AiPrise

10 min read

November 25, 2025

AML Case Management Workflow: Process, Tools and Best Practices

Key Takeaways

As financial crimes grow more sophisticated, anti-money laundering (AML) compliance has become a top priority for financial institutions, payment processors, and fintech platforms. But keeping up with evolving threats and regulatory demands requires more than just alert generation; it demands a structured and efficient response system.

That’s where AML case management workflow comes in. It connects the dots between detection, investigation, and resolution. Without a well-defined workflow, compliance teams often face delays, duplicated efforts, and inconsistent decisions.

In this blog, we break down what AML case management really involves, how workflows improve efficiency, and what to look for in a system that supports speed, accuracy, and compliance — all while reducing operational fatigue.

Key Takeaways

- A well-defined AML management workflow reduces manual workload, improves risk analysis, and ensures faster case resolution.

- With 95% false positives and billions spent on inefficient reviews, optimizing workflows is critical to improving AML outcomes.

- Key stages include alert generation, case creation, data enrichment, risk scoring, investigation, SAR filing, and case closure.

- Real-world use cases show how institutions like digital banks, crypto platforms, and fintech lenders apply workflows to uncover deeper financial crime patterns.

- AML case management differs from general case tools in its risk-driven design, audit-readiness, and regulatory alignment.

What is AML Case Management?

AML (Anti-Money Laundering) case management refers to the systematic process financial institutions use to investigate and handle suspicious financial activities that may indicate money laundering, terrorist financing, or other financial crimes. It encompasses the entire lifecycle of investigating potential financial crime, which includes initial alert generation through final disposition and regulatory reporting.

An effective AML workflow ensures that each case is thoroughly investigated, properly documented, and reported according to regulatory requirements. Beyond compliance, it provides valuable insights and data analysis that help institutions strengthen their overall AML programs and protect the integrity of the financial system.

The Scale of the Challenge

The numbers tell a sobering story about the current state of AML compliance:

- The global AML case management market reached $2.04 billion in 2023 and is projected to grow at a 12.6% CAGR, reaching an estimated $5.91 billion by 2032.

- False positive rates in traditional AML systems average 95%, meaning the vast majority of alerts generated turn out to be legitimate transactions.

- Global AML compliance costs exceed $274 billion annually, with much of this spent handling low-quality alerts rather than investigating genuine threats.

- Only 1% of illicit financial flows are successfully detected by current systems, highlighting massive room for improvement.

These statistics underscore why optimizing your AML case management workflow isn't just about compliance but about operational efficiency, cost management, and actually stopping financial crime.

