AiPrise

7 min read

September 26, 2025

6th Anti Money Laundering Directive: Key Changes and Compliance

Key Takeaways

Fraud and money laundering present serious challenges for financial institutions, payment providers, and cryptocurrency platforms. The pressure to meet compliance standards is immense, as criminals continually find new ways to exploit gaps. Nasdaq reported that in 2023, an estimated $3.1 trillion in illicit funds circulated globally, clearly showing the staggering magnitude of financial crime.

Staying ahead of these risks requires ongoing vigilance. Your organization faces the challenge of protecting operations while maintaining compliance with ever-changing regulations. Falling short of these standards may bring serious outcomes, including heavy financial penalties along with long-lasting harm to your organization’s reputation.

In this blog, we’ll cover the 6th Anti-Money Laundering Directive (6AMLD), its key changes, and how AiPrise’s KYC, KYB, and AML tools can help safeguard your business.

Key Takeaways:

- 6AMLD broadens financial crime definitions and imposes tighter rules on businesses handling transactions across borders.

- Companies are held liable for employee misconduct, with heavier penalties for violations.

- Stronger customer checks and continuous monitoring are mandatory for compliance.

- Member states must share information and strengthen oversight of cross-border activity.

- Tools like AiPrise support compliance by automating verification and monitoring suspicious activity.

What is 6AMLD?

The 6th Anti-Money Laundering Directive (6AMLD) enhances the EU’s legal framework against money laundering and fraud. It updates previous directives, introducing greater uniformity across member states in addressing financial crimes, particularly those related to digital and cross-border transactions.

6AMLD expands the scope of offenses tied to money laundering and introduces stricter business requirements. It mandates thorough customer verification, transaction monitoring, and prompt reporting of suspicious activities. The directive also holds companies accountable for non-compliance, impacting businesses involved in financial transactions.

As a result, 6AMLD directly affects financial institutions, payment providers, and cryptocurrency platforms. These entities must comply with the updated regulations to avoid penalties and protect their reputations.

With a clear understanding of what 6AMLD represents, you can now review the specific updates it introduces.

