AiPrise

13 min read

May 30, 2025

Navigating KYC, AML and Identity Verification in Japan

Key Takeaways

As a global leader in financial technology and regulatory compliance, Japan’s approach to Know Your Customer (KYC), Anti-Money Laundering (AML), and identity verification is rigorous and innovative.

Compliance with these regulations is critical for safeguarding businesses from financial crime risks while fostering credibility and confidence among clients, partners, and regulators.

Understanding Japan's landscape is essential for businesses and professionals aiming to operate there. Let’s examine the key laws and regulations that form the backbone of Japan’s compliance environment.

Evolution of Japan’s KYC and AML Framework

Japan’s approach to KYC and AML has evolved significantly over the past few decades, driven by both domestic needs and international standards. Initially, Japan’s AML efforts focused primarily on traditional banking sectors with basic identity verification practices.

However, as global financial crimes became more complex, Japan enhanced its regulatory environment, especially following its first AML legislation in the early 2000s.

In response to growing risks and international pressure from bodies like the Financial Action Task Force (FATF), Japan continuously updated its laws and enforcement mechanisms. This includes expanding the scope of regulated entities, adopting stricter customer due diligence requirements, and incorporating digital technologies for identity verification.

Today, Japan’s AML framework is recognized as one of the most advanced in Asia, balancing robust compliance with innovations like biometric verification and e-KYC solutions. This evolution reflects Japan’s commitment to protecting its financial system and aligning with global best practices.

The Regulatory Backbone: Laws and Authorities

Japan’s KYC and AML framework is built on a robust legal foundation, aligning closely with international best practices set by the Financial Action Task Force (FATF).

