AiPrise

12 mins read

August 5, 2025

End to End KYC Process: A Complete Guide for Compliance and Fraud Prevention

Key Takeaways

The ability to accurately verify customer identities has become a strategic imperative for today’s leaders. With digital channels multiplying and fraud tactics evolving, the traditional approach to Know Your Customer (KYC) is no longer enough.

Modern compliance, risk management, and customer experience all depend on an integrated, end-to-end KYC process. A process that goes beyond initial checks and delivers continuous oversight, trust, and agility as your business scales.

This guide provides a comprehensive roadmap for CEOs seeking to implement and optimize end-to-end KYC, with practical insights to turn compliance into a competitive advantage.

Key Takeaways

- End-to-end KYC is essential for business growth. Implementing a comprehensive KYC process helps protect businesses from fraud and financial crime while supporting growth in global markets.

- Continuous monitoring, re-verification, and dynamic risk assessment are critical for staying compliant and managing evolving threats in real-time.

- AI, machine learning, and automation accelerate KYC processes, reduce errors, and ensure fast, secure customer verification.

- By segmenting customers based on risk, businesses can optimize their resources and apply stricter checks where necessary, ensuring operational efficiency.

- AiPrise offers a scalable, automated KYC solution that supports over 220 countries, ensuring compliance and fraud prevention across multiple jurisdictions.

What is End-to-End KYC?

End-to-End KYC refers to a holistic approach to customer verification and compliance management that extends beyond just onboarding. This process ensures that businesses can continuously assess the legitimacy of their customers throughout the entire relationship. It involves:

- Customer Onboarding: Verifying essential identity details like names, dates of birth, and addresses using trusted documents.

- Risk Assessment: Evaluating customer profiles against various risk factors and regulatory lists, helping identify potential threats early on.

- Continuous Monitoring: Regularly reviewing customer behavior and transaction patterns to ensure that they remain within expected norms, minimizing exposure to financial crime.

End-to-End KYC ensures businesses aren’t just compliant at the point of entry but are proactively managing and mitigating risks long-term. With this foundational understanding, let’s dive into why End-to-End KYC is so vital for businesses that are scaling and expanding globally.

Why the End-to-End KYC Matters for Growing Companies

CEOs steering expanding companies, the End-to-End KYC is more than a compliance necessity; it’s a strategic infrastructure for protecting your business as it scales. As customer bases grow and operations cross borders, the ability to verify identities quickly and accurately guards against escalating risks: financial crime, fraud, and fines that can threaten momentum and investor trust.

The stakes are high. In 2020 alone, banks faced over $10 billion in fines for AML violations.

By adopting an integrated, automated KYC approach, you can reduce manual workloads, speed up onboarding, and safeguard your company’s reputation as you enter new markets.

In fast-growth environments, KYC isn’t a single checkpoint but a continuous cycle supporting risk management, trust, and sustainable expansion. Companies that treat KYC as a business differentiator—not just a legal requirement—are better positioned to maximize opportunity while minimizing exposure to modern threats.

