AiPrise

14 min read

December 15, 2025

What is Fraud Loss and How to Prevent It? A Simple Guide for 2026

Key Takeaways

Fraud has become one of the most damaging threats to consumers and businesses alike. The FBI’s IC3 received 535,314 complaints, representing $13.7 billion in losses, an average of $25,700 per victim.

Over the past four years, fraud losses reported to IC3 have reached $50.5 billion, with individuals over 60 suffering the greatest financial impact. As scams grow more sophisticated and digital transactions expand, companies face increasing pressure to detect fraud early, prevent financial leakage, and protect vulnerable users.

This guide explains what fraud loss is, the major fraud types driving losses in 2026, and the strategies organizations need to reduce exposure and strengthen fraud prevention.

Key Takeaways

- Fraud losses are skyrocketing: In 2026, IC3 reported $13.7B in losses from 535,314 complaints, with total losses over four years hitting $50.5B.

- Multiple attack types: ATO, APP fraud, synthetic identities, transaction/loan fraud, merchant scams, promo abuse, and device spoofing drive losses.

- AI fuels smarter fraud: Deepfakes, AI-generated IDs, and micro-transactions let scammers bypass verification and coordinate cross-platform attacks.

- Behavioral and real-time monitoring are critical: Tracking micro-behaviors, session anomalies, and device signals helps catch fraud early.

- Unified intelligence cuts exposure: Platforms like AiPrise combine identity, device, behavior, and transaction insights to prevent losses and protect customers.

What Is Fraud Loss? Everything You Need to Know

Fraud loss refers to the financial damage organizations or individuals suffer when bad actors successfully steal money, exploit systems, or manipulate transactions.

These losses come from a wide range of schemes, including identity fraud, account takeovers, imposter scams, payment fraud, and social-engineering attacks. As digital transactions accelerate and fraud networks scale globally, the cost and complexity of preventing fraud have grown significantly.

Fraud loss doesn’t occur from one type of scheme; criminals often combine multiple techniques to bypass traditional controls. Common contributors include:

- Identity fraud (using stolen or synthetic identities to open accounts or secure loans)

- Account takeovers (accessing a victim’s account through phishing, credential-stuffing, or malware)

- Payment and transaction fraud (unauthorized transfers, card-not-present fraud, chargeback abuse)

- Social engineering scams (romance scams, investment scams, impersonation, refund scams)

- Business email compromise (BEC) schemes targeting employees and finance teams

How Fraud Loss Impacts Businesses

Fraud loss affects more than just direct monetary damage. Companies also face:

- Operational impact: Chargebacks, investigations, and disputes raise costs and slow customer operations.

- Regulatory exposure: Failure to detect fraud early can trigger compliance penalties in finance, fintech, and crypto.

- Reputational harm: Customers lose trust when fraud occurs on a platform, reducing retention and acquisition.

- Higher risk of repeat attacks: Fraudsters often return to businesses with weak verification or monitoring systems.

Digital-first platforms, including banks, fintech lenders, wallets, P2P apps, marketplaces, and crypto platforms, are especially vulnerable due to high transaction velocity, cross-border users, and 24/7 financial activity.

Suggested Read: How to Spot a Fake Identity: A Guide to Combating Synthetic Fraud

AiPrise helps businesses detect fraud before losses occur. Its continuous monitoring and Fraud and Risk Scoring solution analyzes user behavior, transaction patterns, and early signs of mule activity. By identifying suspicious movement before schemes escalate, AiPrise enables teams to intervene early and prevent costly fraud losses.

