AiPrise

13 mins read

July 18, 2025

Understanding the Differences and Relationship Between KYC and CDD

Key Takeaways

In today’s increasingly regulated business environment, knowing who you're dealing with is essential. With over 190 countries adhering to guidelines from the FATF, KYC (Know Your Customer) has become a critical process for verifying customer identities and preventing fraud. Coupled with Customer Due Diligence (CDD), these practices are vital in combating financial crime.

While KYC and CDD are intertwined, understanding their distinct roles allows businesses to implement them effectively. KYC focuses on identity verification, while CDD takes a deeper dive into evaluating potential risks.

This blog will explore the relationship and key differences between KYC and CDD, and highlight how both contribute to regulatory compliance in today’s complex financial landscape.

TL;DR

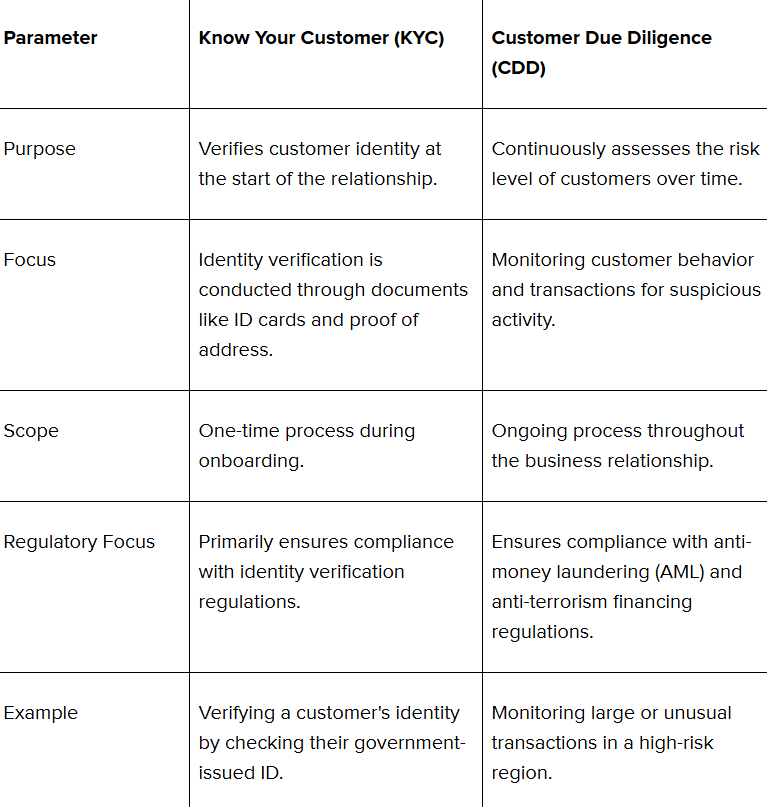

- KYC (Know Your Customer) verifies customer identity at the start of the relationship.

- CDD (Customer Due Diligence) continuously monitors customer behavior and assesses risk over time.

- Key Differences: KYC focuses on identity verification, while CDD manages ongoing risk.

- Importance: Both processes are essential for preventing fraud and ensuring regulatory compliance.

What is KYC and CDD? Definition and Importance

KYC (Know Your Customer) is a critical process for verifying customer identities, ensuring that businesses know exactly who they are dealing with. This involves collecting personal information, such as names, addresses, and government-issued IDs, to confirm a customer’s identity and prevent fraudulent activities.

CDD (Customer Due Diligence) builds on KYC by continuously assessing the risk level of a customer throughout the business relationship. It involves monitoring transactions and behaviors to detect suspicious activity, enabling businesses to respond quickly to potential risks or red flags.

Together, KYC and CDD play a vital role in protecting businesses from financial crimes. They help ensure that businesses:

- Prevent fraud: By verifying legitimate customers, you reduce the risk of engaging with fraudulent individuals or entities.

