AiPrise

6

September 4, 2025

Microstructuring: Challenges in AML Compliance

Key Takeaways

For financial institutions, payment providers, and cryptocurrency platforms, staying compliant with Anti-Money Laundering (AML) regulations is a constant challenge. Non-compliance can result in fines, reputational damage, and the loss of customers. Fraudsters continually find new ways to move illicit funds, and microstructuring is one such tactic that remains hard to detect.

Microstructuring involves breaking up large transactions into smaller ones to avoid detection by AML systems. This makes it difficult for businesses to catch suspicious activity, as these smaller transactions often appear legitimate.

In this blog, we’ll explore microstructuring, its impact on AML compliance, and how businesses can detect and prevent it. We’ll also discuss standard techniques used by fraudsters, red flags to watch for, and practical measures you can take.

Key Takeaways:

- Microstructuring involves breaking large transactions into smaller ones to evade AML detection systems.

- Smurfing and structuring are different methods for money laundering, with smurfing involving multiple individuals and structuring usually involving a single entity.

- Red flags for structuring include multiple small deposits, frequent withdrawals, and unusual transaction patterns.

- To prevent structuring, businesses should adopt advanced monitoring systems, employee training, and KYC processes.

- AiPrise helps businesses stay compliant with AML regulations by offering tools like real-time transaction monitoring, KYC, and watchlist screening.

What is Microstructuring in AML Compliance?

Microstructuring is a technique criminals use to break large transactions into smaller ones, avoiding detection thresholds in AML systems. This tactic makes it harder for institutions to detect suspicious activity, especially when transactions appear normal on the surface.

Money launderers often use microstructuring to “clean” illicit funds by making multiple smaller deposits or withdrawals. These actions may occur across different accounts or institutions, complicating the detection process.

For businesses, identifying microstructuring requires advanced monitoring tools. Traditional methods may not be enough to detect this form of money laundering, making it crucial to implement more sophisticated detection systems.

With microstructuring defined, here are the common methods fraudsters use.