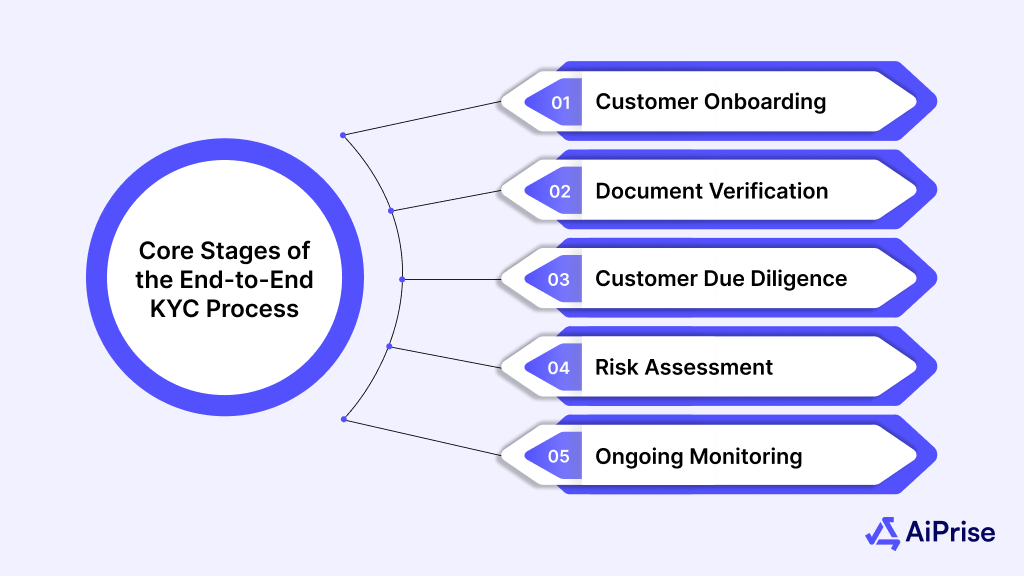

Core Stages of the End-to-End KYC Process

Successful implementation of an End-to-End KYC Process entails a seamless integration of several critical stages throughout the customer lifecycle. Each step is designed to meet compliance obligations while enabling efficient, risk-aware decision making as your company scales internationally and digitally.

1. Customer Onboarding & Identification

This first stage captures and verifies essential customer details such as full name, date of birth, and address. Verification focuses on obtaining government-issued identity documents (e.g., passports, driver’s licenses), which are the foundation of trusted identity. Digital onboarding platforms now accelerate data collection while enhancing user experience.

In the United States, Customer Identification Programs (CIP) form a regulatory backbone to KYC onboarding as part of the Bank Secrecy Act and USA PATRIOT Act mandates. These programs require confirming key identity data before establishing accounts or initiating significant transactions.