- Reduce risks: CDD continuously monitors customer transactions, identifying suspicious activities and allowing businesses to take timely action.

- Ensure compliance: KYC and CDD help businesses meet regulatory requirements, including those set by the FATF, avoiding legal penalties.

- Maintain security: These practices create a secure environment, reducing legal and financial risks and protecting the business’s reputation.

Understanding each step of this process is essential for ensuring that businesses can effectively verify their customers and remain compliant with regulations.

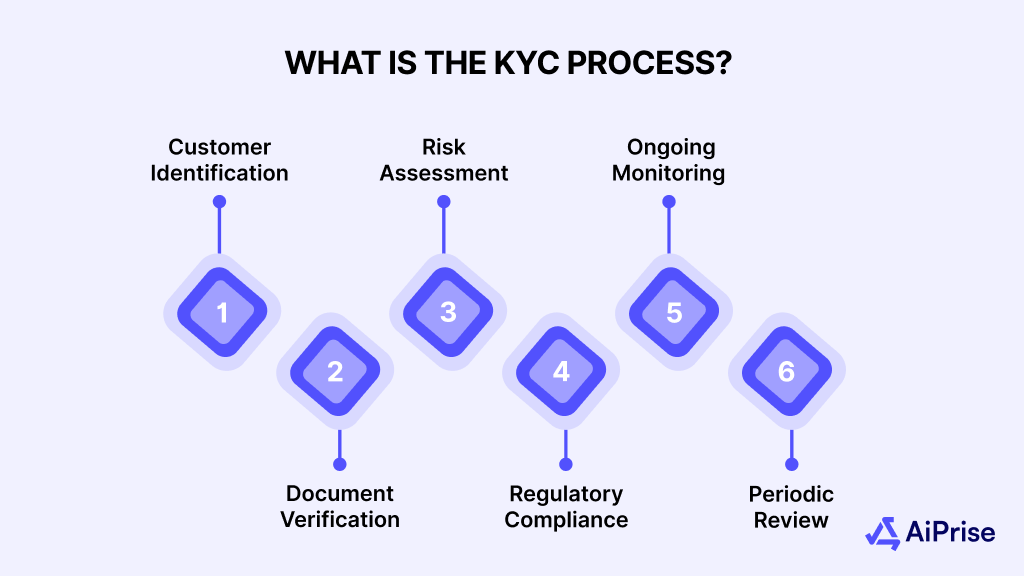

What is the KYC Process?

Knowing the steps in the KYC process is essential for ensuring thorough identity verification and maintaining compliance with regulations. It involves collecting key customer data, verifying the authenticity of documents, and assessing potential risks.

Understanding these steps helps businesses prevent fraud and protect themselves from legal and financial penalties. The steps include:

- Step 1: Customer Identification: Collect key information such as name, address, date of birth, and other identifiers to create accurate customer profiles.

- Step 2: Document Verification: Verify customer information using official documents like passports or IDs, and use advanced verification tools to confirm authenticity.

- Step 3: Risk Assessment: Evaluate the customer’s risk level by assessing factors like transaction history, location, and behavior. Apply enhanced due diligence for high-risk customers.

- Step 4: Regulatory Compliance: Ensure full adherence to regulations aimed at preventing money laundering and terrorist financing, following local and international standards.

- Step 5: Ongoing Monitoring: Continuously track customer transactions and activities to identify suspicious behaviors or sudden changes in risk profiles.

- Step 6: Periodic Review: Regularly update customer profiles and reassess risk to ensure ongoing compliance with evolving regulations and industry standards.

Also Read: 3 Essential Components of KYC

KYC establishes the foundation, and CDD takes it further by assessing the risk associated with different customers. Understanding the different levels of CDD helps businesses determine the depth of scrutiny needed for each customer.

What are the Different Levels of Customer Due Diligence (CDD)?