Also Read: Comprehensive Guide to AML Compliance in FinTech

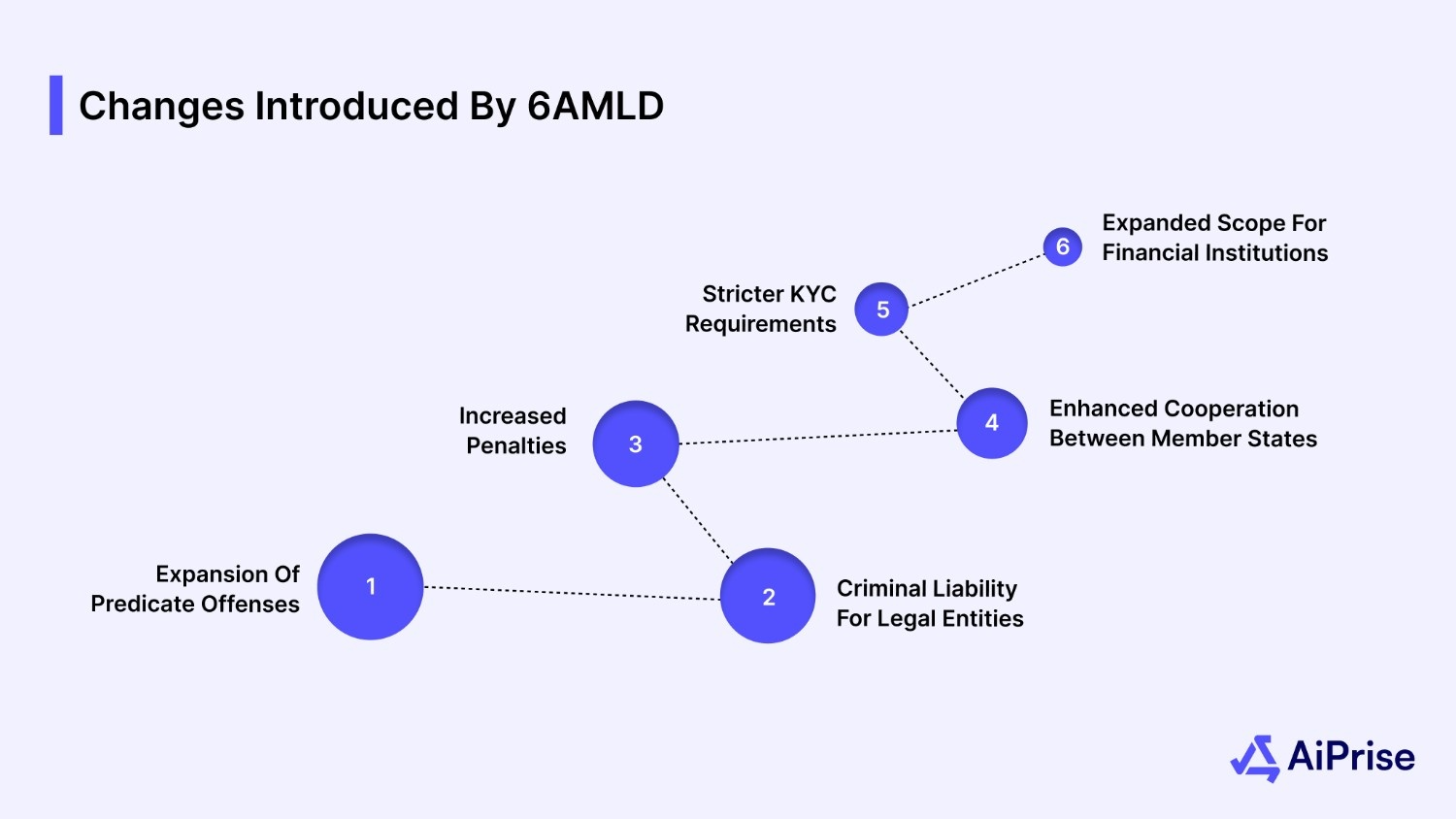

Key Changes Introduced by 6AMLD

The 6th Anti-Money Laundering Directive introduces significant updates to the EU’s approach to financial crime prevention. These changes widen the scope of offenses, increase penalties, and emphasize cross-border cooperation. Let’s review the key updates:

- Expansion of Predicate Offenses: 6AMLD includes 22 specific predicate offenses tied to money laundering, such as cybercrime, tax evasion, and environmental crimes.

- Criminal Liability for Legal Entities: Businesses can now be held criminally liable for money laundering activities, including those committed by employees or contractors.

- Increased Penalties: The directive enhances penalties for non-compliance, including higher fines and longer prison sentences for individuals and organisations.

- Enhanced Cooperation Between Member States: Member states are encouraged to share information and collaborate on combating cross-border money laundering.

- Stricter KYC Requirements: Financial institutions must implement enhanced KYC measures to verify customer identities and monitor transactions.

- Expanded Scope for Financial Institutions: More sectors, including cryptocurrency platforms, are now required to comply with stringent AML regulations.

With the updates outlined, you must also consider the practical obligations they place on your operations.

Compliance Obligations for Financial Institutions

To remain compliant with 6AMLD, financial institutions and payment providers must implement comprehensive procedures to prevent money laundering. These obligations are crucial for reducing risk and ensuring transparency. Let’s explore these compliance duties:

- Customer Due Diligence (CDD): Businesses are required to carefully confirm the identities of their customers while also evaluating each individual’s potential risk level through detailed due diligence checks.

- Ongoing Transaction Monitoring: Continuous monitoring of transactions is required to detect and report suspicious activities related to money laundering.

- Know Your Customer (KYC): KYC measures must be implemented to verify customers’ identities and understand their financial activities.

- Suspicious Activity Reporting (SAR): Businesses must file SARs when suspicious activities are detected, helping authorities investigate potential criminal behavior.

- Employee Training: Regular training ensures staff understand AML policies and can identify and report suspicious activities.

- Record Keeping: Financial institutions must maintain detailed records of customer interactions, transactions, and compliance efforts for review by regulatory authorities.

- Independent Audits: Regular audits of compliance systems help ensure procedures are functioning effectively.

Adhering to these obligations reduces exposure to legal risks and helps businesses remain compliant with EU regulations. Compliance requires careful attention to detail and proactive monitoring.

Also Read: How AI-Powered Compliance is Revolutionizing Risk Management for Businesses

Implications for Financial Institutions and Payment Providers

6AMLD introduces a range of implications for financial institutions, payment providers, and cryptocurrency platforms. The expansion of regulatory requirements directly impacts how businesses manage their operations and risk. Let’s look at the key implications:

- Broader Regulatory Scope: The 6AMLD encompasses more sectors, including cryptocurrency platforms, which require these businesses to implement AML procedures.

- Increased Responsibility for Compliance: With corporate criminal liability, businesses are held accountable for money laundering activities, even those committed by employees.

- Stricter Penalties for Non-Compliance: Companies that ignore compliance requirements risk heavy financial penalties while also damaging their credibility and losing customer trust permanently.

- Enhanced Transaction Monitoring: Financial institutions must intensify efforts to monitor transactions, identifying suspicious activities early to mitigate risk.

- Cross-Border Cooperation: Increased collaboration between EU member states means businesses must be prepared for data sharing and joint investigations.

