AiPrise

18 min read

January 7, 2026

AI Powered Fraud Detection in Payments: 2026 Trends

Key Takeaways

As enterprise payment systems push for faster processing and global scale, fraud is no longer a fringe operational risk. In fact, a 2026 international survey shows that 79% of organizations reported attempted or successful payment fraud incidents in the prior year, highlighting that fraud is now a baseline threat for high-volume payment leaders.

Traditional rule-based systems can’t keep pace with automated fraud attacks, identity spoofing, or sophisticated money movement patterns, leaving compliance teams scrambling and risk teams stretched thin.

As enterprise payment leaders, you need systems that detect fraud at the speed of payment flows without blocking legitimate business activity. In this blog, we break down why fraud detection matters in 2026, what trends are shaping it, and how AI-powered fraud detection technology is setting a new standard.

Key Takeaways

- Enterprise payment fraud in 2026–2026 is driven by complex workflows, shared access, and cross-border activity, making traditional controls insufficient.

- AI enables real-time, contextual fraud detection across the full payment lifecycle without slowing down legitimate transactions.

- High-impact AI trends include dynamic risk scoring, predictive global intelligence, continuous identity verification, and partner-level signal sharing.

- Enterprises must evaluate fraud tools based on accuracy, scalability, explainability, and how well they integrate with existing payment stacks.

- Unified platforms like AiPrise help payment leaders manage KYC, KYB, AML, and fraud risk together, enabling faster decisions and stronger compliance.

Why Is Fraud Detection Becoming More Critical for Enterprise Payments in 2026?

By 2026, fraud risk stops being a back-office issue and becomes a direct growth constraint for payment businesses like yours. As payment volumes scale, partners diversify, and enterprise clients demand uptime with zero tolerance for losses, even small fraud gaps compound quickly.

You are no longer judged only on stopping fraud, but on how cleanly, quickly, and confidently payments move through your systems without hurting conversion, trust, or partner relationships.

Here are the key forces making fraud detection non-negotiable for enterprise payments in 2026.

- Fraud Liability Is Shifting Closer To You: Payment networks and enterprise clients increasingly expect you to absorb losses when fraud slips through, especially in complex payout and B2B flows.

- Authorization Rates Are Now A Competitive Metric: Overblocking legitimate payments directly impacts revenue, marketplace liquidity, and merchant retention, not just risk KPIs.

- Fraud Attacks Are Being Productized: You are no longer facing individual bad actors, but organized fraud services that test your systems continuously and adapt faster than static controls.

- Enterprise Clients Demand Proof, Not Promises: Large merchants and platforms now ask how decisions are made, how disputes are handled, and how fast issues can be traced and explained.

- Payment Ecosystems Are More Interconnected Than Ever: One weak link in your PSP, banking, or partner stack can expose your entire payment flow to downstream fraud and reputational damage.

As enterprise payment volumes grow and attack surfaces expand, understanding why fraud detection is more critical naturally leads to examining how fraud manifests within modern payment systems.