Understanding the different levels of Customer Due Diligence (CDD) is essential for businesses to effectively manage customer risks. By assessing a customer's risk level, CDD helps decide the necessary checks, ensuring the right steps are taken to prevent issues.

This approach not only allows businesses to allocate resources efficiently but also strengthens their ability to identify and address emerging risks in real-time.

The different levels of CDD include:

- Standard CDD: Applied to low-risk customers who only require primary identity verification to ensure legitimacy.

- Enhanced CDD: Conducted for moderate to high-risk customers, involving more thorough analysis, frequent updates, and continuous monitoring.

- Ongoing CDD: In some cases, businesses may implement ongoing checks for higher-risk customers to adapt to changes in their behavior or risk profile.

The levels of CDD determine the depth of scrutiny based on a customer’s risk profile. However, understanding the relationship and differences between KYC and CDD helps you ensure thorough identity verification and continuous risk management throughout business relationships.

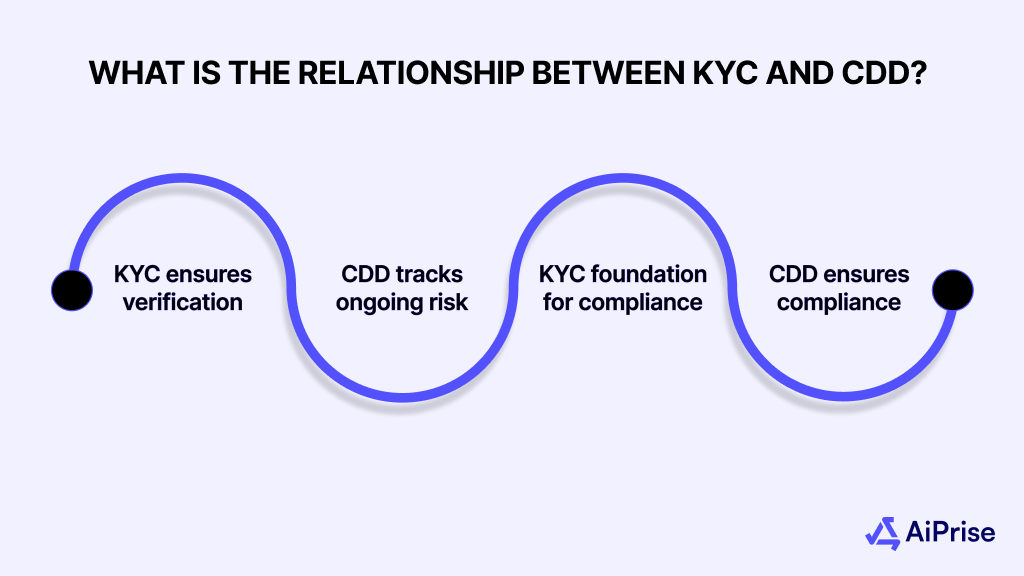

What is the Relationship Between KYC and CDD?

KYC is the first step in customer verification, ensuring proper identification at the onboarding stage. Once a customer is verified, CDD takes over, providing continuous monitoring and assessing ongoing risks throughout the business relationship.

While KYC establishes the foundation of identity verification, CDD ensures that customer profiles remain accurate and secure, helping to prevent financial crimes.

Understanding how KYC and CDD work together is key to effectively managing customer risk. Here’s how they complement each other:

- KYC ensures initial verification: During onboarding, KYC confirms a customer's identity using documents and personal details, setting the stage for a secure relationship.

- CDD tracks ongoing risk: CDD involves regular monitoring of customer behavior and transactions, looking for any changes that might indicate higher risk or suspicious activity.

- KYC lays the foundation for compliance: By verifying identity at the start, KYC ensures businesses have a solid base to build their ongoing monitoring practices.

- CDD ensures ongoing compliance: After KYC, CDD helps businesses stay compliant with anti-money laundering (AML) regulations by evaluating and updating customer risk profiles regularly.