2. Document Verification

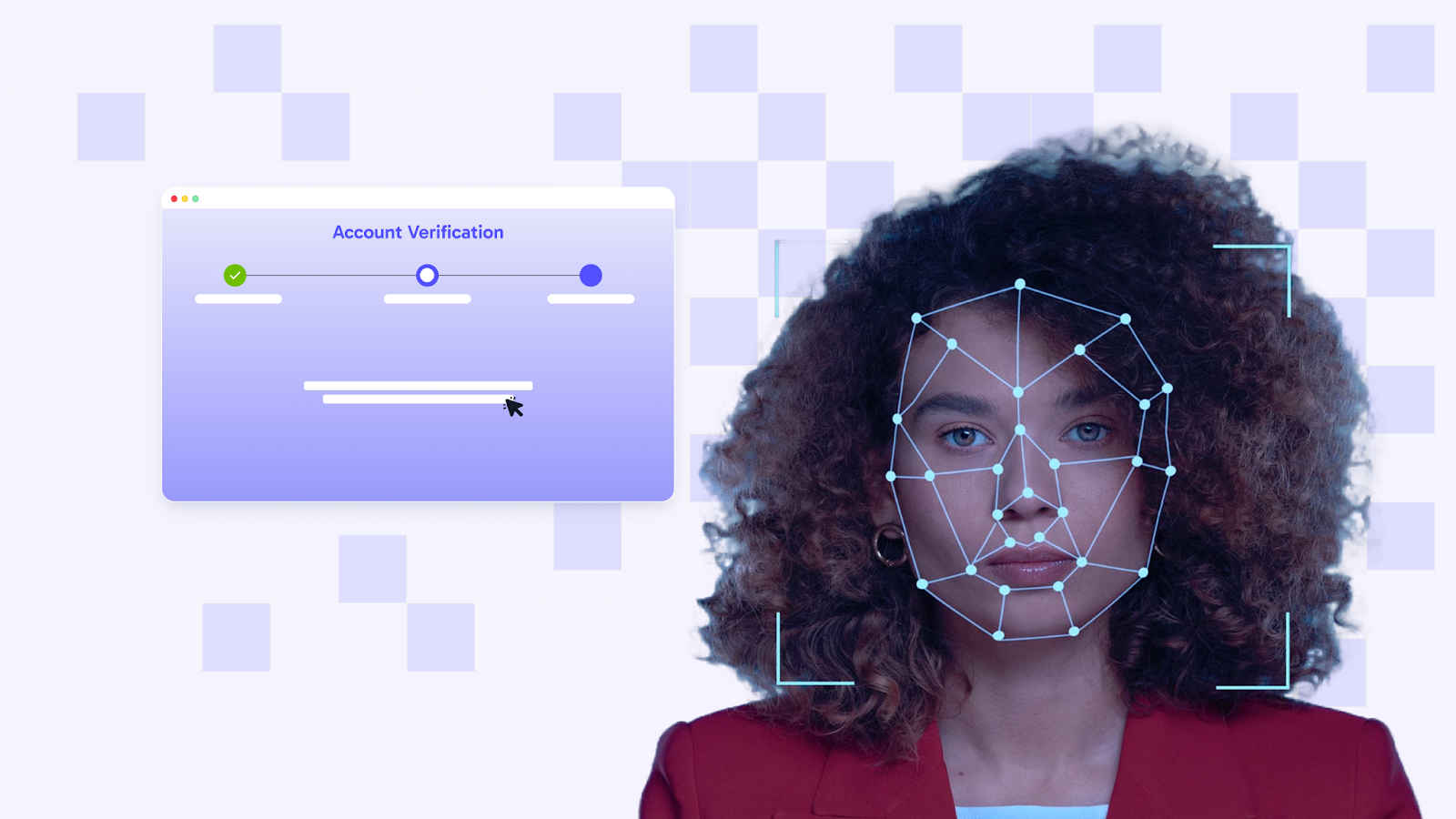

Modern KYC solutions utilize advanced technologies, including Artificial Intelligence (AI), Optical Character Recognition (OCR), and facial biometrics, to authenticate submitted identity documents. These tools detect forgery, alteration, or spoofing attempts by comparing the data against databases and verifying biometrics such as live selfies matched to ID photos.

This stage drastically reduces manual errors and fraud, improves processing speed, and ensures only valid credentials pass through.

3. Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD)

CDD involves deeper analysis beyond basic identity verification to assess the customer’s risk profile. This includes understanding their financial background, nature of business, and expected transaction behavior. Screening lists for politically exposed persons (PEPs), sanctions, and adverse media is standard practice.

For high-risk clients—such as those from sensitive countries or industries—Enhanced Due Diligence (EDD) applies. EDD intensifies investigations to verify the legitimacy of funds, ownership structures, and sources of wealth, often requiring senior compliance approval.

4. Risk Assessment and Profiling

Integrated KYC platforms score customers based on risk factors, combining demographic data, transaction patterns, and regulatory watchlists. This dynamic risk profiling enables tailored monitoring rules, escalating scrutiny for higher-risk profiles and streamlining lower-risk clients through less intensive checking.

Risk models can integrate machine learning to detect anomalies and flag suspicious behavior in near real-time, empowering proactive intervention.

5. Ongoing Monitoring & Compliance

KYC is not a one-time event; continuous monitoring is essential to manage evolving customer risk. This includes periodic re-verification of client data, scrutiny of transaction activity for suspicious patterns, and updates against evolving sanctions and watchlists.

Automation empowers compliance teams to focus on critical alerts while ensuring regulatory requirements for recordkeeping and reporting are met. This vigilant approach mitigates risks such as fraud, money laundering, and terrorist financing, protecting both your company and stakeholders.

This comprehensive framework forms the operational backbone of the end-to-end KYC lifecycle, balancing compliance rigor with efficient customer engagement. In an era where financial crime is becoming increasingly sophisticated, it’s essential to proactively address these challenges from the outset when designing and implementing your E2E KYC process.