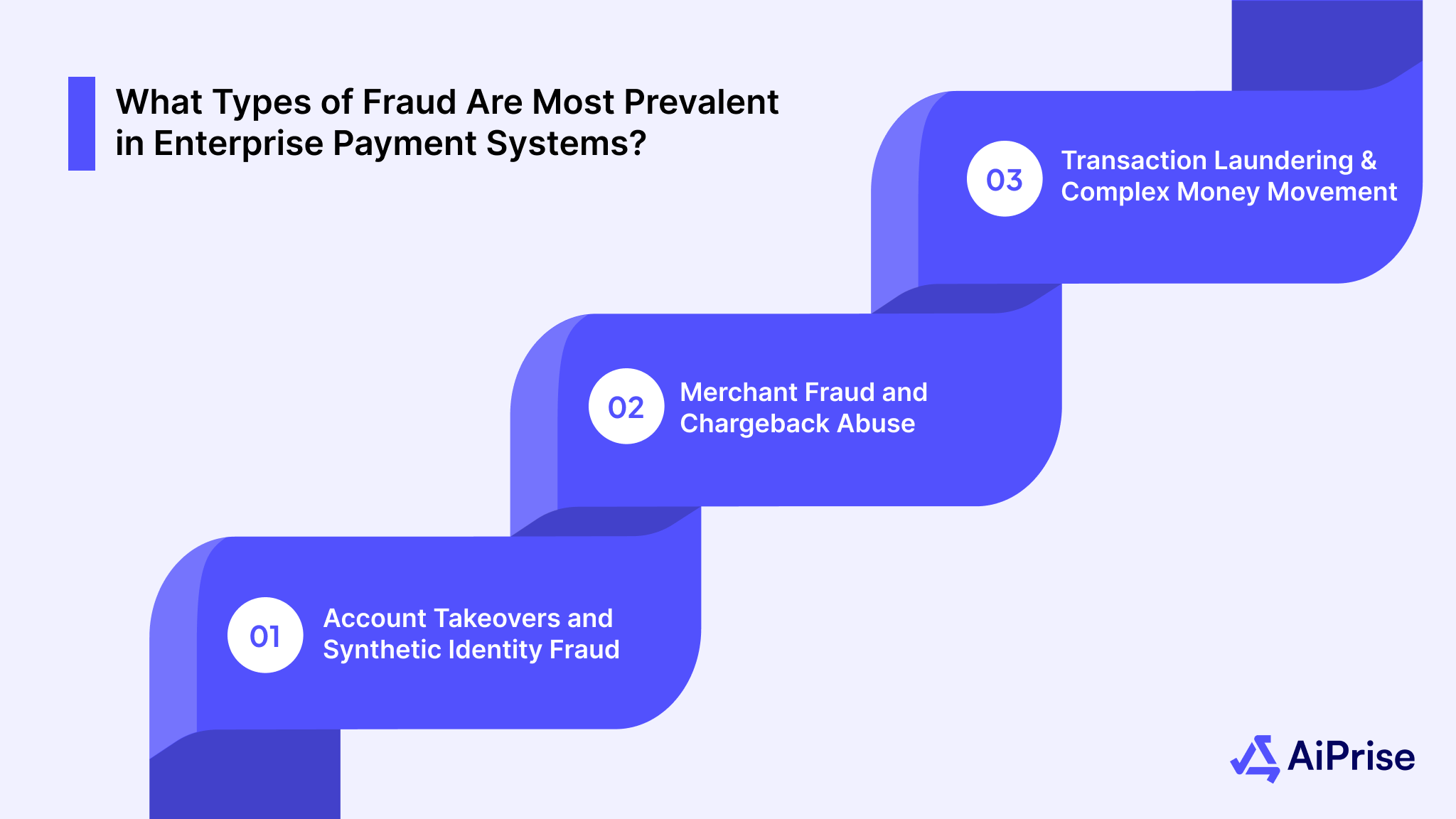

What Types of Fraud Are Most Prevalent in Enterprise Payment Systems?

Enterprise payment fraud in 2026 looks very different from what legacy risk frameworks were designed to catch. You are dealing with fraud that blends identity abuse, operational gaps, and transaction manipulation across multiple touchpoints. These attacks often sit quietly inside normal payment behavior, making them harder to flag without deeper context.

What makes this challenging for you is not just the financial loss, but the downstream impact on settlement confidence, partner trust, and audit exposure. Fraud today targets how enterprise payments are configured, approved, and reconciled, not just how they are authorized at checkout.

Below are the most common fraud types you need to watch closely in enterprise payment systems.

Account Takeovers and Synthetic Identity Fraud

Account takeovers and synthetic identity fraud hit enterprise payment systems at points that often look operational, not suspicious. Access is gained through compromised credentials, weak role controls, or partially verified identities that pass basic checks.

Once inside, fraud hides behind legitimate workflows like vendor updates, payout changes, or account reconfiguration. The real risk for your payment stack is delayed detection, where fraudulent activity blends into routine enterprise behavior until losses surface during reconciliation or audits.

Below are the key ways these fraud types show up in enterprise payment environments.

- Credential Abuse Through Operational Access: Stolen or shared credentials are used to access payment dashboards, merchant portals, or admin tools. Small changes like updating payout details or approval thresholds often go unnoticed until funds are already moved.

- Layered Synthetic Profiles Passing Initial Checks: Partial real and fabricated identity data is combined to create accounts that appear stable over time. These profiles build transaction history before triggering high-value payment actions.

- Privilege Escalation Inside Enterprise Workflows: Access rights are gradually expanded through internal approvals or misconfigured roles. Fraud then executes from trusted user paths rather than external entry points.

- Delayed Detection Due To Legitimate Behavior Signals: Transactions follow normal timing, amounts, and geographies. This makes traditional alerts ineffective and pushes discovery to post-payment reviews or chargeback analysis.

Merchant Fraud and Chargeback Abuse

Merchant fraud and chargeback abuse create risk in places that often look like growth or operational noise. New merchants, high-volume sellers, or fast-scaling platforms can mask risky behavior behind strong sales metrics. Payment flows continue to look healthy while disputes quietly accumulate.

For your enterprise payment stack, the danger lies in delayed visibility, where abuse impacts network standing, processing costs, and partner confidence before it is flagged as fraud.

Below are common patterns of merchant fraud and chargeback abuse you need to account for.

- Intentional Dispute Inflation To Recover Funds: Friendly fraud or planned chargebacks are used to reclaim funds after successful delivery. Disputes appear legitimate but follow repeatable patterns across customers or time periods.

- Merchant Onboarding With Misrepresented Business Models: Business details, fulfillment timelines, or product categories are altered during onboarding. Risk only surfaces once transaction behavior diverges from declared activity.

- Abuse of Refund and Return Workflows: Refunds are issued strategically to avoid scrutiny while maintaining processing volume. This distorts performance metrics and hides underlying fraud exposure.

- Network Threshold Manipulation To Avoid Monitoring: Transaction and dispute volumes are managed just below alert thresholds. This allows risky merchants to operate longer without triggering enforcement actions.

Are chargebacks rising and making it harder to separate real disputes from abuse during onboarding and monitoring? AiPrise reduces this risk using its AI-powered KYC solution, helping validate customer identity signals earlier so fewer bad actors enter your payment flow.

Transaction Laundering and Complex Money Movement

Transaction laundering and complex money movement rarely look fraudulent at first glance. Payments flow through approved accounts, licensed entities, and active merchants, making surface-level checks ineffective.

