AiPrise

11min read

November 20, 2025

Top Compliance Challenges Facing Banks in 2025

Key Takeaways

Do you know that the global cost of financial crime is projected to reach $10.5 trillion by the end of the decade? This staggering figure highlights the critical need for banks to stay on top of ever-increasing regulatory requirements and combat fraud and money laundering risks.

As technology advances and consumer expectations grow, financial institutions are tasked with maintaining compliance with an increasing number of regulations that span national and international borders. The complexity of compliance is only set to rise, and with new technologies, global economic changes, and digital banking becoming more mainstream, banks must adapt quickly to stay ahead of emerging risks.

Compliance departments in banks are continuously evolving to manage regulatory requirements such as Anti-Money Laundering (AML), Know Your Customer (KYC), and data protection laws. To stay compliant and protect their customers, banks will need to embrace new compliance strategies and technologies that we'll discuss in today's blog.

Key Takeaways

- Evolving Regulations: In 2025, banks must stay agile to keep up with ever-changing regulations like AML, KYC, ESG, and cybersecurity requirements.

- Fraud Prevention: To combat the rising risks of fraud and financial crime, banks must invest in AI-driven fraud detection systems and real-time transaction monitoring.

- Data Privacy: Ensuring data privacy and compliance with GDPR and data localization laws will remain a top priority for banks in 2025.

- Third-Party Risk Management: Banks must conduct due diligence and continuously monitor third-party vendors to ensure compliance and mitigate potential risks.

- AiPrise provides an AI-powered compliance platform that automates tasks, enhances fraud detection, ensures data privacy, and simplifies ESG reporting, helping banks stay compliant and secure.

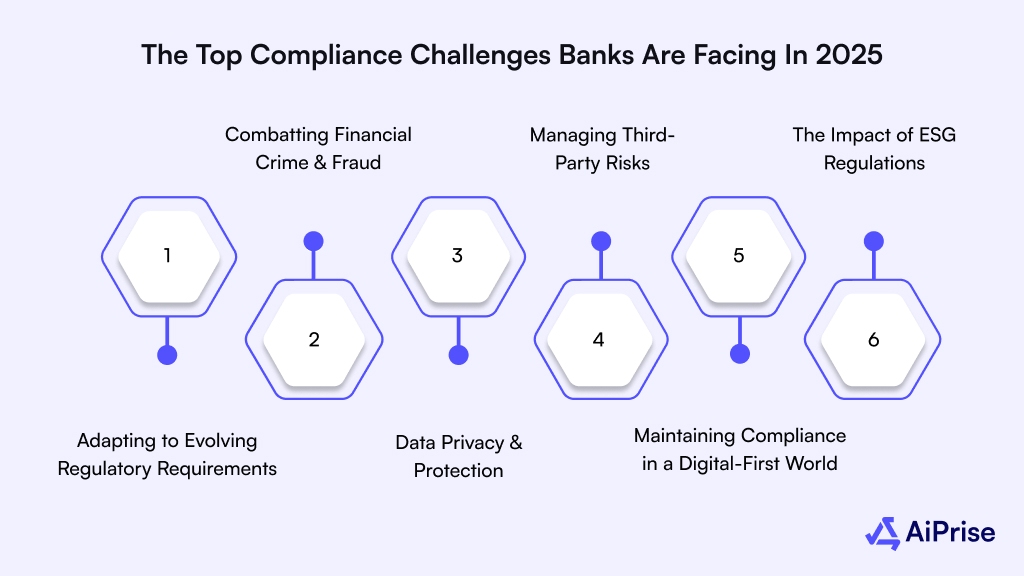

The Top Compliance Challenges Banks Are Facing in 2025

With the stakes higher than ever, let’s explore the most urgent compliance challenges that banks must overcome as we head into 2025

Adapting to Evolving Regulatory Requirements

In 2025, one of the primary compliance challenges banks will face is staying on top of the constant evolution of regulatory requirements. As governments around the world update and introduce new regulations, the financial sector will have to manage these changes while keeping customer trust intact. This is particularly challenging in a global environment where national and international regulations are not always aligned.

The introduction of new regulations like the EU’s Digital Operational Resilience Act (DORA) and changes to Basel III will require banks to invest heavily in compliance technologies and frameworks to remain compliant. Failing to adapt to these changes could result in legal penalties, financial losses, and reputational damage.

With evolving regulations creating significant challenges, banks also face the rising threat of financial crime and fraud. As digital banking becomes more widespread, these risks continue to escalate.

Suggested read: Understanding Regulatory Compliance: Definition and Requirements

Combatting Financial Crime and Fraud

With the rise of digital banking, financial institutions are increasingly exposed to fraud, money laundering, and cybercrime. In 2025, these risks will continue to be one of the most pressing compliance challenges in banking. As online transactions become the norm and more services are offered digitally, criminals are finding new ways to exploit vulnerabilities in financial systems.

To counter these threats, banks must invest in advanced fraud detection systems and AI-driven solutions that can identify suspicious behavior in real-time. These technologies help banks monitor transactions and accounts more effectively, enabling them to detect fraud before it escalates. Real-time monitoring is essential to ensure compliance and reduce risks.

As regulations around AML and KYC requirements continue to tighten, banks must enhance their verification processes. This includes adopting advanced tools like biometric authentication, automated checks for identity verification, and comprehensive tracking of suspicious activities.

