AiPrise

11 mind read

June 24, 2025

Understanding the Importance of Address Verification in KYC

Key Takeaways

Address verification is often viewed as a secondary step in the Know Your Customer (KYC) process, but it holds far more importance than most realize. As businesses continue to combat identity fraud, money laundering, and regulatory pressures, verifying a customer’s address has become essential to maintaining the integrity of financial systems.

Westpac Banking Corporation had to pay AU$ 1.3 billion in penalties due to breaches of the Anti-Money Laundering and Counter-Terrorism Financing Act (AML/CTF Act) in September 2020. The systemic failures in KYC and inadequate verification of customer information, including address, enabled high-risk entities to evade detection.

This blog examines the crucial role of address verification in KYC processes, highlighting its significance in establishing a secure and compliant environment for both businesses and their customers.

What Is Address Verification in KYC?

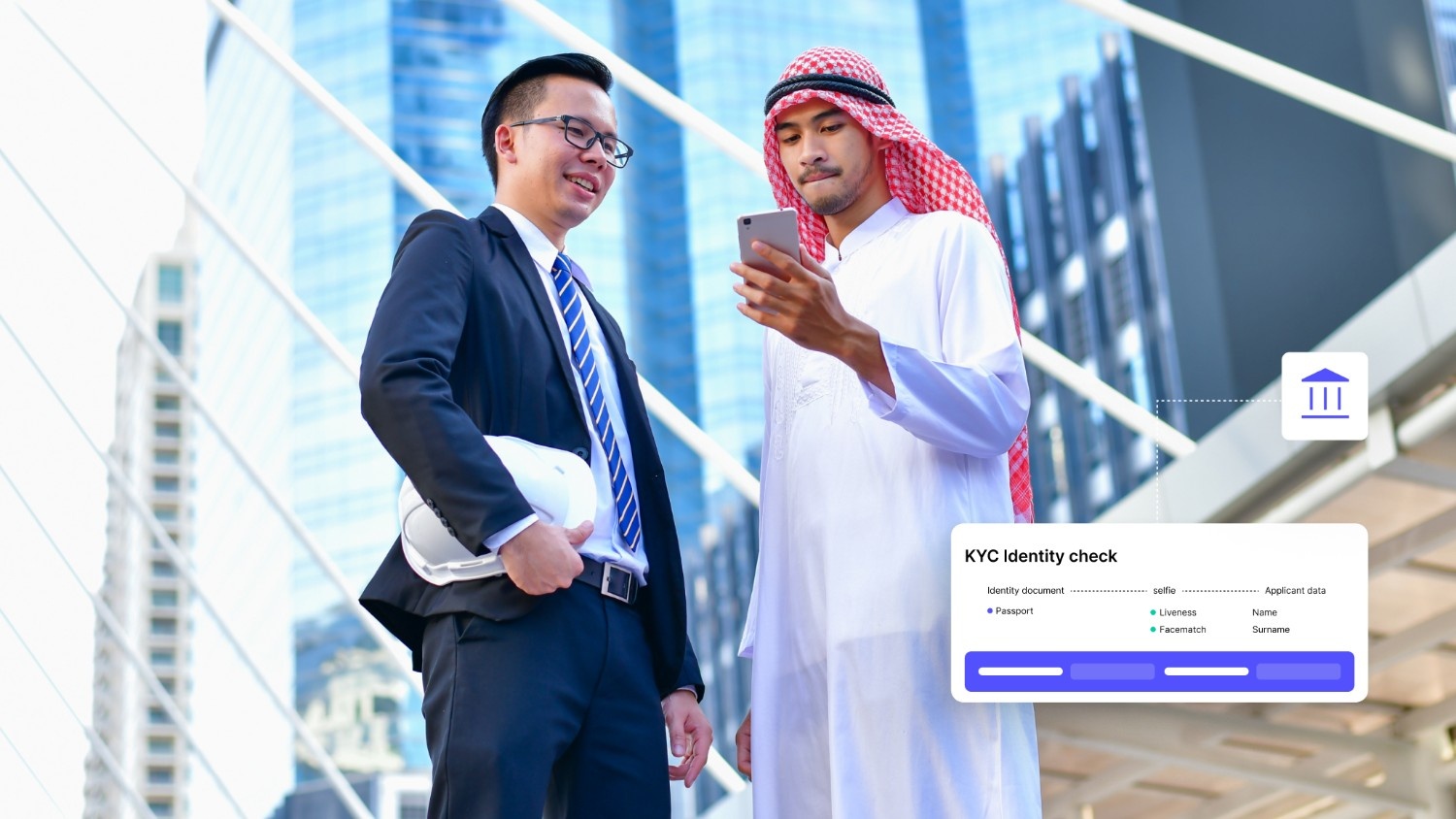

Address verification is an essential part of the Know Your Customer (KYC) process, designed to confirm the authenticity of a customer’s provided address. As part of the broader identity verification efforts, address verification ensures that the information a customer submits about their location is accurate, valid, and consistent with other details provided.