Risk builds when funds are intentionally routed across multiple entities, accounts, or regions to hide their true source or purpose. For your payment operations, this creates exposure that only becomes visible during regulatory reviews, partner audits, or delayed AML investigations.

Below are the most common ways transaction laundering shows up in enterprise payment systems.

- Hidden Payment Flows Behind Approved Merchants: Legitimate merchants process payments on behalf of undisclosed third parties. Settlement data appears clean while actual goods or services fall outside approved categories.

- Layered Transfers To Obscure Fund Origins: Payments are split, pooled, or rerouted across multiple accounts and time windows. This makes transaction tracing difficult once funds leave your direct processing layer.

- Cross-Entity Movement Within Corporate Structures: Related businesses move funds internally to mask exposure or bypass controls. On paper, transactions appear compliant while risk accumulates across the network.

- Geographic Routing To Avoid Regional Controls: Payments are intentionally passed through jurisdictions with lighter oversight. This increases compliance risk without triggering immediate transaction-level alerts.

Also read: Compliance in Business in Singapore: What’s Changing.

Recognizing the most common fraud types highlights the need for advanced, AI-driven strategies shaping fraud detection in 2026.

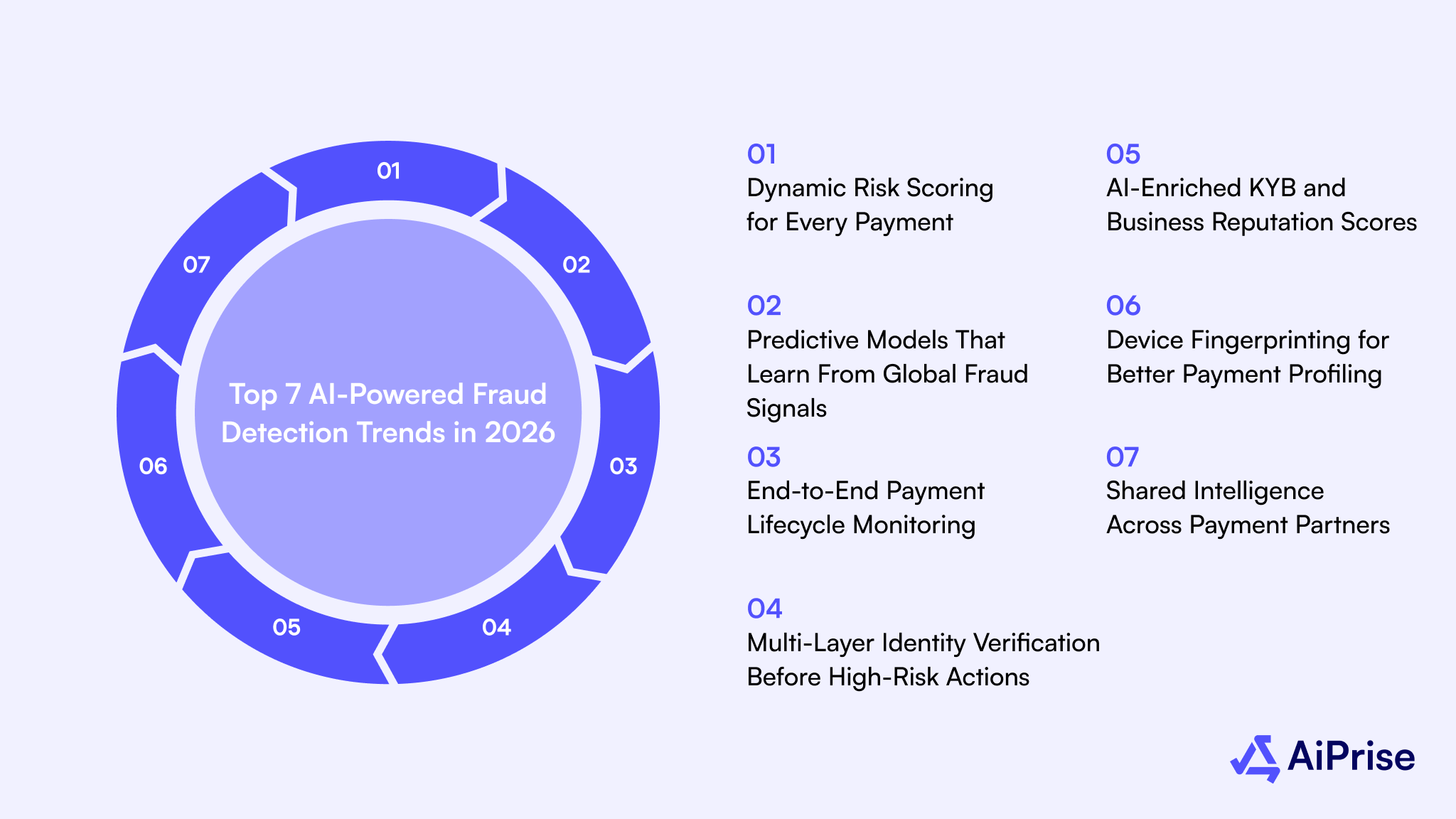

Top 7 AI-Powered Fraud Detection Trends in 2026

Fraud detection in 2026 is no longer about reacting to known threats. AI systems are being designed to anticipate risk before it materializes, using signals that extend beyond individual transactions.