Suggested read: Understanding Customer Screening for AML Compliance

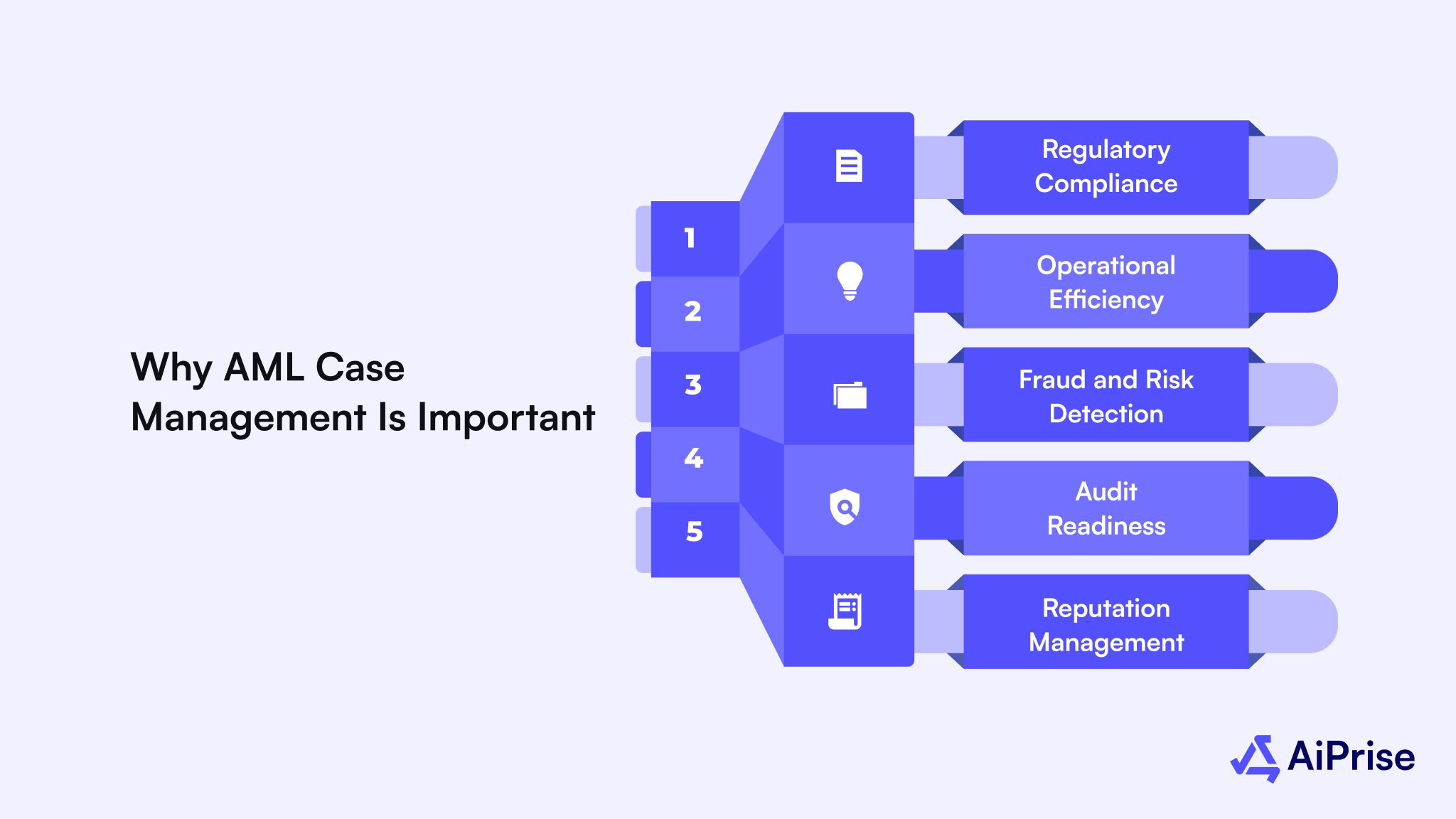

Why AML Case Management Is Important

AML management plays a critical role in preventing financial crime, protecting institutional reputation, and meeting regulatory obligations. Without a structured case-handling process, financial institutions risk both non-compliance and undetected criminal activity.

Here’s why AML case management matters:

- Regulatory Compliance

Authorities like FATF, FinCEN, and the EU mandate strict AML protocols. Poor case management can result in missed suspicious activity reports (SARs), leading to hefty fines and sanctions.

- Operational Efficiency

An organized AML case management workflow ensures analysts spend less time on repetitive tasks and more time on high-risk cases. It reduces manual work, limits investigation delays, and improves productivity.

- Fraud and Risk Detection

Effective case tracking helps detect hidden patterns, linked accounts, or recurring fraud attempts — especially when KYC, transaction, and behavioral data are unified.

- Audit Readiness

Every case decision must be documented and justifiable. A centralized system with clear workflows ensures all actions are traceable for internal audits or regulatory inspections.

- Reputation Management

Failing to report or act on suspicious activity damages trust. Strong AML workflows help institutions prove their commitment to compliance and ethical operations.

In a high-stakes compliance environment, a robust AML case is a business necessity you can't ignore. And to ensure everything goes right, all you need is a trusted partner like Aiprise.

What Is an AML Case Management Workflow?

An AML case management workflow is the defined sequence of steps a financial institution follows to investigate and resolve alerts related to suspicious transactions or users. It turns complex compliance tasks into a structured, repeatable process while ensuring no critical step is missed.