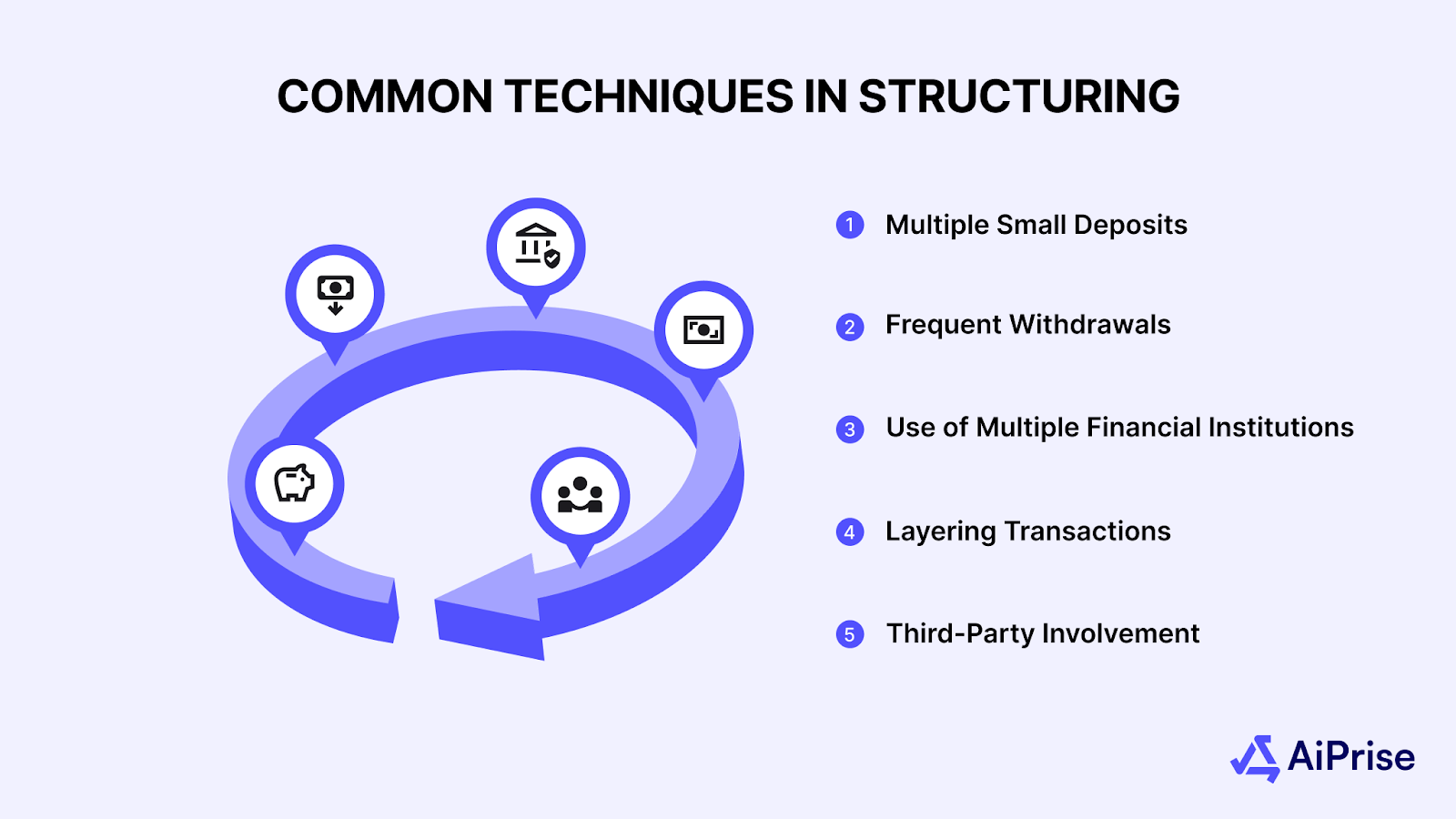

Common Techniques in Structuring

Microstructuring is just one way criminals attempt to bypass detection. Fraudsters employ various methods to hide the true nature of their transactions, making detection difficult. Here are some standard techniques:

- Multiple Small Deposits: Dividing large sums into smaller deposits across multiple accounts, which often go unnoticed by monitoring systems.

- Frequent Withdrawals: Withdrawing small amounts below reporting thresholds makes the activity more challenging to detect.

- Use of Multiple Financial Institutions: Spreading transactions across different banks or payment services to avoid detection by one system.

- Layering Transactions: Transferring funds between accounts or institutions to obscure the origin of the money.

- Third-Party Involvement: Using third parties, commonly referred to as “smurfs,” to conduct transactions on their behalf complicates identification.

Also Read: Money Laundering Techniques And Prevention Methods: Definition And Examples

With these techniques in mind, it's important to understand how smurfing differs from structuring and how both contribute to financial crime.

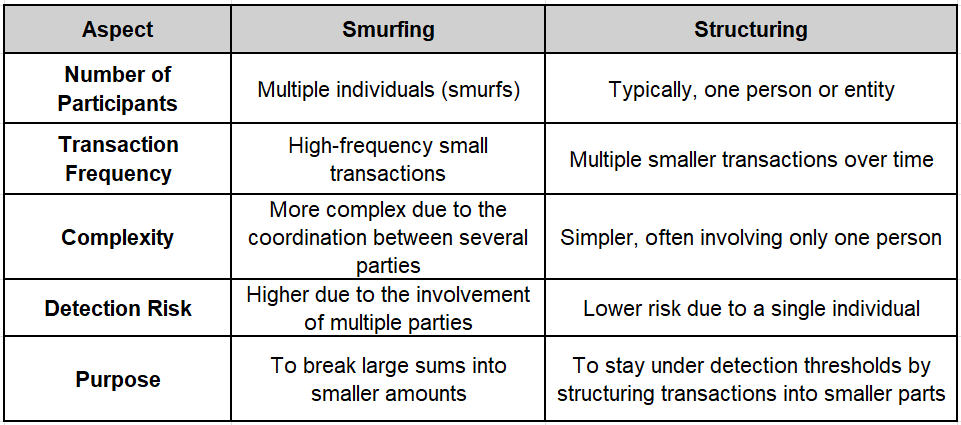

Smurfing vs. Structuring: Similarities and Differences

Smurfing and structuring both aim to avoid detection, but they differ in their methods. Smurfing involves multiple individuals, called “smurfs,” who work together to break up large sums of money into smaller amounts. Structuring, on the other hand, typically involves a single individual or entity splitting transactions to stay below detection thresholds.

The key difference lies in the number of participants. Smurfing requires coordination among multiple parties, whereas a single person generally carries out structuring.

Also Read: What Is the Difference Between Smurfing and Structuring in Money Laundering?