Payment leaders are shifting toward models that understand context across users, businesses, devices, and networks in real time. This evolution matters because enterprise payment environments are becoming more modular, API-driven, and partner-dependent.

Below are the key AI-powered fraud detection trends shaping enterprise payment systems in 2026.

1. Dynamic Risk Scoring for Every Payment

Dynamic risk scoring in 2026 reflects how enterprise payments actually behave, not how they are expected to behave on paper. Risk is recalculated at each decision point based on live context rather than fixed assumptions.

Instead of treating risk as a one-time gate, scoring adapts continuously as signals evolve across the payment lifecycle.

Below are the core ways dynamic risk scoring improves payment fraud control.

- Contextual Scoring That Adjusts In Real Time: Risk levels update as new signals appear, such as changes in payment amount, beneficiary details, or approval paths. Decisions stay aligned with actual behavior, not initial intent.

- Granular Risk At The Transaction Level: Each payment is evaluated independently, even within the same account or merchant. This prevents one clean transaction from masking risk in another.

- Adaptive Thresholds Based On Business Profiles: Risk tolerance flexes depending on transaction type, customer segment, or corridor. High-value enterprise payouts receive tighter scrutiny than routine operational payments.

- Actionable Scores That Trigger Proportionate Controls: Scores directly map to actions like step-up verification, delayed settlement, or escalation. This reduces unnecessary friction while maintaining control where it matters most.

2. Predictive Models That Learn From Global Fraud Signals

Predictive fraud models in 2026 operate beyond your internal data boundaries. Risk intelligence now comes from aggregated patterns observed across regions, industries, and payment types. This allows potential threats to be identified before they surface in your own environment.

For enterprise payment systems handling diverse corridors and clients, early awareness becomes a decisive advantage.

Below are the key ways global signal learning strengthens fraud prevention.

- Early Detection Of Emerging Fraud Tactics: New attack methods are recognized based on similar behavior seen elsewhere. Controls can be adjusted before those tactics reach your specific payment flows.

- Cross-Regional Risk Awareness: Patterns identified in one geography inform risk decisions in another. This is critical when launching new corridors or expanding payment coverage.

- Reduced Reliance On Historical Loss Data: Risk decisions no longer depend solely on past incidents within your system. This limits blind spots when fraud evolves faster than internal learning cycles.

- Smarter Risk Prioritization Across Payment Types: Predictive insights help focus attention on transactions most likely to escalate. Resources are allocated based on forward-looking risk, not past damage.

3. End-to-End Payment Lifecycle Monitoring

End-to-end payment lifecycle monitoring focuses on how risk accumulates over time, not just at a single approval moment. Enterprise payments move through initiation, validation, approval, settlement, and reconciliation, often across teams and systems.

Risk can surface at any of these stages, especially when changes occur after initial authorization. Continuous visibility helps you catch subtle shifts that indicate misuse, policy drift, or hidden manipulation before funds fully exit your control.

Below are the key ways lifecycle monitoring strengthens fraud detection.

- Visibility Across Pre and Post-Authorization Events: Payment behavior is tracked from setup to settlement. Changes made after approval, such as beneficiary updates, are evaluated for added risk.

- Detection of Risk Introduced by Process Changes: Modifications to workflows, approvers, or timing patterns are monitored. Unexpected deviations trigger closer scrutiny without halting normal operations.

- Correlation Across Systems And Teams: Signals from finance, compliance, and operations are analyzed together. This reveals a risk that remains invisible when data sits in silos.

- Faster Root Cause Analysis When Issues Arise: Complete payment histories allow quicker investigation. This reduces resolution time and supports clearer internal and external reporting.

4. Multi-Layer Identity Verification Before High-Risk Actions

Multi-layer identity verification in 2026 is applied selectively, not universally. Instead of verifying everyone all the time, controls activate only when payment behavior crosses predefined risk thresholds.

This approach protects sensitive actions without slowing routine operations. High-risk moments like changing beneficiary details, approving large payouts, or modifying access rights receive deeper scrutiny because that is where financial and compliance exposure concentrates.

Below are the ways multi-layer verification strengthens control before critical payment actions.

- Risk-Based Verification Triggers: Additional checks activate only when behavior deviates from established patterns. This keeps everyday payment activity smooth while protecting sensitive actions.

- Layered Identity Signals Beyond Login Credentials: Verification combines identity data, device context, and behavioral cues. Stolen credentials alone are not enough to complete high-impact actions.

- Stronger Controls Around Payment Configuration Changes: Updates to payout accounts, limits, or approval flows require reinforced verification. This prevents silent manipulation inside trusted accounts.

- Reduced Internal and External Fraud Exposure: Both compromised users and malicious insiders face higher friction at critical points. This limits damage without relying on constant manual oversight.

5. AI-Enriched KYB and Business Reputation Scores

AI-enriched KYB and business reputation scoring in 2026 extends far beyond static onboarding checks. Business risk evolves as ownership changes, transaction behavior shifts, or counterparties expand into new markets. Relying on point-in-time KYB leaves gaps that surface too late.