A well-designed workflow helps compliance teams manage large volumes of alerts efficiently, prioritize high-risk cases, and ensure timely reporting when necessary.

What does an AML case management workflow include?

- Triggering an Alert: An anomaly or rule breach in transaction monitoring, sanctions screening, or behavioral analysis initiates the process.

- Creating the Case: An alert becomes a case, complete with assigned ownership, risk rating, and investigation deadlines.

- Collecting Data: The system pulls KYC profiles, transaction histories, communications, and related account data into one unified case file.

- Investigation and Review: Analysts examine the case using workflow-defined steps with decisions logged and documented at each stage.

- Decision Making: Based on evidence, the case is either closed, escalated, or reported (e.g., through a Suspicious Activity Report).

- Audit Logging and Closure: All activities are logged for compliance, and the case is archived with its outcome recorded.

Workflows may be manual in legacy systems or fully automated in modern platforms. The more structured and intelligent the workflow, the faster and more consistent the investigations.

Also read: Top 8 Compliance Automation Software for Faster Onboarding in 2025

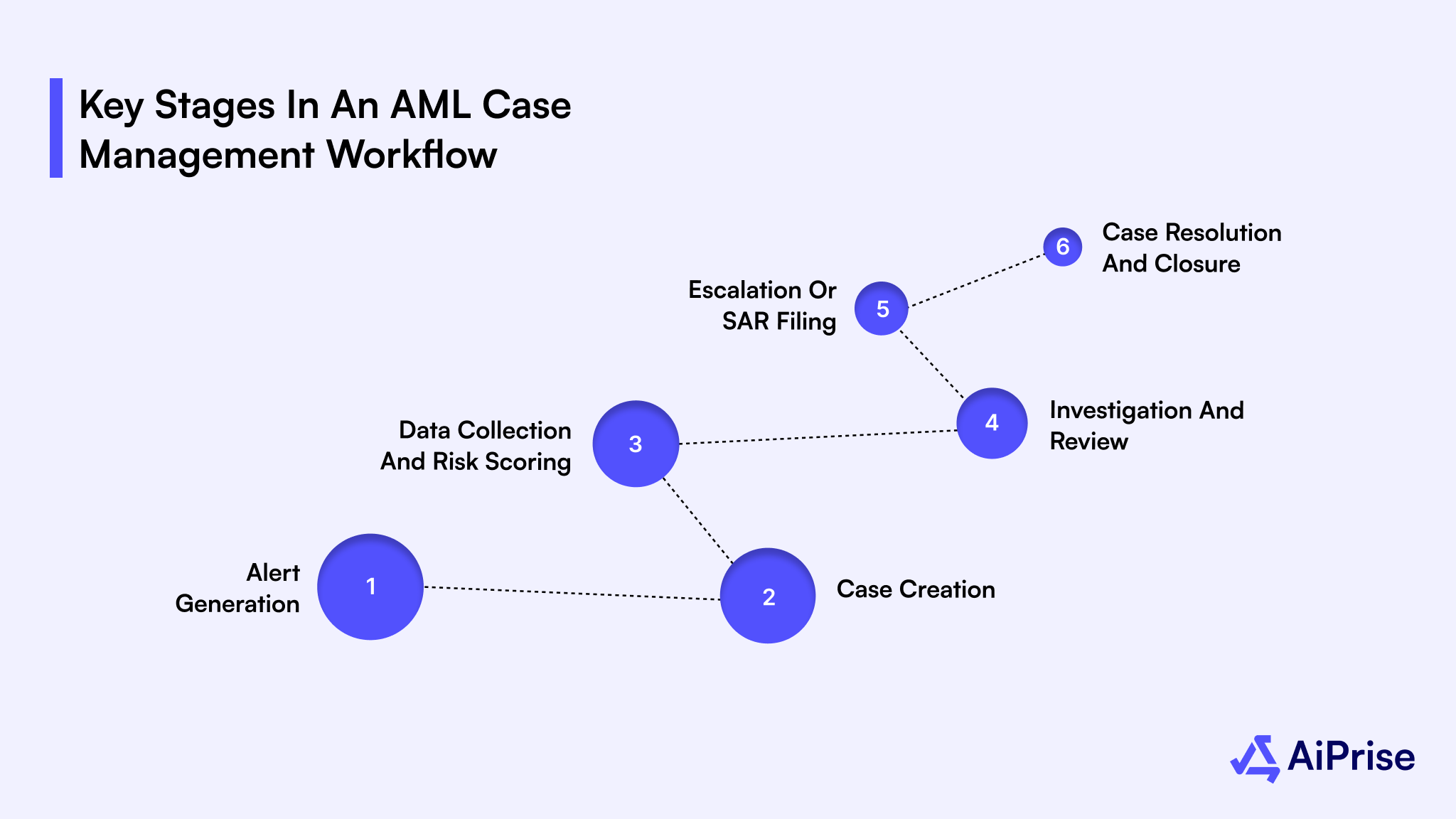

Key Stages in an AML Case Management Workflow

An effective AML workflow is built around clear, repeatable steps. These stages ensure that alerts are handled consistently, risks are properly assessed, and decisions are well-documented.

Step 1. Alert Generation

Monitoring systems trigger alerts based on unusual transaction patterns, sanctions hits, or behavioral red flags.

Step 2. Case Creation

Each alert is converted into a case, assigned to an analyst, and tagged with relevant metadata — such as risk level, priority, and source.

Step 3. Data Collection and Risk Scoring

The system pulls in data from KYC, transaction logs, and external sources to provide full context. Risk scoring helps prioritize cases based on severity.

Step 4. Investigation and Review

Compliance analysts review the case, flag suspicious elements, and determine whether escalation is required. This step may include communication with internal departments or third parties.

Step 5. Escalation or SAR Filing

If suspicious activity is confirmed, the case is escalated, and a Suspicious Activity Report (SAR) may be filed with the relevant authority.

Step 6. Case Resolution and Closure