Red Flag Indicators of Structuring

Recognizing red flags is crucial for identifying microstructuring and other suspicious activity. Businesses need to stay alert to these signs to catch fraudulent transactions early. Here are key red flags that suggest structuring might be occurring:

- Frequent Small Transactions: Multiple transactions just below reporting thresholds over a short period can suggest an attempt to avoid detection.

- Unusual Withdrawal Patterns: Consistent small withdrawals that don’t match a customer’s usual behavior may be a sign of structuring.

- Round Number Transactions: Repeated transactions in round numbers, such as $1,000 or $5,000, could indicate structuring.

- Deposits Across Multiple Accounts: Spreading deposits across different accounts to avoid detection is a common structuring tactic.

- Transfers Between Accounts at Different Institutions: Regular transfers across financial institutions may indicate an effort to hide the origin of funds.

- Inconsistent Deposit and Withdrawal Activity: Sudden fluctuations in deposit and withdrawal patterns could suggest that large sums are being broken into smaller amounts.

Also Read: How to Identify Fraudsters: 4 Common Red Flags

Recognizing red flags is essential, but preventing structuring requires effective measures. Let’s look at the steps you can take.

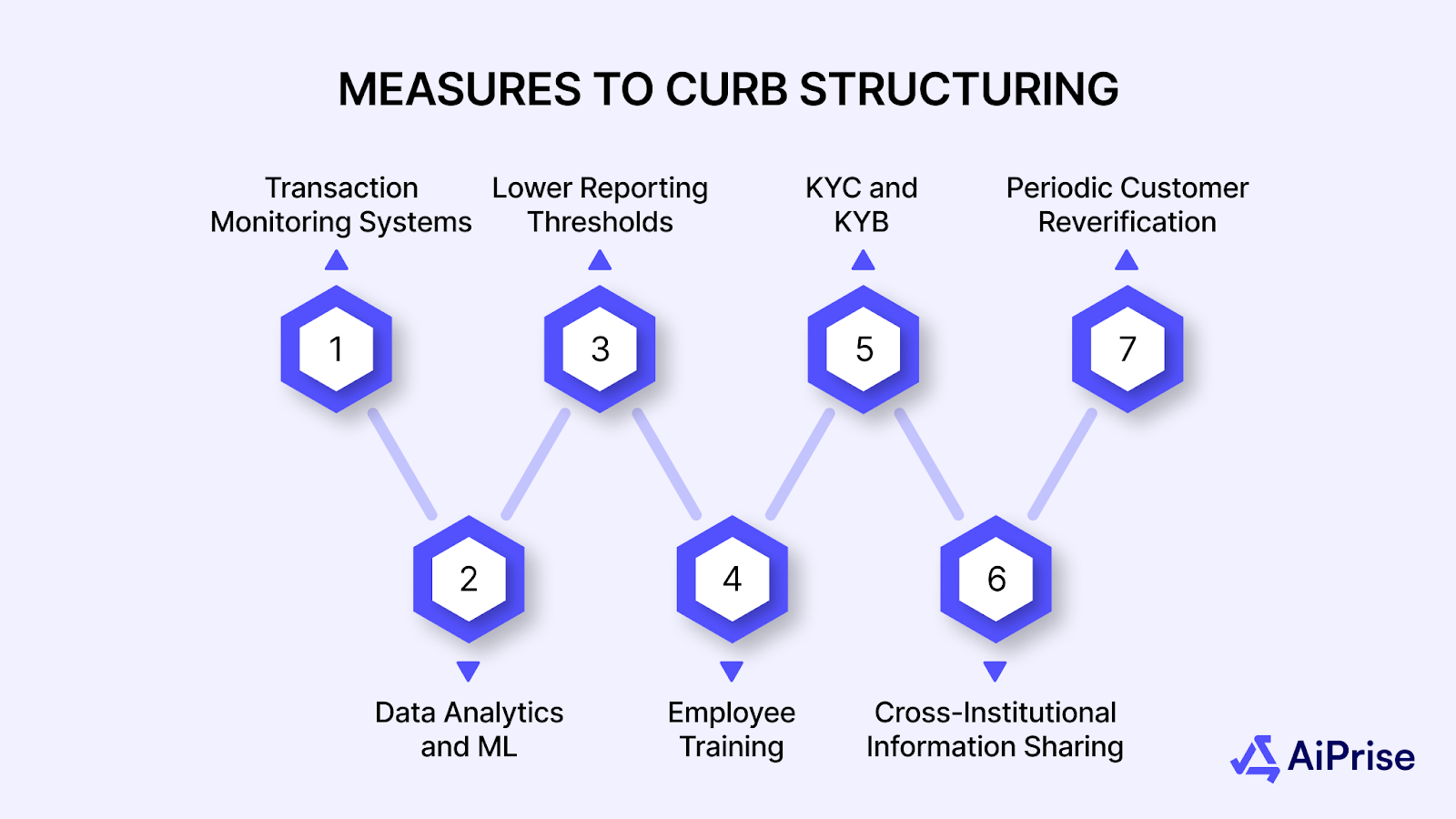

Measures to Curb Structuring

To effectively combat structuring, businesses must adopt strategies that can detect and prevent these activities. These strategies should combine advanced technology with proactive monitoring to identify suspicious behavior early. Here are key measures to curb structuring:

- Advanced Transaction Monitoring Systems: Implement automated systems that track transactions in real time, flagging suspicious patterns.

- Data Analytics and Machine Learning: Use AI tools to analyze large datasets for unusual patterns that may suggest structuring.

- Lower Reporting Thresholds: Adjust reporting thresholds to capture smaller transactions that may indicate structuring.

- Employee Training: Regularly train compliance teams to recognize signs of structuring and understand how to investigate them.

- KYC and KYB: Implement comprehensive identity checks to verify the legitimacy of customers and businesses involved in transactions.

- Cross-Institutional Information Sharing: Work with other financial institutions to share information about suspicious activity and detect patterns that may not be visible within a single institution.

- Periodic Customer Reverification: Regularly update customer records to reflect any changes in their risk profile and ensure your monitoring systems are up to date.

These measures will enhance the ability to detect and prevent structuring activities. With the right tools in place, businesses can better manage the risks associated with money laundering.