Below are the key ways AI-enriched KYB improves enterprise payment risk control.

- Continuous Business Risk Re-Evaluation: Business profiles update as new data emerges. Changes in behavior, structure, or counterparties influence risk scores over time.

- Contextual Scoring Linked To Payment Activity: Reputation scores adjust based on how payments are used, not just who the business claims to be. This reveals risk tied to actual behavior.

- Early Warning Signals For Emerging Business Risk: Subtle shifts appear before losses occur. This allows proactive controls rather than reactive enforcement.

- Smarter Decisions For Enterprise Client Management: Risk insights support informed actions like tiered limits or additional checks. This maintains strong partnerships while managing exposure.

6. Device Fingerprinting for Better Payment Profiling

Device fingerprinting in 2026 plays a critical role in understanding how payment activity truly originates. Enterprise payment environments often involve shared accounts, multiple approvers, and third-party access, which makes user identity alone insufficient.

Device-level context helps distinguish normal operational access from risky behavior patterns. When device signals change unexpectedly, risk becomes visible even if credentials and roles appear valid.

Below are the key ways device fingerprinting strengthens payment profiling.

- Detection of Unfamiliar Access Patterns: New or altered devices accessing payment systems raise early alerts. This helps catch misuse before high-risk actions are completed.

- Consistency Checks Across Sessions and Actions: Device behavior is tracked across login, approval, and payout events. Inconsistencies reveal hidden risk without disrupting normal workflows.

- Improved Attribution in Shared Enterprise Environments: Device signals help differentiate legitimate users within shared accounts. This supports clearer investigations and accountability.

- Stronger Defense Against Credential-Based Abuse: Stolen credentials lose effectiveness when the device context does not align. This reduces exposure without adding friction to compliant users.

7. Shared Intelligence Across Payment Partners

Shared intelligence across payment partners changes how risk is detected in complex ecosystems. Enterprise payments rarely operate in isolation, as banks, PSPs, gateways, and platforms all touch the same flow. When fraud signals stay siloed, exposure multiplies.

Coordinated intelligence allows you to spot risk earlier by learning from activity observed elsewhere in the network. This collective awareness becomes essential as payment chains grow longer and more interconnected.

Below are the key benefits of shared intelligence in enterprise payment fraud detection.

- Earlier Risk Visibility Across The Payment Chain: Signals from upstream or downstream partners reveal threats before they reach critical stages. This reduces reaction time and limits loss.

- Improved Trust Between Payment Ecosystem Participants: Shared insights create aligned expectations around risk. Partners can act with confidence instead of relying on incomplete information.

- Reduced Duplication of Fraud Investigations: Common intelligence prevents repeated analysis of the same threat. Teams focus on response rather than rediscovery.

- Stronger Defense Against Coordinated Fraud Networks: Patterns spanning multiple platforms become visible. This helps disrupt organized fraud that exploits gaps between partners.

These emerging AI-powered trends set the stage for understanding how artificial intelligence is already reshaping the fraud detection scene in 2026.

