AiPrise

14 min read

December 18, 2025

Top 10 Financial Compliance Challenges Businesses Face in 2026

Key Takeaways

Financial compliance is getting harder every year as rules grow stricter and financial crime increases. In 2023, global AML and KYC fines reached about $669 billion, which shows how expensive compliance gaps can be. Reports also show that more than 69% of companies are now spending more on compliance than before, and smaller businesses feel the pressure even more.

These rising challenges can lead to penalties, loss of trust, slower operations, and major financial losses.

This blog explains the top financial compliance challenges businesses face today and shares practical solutions that can help improve compliance in 2026.

Key Takeaways

- Compliance risk is growing: Rapidly changing regulations and complex frameworks increase the chances of breaches.

- Data and process gaps matter: Inconsistent record-keeping, outdated systems, and poor data quality amplify compliance risks.

- Human error is costly: Manual processes, lack of training, and high workloads lead to oversight and mistakes.

- Technology helps: Automation, AI-driven monitoring, and integrated reporting can reduce violations and streamline compliance.

- Proactive strategies win: Businesses that anticipate regulatory changes and strengthen internal controls maintain trust and avoid penalties.

To fully address challenges, it’s important to first understand what financial compliance is.

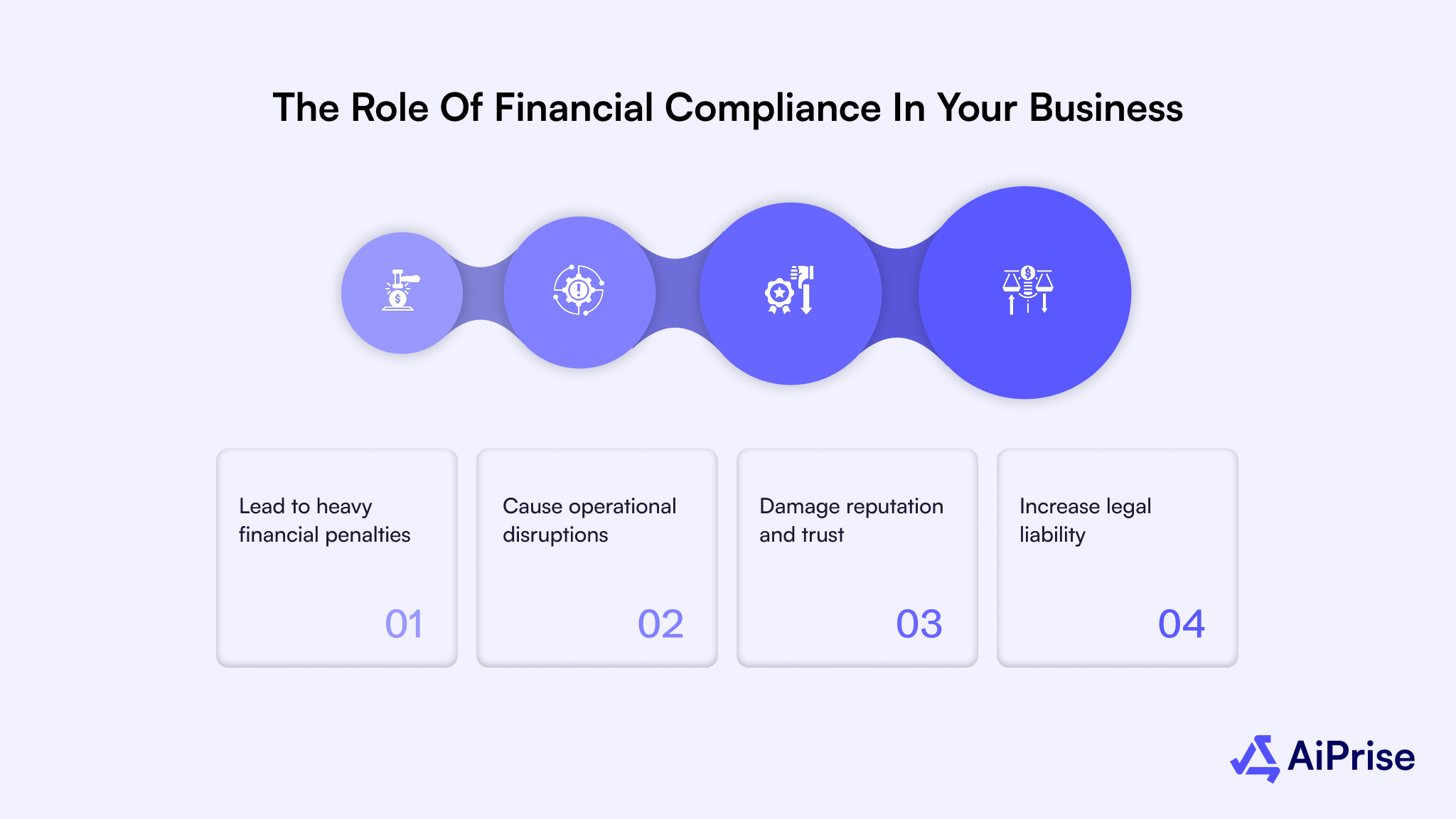

The Role of Financial Compliance in Your Business

Financial compliance refers to how well a business follows the laws, regulations, and internal policies that govern its financial activities. This includes areas such as AML requirements, anti-bribery rules, tax reporting obligations, data protection standards, and risk-management practices.

When these obligations are not met, compliance failures occur, leading to penalties, disrupted operations, and long-term business risks.

Financial compliance failures have a serious impact on organizations. They can:

- Lead to heavy financial penalties: Regulators impose substantial fines for KYC and AML breaches, inaccurate reporting, or tax-related violations. For many businesses, these penalties can quickly escalate into millions.

- Cause operational disruptions: Investigations, audits, and remediation activities slow down processes, divert internal resources, and interrupt normal business workflows.

- Damage reputation and trust: Publicized failures reduce confidence among customers, partners, and investors, making it harder to maintain strong business relationships.

- Increase legal liability: Non-compliance may result in civil or criminal actions against the organization or its leadership, depending on the severity of the violation.

When businesses address compliance gaps early, they reduce exposure to regulatory risks, maintain smoother operations, and build a stronger foundation for sustainable growth.