Once the investigation is complete and action is taken, the case is closed. All steps are documented, and the outcome is archived for future reference or audits.

Understanding the stages is important, but seeing how AML case management works in real-world scenarios brings the concept to life. Let’s explore a few practical use cases and how AML workflows are tailored to different industries.

Suggested read: Using Automation in Case Management System

Use Cases: How AML Case Management Works in Practice

To understand the value of AML case management, it helps to see how it's applied across different industries and risk contexts.

1. Digital-First Banks

An unusually high volume of international fund transfers from a newly opened account triggers an alert. The system auto-generates a case, assigns it to a senior analyst, and aggregates transaction histories and KYC data. The investigation reveals a pattern matching known layering techniques, prompting escalation and a SAR filing.

2. Crypto Trading Platforms

A flagged wallet address initiates a case after being linked to high-risk jurisdictions and elevated transaction velocity. With enriched data from blockchain analytics and sanctions lists, the analyst identifies exposure to a darknet marketplace and locks the account while notifying authorities.

3. BNPL and Fintech Lenders

A user profile is flagged for inconsistencies between declared income and transaction behavior. The automated workflow initiates a case, pulls identity verification data, and triggers a manual review. The investigation reveals synthetic identity indicators and links to a broader fraud ring.

4. Cross-Border Payment Providers

An alert from the transaction monitoring system detects a customer funneling small transfers across multiple countries. The case management platform connects this behavior to prior alerts from related users, enabling case linking. A SAR is filed citing potential structuring.

While these use cases highlight how AML workflows function in real-world settings, it’s equally important to understand how they differ from general case management systems used in other industries.

AML Case Management vs General Case Management

Not all case management systems are created equal. Here’s how AML case management differs from general-purpose case tools:

This comparison highlights why a dedicated AML solution is necessary. But how do you select the one that supports compliance-specific needs, secure data handling, and complex investigative workflows?