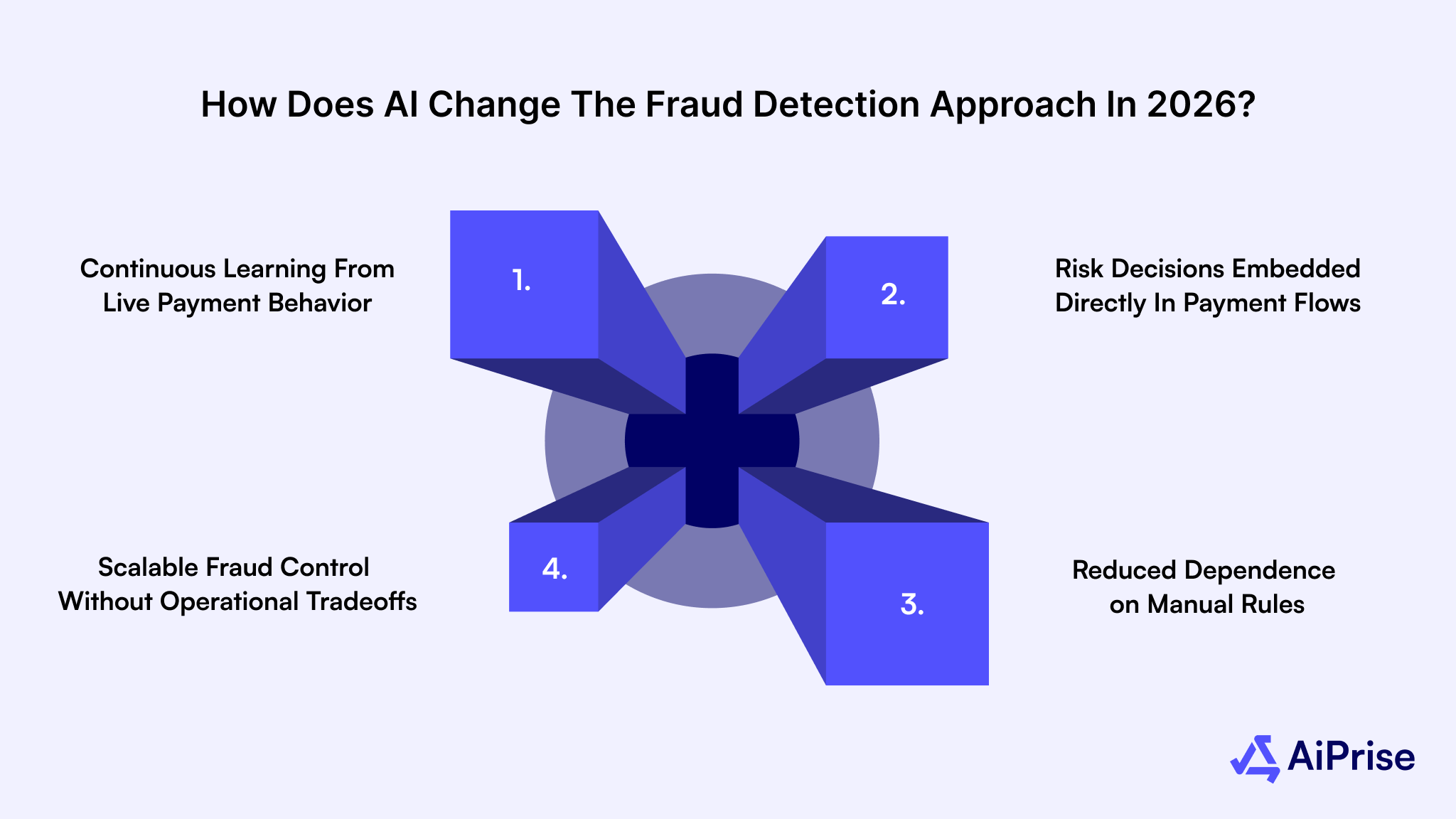

How does AI change the fraud detection approach in 2026?

AI changes fraud detection by shifting control from reactive monitoring to proactive decision-making. Instead of flagging issues after damage occurs, systems now anticipate risk while payments are still in motion.

This is critical when transaction volumes spike unpredictably or when enterprise clients demand uninterrupted processing.

Below are the core ways AI reshapes enterprise fraud detection in 2026.

- Continuous Learning From Live Payment Behavior: Models adapt as behavior changes across accounts and workflows. This keeps controls aligned with how your systems are actually used.

- Risk Decisions Embedded Directly In Payment Flows: Fraud checks operate within transaction paths, not after settlement. This limits downstream remediation and financial exposure.

- Reduced Dependence on Manual Rules and Reviews: AI replaces static thresholds with adaptive logic. This lowers alert fatigue and allows teams to focus on high-impact cases.

- Scalable Fraud Control Without Operational Tradeoffs: Risk evaluation grows with payment volume. Performance remains stable even during peak processing periods.

As AI transforms fraud detection practices in 2026, the next focus is on identifying the specific techniques that deliver the greatest impact in preventing payment fraud.

Which AI Techniques Deliver the Highest Impact for Payment Fraud Prevention?

Not all AI techniques deliver the same value in enterprise payment environments. Impact depends on how well models interpret context, scale across systems, and support defensible decisions.

Techniques that work in consumer payments often fail when applied to complex approval flows, shared access, and cross-entity transactions. High-impact AI methods are those that surface hidden relationships, interpret unstructured signals, and adapt without constant retraining as payment behavior evolves.

Below are the AI techniques that drive the strongest fraud prevention outcomes for enterprise payments.

- Machine Learning For Rapid Anomaly Detection: Models identify subtle deviations from normal payment behavior. This helps surface risk that does not violate predefined rules.

- Natural Language Processing For Data Validation: Unstructured data from documents, descriptions, and communications is analyzed for inconsistencies. This strengthens verification beyond structured fields.

- Graph Analytics For Network-Level Risk Detection: Relationships between accounts, entities, and transactions are mapped. This reveals coordinated activity that isolated checks miss.

While high-impact AI techniques strengthen payment fraud prevention, enterprises must also address the practical challenges of implementing these tools effectively.

What Challenges Do Enterprises Face When Implementing AI Fraud Tools?

Implementing AI fraud tools is rarely blocked by technology alone. Most challenges surface where systems, teams, and accountability intersect. Enterprise payment environments carry legacy infrastructure, strict oversight, and multiple stakeholders, all of which complicate adoption.

Without clear fixes, AI initiatives stall, deliver limited impact, or introduce new risk. Below are the most common challenges enterprises face.

- Fragmented Data Across Payment Systems: Risk signals sit in separate tools, making models incomplete.

Fix: Fix this by unifying transaction, identity, and operational data before applying AI. - Lack of Clear Ownership for Fraud Decisions: Teams hesitate to trust automated outcomes.

Fix: Define decision boundaries so AI handles routine cases while humans oversee exceptions. - Integration Gaps With Existing Payment Infrastructure: Legacy systems resist real-time inputs.

Fix: Use modular APIs to layer AI without rebuilding core payment rails. - Concerns Around Explainability And Accountability: Black-box decisions create audit anxiety.

Fix: Choose models that produce interpretable risk signals and decision rationales.

Addressing implementation challenges enables enterprises to more effectively evaluate and select AI-powered payment fraud solutions.