This is where AiPrise simplifies financial compliance. With a single platform, you can monitor regulations, detect risks, and ensure end-to-end compliance globally, all in real time. Tackle your financial compliance challenges effortlessly with AiPrise.

With the importance of financial compliance established, it’s essential to look at the specific laws and regulations that govern fintech operations.

Major Financial Compliance Regulations Every Fintech Must Follow

Fintech businesses operate under strict regulatory oversight. To function responsibly and avoid legal exposure, they must comply with multiple financial, data security, and consumer protection regulations. These rules are designed to reduce financial crime, protect user data, and ensure fair practices across the financial ecosystem.

Some of the key laws fintech firms must adhere to include:

- Bank Secrecy Act (BSA): Requires fintech firms and financial institutions to maintain records and report suspicious activities to support the prevention of financial crime.

- Know Your Customer (KYC): Obligates companies to verify customer identities to reduce fraud, identity misuse, and illegal transactions.

- Anti-Money Laundering (AML) Regulations: Set requirements for customer due diligence, transaction monitoring, and reporting to detect and prevent money laundering activities.

- Gramm-Leach-Bliley Act (GLBA): Governs how consumer financial data is collected, stored, and protected, while ensuring transparency through privacy disclosures.

- Dodd-Frank Wall Street Reform Act: Introduces broad financial oversight measures, including consumer protection rules enforced by the Consumer Financial Protection Bureau (CFPB).

- PCI DSS: Establishes security standards for organizations handling card payments to ensure safe and reliable transaction processing.

- General Data Protection Regulation (GDPR): Applies to companies operating in or serving the EU, focusing on data privacy, user rights, and secure data handling.

- Consumer Financial Protection Act: Promotes fair treatment, transparency, and accountability in financial services to safeguard consumers.

- Securities Exchange Act of 1934: Regulates securities markets and enforces reporting and disclosure requirements to maintain market integrity.

- Electronic Fund Transfer Act (EFTA): Defines the rights, responsibilities, and protections related to electronic and digital fund transfers.

Non-compliance with these regulations can lead to fines, investigations, and reputational damage. By addressing compliance requirements early, fintech firms can reduce regulatory risk, protect customers, and maintain operational stability.

To understand why compliance challenges arise and how organizations can overcome them effectively, let’s break down the most common causes and practical solutions.

