AiPrise

8 min read

September 17, 2025

Understanding the KYC Remediation Process Steps

Key Takeaways

Fraud prevention is a critical concern for many businesses, especially in the financial sector. You've worked hard to implement strong Know Your Customer (KYC) protocols, but a troubling statistic shows that over 70% of fraud occurs after the KYC stage. This means that even with the best initial screening, your company may still face significant risks.

As fraudsters become more sophisticated, traditional KYC processes may not be enough to stop them. You may be left wondering how to effectively identify and manage these threats without compromising your customer experience or compliance standards. It's frustrating to have done everything "right," only to face costly consequences later.

In this blog, we'll explore the KYC remediation process, why it's essential to preventing fraud, and how tools like AiPrise can improve your compliance efforts. We'll also cover best practices for streamlining remediation, managing ongoing risk, and staying ahead of evolving threats.

Key Takeaways:

- KYC remediation ensures customer data is up-to-date, accurate, and compliant with regulations.

- It helps prevent fraud and mitigate risks associated with financial crimes, like money laundering.

- The process involves identifying data gaps, collecting updated information, and verifying it through trusted sources.

- AiPrise simplifies KYC remediation with automated document verification, real-time liveness checks, and risk profiling.

- Regular KYC updates and compliance with AML standards reduce the risk of penalties and maintain customer trust.

What is KYC Remediation and Why is it Essential to AML Compliance?

KYC remediation is the process of reviewing, updating, and correcting customer due diligence information to ensure it remains accurate and compliant with current regulations. Over time, customer data can become outdated due to factors such as address changes, name alterations (e.g., after marriage), or the expiration of identification documents. Additionally, evolving regulations may require businesses to collect new or different information from their customers.

The Role of KYC Remediation in AML Compliance

Anti-Money Laundering (AML) regulations mandate that financial institutions and other regulated entities verify the identity of their customers and assess their risk profiles. While initial KYC checks are crucial during onboarding, ongoing KYC remediation ensures that customer information remains up-to-date and accurate throughout the business relationship. This continuous process helps businesses identify and mitigate risks associated with financial crimes, such as money laundering and terrorist financing.

The Importance of KYC Remediation

Effective KYC remediation is vital for several reasons:

- Regulatory Compliance: Adhering to AML regulations helps businesses avoid legal penalties and maintain their operating licenses.

- Risk Mitigation: Regularly updated customer information allows for accurate risk assessments, reducing exposure to financial crimes.

- Customer Trust: Demonstrating a commitment to data accuracy and security enhances customer confidence and loyalty.

- Operational Efficiency: Maintaining current records streamlines internal processes and reduces the likelihood of errors.

To ensure your remediation efforts are effective, it’s crucial to follow a clear, structured process. Here’s how to do it.

The KYC Remediation Process: Step-by-Step

KYC remediation is a structured process that involves identifying and correcting discrepancies in customer information. By following a precise and methodical approach, businesses can ensure that their KYC data is accurate and compliant with relevant regulations. Each step is critical in maintaining operational efficiency and reducing risk exposure.

Below is an overview of the KYC remediation process, broken down into clear steps:

Step 1: Identifying the Gaps

Begin by reviewing your existing customer data to identify any missing, outdated, or incorrect information. Common issues include expired identification, missing addresses, or inconsistent personal details. This step requires both automated systems and manual checks to ensure no data gaps are overlooked.

Step 2: Collecting Missing or Updated Information

After identifying discrepancies, reach out to customers to gather the necessary data or updated documents. This may involve sending secure requests via email, app, or direct communication channels. It's essential to maintain a balance between requesting the needed information and respecting the customer's time and privacy.

Step 3: Verifying the Information

Once the customer provides updated data, verify the documents and information through trusted third-party sources, such as government databases or document verification services. For high-risk accounts, you may need to perform additional checks, like facial recognition or biometric verification, to ensure authenticity.

Step 4: Updating Internal Systems

After verifying the information, update your internal systems, such as your CRM or compliance databases. Make sure that customer profiles reflect the most accurate and up-to-date data. This is a critical step to ensure compliance with ongoing monitoring requirements and future audits.

Step 5: Assessing Risk Profiles

With the updated information, reassess the customer's risk profile. Evaluate their transaction history, the nature of their business, and any red flags. This step helps identify whether the customer is still low-risk or if further scrutiny is needed.

Step 6: Documenting and Reporting

Thorough documentation of the entire remediation process is essential. Record each step, including customer communications and verification results. Ensure that all necessary reports are submitted to regulatory bodies to stay compliant with AML and KYC regulations.