To fully understand tier roles in risk management, it’s important to explore the difference between KYC vs CDD in detail.

What are the Differences Between KYC and CDD?

KYC establishes the foundation by verifying a customer’s identity at the start of the relationship. CDD builds on that by offering ongoing risk assessment, ensuring businesses stay ahead of evolving threats.

Now that you’ve explored the relationship and differences between KYC and CDD, it's important to understand the challenges businesses face in implementing these processes effectively.

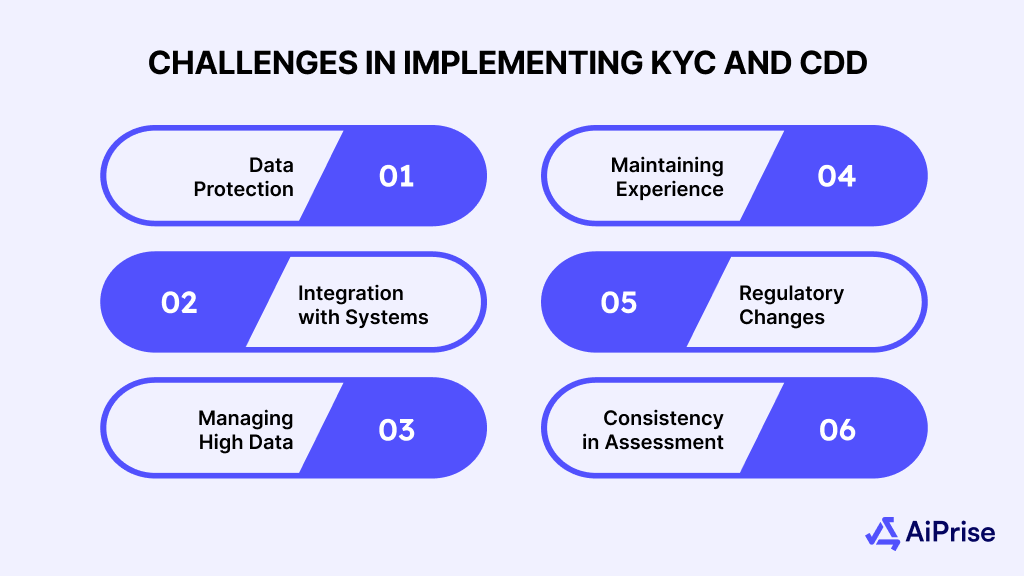

Challenges in Implementing KYC and CDD

Understanding the challenges in implementing KYC and CDD is crucial for businesses to effectively handle regulatory requirements and minimize risks. These processes, while essential for fraud prevention, often involve complex compliance tasks, data verification, and ongoing monitoring.

Recognizing the common obstacles will help you streamline operations and ensure smoother, more efficient implementation. Here are the key challenges businesses face with KYC and CDD.

- Data Protection and GDPR Compliance: Managing sensitive customer data while complying with GDPR can be challenging. Businesses must ensure they are following strict data encryption and retention policies to avoid potential data breaches and legal issues.

- Integration with Legacy Systems: Many businesses still rely on outdated legacy systems, which can make integrating new KYC and CDD technologies difficult. This mismatch can slow down the implementation process and increase the risk of errors.

- Managing High Data Volumes: With an increasing number of customers, the volume of data businesses need to process grows rapidly. Managing and verifying this large amount of data without compromising accuracy or compliance can strain resources.

- Maintaining a Smooth Customer Experience: While KYC and CDD are essential, they can create friction during customer onboarding. Balancing security with a smooth, user-friendly process can be challenging, especially when customers expect quick verification.

- Adapting to Regulatory Changes: Regulatory standards for KYC and CDD are constantly evolving. Keeping up with these changes and implementing them in a timely manner can be a significant challenge for businesses, especially across different jurisdictions.