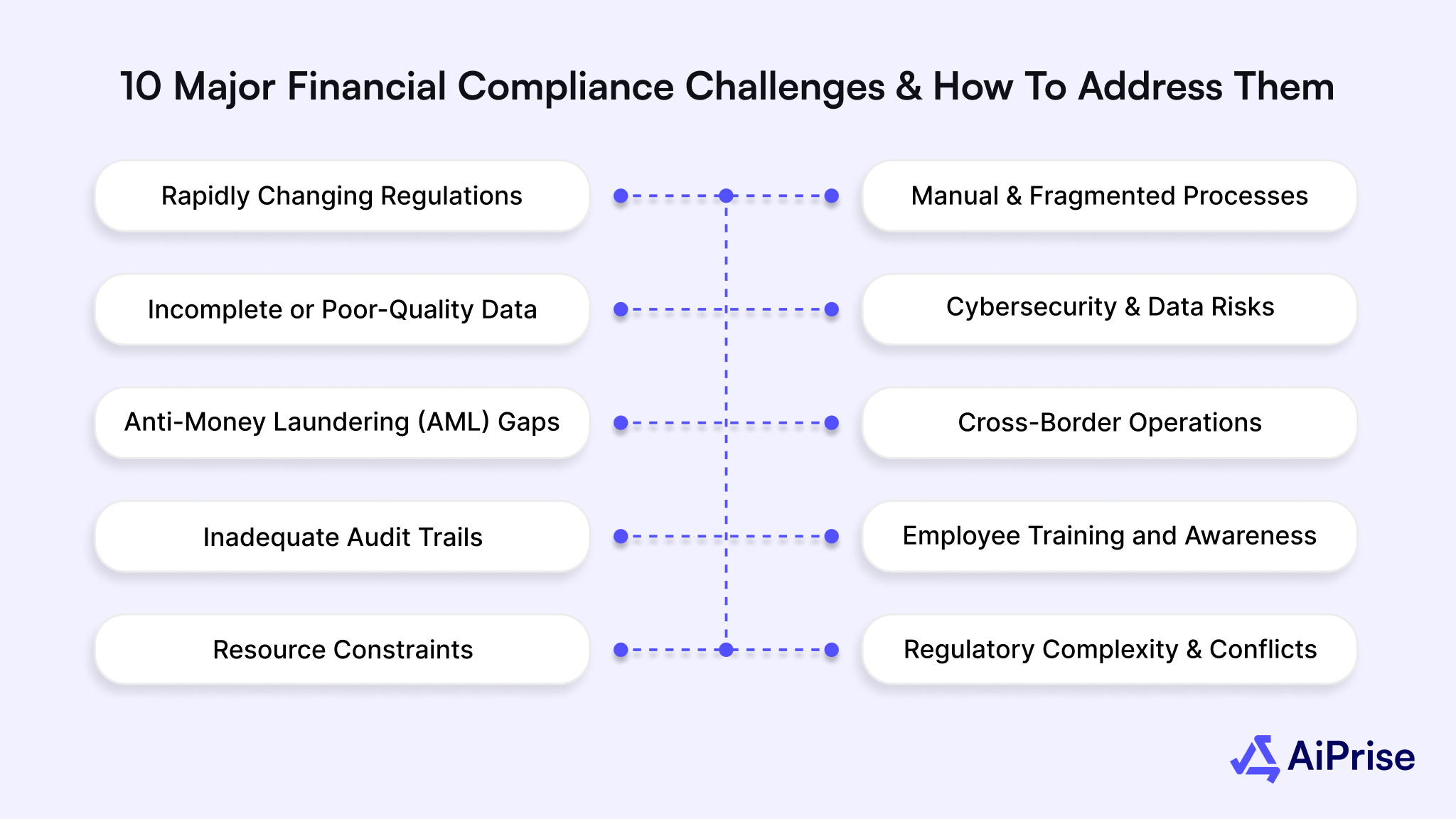

10 Major Financial Compliance Challenges and How to Address Them

As financial rules become stricter and fraud tactics more sophisticated, businesses face growing pressure to stay compliant. Small mistakes or outdated processes can lead to hefty fines, damaged reputation, and operational disruptions. Understanding the most common compliance hurdles can help organizations act before problems escalate.

Below, we break down the key financial compliance challenges and offer practical solutions that businesses can implement

1. Rapidly Changing Regulations

Regulations are changing faster than ever, and businesses often struggle to keep up. For example, in 2024, the EU introduced updated AML rules requiring stricter checks on beneficial owners.

