AiPrise

12 min read

October 14, 2025

A Guide to Crypto Cleansing and Money Laundering

Key Takeaways

Crypto cleansing and money laundering have become urgent concerns for businesses as digital assets increase in popularity.

In 2024 alone, $51 billion flowed to illicit crypto wallets, with $40 billion laundered using mixers, bridges, and decentralized exchanges, marking a 23% rise from the previous year.

Criminals exploit the anonymity of blockchain to conceal illicit funds, posing significant threats to compliance, reputation, and substantial regulatory fines. For companies and financial institutions, understanding these risks is crucial to prevent exposure and implement AML controls.

This blog discusses how crypto cleansing works, explores the latest data-backed trends in money laundering, and details steps businesses can take to protect assets and reputation, keeping your operations secure in the digital world.

Key Takeaways:

- Crypto cleansing is essential for businesses to mitigate risks associated with illicit crypto funds, thereby protecting transactions and their reputation.

- Advanced AI-powered identity verification and continuous wallet monitoring are critical to detect and prevent money laundering in real time.

- Privacy coins, chain hopping, and mixers complicate laundering detection, making sophisticated analytics and compliance workflows necessary.

- Real-world cases highlight how robust crypto cleansing disrupts laundering schemes and improves regulatory adherence.

- AiPrise’s AI-driven KYC/KYB, transaction monitoring, and automated compliance solutions offer businesses scalable, accurate, and seamless crypto security.

What Exactly Is Crypto Cleansing?

Crypto cleansing, also known as crypto money laundering, is the process of identifying and removing illicit, suspicious, or “dirty” cryptocurrency from legitimate financial flows.

It involves methods criminals use to obscure the origin of cryptocurrency obtained through illegal activities, such as fraud, ransomware, or drug trafficking, to make it appear “clean” and usable for mainstream transactions.

This cleansing is actually beneficial for businesses and the broader crypto ecosystem because it helps separate illicit funds, reducing financial risk and improving compliance.

Important factors shaping crypto cleansing:

- Focus on Ecosystem Integrity: Crypto cleansing is about maintaining a trustworthy environment, ensuring that businesses operate with assets free from associations with illegal actions.

- Detection and Segregation: It includes identifying crypto linked to dark markets, fraud, or scams, and isolating these funds from standard payment channels.

- Regulatory Alignment: It supports adherence to international anti-money laundering (AML) regulations that increasingly focus on digital currency transparency.

- Market Confidence: Effective crypto cleansing can reinforce investor and consumer confidence by showing a commitment to preventing financial crimes.

- Evolving Industry: As new laundering methods emerge, crypto cleansing adapts using innovative data analytics and blockchain forensics to stay ahead.

Moreover, Crypto cleansing differs from traditional money laundering in its use of blockchain’s public yet pseudonymous ledger, enabling faster, cross-border transfers without central control.

Unlike traditional methods that rely on banks and cash, crypto cleansing utilizes digital tools such as mixers and privacy coins to obscure the origins of funds.

Let’s now understand the mechanics of how crypto money laundering operates, and why it poses unique risks to businesses handling digital assets.

How Does Crypto Money Laundering Work?