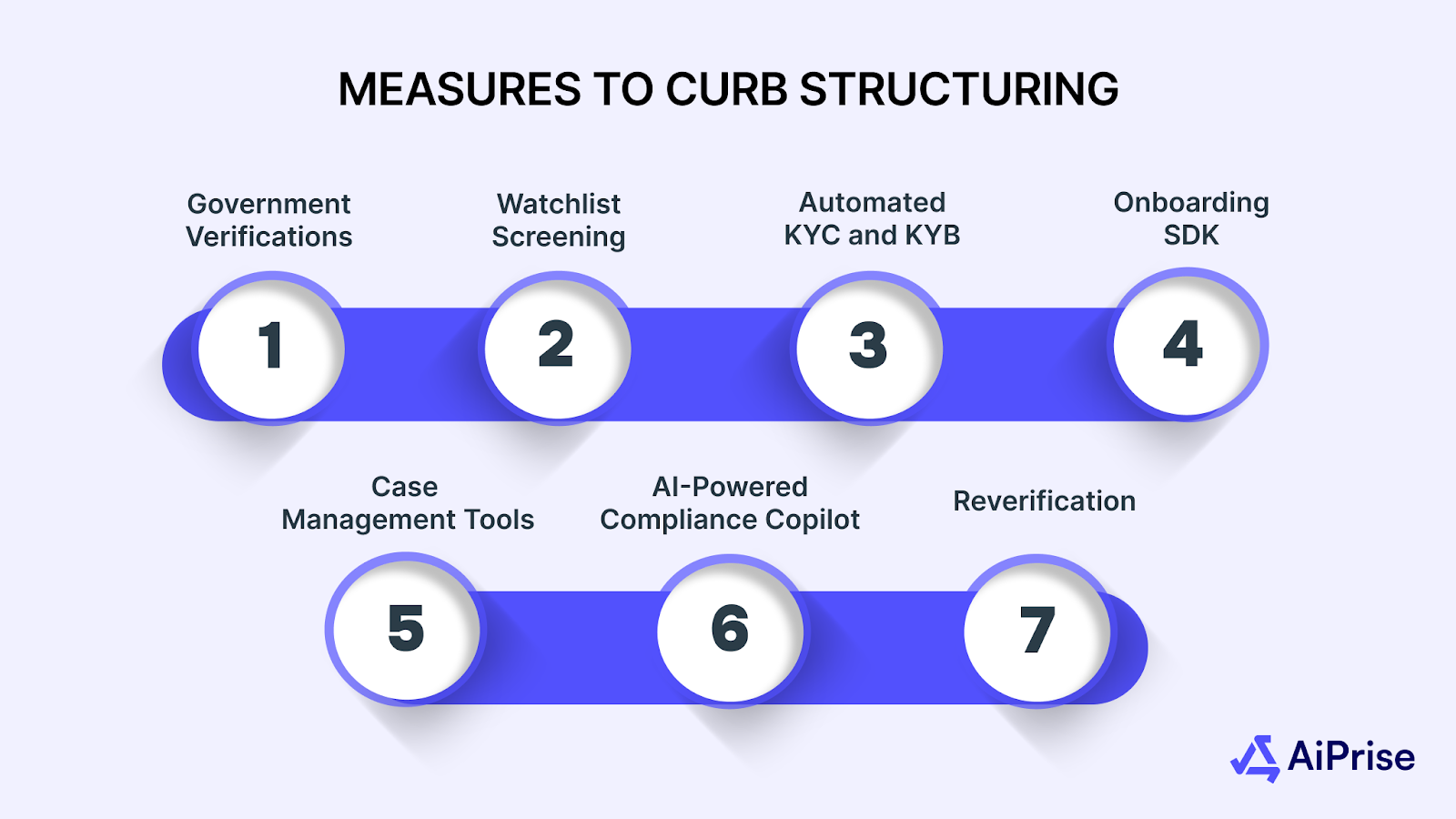

How AiPrise Helps with AML Compliance and Microstructuring Prevention

AiPrise equips businesses with advanced tools to spot suspicious activity early and maintain AML compliance. By combining automation, AI, and real-time checks, it helps organizations cut fraud risk while keeping processes efficient and regulatory-ready.

Key features of AiPrise for AML compliance and microstructuring prevention include:

- Government Verifications: Connects directly with official databases to validate customer identities and filter out fraudulent accounts at the source.

- Watchlist Screening: Continuously screens clients and transactions against international sanctions and watchlists to flag potential risks.

- Automated KYC and KYB: Streamlines customer and business identity verification, ensuring consistent compliance without slowing down operations.

- Onboarding SDK: Enables businesses to plug identity verification and AML checks seamlessly into their customer onboarding workflows.

- Case Management Tools: Centralizes suspicious activity reports, making it easier for compliance teams to investigate, track, and resolve issues quickly.

- AI-Powered Compliance Copilot: Speeds up compliance reviews by as much as 95%, reducing manual errors and freeing teams to focus on critical cases.

- Reverification: Periodically updates customer records, helping businesses maintain accurate risk profiles and stay aligned with compliance rules.

AiPrise’s tools help businesses prevent microstructuring, maintain compliance, and reduce the risks associated with financial crimes. These features make it easier to identify fraudulent activities while staying aligned with regulatory standards.

Wrapping Up

Microstructuring and other fraudulent activities present serious challenges for businesses in the financial sector. By understanding these techniques and recognizing red flags, companies can better protect themselves from financial crime. Implementing the proper measures and monitoring systems is crucial to preventing money laundering.