The US added new reporting standards under the Corporate Transparency Act. Missing updates like these can create compliance gaps, increase risk, and result in fines.

What Makes It More Challenging:

- Regulators release updates quickly and often with limited guidance, leaving teams unsure how to implement them correctly.

- Smaller teams may not have enough staff to review every rule change, causing delays.

- Manual SOPs and slow internal communication can prevent the timely adoption of new standards across departments.

How to Fix This Effectively:

- Use regulatory intelligence platforms that track global updates, such as changes in EU AML directives or US sanctions lists, and provide clear summaries.

- Assign a compliance lead to review these updates and update internal processes regularly.

- Set up automated alerts in workflow tools to notify teams immediately when rules change, like new transaction reporting thresholds in a specific region.

2. Manual and Fragmented Processes

Many organizations still rely on spreadsheets, paper records, and siloed workflows for compliance tasks. For example, a company handling cross-border transactions may track KYC (Know Your Customer) documents in separate folders for each region. At the same time, another team manages AML reporting in a different system.

These manual and fragmented processes make compliance slow, error-prone, and hard to audit.

What Makes It More Challenging:

- Human errors, such as entering incorrect customer details or missing transaction thresholds, increase the risk of inaccurate reporting.

- Slow approval or review cycles create bottlenecks, delaying transaction clearances or compliance sign-offs.

- Siloed teams often duplicate work or miss updates, leading to inconsistencies and regulatory gaps.

How to Fix This Effectively:

- Automate reporting, data entry, and validation workflows to reduce mistakes and speed up processes.

- Centralize all compliance documentation in a single platform so teams can access the same records and updates in real time.

- Train staff to use digital compliance tools consistently, ensuring efficiency and minimizing manual errors.

3. Incomplete or Poor-Quality Data

Incorrect or missing financial data can create major compliance problems. For example, if a company submits reports to regulators with missing transaction details or outdated customer information, it may trigger audits or fines.

Poor-quality data also makes risk assessments unreliable, leaving organizations exposed to financial crime or operational mistakes.

What Makes It More Challenging:

- Businesses often pull data from multiple systems that don’t communicate well, leading to duplication or inconsistencies.

- Large volumes of transactions and customer records make it hard to maintain accuracy without automation.

- Time-sensitive reporting deadlines leave little room to manually validate every entry.

How to Fix This Effectively:

- Implement real-time data validation and automated quality checks to flag errors before submission.

- Use structured digital forms with mandatory fields to ensure all critical information is collected upfront.

- Integrate data from different sources into a single, unified system to provide a complete and reliable view for compliance and risk assessments.

4. Cybersecurity and Data Protection Risks

Sensitive financial and personal data is a prime target for cyberattacks, and weak controls can create serious compliance issues.

For example, in 2023, a major financial services firm in the US faced a $250 million fine under GDPR and CCPA after failing to protect customer data during a breach. Incidents like this highlight how cybersecurity failures directly translate into regulatory penalties and reputational damage.

What Makes It More Challenging:

- Violations of GDPR, CCPA, or other data protection laws can result in significant fines and legal action.

- Breaches erode stakeholder trust, causing customers and partners to lose confidence in the organization.

- Remote work, cloud storage, and multiple digital platforms increase the risk of data leaks if security measures are inconsistent.

How to Fix This Effectively:

- Implement strong access controls, multi-factor authentication, and encryption for sensitive data.

- Conduct regular security audits and penetration tests to identify and fix vulnerabilities before they are exploited.

- Train staff on data protection best practices, including phishing awareness and safe handling of customer information.

5. Anti-Money Laundering (AML) Gaps

AML compliance is complex, and missing suspicious activity can have serious consequences. For example, JP Morgan was fined over €400 million for failing to detect layered transactions used to launder money.

Gaps like these not only lead to fines but also damage reputation and trigger regulatory audits.

What Makes It More Challenging:

- Fraudulent transactions can be subtle, such as small, structured payments designed to avoid detection, and may go unnoticed by manual monitoring.

- Reporting delays or errors, like incomplete suspicious activity reports, can trigger additional regulatory scrutiny.

- High-risk clients, including politically exposed persons (PEPs) or customers in high-risk jurisdictions, require extra diligence that manual processes often miss.

How to Fix This Effectively:

- Use AI-based transaction monitoring systems to detect anomalies in real time, such as unusual transaction patterns or sudden changes in behavior.