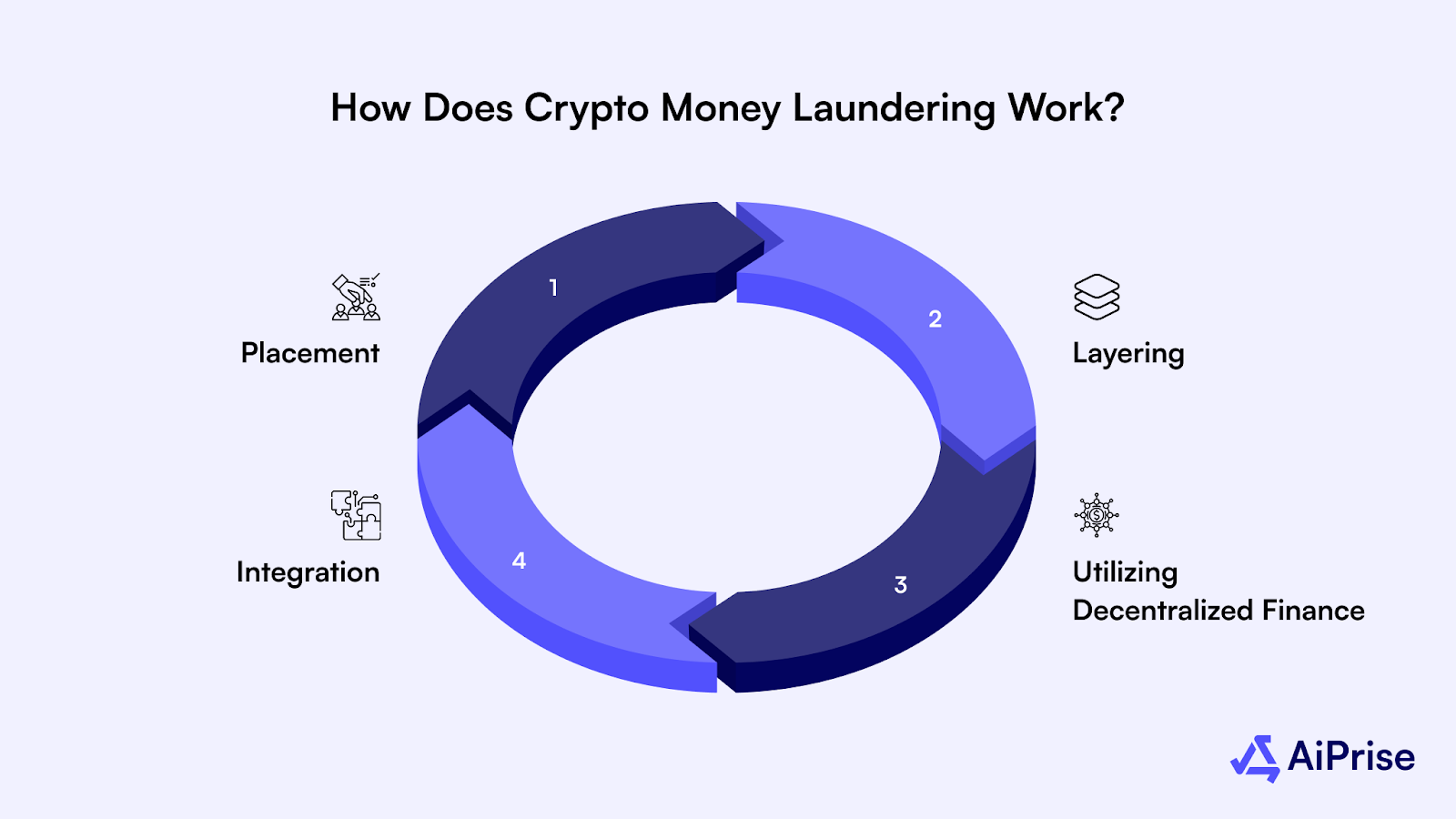

Crypto money laundering adapts the traditional three-stage model, placement, layering, and integration, to the decentralized and pseudonymous nature of cryptocurrencies, to move illicit funds quickly and disguise their origins.

Here's a detailed breakdown:

1. Placement: Introducing Illicit Crypto into the System

Illicit funds enter the crypto economy through methods like ransomware payments, hacks, or converting illegal cash into crypto via exchanges, points where businesses must enhance identity verification and transaction scrutiny.

2. Layering: Complex Obfuscation to Hide Origins

Criminals use advanced techniques such as mixing services that blend funds with legitimate coins, chain hopping across multiple blockchains to break the trace trail, and privacy coins that mask transactional details. These tactics create challenges that make transaction monitoring critical to spot unusual patterns early.

