (EDD) should be applied.

- Independent Audit and Testing: Regular internal and third-party audits are essential to assess the effectiveness of the compliance program and ensure it meets legal requirements.

With the proper framework in place, it's equally important to understand how global coordination is shaping the future of digital asset regulation.

Also Read: How AI-Powered Compliance is Revolutionizing Risk Management for Businesses

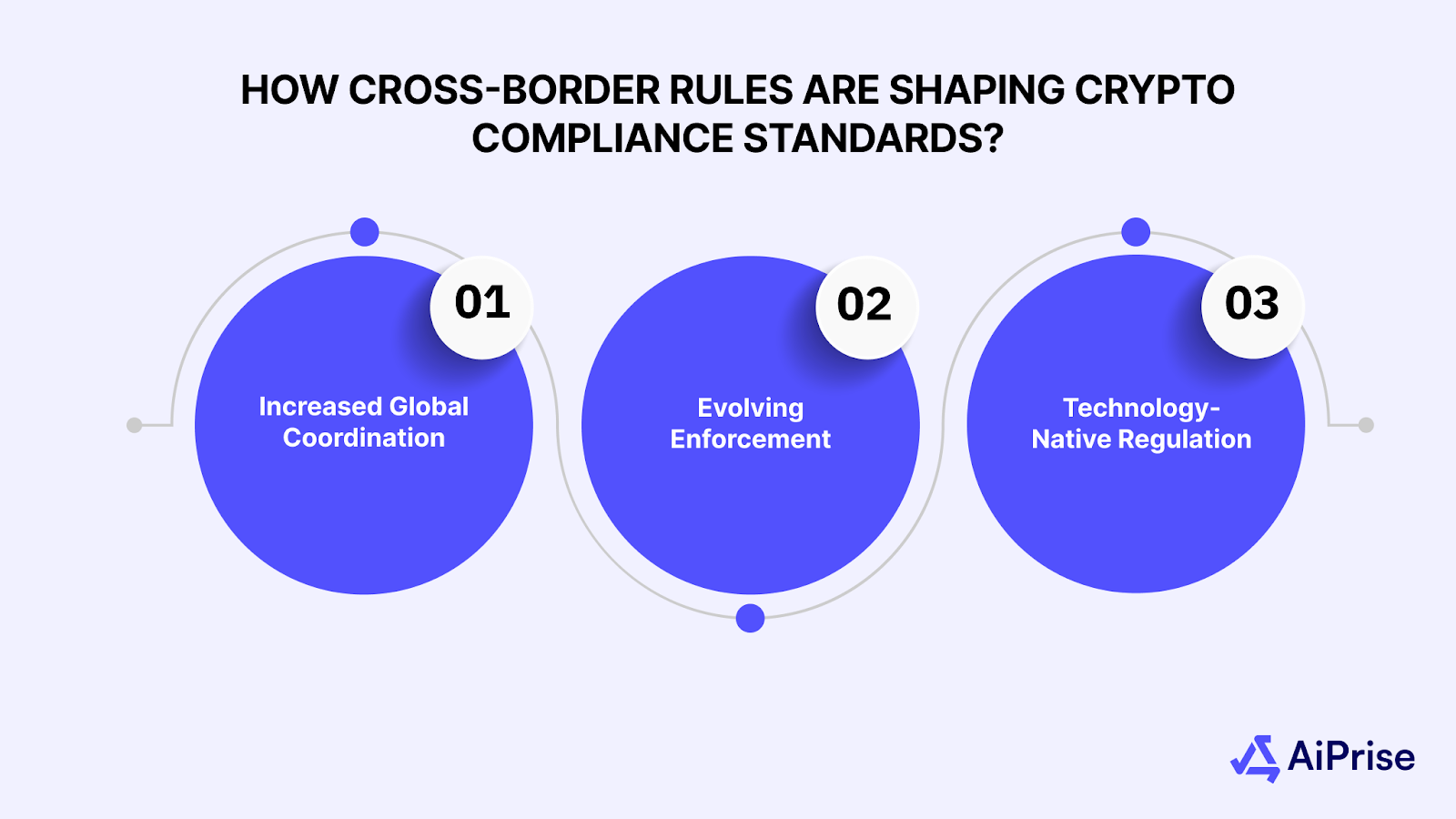

How Cross-Border Rules Are Shaping Crypto Compliance Standards?