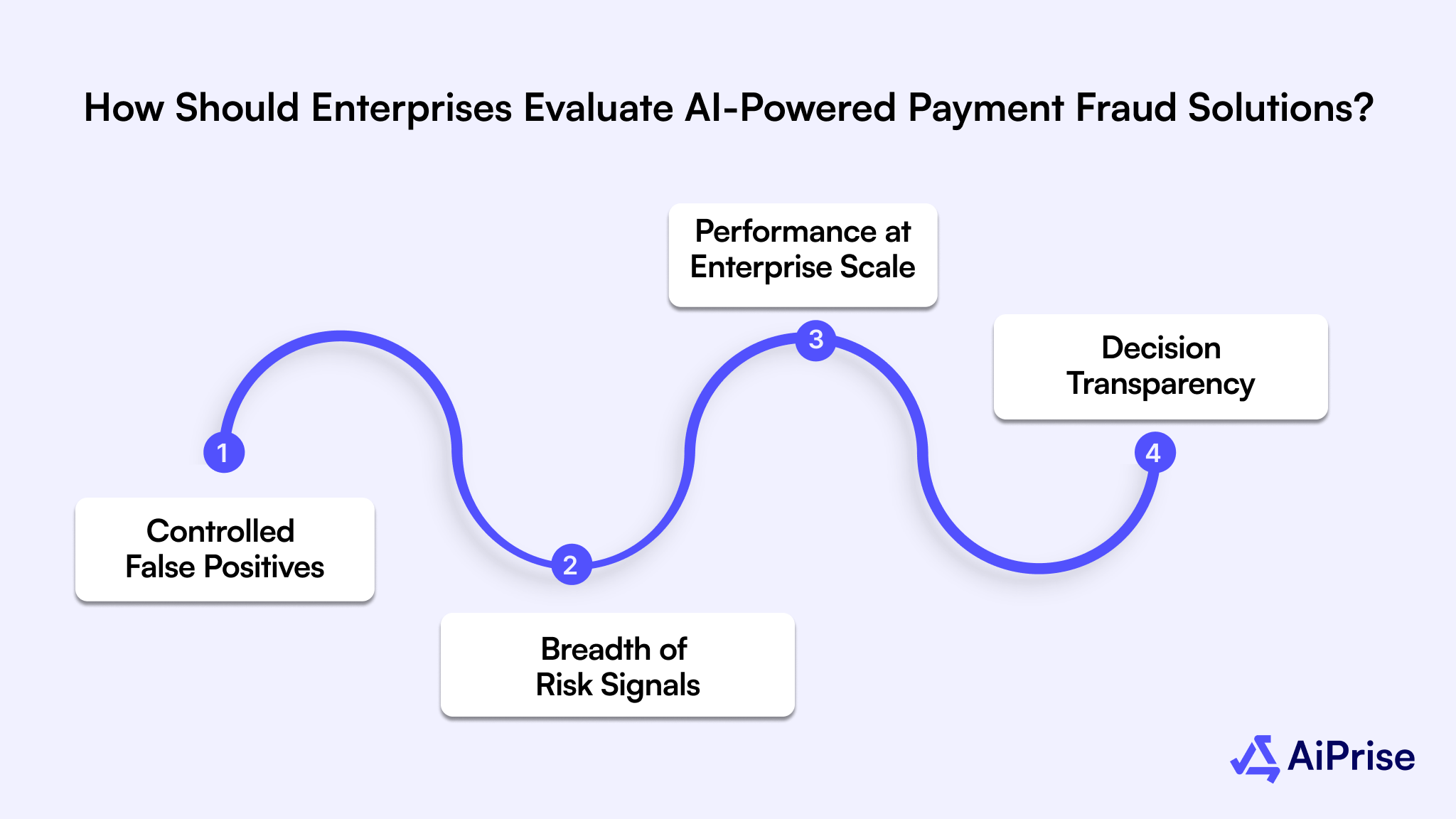

How Should Enterprises Evaluate AI-Powered Payment Fraud Solutions?

Evaluating AI fraud solutions requires looking beyond feature lists and model claims. What matters is how well a platform fits your payment architecture, risk appetite, and regulatory exposure.

Enterprise payments demand consistency, traceability, and scale, not experimental accuracy gains that break under pressure. The right solution should strengthen decision quality while simplifying operations, not introduce new dependencies or blind spots.

Below are the key criteria to use when assessing AI-powered payment fraud solutions.

- Accuracy with Controlled False Positives: Risk detection must reduce fraud without blocking legitimate payments. Balanced outcomes protect revenue and partner relationships.

- Depth and Breadth of Risk Signals: Solutions should analyze identity, business, device, and transaction context together. Narrow inputs limit effectiveness.

- Performance at Enterprise Scale: Models must handle peak volumes without latency. Payment speed and reliability cannot be compromised.

- Auditability and Decision Transparency: Every decision should be explainable. Clear reasoning supports audits, disputes, and regulatory reviews.

Are you struggling to assess transaction risk consistently across identity, device, and payment signals? AiPrise addresses this using AI-driven fraud risk scoring, enabling real-time risk evaluation as payments move through enterprise systems.

A thorough evaluation of AI-powered fraud solutions naturally leads to the key features enterprise payment leaders now expect from modern detection tools.