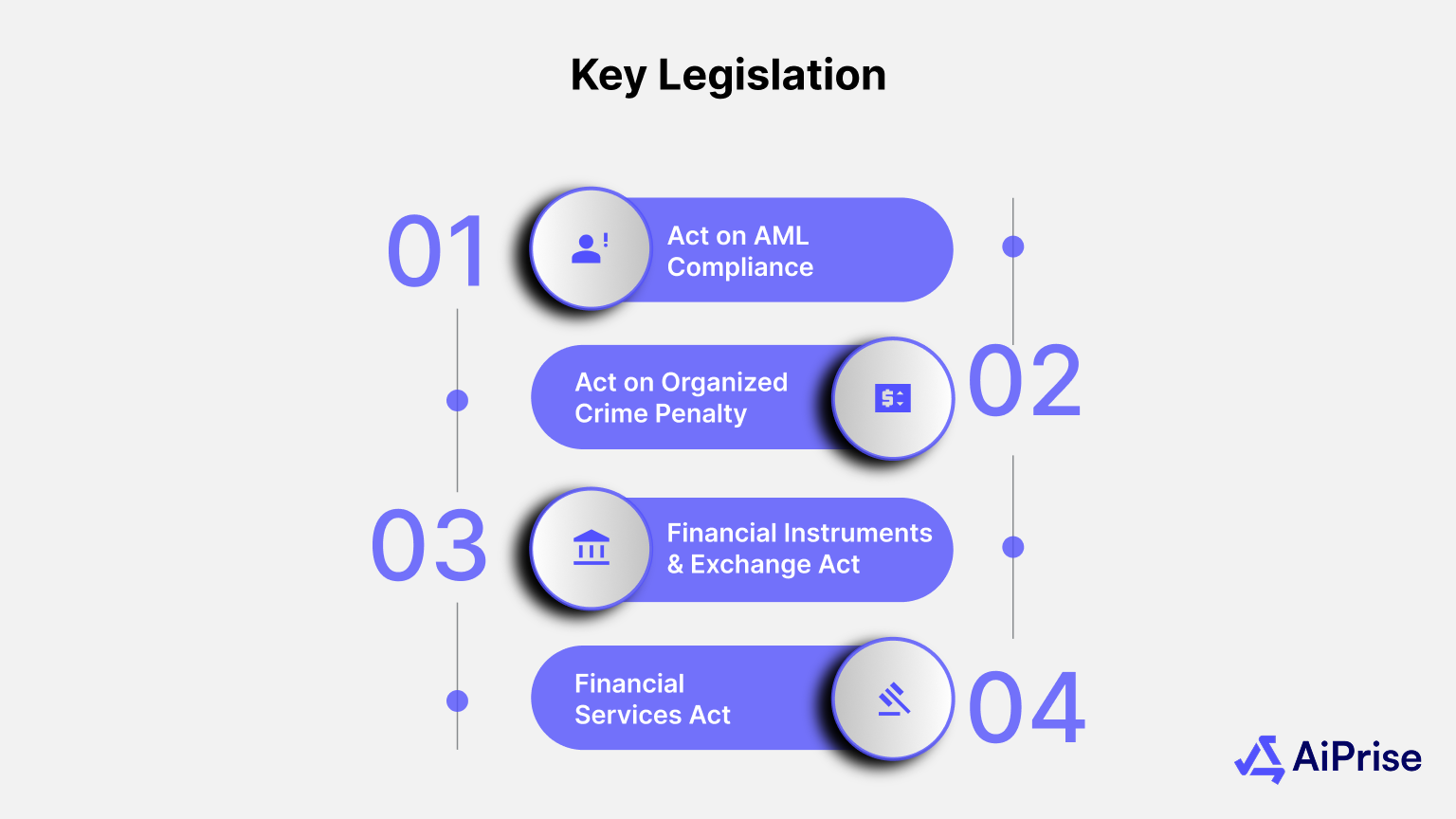

Key Legislation

- Act on Prevention of Transfer of Criminal Proceeds: The core AML law requires businesses to verify customer identities, keep transaction records for at least seven years, and report suspicious activities to the Japan Financial Intelligence Center (JAFIC).

- Act on Punishment of Organized Crimes: This act expands the definition of money laundering to include a broader range of crimes and imposes strict penalties for concealing illicit funds.

- Financial Instruments and Exchange Act (FIEA): The purpose of this act is to regulate financial markets and enforce transparency and client due diligence.

- Financial Services Act: It provides additional oversight and requires strong risk management and governance in financial institutions.

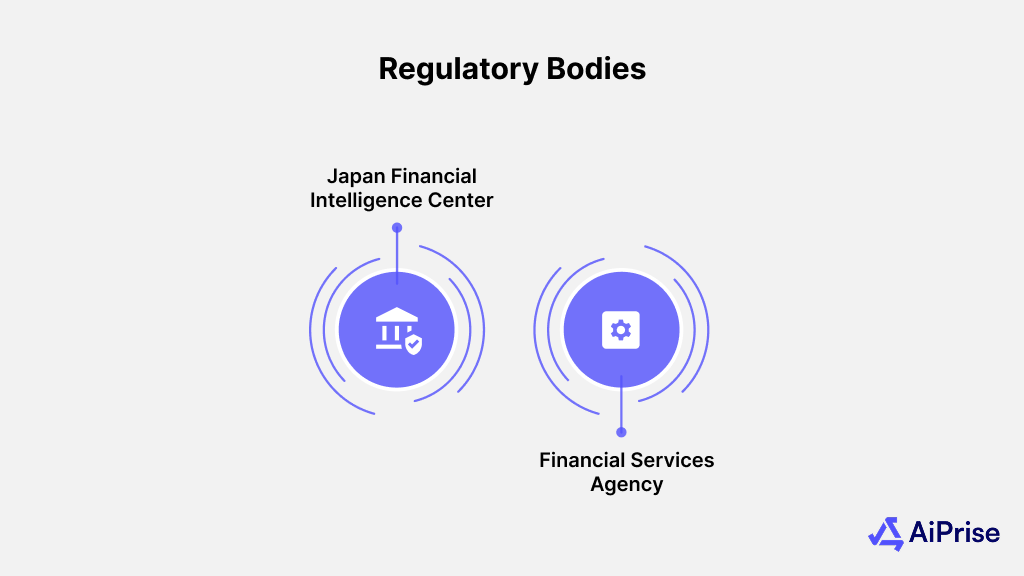

Regulatory Bodies

- Japan Financial Intelligence Center (JAFIC): Collects and analyzes suspicious transaction reports.