- Conduct enhanced due diligence (EDD) for high-risk clients, verifying source of funds, beneficial ownership, and transaction intent.

- Maintain automated and auditable reporting workflows to ensure timely and accurate submission of suspicious activity reports to regulators.

6. Cross-Border Operations

Operating in multiple countries adds compliance complexity because each region has its own rules and standards. For example, a company processing payments in both India and the UK must follow RBI KYC guidelines while also complying with the UK’s Money Laundering Regulations.

Missing or misinterpreting local requirements can lead to fines, delayed transactions, and operational bottlenecks.

What Makes It More Challenging:

- Rapid changes in regional regulations make it difficult to keep policies aligned across all jurisdictions.

- Small teams may struggle to monitor rules in every country where the business operates.

- Decentralized reporting and manual tracking can hide gaps until they become compliance breaches.

How to Fix This Effectively:

- Implement global compliance platforms that automatically adapt to regional rules and provide guidance on local requirements.

- Regularly review local regulations and adjust policies to match changes in each market.

- Use centralized dashboards to monitor multi-country compliance metrics, track risk exposure, and ensure no jurisdiction is overlooked.

7. Inadequate Audit Trails

Incomplete documentation and poor record-keeping can create major compliance risks. For example, in 2023, several financial firms in the US faced penalties because transaction logs and client verification records were missing or inconsistent during AML inspections.

Without clear audit trails, it becomes difficult to prove adherence to regulatory requirements.

What Makes It More Challenging:

- Missing or incomplete logs make it hard to demonstrate compliance during regulatory reviews.

- Manual or paper-based records are prone to human error, misplacement, or tampering.

- In organizations with multiple departments, inconsistent record-keeping can lead to gaps and delays in reporting.

How to Fix This Effectively:

- Store all documents digitally with timestamps, version control, and secure access to ensure a complete record of all activities.

- Automate audit logging to track who accessed sensitive data and what changes were made.

- Conduct regular internal audits to verify records are complete and compliant with current regulations, such as KYC and AML standards.

Also read: AI-Powered KYB Solutions for Streamlined Business Verification

8. Employee Training and Awareness

A lack of staff knowledge about compliance rules can result in accidental breaches. For example, a mid-sized payments firm faced penalties after employees processed high-risk transactions without following updated AML checks because they were unaware of the proper procedures.

In many organizations, frequent staff turnover leads to a loss of institutional knowledge, which increases the chance of errors.

What Makes It More Challenging:

- Mistakes often occur when teams do not fully understand policies or how to apply them in real situations.

- High employee turnover reduces continuity and means critical compliance knowledge is lost when staff leave.

- Without ongoing education, even experienced employees can fall behind on updated regulations.

How to Fix This Effectively:

- Run mandatory compliance training programs that cover real-world scenarios, such as handling high-risk clients or reporting suspicious transactions.

- Provide easily accessible guides, checklists, and real-time support for employees to reference during daily operations.

- Update training modules regularly to reflect new rules, like revised KYC requirements or updated sanctions lists, so staff stay current and confident in compliance practices.

9. Resource Constraints

Many organizations face limited teams or tight budgets, making it difficult to implement comprehensive compliance programs. For example, a small fintech startup may only have two compliance staff, while handling hundreds of transactions daily, increasing the chances of missed alerts or delayed reporting.

Similarly, mid-sized companies may lack the budget to invest in advanced monitoring tools required for multi-jurisdiction compliance.

What Makes It More Challenging:

- Delays in monitoring or reporting can increase regulatory and operational risks.

- Manual processes dominate day-to-day compliance tasks, leading to inefficiencies and human errors.

- Limited internal expertise can make it hard to respond to complex AML, KYC, or tax requirements effectively.

How to Fix This Effectively:

- Prioritize high-risk areas, such as high-value transactions or cross-border operations, when allocating resources.

- Use automation and SaaS compliance tools to scale monitoring, reporting, and verification without expanding teams.

- Outsource specialized compliance tasks, like transaction screening or regulatory reporting, when internal expertise or capacity is insufficient.

10. Regulatory Complexity and Conflicts

Compliance becomes more difficult when rules vary across regions or sectors. For example, a company operating in both the US and the EU may face conflicting AML requirements, while financial reporting standards in India differ from those in Canada.

Misunderstanding these differences can lead to compliance breaches, fines, and operational delays.