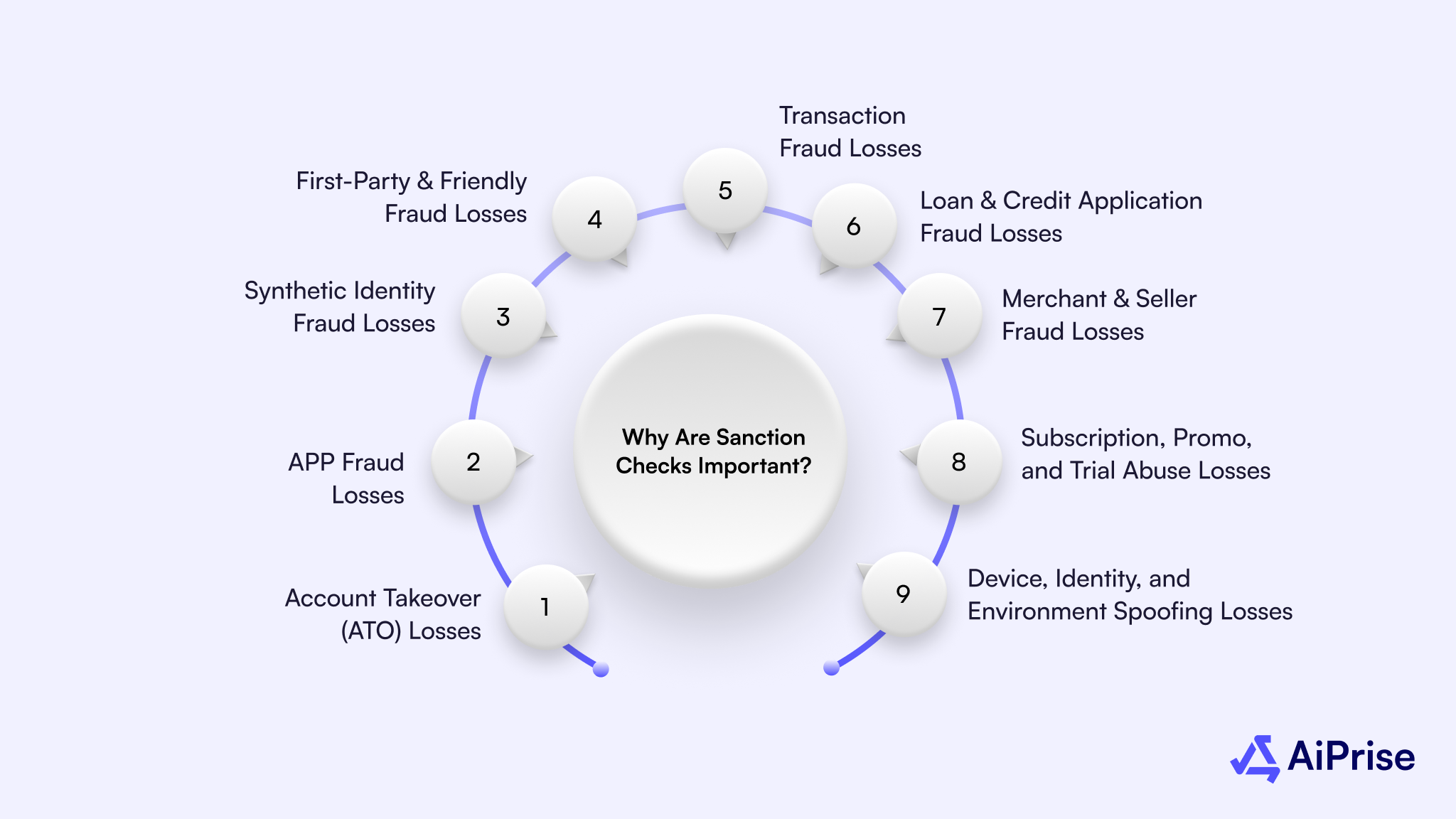

Types of Fraud Loss to Look Out for in 2026

Digital fraud in 2026 is no longer fragmented; it’s interconnected. Fraud rings operate across borders, automate attacks with AI tools, and exploit gaps between identity verification, payment rails, and monitoring systems.

Instant settlement networks, embedded finance, and global PSP stacks have increased speed and volume, giving criminals wider surfaces to exploit. At the same time, consumer pressure, economic slowdown, and intensified online activity create more opportunities for scams, defaults, and abuse.

For financial institutions, fintechs, and digital platforms, understanding the major fraud-loss categories is critical to anticipating attacks before they mature:

Account Takeover (ATO) Losses

ATO schemes increasingly combine credential stuffing, device spoofing, and AI-driven social engineering, allowing attackers to slip past behavioral or risk-based authentication.

Once inside, criminals move quickly, executing transfers, draining wallets, or changing credentials before detection. The financial impact is immediate, but the reputational damage and customer churn that follow often exceed the direct loss.