Challenges in Implementing an End-to-End KYC Process

While embracing the End-to-End KYC Process brings clear business advantages, decision makers must recognize several real-world obstacles that can complicate implementation and operational success:

- Data Fragmentation: Many organizations still operate with siloed customer data spread across departments, geographies, or legacy systems—making a unified customer view difficult. This lack of integration leads to inconsistencies, incomplete risk profiles, and gaps in compliance documentation.

- Evolving Regulatory Complexity: KYC regulations change frequently and differ across regions, forcing companies to continually adapt their policies, train staff, and upgrade systems to comply. In 2024 alone, global AML/KYC fines $4.6 billion, with the U.S. accounting for more than $4.3 billion—highlighting both rising regulator scrutiny and the cost of falling short

- Resource Constraints: Effective KYC requires significant investment in technology, skilled personnel, and ongoing training. Smaller organizations or those expanding internationally may struggle to keep up, increasing exposure to compliance and reputational risks.

- Technology Adoption Gaps: Despite a push toward digital, automated KYC, a substantial proportion of institutions still rely on manual or partially-automated workflows—leading to slow onboarding, higher error rates, and limited scalability. In 2025, more than 70% of KYC onboarding is expected to be automated, but gaps remain for many companies.

- Emerging Fraud Tactics: The sophistication of financial crimes continues to grow. Synthetic identity fraud, where perpetrators blend real and fake information, reached $27.2 billion in 2024 according to the 2025 Javelin Identity Fraud Study.

Fraudsters increasingly combine traditional fraud methods with emerging technologies such as AI-powered deepfakes, phishing, and data breaches, outpacing traditional detection techniques. - Customer Experience vs. Compliance: Balancing stringent compliance with a seamless customer experience remains a key challenge. Nearly 68% of consumers abandoned digital onboarding in 2022, which pushes companies to dynamically optimize verification flows.

To overcome these hurdles, businesses must adopt best practices and use advanced technologies that streamline KYC processes, ensuring both compliance and a positive customer experience. Let’s explore the most effective strategies and tools for implementing a seamless End-to-End KYC process.

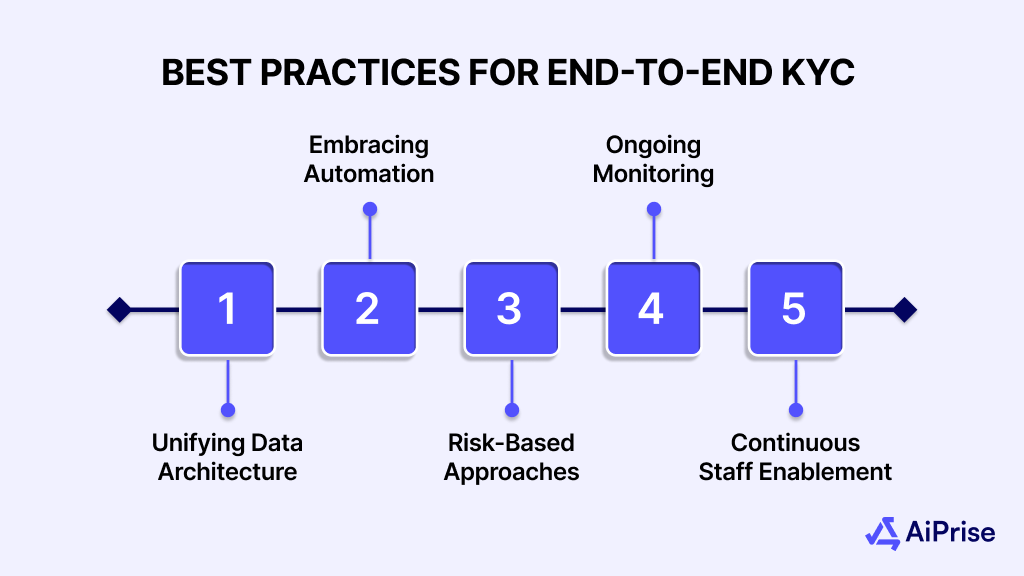

Best Practices and Technologies for End-to-End KYC

To build a scalable, efficient, and future-proof KYC process, businesses must adopt a blend of innovative technologies and smart practices that address both regulatory demands and customer expectations. Here’s how high-growth companies can make their End-to-End KYC process a competitive advantage:

- Unifying Data Architecture: Modern KYC platforms consolidate siloed sources into a single, auditable view, streamlining onboarding and risk assessment while minimizing manual input.