3. Utilizing Decentralized Finance (DeFi) and Peer-to-Peer Platforms

Funds are moved through decentralized exchanges and peer-to-peer trading platforms, which often lack complete regulatory oversight, allowing illicit funds to mix with clean assets. Businesses should evaluate partners carefully and use analytics that trace these multi-layered flows.

4. Integration: Laundered Crypto Re-enters the Legitimate Market

Once cleansed, crypto is converted back to fiat, used in purchasing goods, or entered into financial products. Monitoring outgoing transactions for suspicious destinations or amounts protects businesses from unknowingly completing laundering cycles.

Understanding the methods behind cryptocurrency money laundering highlights why your business must prioritize cryptocurrency cleansing to safeguard transactions and ensure compliance.

Why Crypto Cleansing Should Concern You?

For businesses, crypto cleansing is not just about regulation; it's a critical shield that protects transactions, assets, and reputation in an increasingly digital economy.

Here’s why:

- Risk of Regulatory Penalties: Accepting or transacting with tainted crypto can trigger severe fines and legal consequences under anti-money laundering laws globally, impacting your bottom line directly.

- Financial Exposure to Fraud and Theft: Dirty crypto increases vulnerability to fraud schemes tied to ransomware, scams, or darknet markets, potentially causing significant financial losses if undetected.

- Reputation and Trust Damage: Businesses unknowingly linked to illicit crypto face loss of customer trust, negative publicity, and diminished brand value, risks far harder to recover from than financial penalties.

- Complex Compliance Landscape: Global AML and KYC regulations are evolving rapidly to cover cryptocurrencies, demanding that businesses implement dynamic cleansing and monitoring strategies to stay ahead.

- Operational Efficiency and Market Access: Crypto cleansing enables smoother audits, clearer transaction histories, and opens doors to partnerships and markets requiring stringent compliance credentials.

By effectively integrating crypto cleansing into your business processes, you protect your financial transactions.

Having explored why crypto cleansing is critical for safeguarding your business, it’s vital to understand the specific laundering techniques at play to better identify and counteract risks within your crypto transactions.