Here's how address verification contributes to the broader KYC process:

- Prevents Identity Theft: Confirms the authenticity of the customer’s identity, ensuring they are not using stolen or fraudulent information.

- Reduces Financial Fraud: It helps identify and block fraudulent transactions, protecting the business and its customers from financial loss.

- Mitigates Money Laundering Risks: Ensures the customer's address matches verified data, helping to identify and prevent money laundering schemes.

- Enhances Regulatory Compliance: Assists in meeting local and international regulations, reducing the risk of non-compliance penalties.

Next, let's explore the key criteria that must be met when validating the proof of address (POA).

Key Criteria for Valid Proof of Address (POA)

For address verification to be effective and comply with KYC regulations, the submitted proof of address (POA) must meet the criteria mentioned below:

- Customer’s Full Name and Address: The document must clearly display the customer’s full name and address. The match between the provided information and the submitted documents must be precise.

- Document Recency: The document should be recent, typically within the past three to six months, to ensure the customer’s address is up to date. Older documents may not reflect the customer’s current residence.

- Official Source: The document must originate from a reputable, official source, such as a utility company, financial institution, or government agency. This ensures the document's legitimacy and reduces the risk of fraud.

- No Alterations: The submitted document should be free from alterations or signs of tampering. Fraudulent documents can often include manipulated addresses or forged signatures.

- Clear Legibility: All the details on the document must be clearly readable. This includes ensuring that the text is not blurry or obscured, which could compromise the verification process.

With these key criteria in mind, it's time to know the steps for the address verification process.

How Does Address Verification Work in KYC?

Address verification is a structured process that businesses use to ensure the accuracy and legitimacy of the addresses provided by their customers. Over the years, this process has evolved from manual checks against physical records to sophisticated, automated systems that use external databases and machine learning for faster and more accurate verification.

The process typically involves a few key steps, as mentioned below:

Step 1: Document Submission

The first step in address verification is having the customer submit proof of address (POA) documents. These documents often include utility bills, bank statements, government-issued IDs, or rental agreements that clearly display the customer’s name and address.

Step 2: Document Validation

Once the customer submits their proof of address, the next step is to validate the document’s authenticity. Businesses often use automated systems that verify the document's format, check for signs of tampering, and confirm that it originates from a legitimate source (such as a utility company, financial institution, or government agency).

Step 3: Cross-Referencing Data

In this stage, businesses may cross-reference the submitted address with third-party databases, such as postal records, utility companies, or government databases. This helps confirm that the provided address exists and matches the details in official records. Advanced systems may also utilize machine learning to identify discrepancies between customer-provided data and existing data sources.

Step 4: Data Matching

Finally, the address is cross-checked against the customer’s profile to ensure consistency. If there are any discrepancies, such as a mismatch between the name on the address document and the name in the customer's record, the system flags this for further review. Businesses typically follow up with customers for clarification if needed.

By combining human oversight with automated verification systems, businesses can ensure a high level of accuracy and efficiency during the address verification process.

Now that we understand the process of address verification, it's always beneficial to know the best practices.

Best Practices for Implementing Address Verification Systems

A strong address verification system prevents fraudulent activities, ensures secure customer onboarding, and maintains regulatory compliance. By using advanced technologies and best practices, mentioned below, businesses can enhance the reliability of their verification processes while minimizing risk.

- Utilize Real-Time Verification: Automating the process and employing real-time verification systems helps minimize delays and ensures quicker identification of fraudulent activity. This also enhances customer experience and operational efficiency.

- Integrate Multiple Data Sources: By leveraging data from various sources such as government databases, utility companies, and financial institutions, businesses can cross-check and validate address data more accurately.

- Ensure Compliance with Regional Regulations: Different regions have specific regulations governing KYC and address verification. Ensure your verification system complies with local laws such as GDPR in the EU or AML regulations in the U.S.

- Regularly Update Sanctions and Watchlists: Keep your systems up to date to stay compliant as regulations evolve and new sanctions are imposed. This is particularly important for businesses operating in multiple countries with varying regulatory requirements.

- Implement Machine Learning for Improved Accuracy: Incorporating AI and machine learning algorithms helps detect subtle discrepancies and patterns, reducing human errors and false positives.

- Provide a Seamless Customer Experience: Ensure the address verification process is straightforward for customers. Clear instructions and easy-to-use submission channels will help prevent customer frustration and improve overall satisfaction.

- Monitor for Ongoing Compliance: Address verification doesn't stop after onboarding. Continually monitor and verify addresses at key stages, such as during transactions, to ensure ongoing compliance and reduce risks.