How to Choose the Right AML Case Management System

Not all AML case management tools are built the same. To handle increasing alert volumes and meet evolving regulatory demands, your system must be scalable, intelligent, and flexible enough to match your internal processes.

Here are the key factors to consider:

1. Scalability and Performance

The system should be able to handle thousands of alerts and users without delays. As your customer base grows, so should your ability to manage risk efficiently.

2. Customizable Workflows

Look for platforms that let you define rules, escalation paths, case statuses, and user roles. Every institution has unique compliance policies — your system should adapt to them, not the other way around.

3. Data Integration

Your AML system must integrate with KYC platforms, transaction monitoring tools, sanction screening systems, and external databases. A unified view prevents silos and improves decision-making.

4. Role-Based Access and Case Assignment

To maintain accountability and confidentiality, the system should support role-based permissions and smart case routing based on expertise, region, or risk.

5. Real-Time Reporting and Dashboards

Compliance teams need access to performance metrics, open cases, investigation timelines, and SAR submissions — all in real-time, with filtering and export options.

6. Audit Trails and Documentation

Every action in the case lifecycle should be logged and timestamped. A strong audit trail is essential for internal reviews and external inspections.

7. Regulatory Alignment

The system should support SAR/STR filing formats and be updated regularly to align with evolving FATF, FinCEN, or EU AML directives.

A reliable AML case management system doesn’t just reduce risk, it enables your team to act faster, more confidently, and with full transparency.