As digital asset crime becomes an increasingly global concern, there is growing pressure on regulatory bodies worldwide to harmonize their approaches. The DAAMLA represents just one piece of a broader movement toward tighter global regulation.

Key trends shaping the future of digital asset regulation include:

- Increased Global Coordination: Regulatory bodies like the FATF are pushing for worldwide adoption of the "Travel Rule" and other standards, leading to more harmonized (and stringent) global regulations.

- Evolving Enforcement: Regulators are building specialized units to tackle crypto-related crime. Enforcement actions and penalties for non-compliance are expected to rise significantly.

- Technology-Native Regulation: Future rules would likely focus more on the underlying technology, targeting smart contracts and decentralized protocols directly.

As regulations continue to develop globally, staying compliant requires advanced tools designed to handle complex requirements.

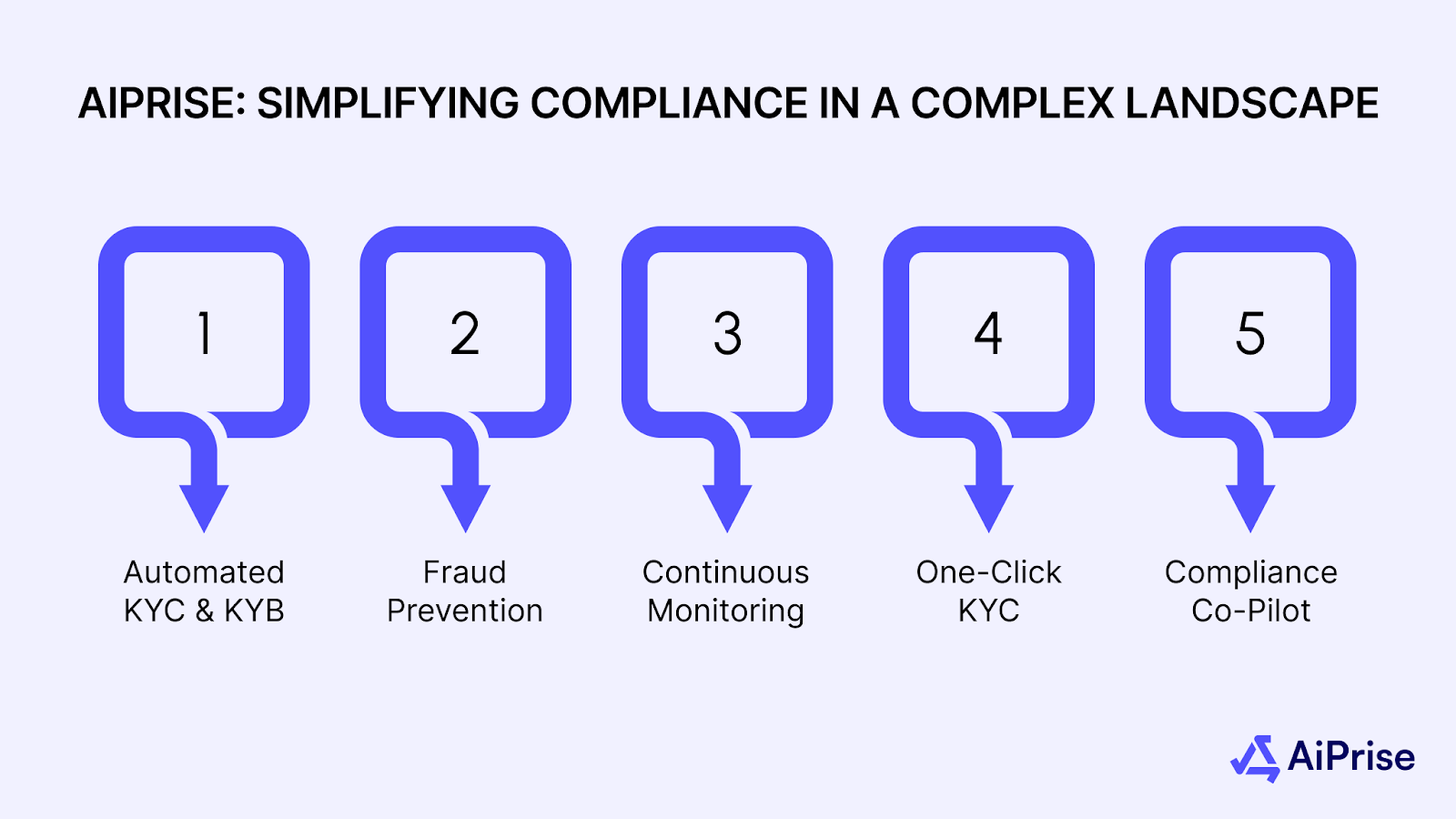

AiPrise: Simplifying Compliance in a Complex Landscape

As the regulatory environment for digital assets becomes more complex, staying compliant with evolving regulations like the DAAMLA can be challenging. AiPrise offers a comprehensive compliance solution designed to help digital asset businesses meet the demands of modern regulatory frameworks efficiently.

AiPrise automates core compliance functions, including KYC, KYB verification, fraud detection, and continuous monitoring, enabling businesses to stay compliant while scaling.

Key features of AiPrise include:

- Automated KYC & KYB: Onboard individuals and businesses securely in over 200 countries, with identity verification and cross-checks against official databases.

- Fraud Prevention: AiPrise uses advanced data analytics to detect fraud and assess risk profiles in real-time.

- Continuous Monitoring: Real-time alerts for suspicious activities, ensuring ongoing compliance.

- One-Click KYC: Simplifies verification for returning clients, maintaining security while reducing friction.

- Compliance Co-Pilot: AiPrise's AI-driven assistant automates document reviews and generates Enhanced Due Diligence (EDD) reports.

AiPrise's ability to consolidate multiple compliance tools into a single platform reduces costs by up to 30%, allowing firms to stay compliant while improving operational efficiency.