How it occurs:

- Credential compromise: Phishing, infostealers, SIM-swaps, or breached passwords allow criminals to log in undetected.

- Session or device hijacking: Fraud rings use malware or MITB attacks to seize authenticated sessions.

- Bypassing 2FA: Using social engineering, OTP forwarding bots, or deepfake phone calls to override authentication.

Takeaway: ATO generates immediate financial loss and long-term customer distrust. Institutions face reimbursement costs, regulatory scrutiny, and increased operational workload from recovery efforts.

Authorized Push Payment (APP) Fraud Losses

APP fraud has escalated globally as real-time payment systems expand. Unlike unauthorized transfers, these payments are initiated willingly by victims under manipulation, making liability and recovery far more complicated.

Criminals now operate sophisticated call-center scams, impersonation networks, and deepfake-assisted communications to pressure victims into acting quickly.

How it occurs:

- Impersonation scams: Criminals pose as banks, government agencies, family members, or employers.

- Social engineering: Victims are pressured to “verify an account,” “avoid penalties,” or “save a loved one.”

- Payment diversion: Fraudsters alter invoices, payroll details, or vendor instructions.

Takeaway: APP fraud is now one of the fastest-growing loss categories for 2026, especially with instant settlement systems where funds disappear before intervention.

Synthetic Identity Fraud Losses

Synthetic identities have become structurally embedded in credit and onboarding systems. Fraudsters combine real personal identifiers with fabricated digital footprints to create identities that pass automated checks and credit bureaus.

These identities behave like real users for months, building positive credit history, maintaining accounts, and appearing low-risk.

How it occurs:

- Combining stolen and forged data: Real SSNs or national IDs paired with fake emails, addresses, and phone numbers.

- Gaming onboarding: Passing automated KYC using AI-generated documents or deepfake liveness.

- Long-con behavior: Building credit over months before maxing out loans or BNPL and disappearing.

Takeaway: Synthetic profiles are difficult to detect because they have no real victim; losses appear as credit defaults rather than fraud, masking the scale of the problem.

First-Party & Friendly Fraud Losses

Economic pressure, rising living costs, and easier access to online disputes have fueled a sharp rise in first-party fraud. Unlike third-party attacks, these losses come from real customers who intentionally avoid repayment or misuse consumer protection rules.

The challenge for platforms is distinguishing legitimate hardship from malicious intent, especially when behavior appears reasonable at first glance.

How it occurs:

- Chargeback abuse: Customers claim items weren’t received or transactions weren’t authorized.

- Refund and return scams: Using multiple accounts or exploiting generous refund windows.

- Intentional non-payment: Customers take loans, credit lines, or BNPL with no intent to repay.

Takeaway: First-party fraud is rising sharply due to economic pressure. Because the “fraudster” is also the customer, businesses struggle to distinguish legitimate hardship from intentional abuse.

Transaction Fraud Losses

Transaction fraud has evolved beyond simple card theft. In 2026, fraudsters use automated bots, stolen identity packages, and real-time behavioral mimicry to execute unauthorized payments across cards, bank transfers, instant rails, and digital wallets.

Cross-border schemes are especially prevalent, with attackers exploiting PSPs operating in countries with inconsistent risk controls.

How it occurs:

- Card testing: Bots run thousands of low-value transactions to identify valid cards.

- Compromised wallets: Criminals exploit weak device security or account reuse.

- Cross-border misuse: Fraud rings use PSPs in multiple countries to confuse risk models.

Takeaway: Transaction fraud drains revenue quickly and spikes chargeback ratios, threatening merchant accounts and compliance standings.

Loan & Credit Application Fraud Losses

Loan and credit fraud is expanding rapidly across lenders, BNPL providers, and embedded finance platforms. Fraudsters exploit same-day decisions and automated underwriting by using fabricated documents, synthetic data, or stolen identities.

Loan stacking, applying to multiple lenders before data updates, creates massive exposure within hours.

How it occurs:

- Loan stacking: Multiple applications across lenders before credit bureaus update.

- Fake documents: AI-generated paystubs, identity photos, and employment proofs.

- Ghost employers: Fraud rings create fake workplaces to validate income.

Takeaway: Application fraud can evaporate large sums instantly. Losses usually manifest months later as defaults, making early detection crucial.