- Consistency in Risk Assessment: Assessing the risk level of customers consistently over time is difficult. CDD requires continuous monitoring and adjusting of risk assessments, which can be resource-intensive and prone to human error if not automated.

Technology advancements in KYC and CDD are helping businesses address these challenges by offering faster, more accurate, and scalable solutions.

How Technology is Transforming KYC and CDD Processes?

Technology advancements in KYC and CDD are transforming how businesses handle customer verification and risk management. Automating processes like KYC can save up to 70% of onboarding costs and reduce onboarding time by 90%.

With tools like AI and machine learning, businesses can streamline these processes, ensuring quicker, more accurate verifications while minimizing human error and enhancing security.

The upcoming technological advancements in KYC and CDD include:

- AI and Machine Learning for Automation: AI and machine learning streamline verification and risk assessment by analyzing large data sets in real time. This reduces manual effort, speeds up processes, and improves fraud detection accuracy.

- Ongoing Monitoring and Compliance Management: Real-time monitoring tools powered by AI track customer activities continuously, flagging suspicious behavior and ensuring compliance with evolving regulations.

- Blockchain for Secure Data Sharing: Blockchain allows secure, immutable sharing of KYC data between institutions, reducing redundant checks and minimizing the risk of data breaches.

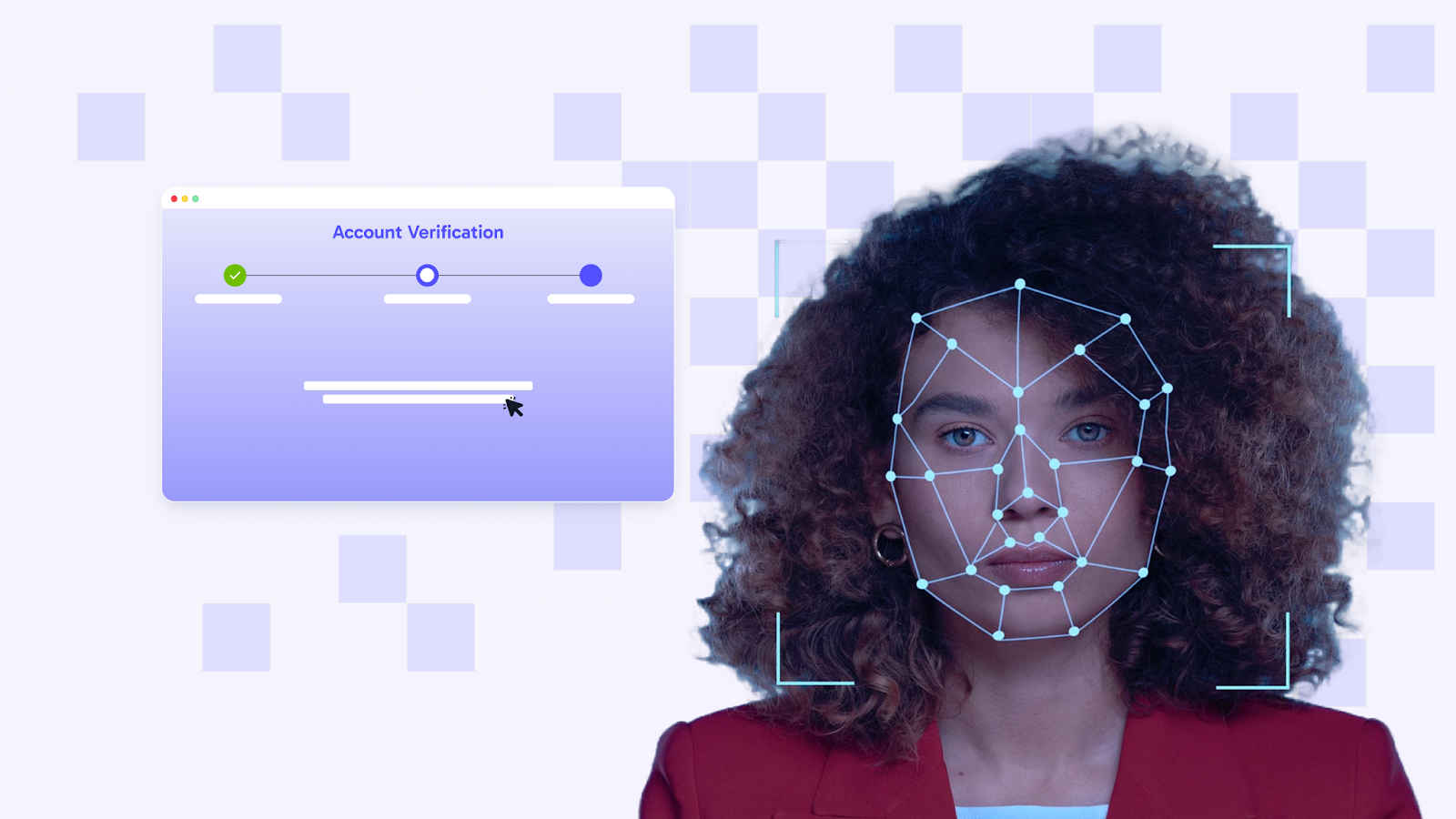

- Biometric Verification Integration: Biometric tools like facial recognition and fingerprints add another layer of security, making customer impersonation nearly impossible.

- Cloud-Based KYC Platforms: Cloud platforms enhance scalability by enabling efficient data storage and real-time updates, helping businesses manage customer data while staying compliant.