- Embracing Automation: AI, machine learning, and optical character recognition (OCR) reduce speed-to-decision, cut errors, and accelerate onboarding. Leading institutions report a 17% reduction in response time and a 38% drop in completion time by stepping up automation.

- Adopting Risk-Based Approaches: Rather than treating all clients equally, top KYC programs segment customer risk and tailor due diligence accordingly, focusing resources where it matters most.

- Ongoing Monitoring: Automated alerts, sanctions list screening, and behavior analytics supplement periodic reviews, providing continuous coverage against emerging threats and regulatory changes.

- Continuous Staff Enablement: Regular compliance training, robust governance frameworks, and investment in talent ensure both compliance and operational flexibility in response to new mandates and market shifts.

As organizations continue to refine their KYC processes, the strategic return on investment (ROI) becomes clear.

The Strategic ROI of KYC: Compliance, Trust, and Growth

For CEOs, End-to-End KYC is a lever for both protection and profit. By digitizing identity verification, streamlining operations, and building regulatory resilience, companies unlock competitive agility and long-term brand credibility.

Automation and best-in-class processes produce measurable gains: faster customer onboarding, reduced compliance costs, lower risk exposure, and improved client retention. In an environment where global fines and soaring digital fraud are the norm, robust end-to-end KYC is no longer optional—it's foundational.