What Makes It More Challenging:

- Businesses may unintentionally violate overlapping or contradictory regulations when a single process cannot satisfy multiple jurisdictions.

- Confusion over which rules to follow slows decision-making and increases operational risk.

- Teams without clear guidance struggle to interpret conflicting requirements, leading to inconsistent implementation across departments.

How to Fix This Effectively:

- Use centralized compliance management software to map and reconcile rules from different regions or sectors.

- Maintain clear SOPs with jurisdiction-specific instructions to guide teams in following the right procedures.

- Conduct scenario testing to anticipate potential conflicts, such as differing transaction reporting thresholds or KYC requirements, before they impact operations.

AiPrise’s financial compliance platform combines AI-driven transaction monitoring, automated reporting, and real-time risk scoring to deliver fast, accurate compliance checks.

Its intelligent system reduces manual work by up to 90% while keeping your business fully compliant.

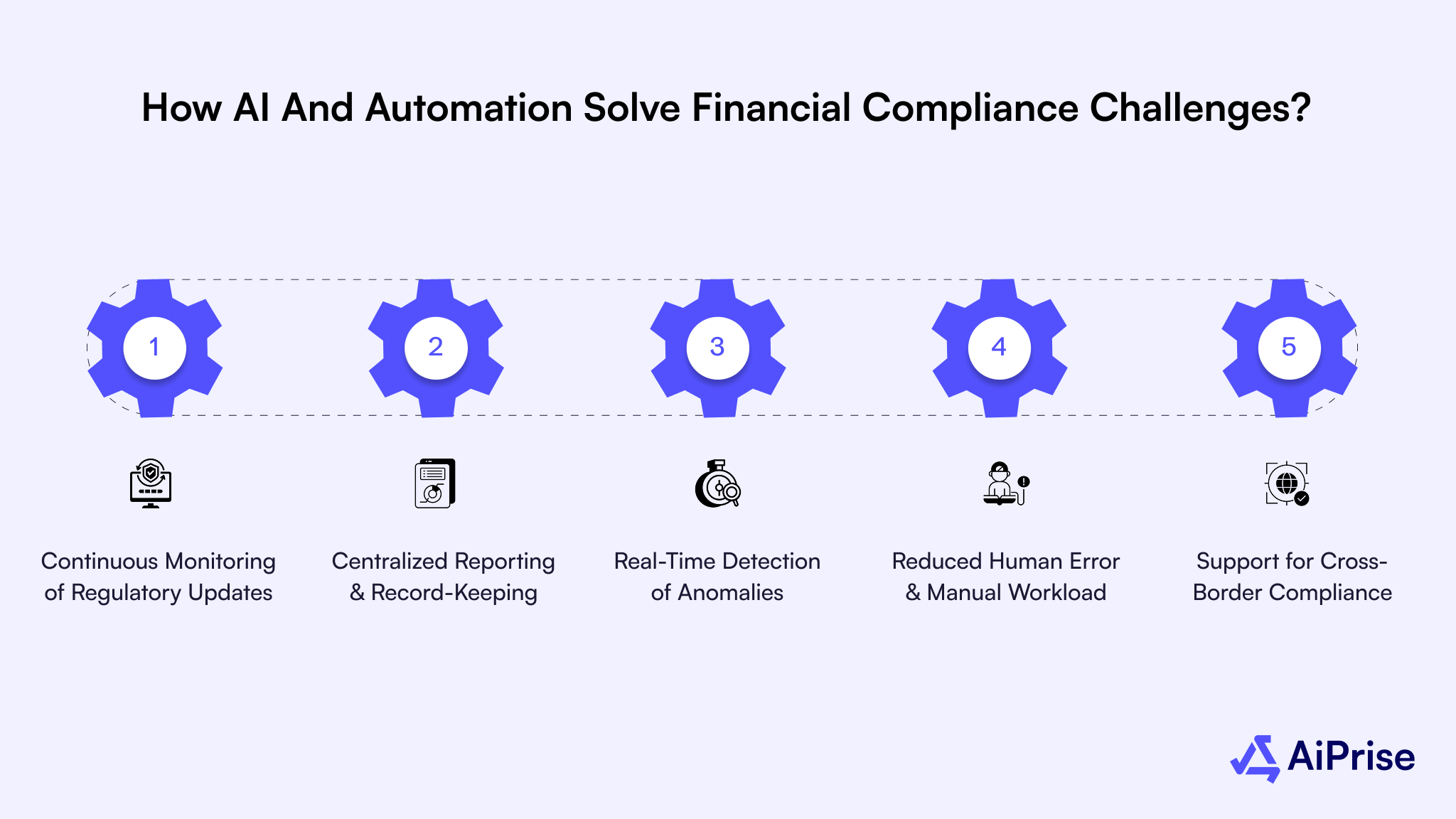

How AI and Automation Solve Financial Compliance Challenges?