Also Read: How Compliance Technology Drives Efficiency and Trends

As technology continues to drive improvements in KYC and CDD processes, it’s equally important to stay informed about the international regulations that govern them.

International Regulations on KYC and CDD

Understanding international regulations on KYC and CDD is essential for businesses to stay compliant and avoid legal risks. Knowing these regulations helps businesses operate smoothly in regions like the US and EU, where strict laws are in place to combat money laundering and terrorist financing.

By adhering to these standards, businesses can ensure they meet legal requirements and protect themselves from financial penalties and reputational damage.

Some common international regulations include:

- United States: The Bank Secrecy Act (BSA) and the USA PATRIOT Act require financial institutions to implement Customer Identification Programs (CIP) and perform due diligence to prevent money laundering and terrorist financing.

- European Union: The Fourth and Fifth Anti-Money Laundering Directives mandate due diligence for high-risk customers and require the identification of beneficial owners and politically exposed persons (PEPs).

- India: The RBI’s Master Direction on KYC outlines procedures for customer identification and verification, including the use of Video-based Customer Identification Process (V-CIP) for remote onboarding.

- China: China's Anti-Money Laundering Law mandates financial institutions to conduct due diligence on clients and store identity and transaction data.

- United Kingdom: Under the Money Laundering Regulations 2017, businesses must verify customer identities and assess the nature and purpose of business relationships.

- Canada: The Proceeds of Crime (Money Laundering) and Terrorist Financing Act requires financial institutions to implement KYC procedures, conduct ongoing monitoring, and report suspicious transactions to FINTRAC.