AiPrise offers a comprehensive suite of tools to help businesses detect microstructuring and stay compliant with AML regulations. With features like real-time transaction monitoring, government verifications, and AI-powered compliance tools, AiPrise makes it easier to prevent fraud and maintain regulatory standards.

Book A Demo today to see how our solutions can help safeguard your business and simplify your AML compliance processes.

FAQs

1. What Is Microstructuring, And Why Is It A Concern For Businesses?

Microstructuring involves breaking large transactions into smaller amounts to evade detection by anti-money laundering (AML) systems. This method can make it difficult for businesses to identify suspicious activity, which increases the risk of non-compliance and fraud.

2. How Can I Identify Microstructuring Activity In My Transactions?

Look for multiple small transactions over a short period, especially if they stay just below the reporting threshold. Other signs include unusual withdrawal patterns, round-number transactions, or deposits spread across different accounts.

3. What Tools Can Help Detect Microstructuring?

Advanced transaction monitoring systems and data analytics tools can analyze transaction patterns in real-time, helping to flag suspicious activities. Automated alerts and AI-driven analysis can assist in detecting signs of microstructuring early.

4. How Can Employee Training Support AML Compliance?

Regular employee training ensures that your team can recognize and handle potential structuring activities. A knowledgeable compliance team is essential in investigating red flags and taking appropriate action when suspicious activity is detected.

5. How Does Aiprise Support Compliance And Fraud Prevention?

AiPrise offers tools like real-time transaction monitoring, government verifications, and AI-powered compliance solutions. These features help businesses detect suspicious activities, stay compliant with AML regulations, and reduce the risk of fraud.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

.png)

.png)

.png)