Merchant & Seller Fraud Losses

Merchant fraud is increasingly common on payment platforms, creator marketplaces, gig-economy apps, and e-commerce ecosystems. Fraudulent sellers set up accounts, run a period of normal activity to build trust, then suddenly process a large volume of transactions and disappear with the funds.

Others list fake inventory, operate dropshipping scams, or intentionally trigger chargeback cycles.

How it occurs:

- Bust-out merchants: Launching a store, making a few real sales, then processing fraudulent orders.

- Fake inventory or dropshipping fronts: Collecting payments for goods that don’t exist.

- Chargeback farming: Coordinating schemes to drain PSPs with disputes.

Takeaway: Merchant fraud damages platform trust, forces PSPs to cover losses, and triggers higher reserve requirements from banks.

Subscription, Promo, and Trial Abuse Losses

Promotional abuse has evolved from casual misuse to coordinated exploitation. Fraud rings use device farms, emulators, VPNs, and synthetic users to repeatedly claim sign-up bonuses, referral payouts, or trial periods.

Digital goods platforms, streaming, gaming, SaaS, fintech, are especially vulnerable because the fraud is low-value but extremely high-volume.

How it occurs:

- Multi-accounting: Using VPNs, new emails, and virtual numbers for repeated free trials.

- Promo exploitation: Abusing cashback, referral bonuses, or discount codes.

- Refund loops: Repeated “accidental purchase” claims on digital goods.

Takeaway: While individual losses look small, cumulative fraud across large user bases leads to major revenue leakage.

Device, Identity, and Environment Spoofing Losses

In 2026, fraud begins before the transaction, at the moment of identity. Attackers use virtual machines, emulators, spoofed IPs, and AI-generated personas to create digital environments that mimic legitimate users. This undermines the signals that identity and fraud systems rely on to assess risk.

How it occurs:

- Device farms & emulators: Simulating thousands of “new” users.

- IP/VPN rotation: Masking geolocation and risk patterns.

- Identity morphing: Using AI to generate faces, IDs, and liveness responses.

Takeaway: Spoofing corrupts identity and risk signals at the source, making even advanced KYC and fraud models easier to bypass.

Emerging Fraud Loss Trends in 2026:

- AI-powered scams: Deepfake audio/video used to trick victims

- Real-time payments: Shorter recovery windows increase net losses

- Device-spoofing tools: Fraudsters masking location and identity

- Cross-platform fraud rings: Coordinated attacks targeting multiple fintechs simultaneously

Preventing fraud loss requires faster detection, richer behavioral insights, and early risk scoring before funds leave the ecosystem.

Also Read: How AI is Transforming AML Compliance

With a clear understanding of the different types of fraud loss, let’s look at some useful techniques to discover fraud.

How to Discover Fraud in 2026

Detecting fraud in 2026 requires far more than rule-based monitoring. Fraud rings now operate across payment channels, automate identity abuse with generative AI, and exploit gaps between KYC, onboarding, and transaction monitoring.

For banks, fintechs, lenders, and PSPs, the challenge is identifying behavioral anomalies and environmental signals that AI-enabled attackers can’t easily fake.

Here are the most critical areas of focus:

Spot AI-Enhanced Identity Manipulation: Fraud teams must evaluate signals that go beyond IDs or documents. Synthetic applicants now use:

- AI-generated faces that pass basic liveness challenges

- High-quality deepfake video for verification

- Machine-generated documents with perfect metadata

The strongest indicators today come from:

- Device risk markers

- Environment integrity checks

- Network-graph link analysis

If a “new” applicant shares infrastructure, devices, or behavioral patterns with known fraud clusters, treat it as high risk, even if the documents appear valid.

Examine Transaction Behavior at Micro and Network Levels: Fraud loss in 2026 often begins with tiny anomalies that don’t trigger traditional thresholds. Banks and payment businesses should monitor:

- Repeated micro-transactions that test limits or card validity

- Velocity patterns across interconnected accounts

- Sudden shifts in location, device, or transaction time windows

- Cross-border movements inconsistent with customer profiles

These signals help identify mule accounts, ATO behavior, loan-stacking, and early-stage APP fraud.