Also Read: How KYC Is Done In Banks: A Step-by-Step Guide

While following these steps is crucial, there are a few key tips to ensure your KYC remediation process is as effective as possible.

4 Tips for Creating a Successful KYC Remediation Process

Creating an effective KYC remediation process requires careful planning, continuous improvement, and the right tools to ensure compliance. While the basic steps of remediation are important, implementing key strategies will help optimize the process. The following tips will help you improve your KYC remediation efforts, reduce errors, and stay compliant.

Below are four valuable tips for enhancing your KYC remediation process:

Tip 1: Stay Current with Regulation Changes

Regularly monitor updates to KYC and AML regulations to ensure your remediation process aligns with new requirements. Regulatory changes may introduce new documentation or verification steps. Proactively adjusting your process keeps your business compliant and reduces the risk of penalties due to non-compliance.

Tip 2: Communicate Clearly with Customers

When requesting updated information, ensure your communication is clear and straightforward. Customers should easily understand what documents are required and why they are necessary. Providing a simple and quick process to submit updates will increase response rates and prevent delays in remediation.

Tip 3: Automate Where Possible

Implement automation tools to handle repetitive tasks, such as document verification, data entry, and flagging discrepancies. Automation can reduce human error and speed up the process. Tools that use AI and machine learning can also help detect patterns or risks that may be missed during manual reviews.

Tip 4: Continuously Monitor and Update Data

KYC remediation isn’t a one-time process; it requires regular checks to ensure customer data stays up-to-date. Set systems to flag expired documents or incomplete forms. Monitoring data continuously ensures that your remediation process remains effective and that you’re always prepared for regulatory audits.

Also Read: 3 Essential Components of KYC

These tips will guide your strategy, and AiPrise can enhance your process with advanced features to make it even more effective.