AI-driven compliance systems play a crucial role in reducing financial compliance failures. When organizations rely heavily on manual checks, they face higher risks of missed alerts, reporting delays, regulatory breaches, and operational inefficiencies.

AI and automation simplify compliance workflows in several impactful ways:

1. Continuous Monitoring of Regulatory Updates

AI systems track global regulatory changes in real time, helping organizations stay aligned with new rules. Missing these updates is a common reason for compliance gaps and outdated internal policies.

2. Centralized Reporting & Record-Keeping

Automation consolidates documentation, audit trails, and compliance logs into a unified system. Poor record maintenance remains one of the biggest contributors to regulatory penalties and failed audits.

3. Real-Time Detection of Anomalies

Machine learning models flag suspicious patterns, unusual transactions, and potential violations instantly. Without automated detection, businesses often discover compliance issues late after the risk has escalated.

4. Reduced Human Error & Manual Workload

Automation eliminates repetitive tasks such as data entry, verification checks, and routine reporting. Manual processes increase the risk of errors, incomplete reviews, and inconsistent compliance outcomes.

5. Support for Cross-Border Compliance

AI-powered platforms include region-specific rules for multiple jurisdictions. This helps organizations meet local AML, KYC, tax, and reporting requirements when operating internationally, an area where manual oversight frequently falls short.

Using automated compliance tools such as AiPrise allows teams to detect issues earlier, maintain accurate records, and manage complex regulatory expectations with greater consistency.