Detecting Environment Spoofing and Device Tampering: Fraud rings increasingly use device farms and emulated environments to impersonate thousands of “unique” users. Key risk indicators include:

- Virtual device fingerprints cycling through multiple identities

- High-volume applications routed from the same system image

- VPN chaining and IP tunneling to mimic customer geographies

Environment checks like OS integrity, emulator detection, and hardware signals are now essential for early detection.

Identify Behavioral Red Flags in Real Time: Static KYC no longer stops fraud. Fraud teams should look for live, session-level anomalies:

- Hesitation patterns inconsistent with genuine users

- Rapid form completion indicative of automated scripts

- Abnormal navigation flows (e.g., bypassing disclosures or T&Cs)

- Copy-paste behavior in key KYC or credit application fields

Behavioral biometrics help differentiate legitimate customers from AI-assisted fraudsters.

Integrate External Intelligence & Public Scam Feeds: Emerging fraud often follows global scripts. Banks and PSPs should ingest:

- National fraud alerts (IC3, FCA, AUSTRAC, FIU bulletins)

- Compromised credential databases

- Industry consortium data on active mule networks and merchant clusters

Cross-referencing internal signals with live intelligence significantly improves detection speed and accuracy.

The shift toward AI-driven fraud means banks and financial platforms must evaluate how a user behaves and what environment they operate from, not just the data they submit.

Now that you know how to discover fraud, let’s see what to do afterward.

What To Do After You Discover Fraud

When a fraud incident surfaces inside a fintech, payments app, or marketplace, response speed determines how much financial and operational damage can be contained. The steps below condense best-practice guidance modeled on 2026 expectations from U.S. regulators, financial intelligence units, and fraud-risk teams.

Freeze the Suspicious Activity Immediately

Stop additional movement of funds or account actions. Fraud rings often attempt rapid follow-on withdrawals, account takeovers, or “last-mile” transfers once they detect internal review.

A legitimate financial institution or processor will never request new fees or additional verifications to release frozen funds. This is a hallmark of scam behavior targeting consumers.

Collect all available evidence

Fraud teams should centralize evidence while logs and metadata are still intact:

- Device fingerprints, IP clusters, behavioral patterns, and session trails

- Transaction timelines, linked accounts, and velocity anomalies

- KYC files, selfie/ID mismatches, and onboarding risk signals

- Crypto wallet traces, exchange TXIDs, or blockchain paths

- Support tickets, email headers, and communication logs

This data becomes essential when conducting internal reviews, SAR filings, or responding to regulatory inquiries.

Secure Affected Accounts and Credentials

If the incident involves account takeover, mule activity, or data exposure, tighten security immediately:

- Reset passwords and revoke session tokens

- Add enhanced MFA or step-up verification

- Notify issuing banks or processors of potential card or ACH compromise

- Set internal fraud or identity-risk flags

- For severe exposure, apply consumer fraud alerts or credit freezes as required

File the Appropriate Regulatory Reports

For U.S. operations, fintechs typically escalate based on scope and exposure. Relevant channels include:

- FinCEN SAR filings for suspicious movement, mule networks, or laundering attempts

- FTC, IC3, or state regulators if consumer harm is involved

- CFTC, SEC, or FINRA for investment-related fraud impacting trading or derivatives platforms

- Local law enforcement when identity theft or cross-border fraud is present

Early reporting strengthens the institution’s compliance posture and helps prevent broader ecosystem risk.

Assess Loss Exposure and Recovery Options

You can do this in several ways.

Evaluate:

- Whether insurance (cyber, E&O, crime) applies

- Processor or card-network chargeback eligibility

- Whether the fraud path includes recoverable crypto flows

- Required customer restitution steps, especially in ATO or payment diversion cases

Avoid third-party "recovery services". Many target consumers and create secondary fraud risk for institutions.

Strengthen your Fraud Controls Going Forward

Post-incident review helps identify operational and system gaps. Fraud-risk teams typically reassess:

- Risk scoring thresholds and false-negative patterns

- Real-time transaction monitoring logic

- Bot detection, behavioral analysis, and identity verification flows

- Exposure to synthetic identities, money mules, and cross-border rings

- Vulnerable channels (support, SMS, email, MFA fatigue)

Modern defenses require continuous behavior-based monitoring, deep-link device intelligence, and ecosystem-wide risk scoring, capabilities AiPrise continuously supports.