- Thorough Customer Verification: Enhanced verification processes are necessary to ensure businesses comply with 6AMLD’s strict KYC requirements.

- Increased Scrutiny: Financial institutions will undergo more frequent audits, necessitating greater preparedness and ongoing monitoring.

These implications highlight the importance of businesses remaining proactive in their compliance efforts. Growing regulatory expectations require firms to invest in technology and resources to stay compliant.

Best Practices for 6AMLD Compliance

To ensure compliance with 6AMLD and mitigate risks, businesses should adopt best practices in their operations. These steps help organizations stay ahead of regulatory requirements and avoid penalties. Here’s how companies can comply with 6AMLD:

- Conduct Regular Risk Assessments: Regularly assess client and transaction risks to identify potential vulnerabilities and improve compliance processes.

- Enhance KYC and AML Procedures: Strengthen KYC and AML practices to ensure proper customer verification and monitor for suspicious activities.

- Invest in Technology: Use technology to monitor transactions, automate compliance tasks, and detect suspicious activities more accurately and quickly.

- Train Employees: Ensure all employees, particularly those in compliance roles, receive regular training on updated regulations and compliance procedures.

- Promote a Compliance Culture: Create a company-wide commitment to compliance, ensuring everyone understands the importance of following the rules.

- Monitor Cross-Border Transactions: Ensure your business has the necessary systems in place to monitor and report cross-border transactions, particularly in light of increased international cooperation.

- Maintain Thorough Documentation: Keep detailed records of all compliance efforts, transactions, and staff training for regulatory audits.

To support these practices, AiPrise provides solutions designed to help you meet regulatory requirements with confidence.

Also Read: Principles, Assessment, And Strategies In Fraud Risk Management

AiPrise: Supporting Compliance with Advanced Technology

AiPrise provides tools that help businesses meet the compliance requirements of the 6th Anti-Money Laundering Directive (6AMLD). AiPrise helps businesses by automating verification and monitoring processes, allowing them to lower fraud risks while staying fully compliant with regulations.

Here’s how AiPrise can help:

- Government Verifications: AiPrise integrates with government databases to verify client identities. This ensures compliance with KYC regulations by confirming client legitimacy.

- Watchlist Screening: AiPrise screens clients and transactions against global sanctions lists. This helps businesses identify high-risk transactions, ensuring compliance with regulations.

- Onboarding SDK: AiPrise offers an onboarding SDK that enables businesses to integrate KYC and AML checks seamlessly into the client onboarding process. This simplifies the verification process and ensures compliance with regulations.

- Reverification: AiPrise simplifies the periodic verification of client information. This ensures businesses stay compliant by regularly updating customer risk profiles.

- Compliance Copilot: AiPrise’s AI-powered Compliance Copilot helps businesses achieve faster and more efficient compliance processes, reducing review times by 95%.

AiPrise’s solutions make it easier for businesses to comply with KYC, KYB, and AML requirements, reducing the risk of financial crime and helping maintain regulatory standards.

Conclusion

Following the 6th Anti-Money Laundering Directive (6AMLD) is essential for businesses that want to protect themselves from serious financial crime risks and penalties. With the growing complexity of compliance requirements, adopting the right strategies and technologies is essential. By implementing the necessary tools and processes, businesses can ensure ongoing compliance and effective fraud prevention.

AiPrise offers the technology and support needed to meet 6AMLD standards efficiently. With solutions for KYC, KYB, and AML compliance, AiPrise helps businesses manage risks and meet regulatory demands with ease.

Ready to strengthen your compliance efforts and stay ahead of regulatory changes? Book a Demo today to see how AiPrise can support your business.

FAQs

1. What Is The Main Goal Of The 6th Anti-Money Laundering Directive?

The directive primarily seeks to strengthen legal measures against financial crimes by introducing stricter rules, broader offense categories, and stronger accountability for corporate entities.

2. How Does 6amld Affect Cryptocurrency Service Providers?

Cryptocurrency businesses are now required to apply enhanced checks, monitor suspicious transactions, and maintain transparency standards similar to traditional financial service providers.

3. Can Employees Be Prosecuted Under The 6amld?

Yes, employees involved in money laundering activities can face prosecution, with penalties extending to their employers through expanded corporate liability provisions.

4. Why Are Environmental Crimes Included Under 6amld?

Environmental crimes were added because illicit profits from activities like illegal waste trafficking or wildlife smuggling often fuel broader financial crime networks.

5. How Should Businesses Prepare For Cross-Border Cooperation Requirements?

Companies must strengthen data management practices, ensure accurate reporting, and maintain systems capable of sharing relevant information quickly with authorities in other member states.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

.png)

.png)

.png)