Also Read: How Banks Utilize Machine Learning For Fraud Detection

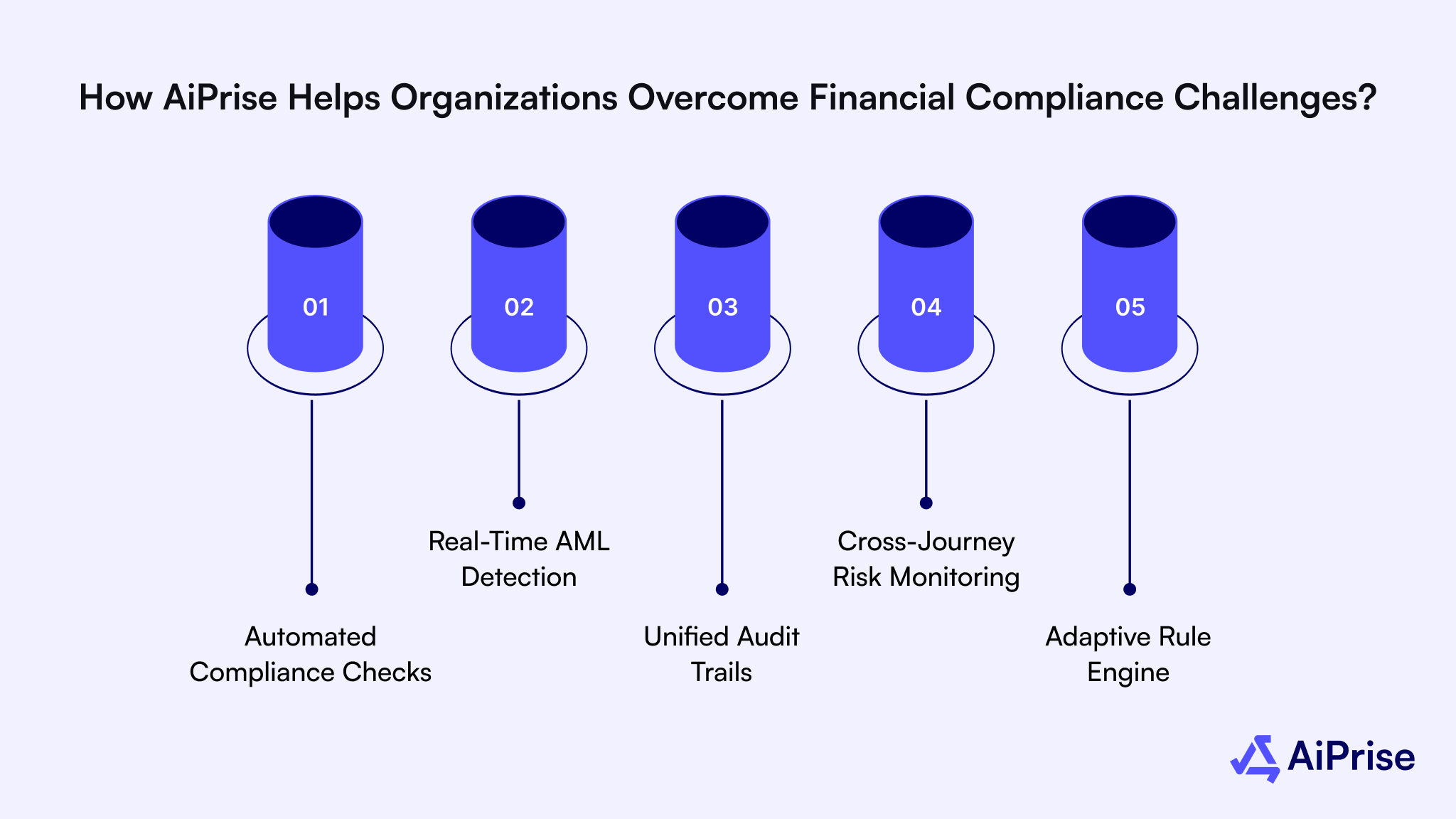

How AiPrise Helps Organizations Overcome Financial Compliance Challenges?

AiPrise brings identity verification, behavioral intelligence, and real-time risk monitoring into one orchestration layer, helping organizations stay compliant, reduce exposure to regulatory penalties, and prevent fraudulent activity at every stage of the customer journey.

With automated checks and adaptive controls, AiPrise removes complexity from financial compliance without creating friction for genuine users.

With AiPrise, you can:

- Automated Compliance Checks: Run continuous KYC, AML, sanctions, PEP, and adverse media screenings using 100+ global data sources to meet evolving regulatory standards.

- Real-Time AML Detection: Identify suspicious transactions, unusual patterns, and high-risk behaviors instantly using AI-driven risk scoring.

- Unified Audit Trails: Maintain detailed logs of every identity verification, transaction, and compliance decision, helping you meet reporting obligations with ease.

- Cross-Journey Risk Monitoring: Track risk signals across onboarding account activity, payments, and user interactions to catch compliance breaches before they escalate.

- Adaptive Rule Engine: Build custom compliance rules, automate reviews, and align workflows with internal policies and global regulatory requirements without engineering support.

AiPrise delivers accuracy, transparency, and end-to-end control, helping you address compliance gaps, reduce manual workload, and stay ahead of regulatory expectations.

Wrapping Up

Financial compliance isn’t just a requirement; it’s what protects your business, customers, and operations in a fast-changing regulatory environment. When managed well, it prevents penalties, stops risks early, strengthens security, and maintains trust. But as the challenges of financial compliance grow, you need smarter systems to stay ahead.

Modern platforms with automation, AI-driven monitoring, and real-time reporting help you cut manual work, improve accuracy, and respond to regulatory changes without slowing down operations.

If you're ready to reduce risk and simplify compliance across your workflows, the right technology can make it happen.

Book A Demo to see how AI-powered compliance solutions can transform your processes.

FAQs

1. What are the biggest financial compliance challenges?

The main financial compliance challenges include rapidly changing regulations, manual processes, poor-quality data, and cybersecurity risks that can lead to errors, delays, or penalties.

2. How does automation help improve compliance?

Automation minimizes manual mistakes, speeds up reporting, and continuously monitors transactions to identify suspicious or risky activity before it escalates.

3. Why is cross-border compliance so difficult?

Different countries have varying rules and standards, which can conflict and make it hard for businesses to maintain consistent compliance across multiple jurisdictions.

4. Can AI help prevent compliance failures?

Yes, AI detects unusual patterns, monitors regulatory updates in real time, and flags potential violations, helping businesses stay compliant efficiently.

5. How can businesses improve employee compliance awareness?

Regular training programs, clear guidelines, and scenario-based exercises ensure staff understand regulations and follow proper compliance procedures consistently.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

Speed Up Your Compliance by 10x

Automate your compliance processes with AiPrise and focus on growing your business.