Also Read: How Banks Utilize Machine Learning For Fraud Detection

Financial institutions, fintechs, and digital platforms need tools that detect suspicious behavior early, verify identities reliably, and flag high-risk transactions before laundering escalates.

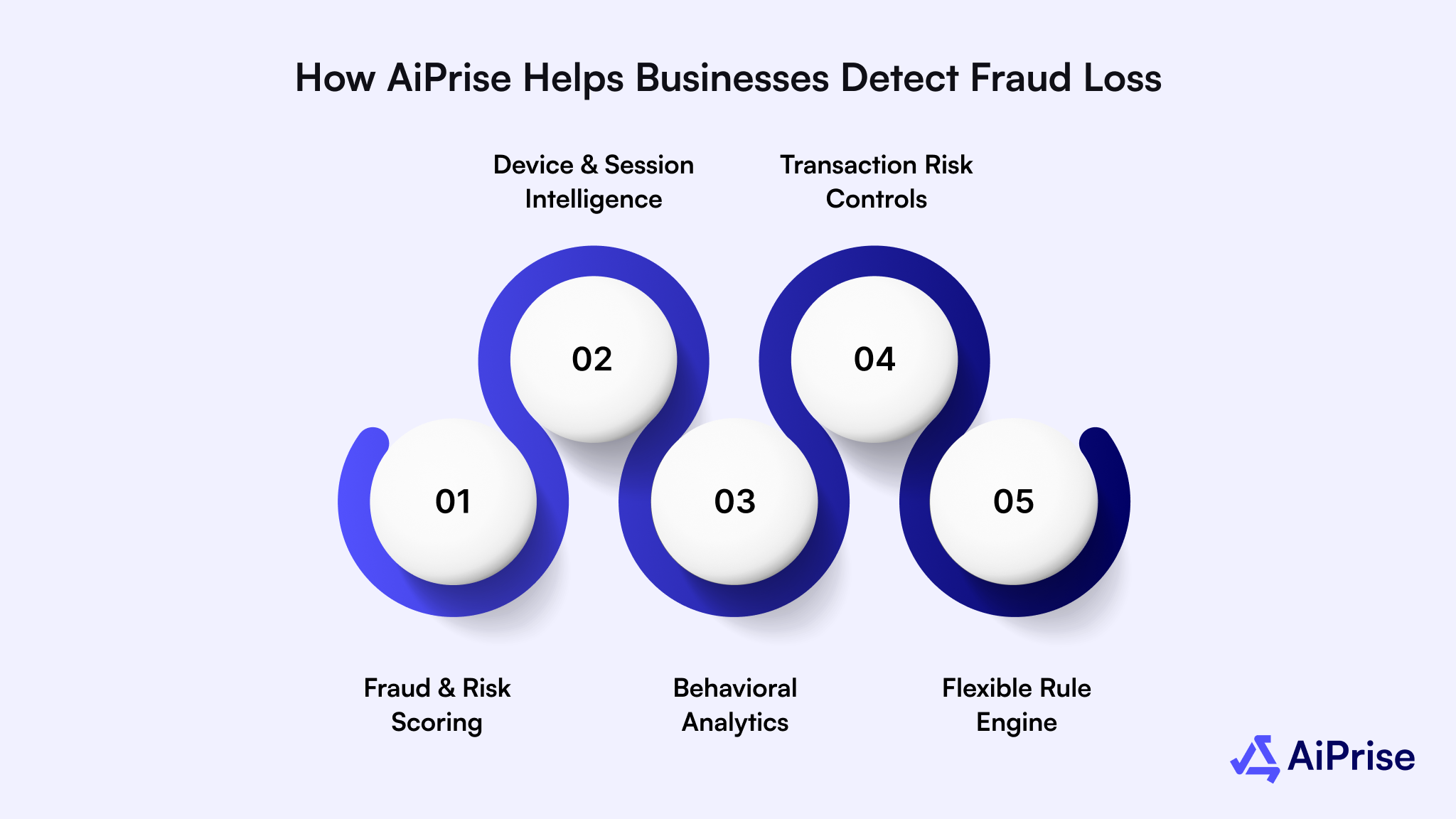

How AiPrise Helps Businesses Detect Fraud Loss

In 2026, detecting fraud requires visibility across onboarding, devices, user behavior, and real-time transaction flows.