While implementing best practices for address verification significantly enhances security and compliance, businesses must also be aware of potential challenges that may arise.

Challenges in Address Verification

While address verification is critical in the KYC process, businesses face several challenges that can complicate its effectiveness. These challenges stem from various factors, including document fraud, data inconsistencies, and privacy concerns.

Let's examine these challenges in detail:

Document Fraud

Fraudulent documents are one of the most significant risks in address verification. Criminals may alter or forge utility bills, bank statements, or government-issued IDs to create a false address. These fake documents can easily slip through if there's insufficient scrutiny or if businesses rely solely on manual checks.

While automation and AI have reduced the chances of fraud, the issue remains a serious concern, particularly for smaller businesses that may not have access to advanced verification tools.

Data Inconsistencies

Address formats differ across countries, making it difficult to standardize verification processes globally. For example, in some countries, addresses may include postcodes, while in others, they may not. Some regions might require a business's name on the proof of address, while others focus only on the individual's name.

These variations can cause inconsistencies and errors in the verification process, particularly when businesses operate across multiple jurisdictions.

Privacy Concerns

In an era where privacy regulations, such as the General Data Protection Regulation (GDPR) in the European Union, are gaining prominence, customers are increasingly cautious about sharing their personal information. Some may be reluctant to provide sensitive data, such as proof of address, due to concerns over how their information will be stored and used.

Risk of False Positives

False positives are a significant challenge in address verification. These occur when legitimate customer data is mistakenly flagged as a match to sanctioned individuals or entities, creating unnecessary delays and manual interventions. The high volume of data can increase the risk of false positives, particularly for businesses that rely on automated systems without machine learning capabilities to enhance accuracy. Managing false positives can strain resources and reduce operational efficiency.

Businesses must strike a balance between the need for verification and the responsibility to protect customer privacy while complying with data protection laws.

While the challenges in address verification are significant, businesses can use advanced tools and strategies to overcome these hurdles. Let's now explore how AiPrise can help streamline the address verification process and enhance compliance.