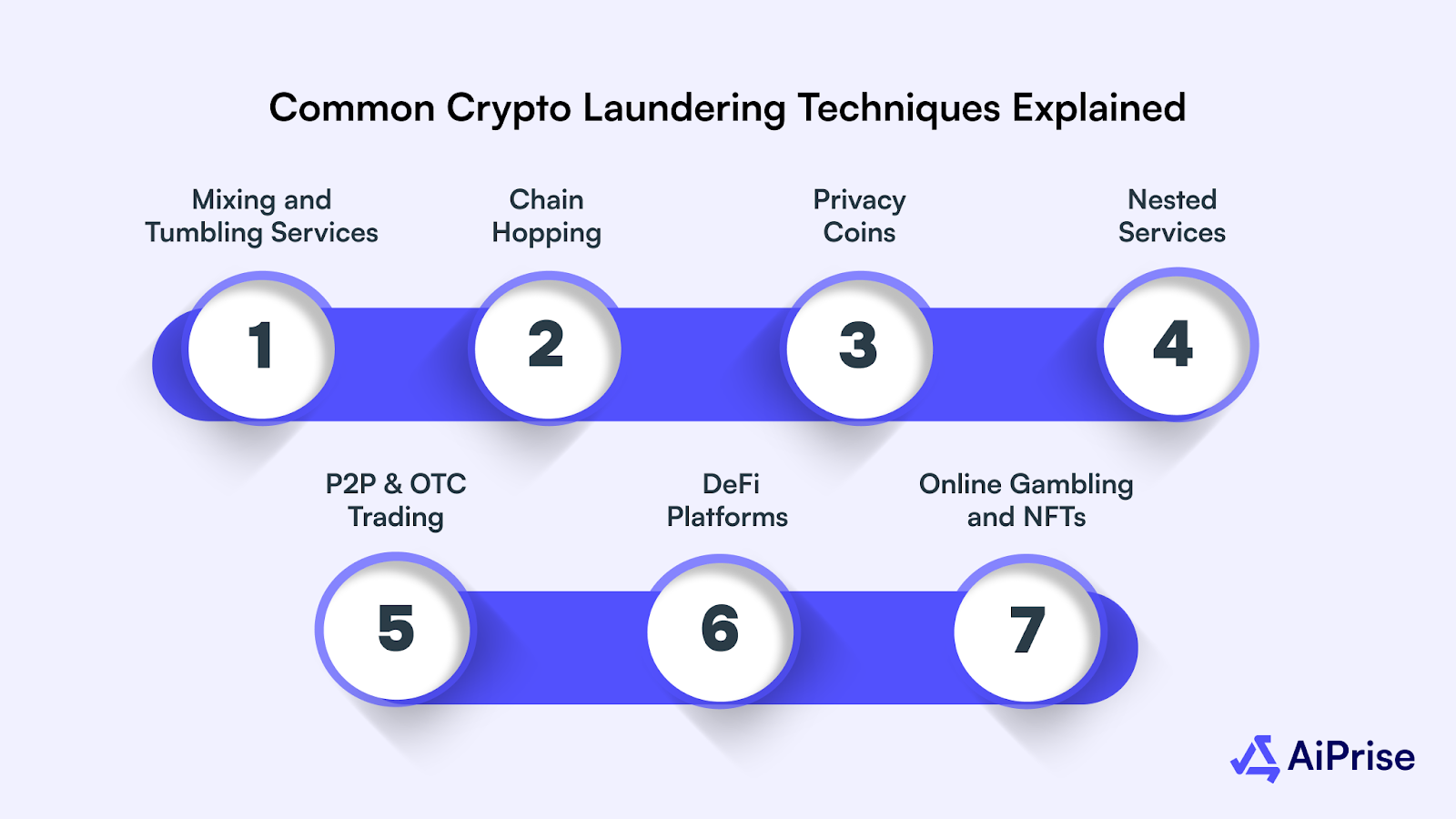

Common Crypto Laundering Techniques Explained

Cryptocurrency's unique characteristics have led to diverse money laundering methods that criminals, intentionally or unwittingly avoided by legitimate businesses, exploit to obscure illicit funds.

Recognizing these techniques helps your business strengthen defenses and ensure that crypto cleansing effectively protects your operations.

Key laundering techniques include:

1. Mixing and Tumbling Services

These platforms pool cryptocurrencies from many users, redistributing funds through multiple addresses to sever transaction links, producing ‘cleaned’ coins. For businesses, transactions involving the mixing of services are high-risk, as they obscure the origins of funds and complicate due diligence.

2. Chain Hopping

Funds rapidly move across different blockchains using cross-chain bridges or swaps to evade detection. This technique complicates tracing efforts and requires businesses to have cross-chain monitoring capabilities to identify potentially suspicious flows.

3. Privacy Coins

Cryptocurrencies like Monero and Zcash employ advanced cryptographic features to conceal transaction details entirely. Due to limited on-chain transparency, accepting or processing such coins without enhanced screening exposes businesses to risks of money laundering.

4. Nested Services and Non-Compliant Exchanges

Some exchanges host nested services or have lax AML/KYC standards, allowing illicit actors to exploit their liquidity pools anonymously. Businesses must vet partners rigorously to avoid association with these platforms.

5. Peer-to-Peer (P2P) and Over-the-Counter (OTC) Trading

Direct trading platforms enable participants to swap crypto with minimal identification, often bypassing regulated exchanges. This anonymity increases laundering risks that businesses should mitigate by establishing clear transaction policies and robust screening.

6. Decentralized Finance (DeFi) Platforms

DeFi’s permissionless, complex protocols enable rapid layering of funds through lending, swapping, and liquidity pools without centralized oversight. Businesses engaging with DeFi should implement analytics tools capable of detecting patterns indicative of laundering.

7. Online Gambling and NFTs

Launderers exploit crypto-funded bets or buy/sell digital assets at inflated prices to disguise illicit gains. Businesses working in these sectors must adopt stringent transaction monitoring and risk management frameworks.