- Financial Services Agency (FSA): Oversees compliance and issues AML guidelines.

These regulations and regulatory bodies create a secure framework for businesses in Japan, ensuring compliance with KYC and AML standards and protecting the integrity of the financial system.

Now that we’ve outlined Japan’s regulatory framework, let’s explore the specific KYC and AML compliance requirements businesses must adhere to in order to operate legally in the country.

KYC and AML in Practice: What is Required?

Japan’s regulations apply to banks, fintech, crypto companies, real estate, and other sectors handling financial transactions. Here’s what businesses must do:

- Customer Identification: Businesses must verify customer identities by collecting government-issued documents such as the My Number Card (Japan’s national ID system), passport, driver’s license, or residence card for foreign residents.

- Record Keeping: Detailed records of customer identification documents, transaction histories, and due diligence processes must be retained for at least seven years to facilitate regulatory audits and investigations.

- Due Diligence: Customer due diligence (CDD) requires businesses to assess each customer's risk profile by verifying identity and understanding the purpose and nature of the business relationship.

- Enhanced Due Diligence (EDD): Businesses must conduct enhanced due diligence (EDD) for high-risk customers or transactions. EDD involves deeper scrutiny, including verifying the source of funds, ongoing transaction monitoring, and sometimes additional approvals before proceeding.

- Continuous Monitoring: Monitoring customer transactions is essential to detect suspicious or unusual activity. This includes reviewing transaction patterns and updating customer information periodically to reflect any changes in risk status.

- Reporting and Compliance: If suspicious transactions or activities are detected, businesses are legally obligated to report these to the Japan Financial Intelligence Center (JAFIC). Regular compliance reviews, staff training, and adherence to guidelines issued by regulatory bodies such as the Financial Services Agency (FSA) help maintain robust AML programs.

With these key steps in place, businesses are better equipped to meet Japan’s compliance requirements. Now, let’s discuss the important identity documents and verification methods for accurately confirming customer identities.

Identity Verification in Japan

Identity verification is a critical component of Japan’s KYC and AML processes. Businesses must ensure that they accurately verify their customers’ identities to prevent fraud, money laundering, and terrorist financing.

Japan has established specific documents and procedures for effective identity verification.

Key Documents for Identity Verification

Businesses in Japan typically rely on the following documents to verify customer identities:

- My Number: This is Japan’s national identification system and is used to verify the identities of citizens and residents. It is a vital tool for businesses, ensuring that they are engaging with legitimate individuals and companies.

- Passport: Foreign nationals in Japan are often required to provide their passport as proof of identity. This document is accepted for verifying the identity of international customers or travelers.

- Residence Card: Issued to foreign residents, this card serves as an official identification for non-citizens living in Japan. It’s a critical document for confirming the identity of foreign residents.

Biometric Verification and Digital Identity Solutions

As Japan’s financial sector becomes increasingly digitized, biometric verification and digital identity solutions are gaining prominence. These technologies provide an additional layer of security, reducing the risk of fraud:

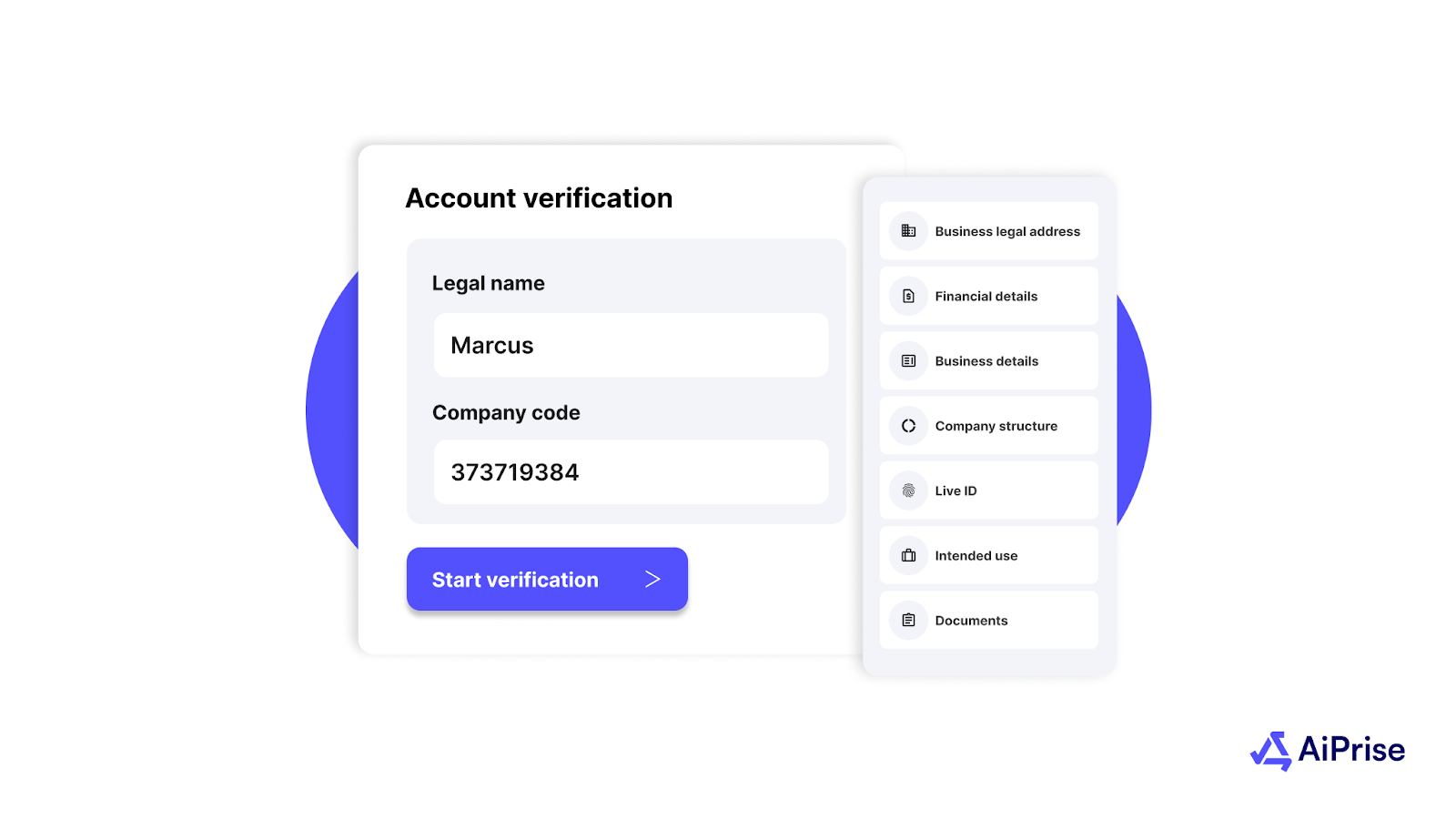

- Biometric Technologies: Facial recognition and fingerprint scanning are widely used to verify customer identities. These technologies are particularly helpful in digital and remote verification processes, providing accuracy and speed.

- Digital Identity Solutions: Japan is adopting digital identity solutions such as e-KYC (electronic Know Your Customer) systems. These digital platforms allow businesses to verify customers remotely and securely, streamlining the verification process while maintaining compliance.