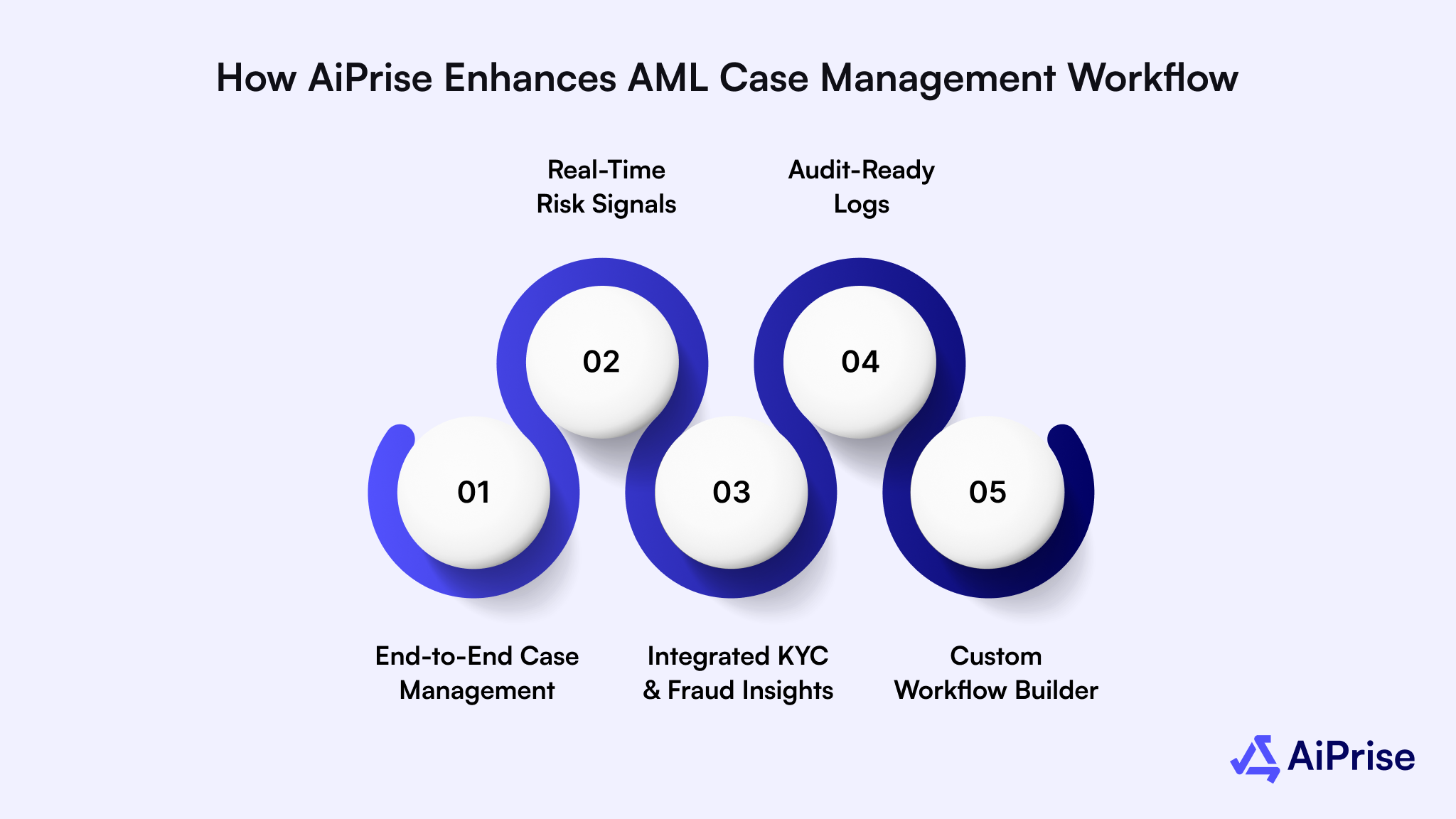

How AiPrise Enhances AML Case Management Workflow

AiPrise helps organizations manage and optimize their AML case management workflow by combining automation, real-time data, and flexible investigation tools.

Here’s what AiPrise offers:

- End-to-End Case Management

Manages the entire case lifecycle, from alert generation to SAR filing, in one unified platform. Teams can assign cases, track progress, and maintain full oversight.

- Real-Time Risk Signals

Integrates with global sanctions lists, PEP databases, and adverse media sources to provide instant alerts and enriched investigation context.

- Integrated KYC and Fraud Insights

Links all KYC records, biometric checks, and fraud signals to the case, giving teams a complete, real-time view for better decision-making.

- Audit-Ready Logs

Captures every action and document with time-stamped logs. Includes built-in SAR templates to simplify reporting and ensure compliance.

- Custom Workflow Builder

Allows compliance teams to define workflows tailored to internal policies, including custom stages, escalation paths, and risk thresholds.

With AiPrise, compliance teams gain full control over their AML case management process, improving accuracy, response time, and audit readiness.

Conclusion

Managing financial crime risk requires a structured, end-to-end AML case management workflow that supports speed, accuracy, and regulatory compliance.

From structured workflows and real-time alerts to integrated KYC and audit-ready reporting, a strong case management process helps compliance teams stay ahead of risk and maintain operational efficiency.

Whether you’re scaling your compliance team or upgrading outdated tools, choosing the right system makes all the difference.

Book a Demo with AiPrise to see how our intelligent AML case management platform can help streamline investigations, reduce manual workload, and strengthen your compliance outcomes.

Frequently Asked Questions(FAQs)

Q1. What is AML case management?

AML case management refers to the systematic process that financial institutions use to monitor, detect, investigate, and report suspicious transactions or activities that may indicate money laundering, terrorist financing, or other financial crimes.

Q2. What is an AML case management workflow?

An AML case management workflow is the defined sequence of steps a financial institution follows to investigate and resolve alerts related to suspicious activity. It turns complex compliance tasks into a structured, repeatable process — ensuring consistent handling of cases.

Q3. How do you manage an AML investigation?

Managing an AML investigation involves collecting and analysing relevant data (KYC, transactions, external sources), reviewing alerts, assigning ownership, making a decision (close, escalate, report), and documenting every step for audit purposes.

Q4. What is an example of an AML case management system in compliance?

An example is a platform that centralises alerts, case data, KYC profiles, and routing logic into one interface, allowing the compliance team to handle the entire workflow from alert to closure while maintaining audit logs and regulatory reporting capabilities.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

.png)

.png)

.png)

.png)

.png)