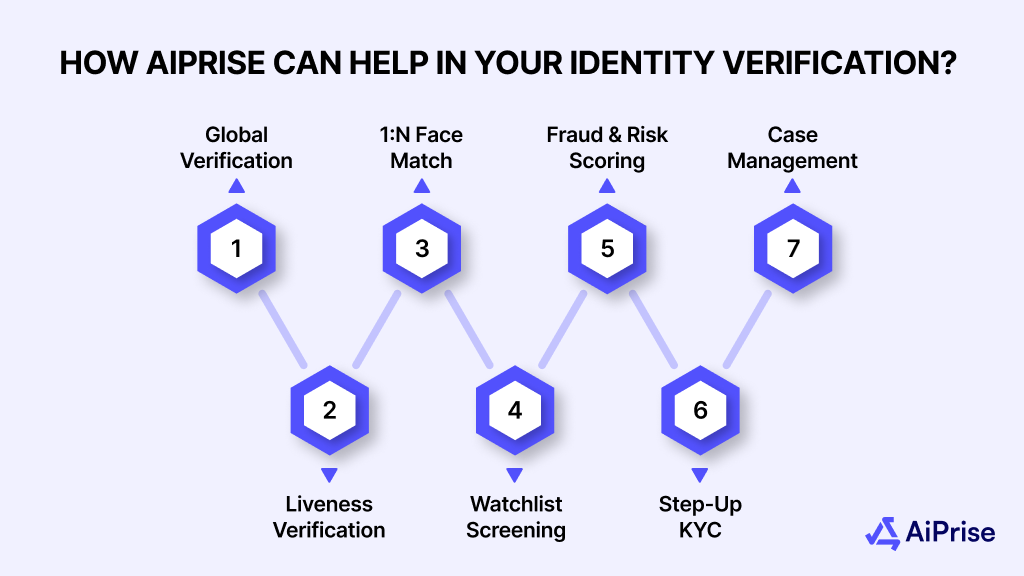

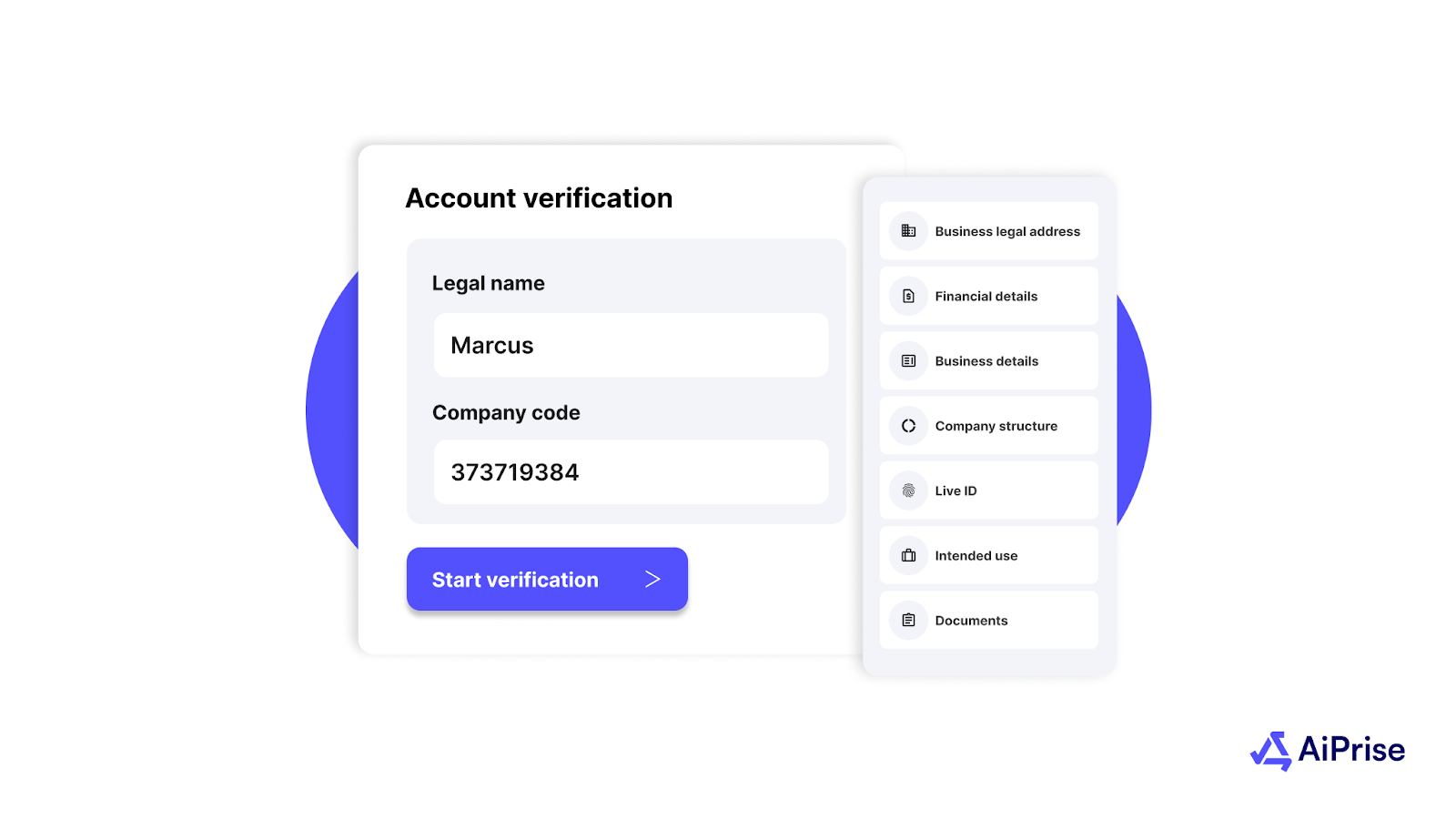

How AiPrise Can Help Streamline Your Identity Verification?

AiPrise provides AI-powered solutions for fast and secure document verification, including real-time KYC, KYB, and AML checks, ensuring your business stays compliant and protected.

- Global Document Verification: Verifies over 12,000 types of ID documents from any country in under 30 seconds, offering Document Insights to assess authenticity and validity.

- Liveness Verification: Safeguards against advanced spoofing attempts, like deepfakes, by instantly confirming the person’s physical presence.

- 1:N Face Match: Uses AI to accurately match and block duplicate users, preventing synthetic identities and fraudulent onboarding.

- Watchlist Screening: Automatically screens individuals against global sanctions, PEPs, and adverse media lists, identifying high-risk entities in real-time.

- Fraud & Risk Scoring: Leverages AI-powered tools to detect fraud and assess risk, helping businesses identify potential threats during the KYC and CDD process.

- Step-Up KYC: Adapts to your risk-based approach, allowing businesses to scale their verification intensity with basic checks or enhanced due diligence, ensuring compliance with varying regulatory standards.

- Case Management: Streamlines the verification process, improving efficiency by automating case management, tracking, and escalation.

Conclusion

KYC and CDD are not just regulatory requirements; they are your first line of defense against financial crimes. By verifying identities and continuously monitoring customer risk, these processes help you stay compliant and identify issues before they escalate.