Incorporating biometric verification and digital identity solutions into the KYC process is essential for enhancing security and ensuring the accuracy of customer identification.

With identity verification methods in place, businesses in Japan also face a range of challenges when it comes to compliance. Let’s explore some of the most common hurdles and how businesses can overcome them.

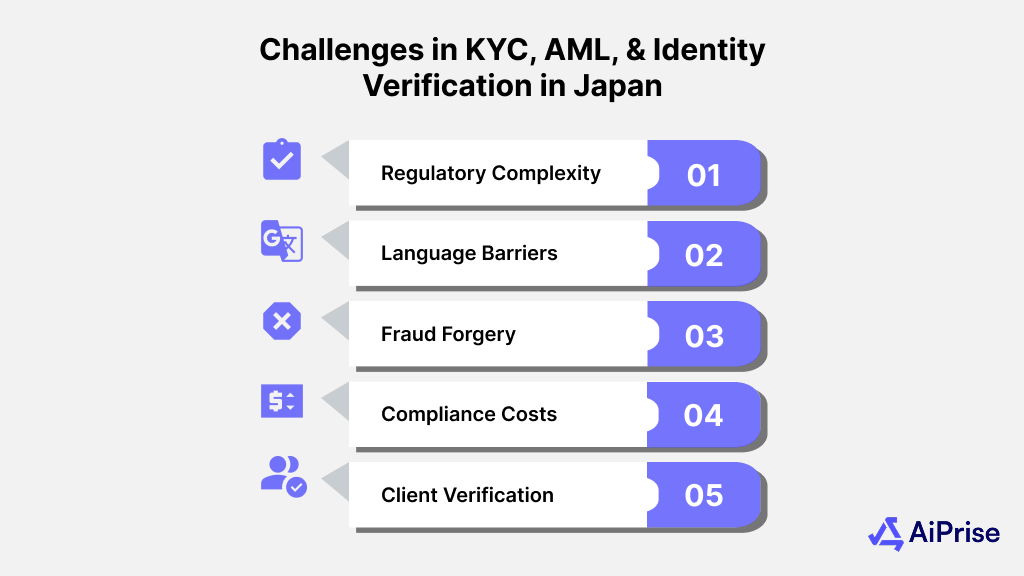

Challenges in KYC, AML, and Identity Verification in Japan

Despite having a clearly defined regulatory environment, businesses in Japan face several practical challenges when implementing KYC, AML, and identity verification protocols. These challenges can impact efficiency, compliance, and the ability to detect financial crimes effectively.

Regulatory Complexity

Japan’s financial regulations are continuously evolving to align with international standards. For businesses—especially those operating across borders—keeping up with legal updates and ensuring ongoing compliance can be resource-intensive and difficult to manage.

Language and Documentation Barriers

Most regulatory documentation, official forms, and government communications are in Japanese. This creates challenges for international companies that may not have native language expertise. Verifying customer documents, especially from foreign nationals, can also be complicated by varying global standards and formats.

Fraud Risks and Identity Forgery

As fraud techniques become more sophisticated, businesses in Japan must contend with forged documents, identity theft, and synthetic identities. Manual verification processes are often not enough to detect these advanced threats, putting institutions at higher risk.

Compliance Costs

Developing and maintaining a robust KYC/AML program can be expensive. Small and medium-sized businesses may struggle with the financial and operational burden of investing in secure infrastructure, staff training, and compliance technologies.

Cross-Border Client Verification

Businesses working with international clients must balance Japanese compliance rules with international data protection laws like GDPR or FATCA. This creates additional layers of complexity, especially when handling sensitive customer information.

Despite these challenges, businesses can stay ahead by adopting advanced technologies, automating manual tasks, and leveraging platforms that offer real-time data access and global verification coverage.

As compliance challenges grow more complex, the role of technology in simplifying KYC, AML, and identity verification has never been more important. In the next section, we’ll explore how digital tools are reshaping compliance operations in Japan.