Moving from common laundering tactics, now let's focus on the scale of the problem with concrete data to illustrate why crypto cleansing is essential for your business security.

How Much Crypto Is Laundered? Eye-Opening Stats

Understanding the volume and trends in crypto laundering is crucial for businesses aiming to strengthen transaction integrity and regulatory compliance.

Here are the latest specific figures and what they mean for your operations:

- In 2024, approximately $51 billion in cryptocurrency flowed into illicit wallets worldwide, marking a record high as adoption grows.

- Of this, about $40 billion was laundered through wallets, mixers, bridges, and exchanges to "clean" illicit funds and reintroduce them into the legitimate economy.

- Despite representing only about 0.4% of the total crypto transaction volume (over $10.6 trillion in 2024), illicit transactions pose outsized risks due to their association with scams, ransomware, and sanctions evasion.

- Stablecoins now account for 63% of illicit laundering activity, signaling a shift from Bitcoin dominance to these digital assets in criminal networks.

- The first half of 2025 saw $2.17 billion stolen, with laundering efforts rapidly evolving to exploit cross-chain bridges and decentralized finance platforms.

The large scale emphasizes the importance of integrating strong crypto cleansing into your compliance strategies.

Let’s focus on actionable measures your business can implement to protect cryptocurrency transactions and maintain effective regulatory compliance.