Conclusion

The Digital Asset Anti-Money Laundering Act (DAAMLA) of 2023 marks a pivotal shift in how digital asset businesses must approach compliance. The bill's provisions reflect the increasing need for robust AML/CFT frameworks to protect the financial system.

For digital asset businesses, proactive compliance is now an opportunity for growth and trust-building. By embracing a comprehensive AML framework and leveraging technology like AiPrise, companies can turn compliance into a source of operational efficiency. This will help firms grow, build trust, and secure long-term market positioning.

Book A Demo today to explore how AiPrise can simplify your compliance processes and ensure you remain fully aligned with the latest regulatory standards.

FAQs

1. What Is the Digital Asset Anti-Money Laundering Act (DAAMLA)?

The DAAMLA is a proposed bill introduced in 2023 to amend the Bank Secrecy Act, extending compliance requirements to digital asset businesses and participants, including miners, wallet providers, and validators.

2. How Does the DAAMLA Impact Digital Asset Companies?

The DAAMLA introduces new compliance requirements, including KYC/AML obligations, transaction monitoring, and reporting for unhosted wallets and anonymity-enhancing technologies.

3. What Are the Key Provisions of the DAAMLA?

Key provisions include extending BSA responsibilities to digital asset companies, finalizing unhosted wallet rules, regulating anonymity-enhancing tech, and establishing new compliance guidelines for crypto kiosks.

4. How Can Digital Asset Businesses Ensure Compliance with the DAAMLA?

Businesses should implement strong KYC/AML procedures, perform risk assessments, appoint compliance officers, conduct regular audits, and adopt technology solutions for monitoring and reporting.

5. What Role Do Global Regulations Play in Crypto Compliance?

Global regulatory bodies like the FATF are pushing for uniform crypto regulations, including adopting standards like the "Travel Rule," which helps ensure crypto transactions are not used for illicit activities.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

Speed Up Your Compliance by 10x

Automate your compliance processes with AiPrise and focus on growing your business.

.png)

.png)

.png)