The Role of Technology in Simplifying KYC, AML, and Identity Verification

Advancements in technology have been transformative for businesses in Japan, making it easier to meet KYC, AML, and identity verification requirements.

- AI and Machine Learning: These technologies can quickly analyze large datasets to identify suspicious activities and flag high-risk transactions, helping businesses detect money laundering activities more effectively.

- Biometric Verification: Using facial recognition, fingerprint scanning, and other biometric tools enhances the accuracy of identity verification, reducing the risk of fraud.

- Automation: Automating compliance tasks, such as document verification and transaction monitoring, improves efficiency and reduces the chances of human error.

- Real-Time Data Access: Platforms that integrate global data sources allow businesses to verify identities quickly and detect risks in real time.

By adopting these technologies, businesses in Japan can better manage regulatory risk, streamline compliance operations, and scale their processes as they grow.

Technology is a powerful enabler, but businesses need the right platform to fully realize their potential. Let’s examine how AiPrise helps organizations in Japan simplify and strengthen their KYC and AML efforts.

AiPrise Solutions for KYC, AML, and Identity Verification in Japan

AiPrise offers an integrated platform that helps businesses in Japan streamline their KYC, AML, and identity verification processes. With access to over 100 data sources and advanced AI technology, AiPrise simplifies compliance while reducing the risk of fraud.

- Global Data Access: AiPrise integrates data from 500 million businesses and 5 billion users worldwide, enabling businesses in Japan to perform thorough due diligence.

- Fraud Prevention Tools: AiPrise provides robust tools to detect and prevent fraudulent activities, helping businesses secure transactions and build trust with customers.

- Seamless Integration: AiPrise’s platform integrates seamlessly into existing workflows, providing businesses with a unified solution to manage compliance requirements efficiently.

Conclusion

Successfully managing KYC, AML, and identity verification in Japan means staying up-to-date with regulations and implementing effective compliance strategies.

With the regulatory landscape continually evolving, leveraging technology like AiPrise can help businesses streamline their compliance processes, reduce risks, and enhance security.

Ready to simplify your compliance efforts in Japan?

Book a Demo with AiPrise today to explore how our platform can help you stay compliant and secure in Japan’s dynamic market.

Frequently Asked Questions (FAQs)

1. What are the key laws governing KYC and AML compliance in Japan?

Japan’s KYC and AML framework is governed primarily by the Act on Prevention of Transfer of Criminal Proceeds, the Act on Punishment of Organized Crimes, the Financial Instruments and Exchange Act (FIEA), and the Financial Services Act. These align with international standards set by the FATF.

2. Which identity documents are used for verification in Japan?

Commonly used documents include the My Number Card (Japan’s national ID), passports for foreign nationals, and residence cards for foreign residents.

3. What sectors are subject to KYC and AML regulations in Japan?

Regulations apply to banks, fintech companies, cryptocurrency platforms, real estate, and other businesses handling financial transactions.

4. What is the difference between due diligence and enhanced due diligence?

Due diligence involves verifying a customer's identity and assessing risk. Enhanced due diligence (EDD) applies to high-risk customers or transactions and includes more thorough checks, such as verifying the source of funds.

5. How long must businesses keep KYC and AML records in Japan?

Businesses are required to retain records for at least seven years to comply with regulatory requirements and support audits.

6. What are the main challenges businesses face in KYC and AML compliance in Japan?

Key challenges include regulatory complexity, language barriers, sophisticated fraud techniques, high compliance costs, and complexities in cross-border client verification.

7. How does technology aid KYC and AML compliance in Japan?

Technologies like AI, biometric verification, automation, and real-time data access help businesses detect risks more efficiently, reduce errors, and streamline compliance processes.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

Speed Up Your Compliance by 10x

Automate your compliance processes with AiPrise and focus on growing your business.

.jpeg)

.jpg)

.jpeg)

.png)

.png)

.png)

.png)