Features Enterprise Payment Leaders Expect in Modern Fraud Detection Tools

Modern fraud detection tools are expected to operate as part of your payment infrastructure, not as external checkpoints. Enterprise leaders prioritize solutions that reduce operational friction while strengthening risk control across teams and systems.

Tools must support fast decision-making, clear accountability, and seamless collaboration between risk, compliance, and operations. Feature depth matters, but alignment with real enterprise workflows matters more.

Below are the core features enterprise payment leaders expect from modern fraud detection platforms.

- Real-Time Risk Assessment Across Multiple Signals: Fraud detection should evaluate identity, behavior, and transaction context together. This ensures decisions reflect full payment reality.

- Automated Case Management For Faster Resolution: Alerts should flow into structured workflows. This reduces investigation time and improves response consistency.

- Unified Views Across Risk And Compliance Data: Risk, AML, and verification insights must connect in one place. This supports informed decisions and easier audits.

- Scalable APIs for Rapid Integration: Deployment should not require heavy system changes. Flexible APIs allow faster rollout across payment channels.

- Built-In Support For Cross-Border Payments: Tools must adapt to regional differences. This helps manage global exposure without duplicating controls.

Also read: KYC and AML in France: How Identity Verification Works.

These essential features set the benchmark for solutions like AiPrise, which help payment enterprises detect and respond to fraud faster.

How Is AiPrise Helping Payment Enterprises Detect Fraud Faster?

Payment enterprises need fraud controls that move at the same speed as money, without adding friction or operational drag. The challenge is not only detecting fraud, but doing it early enough to prevent loss, audit issues, or partner impact.

This is where execution matters more than theory. The way systems ingest data, score risk, and trigger action determines whether fraud is stopped in motion or discovered after settlement.

Below is how AiPrise supports faster and more reliable fraud detection across enterprise payment environments.

- AI-Based KYC and KYB for Instant Identity Validation: Identity and business verification are completed in real time using AIPrise to validate individuals and entities before payments, payouts, or access changes occur. This reduces exposure during onboarding and high-risk actions.

- Unified Risk Coverage Across KYC, KYB, AML, and Fraud: Risk signals from identity checks, business verification, AML Screening, and fraud detection are analyzed together, allowing AiPrise to surface correlated risk instead of isolated alerts.

- Comprehensive AML Screening Across Global Databases: Sanctions, watchlists, and adverse media are continuously screened, so payment activity is assessed against current regulatory risk, not outdated snapshots.

- Automated Verification Workflows That Lower Review Costs: Manual reviews are replaced with configurable workflows where AiPrise automates low-risk decisions and escalates only what truly needs human attention.

- Risk Signals From Hundreds Of Global And Local Sources: Business, identity, and transaction data are enriched using broad intelligence coverage, helping AiPrise detect risk patterns that internal data alone cannot reveal.

- Built For High-Volume Payment Providers And PSPs: APIs and infrastructure are designed to scale with transaction growth, allowing AiPrise to operate seamlessly within fast-moving enterprise payment stacks without latency.

Together, these capabilities demonstrate AiPrise’s impact, leading to a clear conclusion on the future of faster, smarter enterprise fraud detection.

Conclusion

AI-powered fraud detection has become a foundational requirement for enterprise payment systems, not a differentiator. As payment flows grow more complex, risk control must operate continuously, adapt to changing behavior, and remain defensible under regulatory scrutiny.

AiPrise brings these capabilities together by unifying KYC, KYB, AML, and fraud risk management into a single, scalable platform built for modern payment environments. With real-time intelligence, automated decisioning, and global data coverage, AiPrise enables payment enterprises to detect risk earlier and act with confidence.

To see how this works in practice, Book A Demo and explore how AiPrise can help your payment operations move faster while staying secure.

FAQs

1. How does AI fraud detection differ from rule-based fraud systems in payments?

AI fraud detection adapts to behavior changes using data patterns, while rule-based systems rely on fixed conditions. This means AI can detect new and evolving fraud tactics without constant manual updates. For enterprise payments, this results in better accuracy, fewer blind spots, and reduced operational effort.

2. Can AI-powered fraud detection reduce false declines in enterprise payments?

Yes. AI evaluates transactions using context like behavior history, device signals, and payment intent. This helps distinguish risky activity from legitimate transactions more accurately. As a result, fewer valid payments are blocked, improving authorization rates, merchant satisfaction, and overall payment flow efficiency.

3. Is AI fraud detection suitable for both B2B and B2C payment models?

AI fraud detection works well for both models because it adapts to different payment behaviors. In B2B, it handles complex approvals and high-value transactions. In B2C, it scales across volume and speed. The same models adjust risk logic based on transaction context.

4. How long does it take to implement AI fraud detection in enterprise payment systems?

Implementation time depends on system complexity, but modern API-based platforms reduce deployment timelines significantly. Many enterprises can integrate AI fraud detection within weeks by layering it onto existing payment infrastructure without disrupting core processing or settlement workflows.

5. What data sources are required for effective AI fraud detection in payments?

Effective AI fraud detection combines transaction data, identity information, business profiles, device signals, and behavioral patterns. Adding external intelligence, like sanctions lists and adverse media, improves accuracy. Broader data coverage allows AI models to assess risk with stronger context and fewer gaps.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

.png)

.png)

.png)

.png)

.png)