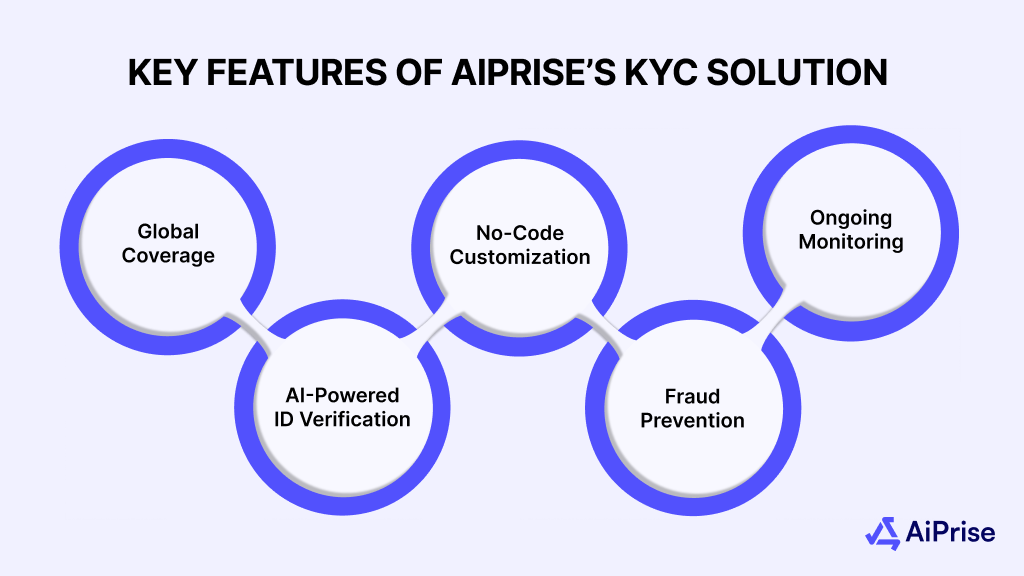

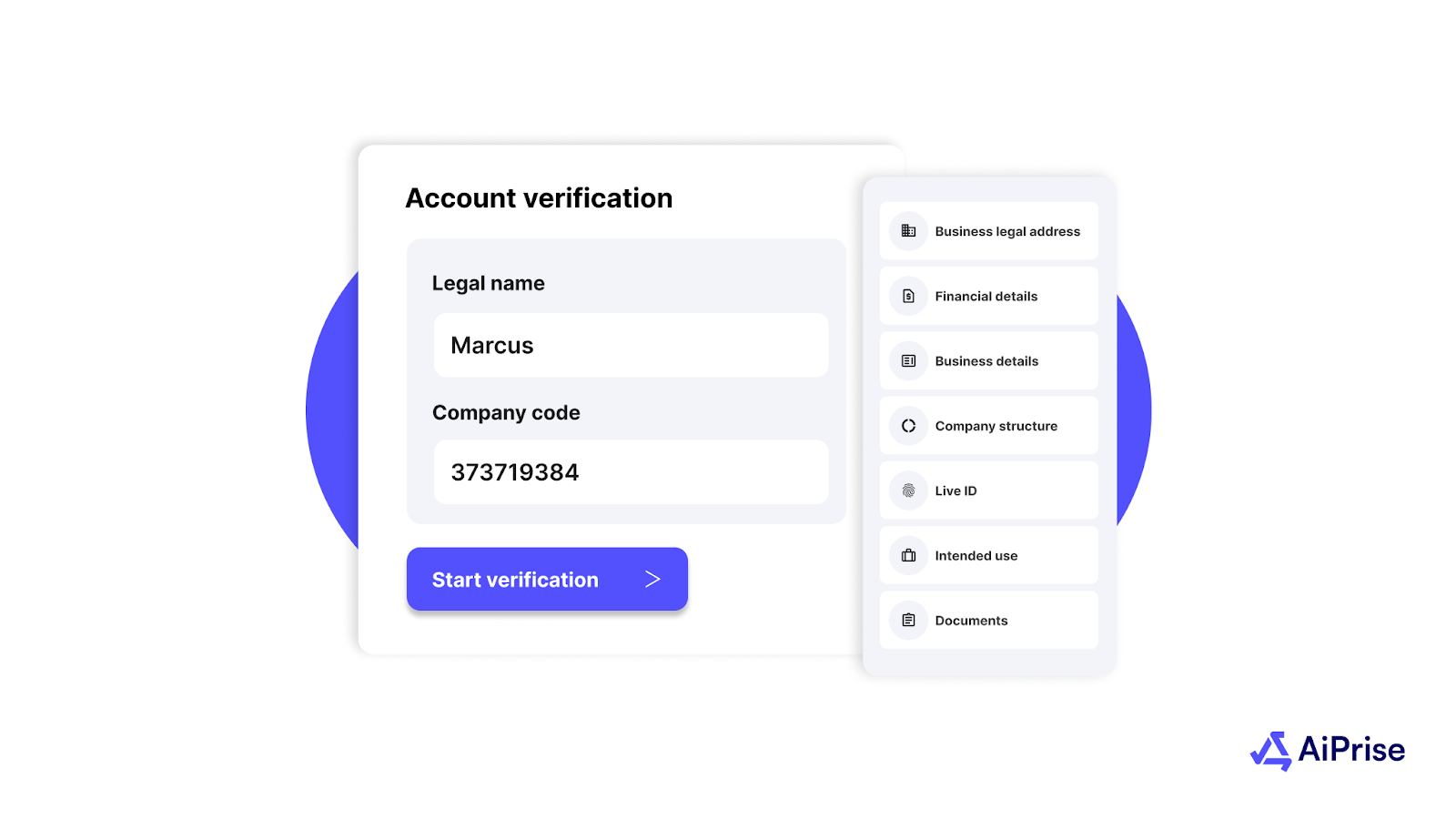

How AiPrise Verifies Users Globally with Scalable Solutions

AiPrise provides businesses with a comprehensive and scalable KYC verification suite, enabling seamless global user verification. By utilizing AI-powered tools, adaptive workflows, and multi-language support, AiPrise ensures high verification pass rates while maintaining compliance with international regulations.