AiPrise unifies identity verification, behavioral intelligence, and risk scoring into a single orchestration layer, giving compliance, fraud, and risk teams a faster, clearer way to identify potential fraud activity tied to users, payment methods, and transaction networks. The platform helps firms intervene before anomalies result in chargebacks, stolen funds, or reputational damage.

By detecting risks before they escalate into costly incidents, AiPrise helps businesses reduce fraud exposure, prevent operational losses, and maintain smooth customer and transaction workflows.

With AiPrise, businesses can:

- Fraud & Risk Scoring: Analyze user risk at onboarding and throughout the transaction lifecycle using 100+ signals, including identity data, behavior patterns, devices, IP intelligence, corporate registries, and adverse media. This helps surface high-risk users, synthetic identities, and compromised accounts early.

- Device & Session Intelligence: Detect compromised devices, browser spoofing, emulator usage, VPN abuse, and remote-access tools (RATs) commonly used in account takeover, scam operations, and coordinated fraud attacks.

- Behavioral Analytics: Monitor navigation habits, interaction cadence, and session anomalies to identify manipulated users, social-engineering victims, and coordinated fraud rings.

- Transaction Risk Controls: Run transaction-level validation such as source-of-funds checks, counterparty scoring, velocity limits, cooling-off periods, circular-flow detection, and automated holds for suspicious transfers.

- Flexible Rule Engine: Configure detection rules and automated workflows aligned with internal fraud policies, regulatory expectations, and risk thresholds—without slowing down legitimate users.

AiPrise provides end-to-end visibility and adaptive controls across identity, behavior, devices, and transactions, helping businesses detect fraud early while keeping trusted customers moving.

Book a Demo to see how AiPrise strengthens fraud detection and reduces financial losses across your operations.

Wrapping Up

Fraud schemes continue to grow in scale and sophistication as digital payments, online platforms, and cross-border transactions accelerate. Businesses face increasing challenges in detecting account takeover, scam activity, and coordinated fraud rings before losses occur.

AiPrise delivers unified fraud intelligence by combining identity verification, behavioral analytics, and transaction risk monitoring into a single platform. Spotting suspicious activity early and revealing hidden fraud patterns helps organizations reduce financial loss, protect customers, and strengthen compliance and risk operations with greater confidence.

Talk to Us Today to see how AiPrise helps businesses detect fraud earlier, minimize losses, and safeguard their operations end-to-end.

FAQs

1. How is synthetic identity fraud evolving in 2026?

Criminals are creating fully fabricated profiles using stolen data, AI-generated photos, and false documentation. These synthetic identities can open accounts, apply for loans, or trigger new digital services without immediate detection, allowing fraud losses to accumulate before being flagged.

2. Why are micro-fraud schemes becoming more costly?

Fraudsters now use “micro-transactions” to test stolen credentials, prepaid cards, or small-scale payment flows. Individually, these seem minor, but when executed at scale across multiple accounts or platforms, they generate substantial cumulative losses before standard monitoring detects them.

3. How do insiders contribute to fraud losses?

Employee fraud and account misuse remain a top concern. Insider schemes often involve manipulating client accounts, bypassing internal controls, or colluding with external scammers. Real-time behavioral analytics and transaction monitoring are now critical to spot anomalies caused by trusted personnel.

4. What role do social engineering campaigns play in 2026 fraud losses?

Fraudsters increasingly use highly personalized messages via email, messaging apps, or social media to trick staff or customers into authorizing transactions. These attacks often exploit current events, company hierarchies, or payment habits, making them highly effective and costly.

5. How are cross-platform scams increasing the risk for digital businesses?

Fraudsters coordinate attacks across banking apps, crypto wallets, e-commerce accounts, and gig platforms. By splitting funds and actions across multiple services, they evade single-platform monitoring, forcing businesses to adopt integrated fraud-detection systems across all customer touchpoints.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

Speed Up Your Compliance by 10x

Automate your compliance processes with AiPrise and focus on growing your business.

.png)

.png)

.png)

.png)

.png)