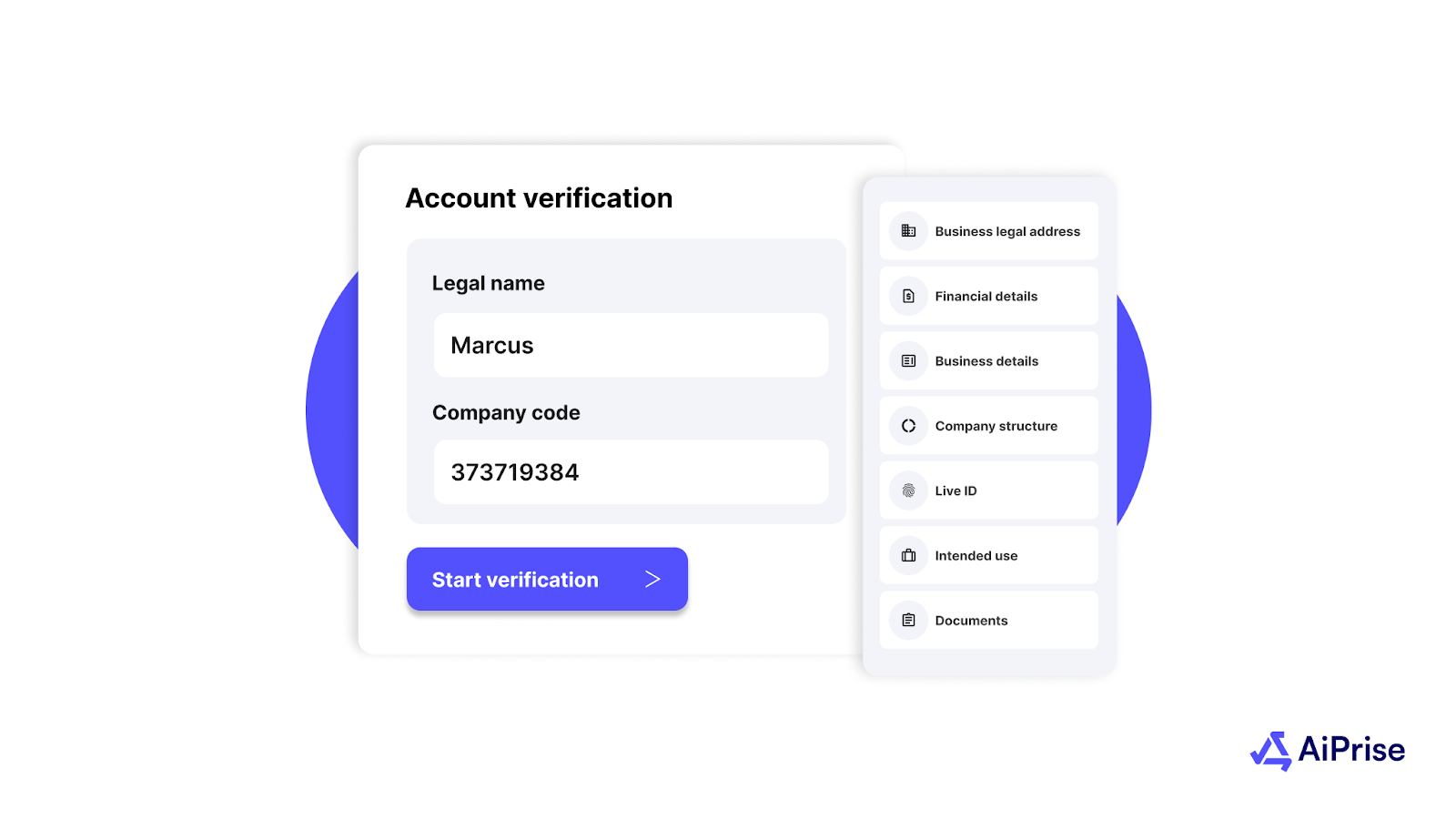

How AiPrise Enhances Your KYC Remediation Process

AiPrise offers a comprehensive suite of tools that simplify and enhance the KYC remediation process. By integrating document verification, fraud detection, and risk assessment, AiPrise ensures that businesses maintain high levels of compliance while improving operational efficiency. This platform automates key tasks, reducing manual work and improving accuracy across the remediation stages.

Here's how AiPrise can help improve your KYC remediation process:

- Automated Document Verification: AiPrise verifies over 12,000 document types from more than 220 countries, reducing human error and speeding up the data collection process.

- Real-Time Liveness Detection: The platform includes real-time face liveness checks to prevent spoofing and ensure that users are who they claim to be.

- 1:N Face Match Technology:

AiPrise compares the submitted facial data with a database of existing profiles, blocking duplicate users and preventing fraudulent activities. - AML Screening: AiPrise automates screening against global sanctions lists, PEPs, and adverse media, ensuring compliance and identifying high-risk individuals.

- Comprehensive Risk Profiling: AiPrise evaluates customer risk levels using updated information and transaction patterns, ensuring continuous compliance and mitigating financial crime risks.

- Reverification Triggers: The platform automatically triggers reverification when sensitive information changes, such as bank details, helping to prevent identity theft or account takeovers.

AiPrise's tools work together to enhance your KYC remediation process, improving accuracy and compliance while reducing the effort required to maintain a secure customer database.

Conclusion

KYC remediation is a crucial process for ensuring compliance and mitigating the risk of fraud within your organization. By maintaining accurate, up-to-date customer data, businesses can prevent potential security breaches and avoid regulatory penalties. With the right tools and approach, KYC remediation becomes a manageable task, allowing your team to focus on growth and customer satisfaction.

AiPrise can help simplify your KYC remediation process by automating key steps, improving accuracy, and ensuring compliance with the latest regulations.

To see how AiPrise can enhance your KYC process, Book A Demo today and explore how we can support your business in meeting compliance standards and protecting against fraud.

FAQs

1. What Are the Main Challenges in the KYC Remediation Process?

The main challenges include dealing with outdated customer information, ensuring compliance with changing regulations, and collecting missing or inaccurate data from customers. Effective data verification and timely updates are also common obstacles.

2. How Does KYC Remediation Reduce the Risk of Financial Crime?

KYC remediation helps ensure that customer data is accurate and up-to-date, which allows for better risk profiling. By identifying and correcting discrepancies, businesses can reduce the chance of fraud, money laundering, and other financial crimes.

3. What Role Does Automation Play in KYC Remediation?

Automation helps speed up the KYC remediation process by handling tasks like document verification, risk assessment, and re-verification. This reduces manual work, enhances data accuracy, and ensures that companies stay compliant with regulations.

4. Can KYC Remediation Help with Customer Retention?

Yes, maintaining accurate and secure customer data through KYC remediation builds trust with clients. Customers appreciate businesses that ensure their information is protected and remain transparent about regulatory compliance, which can improve loyalty.

5. How Do Regulatory Changes Impact KYC Remediation?

Regulatory changes often require businesses to update their KYC processes to meet new standards. KYC remediation ensures that businesses stay compliant by regularly updating customer records to reflect the latest legal requirements and guidelines.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

Speed Up Your Compliance by 10x

Automate your compliance processes with AiPrise and focus on growing your business.

.jpeg)

.jpg)

.jpeg)

.png)

.png)