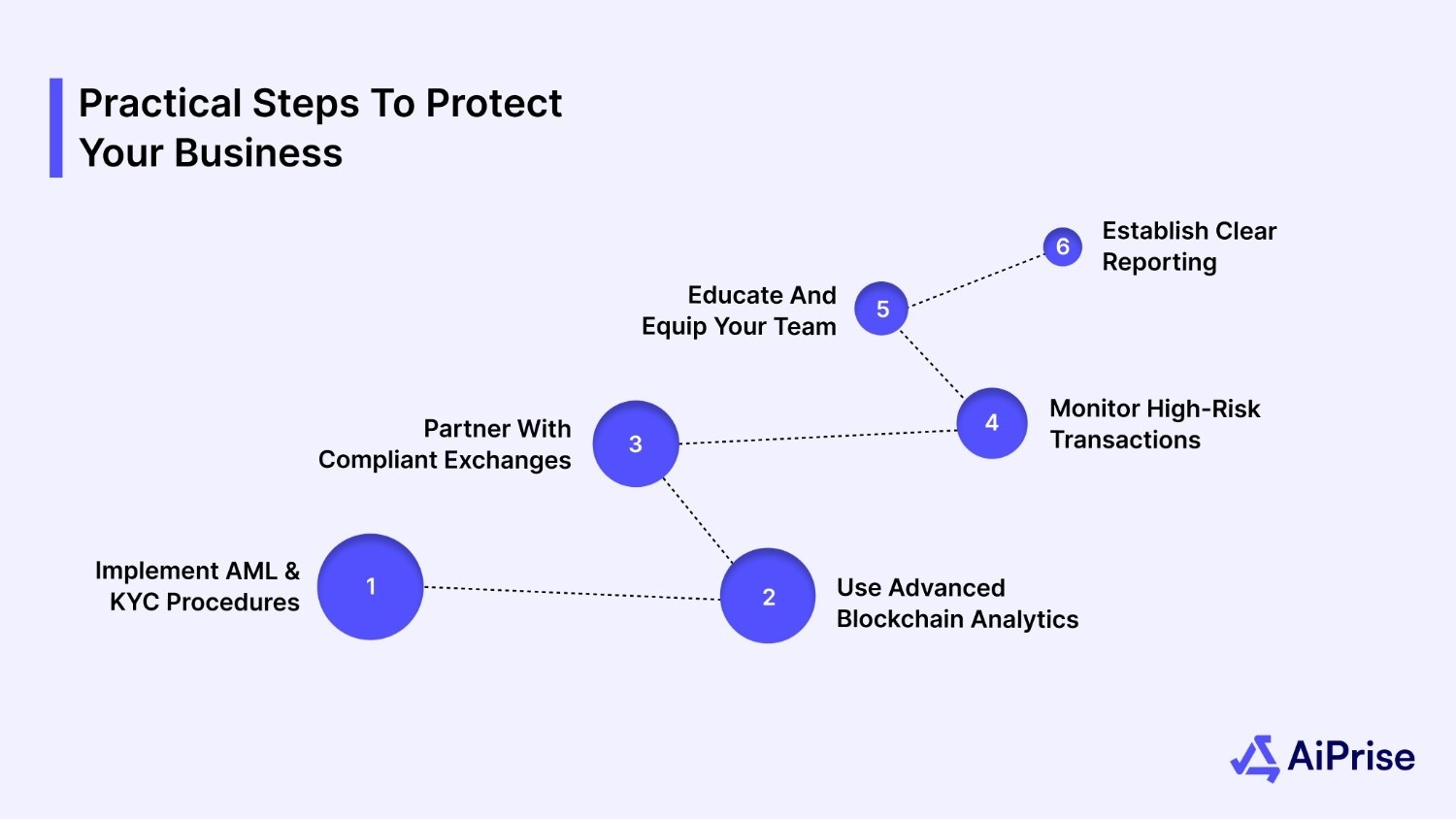

Practical Steps to Protect Your Business

Protecting your business from risks associated with illicit crypto requires a multifaceted, proactive approach.

Here are targeted strategies to improve your crypto cleansing efforts and safeguard your transactions:

1. Implement Comprehensive AML and KYC Procedures

Develop strong identity verification protocols customized for crypto clients, utilizing digital ID verification and biometric checks.

Also, establish ongoing monitoring protocols to flag suspicious activities beyond initial onboarding. This reduces the risk of illicit actors entering your system and helps you identify faulty or suspicious accounts early.

For businesses looking to implement these sophisticated identity verification and AML strategies, AiPrise’s Business and User Verification product simplifies this process with its One-Click KYC feature.

2. Use Advanced Blockchain Analytics

Adopt blockchain forensic tools that trace transaction history, detect mixers, chain hopping, and other laundering techniques.

Utilize AI and machine learning-powered solutions to identify suspicious patterns and predict emerging laundering methods.

3. Partner with Compliant Exchanges and Service Providers

Conduct due diligence on exchanges and custodians to ensure they adhere to strict AML/KYC standards.

Avoid exchanges or custodians with weak AML procedures or those flagged for lax oversight. Solid partners not only reduce laundering risk but also provide you with improved transparency into transactional histories and compliance readiness.

4. Monitor High-Risk Transactions and Asset Types

Pay extra attention to transactions involving privacy coins, stablecoins, and DeFi tokens.

Set transaction limits and enhanced review for complex cross-chain movements or unusually timed transfers.

5. Educate and Equip Your Team

Educate your compliance and finance teams on crypto-specific laundering tactics and red flags.

Regularly update policies and conduct audits to ensure adherence to evolving regulatory requirements.

6. Establish Clear Reporting and Remediation Processes

Define protocols for promptly reporting suspicious activity to authorities in line with local and international laws. Prepare incident response measures, including transaction freezes, customer verifications, and cooperation frameworks with law enforcement.

Also Read: Money Laundering Techniques And Prevention Methods: Definition And Examples

Let’s examine some notable real-world scenarios where crypto-cleansing and anti-money laundering efforts have had a significant impact.

Lessons From Real Crypto Crime Cases

Studying notable crypto crime cases offers businesses invaluable insights into laundering schemes, regulatory responses, and how effective crypto cleansing can mitigate risks.

Some of the key crypto crime cases are:

1. PlusToken Scam (2019-2023):

One of the largest crypto Ponzi schemes defrauded investors of over $2 billion. Launderers used mixers, chain hopping, and multiple exchange cash-outs.

Lesson: Comprehensive blockchain analytics and exchange cooperation are essential to trace and freeze laundered funds early.