When executed effectively, they strengthen security, protect your reputation, and foster lasting trust with customers.

Don’t let compliance challenges or fraud risks hold your business back. With our advanced KYC/AML solutions, you can streamline verification, mitigate risks, and ensure regulatory compliance. Book A Demo today to discover how our technology can fortify your processes and safeguard your business.

FAQs

1. What is the primary difference between KYC and CDD?

KYC focuses on verifying a customer's identity at the beginning of a business relationship, while CDD involves assessing and monitoring the customer's risk level throughout the relationship.

2. Is CDD a part of the KYC process?

Yes, CDD is a component of KYC. It extends beyond initial identity verification to include ongoing monitoring and risk assessment.

3. How does KYC contribute to CDD?

KYC provides the foundational identity information needed for CDD to assess and manage potential risks associated with a customer.

4. Do KYC and CDD apply to both individuals and businesses?

Yes, both processes apply to individuals and businesses. For businesses, this is often referred to as Know Your Business (KYB), which includes verifying the identity of beneficial owners and assessing financial risks.

5. Why are KYC and CDD important for businesses?

They help businesses comply with anti-money laundering regulations, prevent financial crimes, and build trust with customers by ensuring secure and transparent operations.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

.jpeg)

.jpg)

.jpeg)

.png)

.png)