Key Features of AiPrise’s KYC Solution include:

- Global Coverage: Verify users across 220+ countries, supporting various ID types like passports, driver’s licenses, and national IDs.

- AI-Powered ID Verification: Use advanced AI and Optical Character Recognition (OCR) to quickly and accurately validate identity documents.

- No-Code Customization: Customize KYC workflows to accommodate different risk levels, ensuring a smooth process for legitimate users while adding extra layers of verification for higher-risk customers.

- Fraud Prevention: Prevent fraud with advanced techniques like document validation, liveness detection, face matching, and behavioral analysis to block deepfakes, synthetic identities, and other fraudulent attempts.

- AML Screening & Ongoing Monitoring: Continuously monitor users against global sanctions, PEP lists, and criminal databases, while tracking suspicious activities and ensuring ongoing compliance.

AiPrise ensures that your KYC processes are aligned with the latest compliance regulations, delivering an efficient, automated, and secure onboarding experience. With real-time alerts, dynamic risk scoring, and the latest AI technology, AiPrise brings efficiency, agility, and security to your KYC operations, positioning your business to grow globally while staying protected from fraud.

Conclusion

As businesses scale and customer bases grow, ensuring the integrity of your identity verification process becomes non-negotiable. An efficient End-to-End KYC process isn’t just about ticking compliance boxes—it’s about creating a reliable, secure environment that builds trust with your customers and partners, while protecting your business from evolving threats.

For fast-growing companies, adopting a seamless KYC process provides a clear competitive edge, helping you navigate regulatory complexities and fraud risks more effectively. By integrating modern technologies and risk-based approaches, businesses can not only stay compliant but also accelerate their expansion with confidence.

If you’re ready to enhance your KYC processes and future-proof your business, Book a Demo today to explore how AiPrise can help you meet your regulatory and operational goals with ease.

Frequently Asked Questions (FAQs)

1. What are the 4 steps in the KYC process?

The four key steps in the KYC process are customer onboarding and identification, document verification, customer due diligence (CDD), and ongoing monitoring. These steps ensure that businesses accurately verify their customers' identities and continuously assess potential risks

2. How does the KYC process work?

KYC works by verifying the identity of customers through the collection of personal information, such as names, addresses, and identity documents. This data is then cross-checked using advanced technology like AI and machine learning to detect fraud and ensure compliance with relevant regulations.

3. Why is end-to-end KYC important?

End-to-end KYC is crucial because it ensures that identity verification is not just a one-time task but an ongoing process that continuously monitors and reassesses risk. This helps businesses mitigate fraud, comply with regulations, and foster trust with customers.

4. What is the second step in the KYC process?

The second step in the KYC process is document verification. This step involves verifying the authenticity of documents provided by the customer, such as passports or driver’s licenses, using advanced technologies like Optical Character Recognition (OCR) and AI.

5. What are the key challenges in implementing an end-to-end KYC process?

Some of the key challenges include data fragmentation, evolving regulatory requirements, resource constraints, technology adoption gaps, and the growing sophistication of fraud tactics. These hurdles make it difficult for businesses to implement a seamless and efficient KYC process.

6. How does AiPrise ensure compliance with global KYC regulations?

AiPrise ensures compliance by offering real-time monitoring, ongoing screening against global sanctions and PEP lists, and leveraging AI-driven technology for document validation. Their solution is tailored to meet the varying regulatory requirements across 220+ countries.

7. How can businesses enhance the customer experience while ensuring KYC compliance?

By adopting a risk-based approach and leveraging automation, businesses can streamline the KYC process without compromising compliance. Customizable workflows allow businesses to cater to low-risk customers with fast, frictionless onboarding while adding more scrutiny for high-risk users.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

Speed Up Your Compliance by 10x

Automate your compliance processes with AiPrise and focus on growing your business.

.jpeg)

.jpg)

.jpeg)

.png)

.png)