2. Silk Road Marketplace (Talk Early 2010s):

An underground darknet marketplace facilitating illegal drug sales, laundering millions in Bitcoin through tumblers and decentralized exchanges.

Lesson: Vigilant transaction monitoring and KYC enforcement can disrupt illicit platform financing.

3. Twitter Bitcoin Hack (July 2020):

Attackers hijacked major accounts to solicit Bitcoin donations, then used tumblers and privacy coins to obscure gains.

Lesson: Rapid detection of suspicious wallets and improved AML protocols on exchanges limit damage from sudden illicit influxes.

Now, through these real-world lessons, it’s clear that securing your crypto operations demands equally advanced and tailored solutions.

How AiPrise Can Secure Your Crypto Operations?

AiPrise offers a comprehensive suite of products designed specifically to address the complex compliance and security challenges in cryptocurrency businesses.

By using advanced technology, AiPrise helps companies embed crypto cleansing deeply into their operational infrastructure, ensuring secure and compliant crypto transactions at every step.

Here's a detailed overview of AiPrise crypto security solutions:

- AI-Powered Business and User Verification: AiPrise provides instant identity verification of both individuals and corporate entities. Through document authentication and facial biometrics, AiPrise guarantees that only verified, legitimate parties participate in your ecosystem.

- One-Click KYC: This streamlined feature accelerates Know Your Customer compliance by combining multiple verification processes into a single, user-friendly step. It balances stringent regulatory adherence with a smooth customer onboarding experience.

- Real-Time Wallet Risk Screening: AiPrise continuously monitors crypto wallets against known risk indicators such as connections to mixers, tumblers, and sanctioned or illicit networks.

- AI-Driven Transaction Monitoring: Utilizing machine learning models trained on vast datasets from the cryptocurrency ecosystem, AiPrise detects complex money laundering patterns, such as address cycling, layering, and chain hopping.

- Comprehensive KYB (Know Your Business): AiPrise’s KYB verification extends to corporate clients, providing swift and continuous checks to ensure that business partners comply with AML regulations, exposing and mitigating risks from shell companies or illicit entities.

- Automated Compliance Workflows: AiPrise streamlines all compliance processes, from verification to risk assessment and regulatory reporting, via automation.

Deploying AiPrise safeguards against crypto fraud and laundering, ensuring compliance with evolving regulatory landscapes while protecting every transaction.

Contact us today and experience how AiPrise’s product can help you operate securely, confidently, and in full regulatory compliance.

Final Thoughts

Crypto cleansing is an indispensable layer of protection for businesses operating in the digital asset ecosystem. With increasing regulatory scrutiny and sophisticated laundering techniques, embedding advanced crypto cleansing and compliance tools like AiPrise into your operations is no longer optional but critical.

Take control of your crypto security today. Book A Demo with AiPrise and experience how AI solutions can safeguard your business from evolving crypto crime and pave the way for trusted, compliant growth.

FAQs

1. How can businesses identify high-risk crypto transactions without disrupting user experience?

Using AI-powered transaction monitoring tools enables businesses to flag suspicious activities in real time while maintaining smooth and fast user onboarding and transaction processes.

2. What role does continuous monitoring play in effective crypto cleansing?

Continuous monitoring helps detect evolving laundering tactics, ensuring that suspicious transactions are interdicted promptly, minimizing risk exposure beyond initial onboarding.

3. Why is integrating business (KYB) verification crucial for crypto platforms?

KYB verification identifies hidden risks associated with shell companies or illicit entities, ensuring that corporate clients comply with AML standards and reducing the likelihood of laundering through business accounts.

4. How do privacy coins impact crypto compliance strategies?

Privacy coins obscure transaction details, making it challenging for traditional AML techniques to be effective. Businesses must adopt advanced analytics and enhanced screening to manage the risks posed by these coins effectively.

5. Can automated compliance workflows improve regulatory reporting accuracy?

Yes, automation reduces human error and speeds up reporting, ensuring businesses stay compliant with evolving regulations while freeing compliance teams to focus on high-risk cases.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.