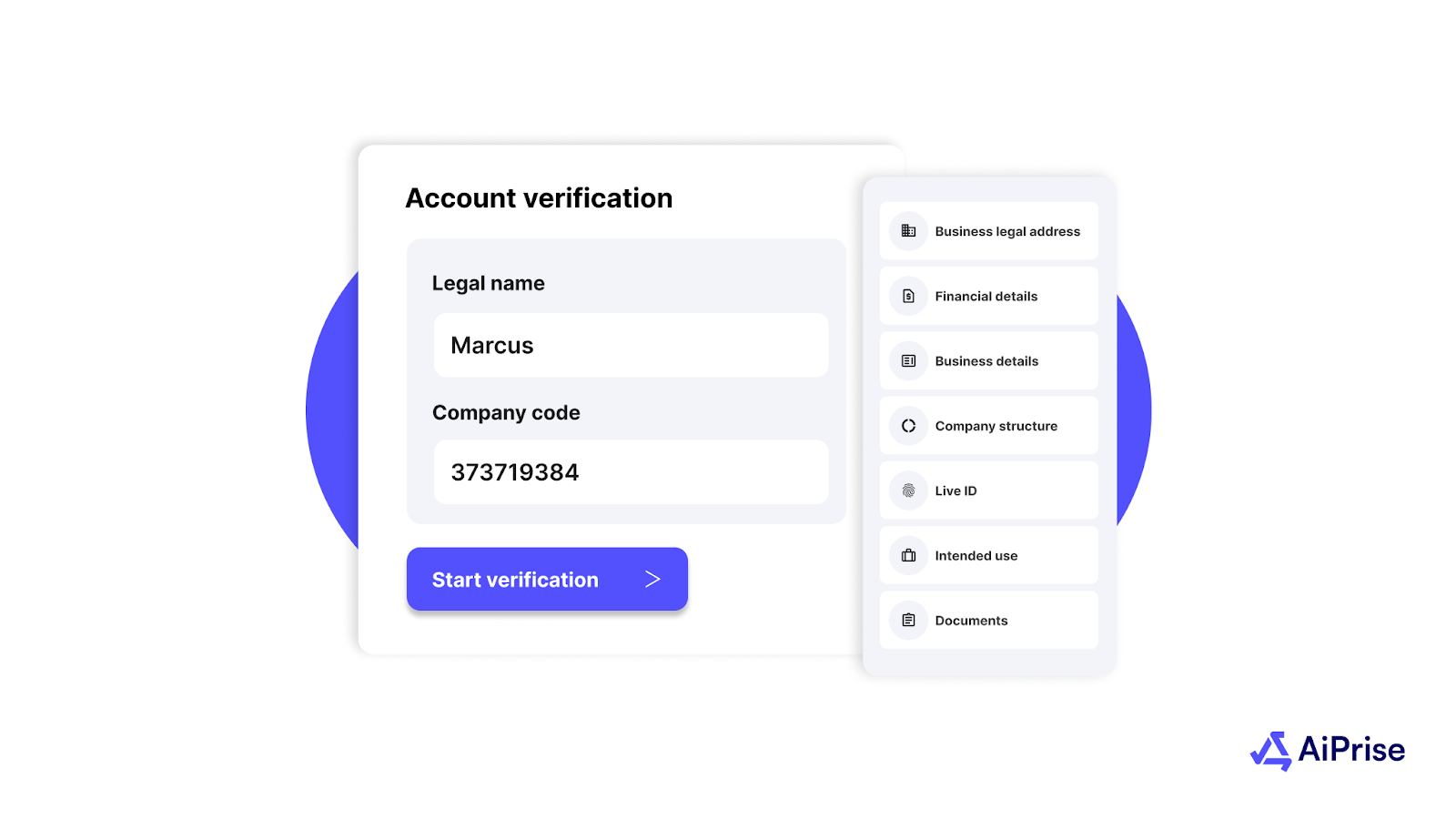

How AiPrise Helps with Address Verification in KYC?

AiPrise offers advanced KYC solutions that integrate automated address verification tools to help businesses streamline their compliance processes. Using automation and AI, AiPrise ensures companies can verify customer addresses accurately while reducing fraud and meeting global regulatory requirements.

Here are the key features of AiPrise's Proof of Address solution:

- Automated Address Verification

AiPrise automatically extracts key details from submitted proof of address (PoA) documents and cross-references them with the user-provided information, such as name and address, ensuring accurate verification with minimal manual intervention. - Document Recency Check

To maintain compliance, AiPrise rejects documents older than 3 months, ensuring that the address data is up-to-date and reflects the current residence or business location. - Tamper Detection

AiPrise conducts thorough tamper checks to verify document authenticity. The system checks fonts, logos, and other document elements to ensure the proof of address has not been altered or forged, minimizing the risk of fraudulent activity. - Seamless User Experience

The address verification process is simplified for users with a seamless, one-step document submission process, reducing friction and improving the overall user experience. - Fewer Manual Processes

By automating the verification of proof of address documents, AiPrise reduces the need for manual processing, saving both time and resources while improving efficiency. - Comprehensive Compliance

AiPrise ensures that businesses stay compliant with global regulations by providing accurate address verification in line with local and international standards. - Real-Time Verification

With AiPrise’s automated system, businesses can verify addresses in real-time, providing faster and more reliable compliance checks during customer onboarding and customer relationships.

With these powerful features, AiPrise streamlines the address verification process, ensuring businesses can quickly and accurately validate customer addresses while minimizing fraud and staying compliant with ever-evolving regulations.

Conclusion

Address verification is an essential part of the Know Your Customer (KYC) process, providing businesses with a reliable method to confirm the authenticity of customer information and protect against fraud. As regulations become stricter and the threat of identity theft rises, implementing robust address verification measures has never been more critical.

For organizations committed to fortifying their security and streamlining their operations, AiPrise emerges as the premier choice, simplifying complexities while ensuring unwavering compliance and significant fraud reduction.

Want to simplify your address verification? Book a Demo today and see how AiPrise can help your business stay compliant and secure!

FAQs (Frequently Asked Questions)

1. What documents are typically required for address verification in KYC?

Common documents used for address verification include utility bills (such as electricity, water, or gas), bank statements, government-issued identification (like a driver's license or passport), and rental agreements. These documents must display the customer's full name and address.

2. Why is address verification important in the KYC process?

Address verification helps confirm that the customer’s provided address is legitimate and accurate. It plays a vital role in fraud prevention, regulatory compliance, and risk management, ensuring that businesses adhere to anti-money laundering (AML) and KYC regulations.

3. What are the most common challenges in address verification?

The challenges in address verification include document fraud (the use of fake or altered documents), data inconsistencies resulting from differing address formats across regions, and privacy concerns related to the handling of sensitive personal data. These challenges require careful attention and robust systems to address effectively.

4. How does AiPrise help businesses with address verification?

AiPrise automates the address verification process using AI and machine learning technologies. The platform cross-references addresses against a global network of databases, reducing the risk of fraud, ensuring compliance, and improving the efficiency of KYC procedures.

5. Can address verification be done digitally?

Yes, address verification can be done digitally using automated tools and online databases. Platforms like AiPrise offer digital address lookup services, enabling businesses to verify addresses in real-time and provide faster and more reliable results than manual verification.

6. How does AiPrise ensure compliance with global KYC regulations?

AiPrise continually updates its systems to stay in line with evolving global regulations. It provides businesses with access to more than 100 data sources across 220+ countries, ensuring that address verification and other KYC checks comply with local and international laws.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

.jpeg)

.jpg)

.jpeg)

.png)

.png)