Failure to meet these standards can lead to significant penalties, legal consequences, and severe damage to a bank’s reputation. A robust anti-fraud framework not only helps with regulatory compliance but also safeguards customers, builds trust, and reduces the financial impact of fraudulent activities.

As banks work to strengthen their defenses against financial crime, the need to prioritize data privacy and protection becomes even more critical as they handle increasing volumes of sensitive customer data.

Data Privacy and Protection

As digital banking continues to evolve, the volume of sensitive customer data handled by banks is increasing at an unprecedented rate. With this comes the growing responsibility to protect that data from unauthorized access, breaches, and misuse. In 2025, ensuring data privacy and protection will remain a top compliance challenge for banks.

The implementation of regulations such as the General Data Protection Regulation (GDPR) in the EU and other national data protection laws requires banks to adhere to stringent standards for data collection, storage, and processing. As part of their compliance efforts, banks must ensure that sensitive data is properly encrypted, securely stored, and only shared with authorized parties under well-defined conditions.

Banks will also need to stay updated on emerging data localization laws, particularly in regions like India and China, where local regulations require customer data to be stored within the country. Compliance teams must navigate these rules while managing cross-border data flows, ensuring they don’t run afoul of local and international laws.

Beyond regulatory compliance, data breaches can result in significant reputational damage, loss of customer trust, and financial penalties. Therefore, banks will need to invest in advanced cybersecurity measures, including AI-based monitoring, multi-factor authentication, and data access controls to safeguard customer information from unauthorized access and potential threats.

As banks focus on protecting customer data, they must also ensure that their relationships with third-party vendors are managed properly to avoid additional compliance risks.

Also read: 17 Tips For Identity Theft Protection And Prevention

Managing Third-Party Risks

As banks increasingly rely on third-party vendors for services ranging from cloud computing to payment processing and compliance technology, managing the risks associated with these relationships has become a critical compliance challenge in 2025. Third-party partnerships can introduce vulnerabilities, particularly when sensitive customer data is involved.

With regulations like GDPR and the EU’s Digital Operational Resilience Act (DORA) placing greater emphasis on ensuring that third-party vendors meet stringent security and compliance standards, banks must take extra care in managing their vendor relationships. A breach or non-compliance by a third party can expose the bank to financial penalties, reputational damage, and regulatory scrutiny.

Banks will need to perform rigorous due diligence on third-party vendors, ensuring they have strong security protocols and meet compliance requirements. This includes validating that vendors adhere to the same standards for data protection, cybersecurity, and AML/KYC regulations. Additionally, banks must regularly monitor and audit third-party vendors to ensure ongoing compliance and mitigate risks.

With an increasing reliance on FinTech companies and outsourcing partners, third-party risk management will be essential to maintaining compliance and protecting both the bank and its customers from potential security breaches or fraud.

While managing third-party risks is essential, banks must also keep pace with the digital revolution. The rise of new technologies is shaping the future of banking compliance, especially as digital-first solutions become more common.

Maintaining Compliance in a Digital-First World

As the financial industry embraces digital transformation, maintaining compliance has become more complex. The integration of artificial intelligence (AI), machine learning, and blockchain into banking operations offers substantial benefits, such as improved efficiency, enhanced customer experiences, and cost reductions. However, these technologies also introduce new compliance challenges that banks must address.

In 2025, banks will face the challenge of ensuring that their digital solutions adhere to ever-evolving regulatory requirements. This includes real-time transaction monitoring, automated AML checks, and secure digital identity verification. While these technologies provide immense advantages, they must also comply with existing and emerging regulations, such as KYC, data protection laws, and cybersecurity standards.

The rise of cryptocurrencies and Central Bank Digital Currencies (CBDCs) further complicates this issue. These emerging digital assets are not always subject to the same regulations as traditional currencies, creating gaps in compliance frameworks. Banks must navigate the uncertainty surrounding these assets and adapt their compliance processes to accommodate them.

At the same time, digital-first banking solutions must prioritize data security, particularly as digital platforms often store vast amounts of customer information. Compliance teams will need to integrate strong cybersecurity measures into digital systems to ensure they are secure, resilient, and compliant with global standards.

As digital transformation brings new opportunities, banks must also focus on the growing importance of Environmental, Social, and Governance (ESG) compliance, which is becoming an increasing regulatory requirement.

The Impact of ESG Regulations

In 2025, banks will face increasing pressure to comply with Environmental, Social, and Governance (ESG) regulations. These regulations are rapidly gaining traction globally, with governments and regulatory bodies pushing for greater transparency in how companies operate regarding their environmental and social impact. For financial institutions, this means that ESG compliance is no longer just a matter of corporate social responsibility but a strict regulatory requirement.

The EU Sustainable Finance Disclosure Regulation (SFDR) and other similar frameworks will play a significant role in shaping banking compliance in 2025. Banks will be required to disclose how they align with ESG goals, including their investments in green and sustainable projects, their carbon footprint, and how they manage social issues like diversity and labor rights. This will place a heavy burden on compliance teams to track, measure, and report ESG data accurately.

In addition, as investors increasingly demand transparency regarding ESG performance, banks will need to ensure they not only meet regulatory requirements but also align with the expectations of their stakeholders. Failure to do so could result in reputational damage, loss of investor confidence, and missed business opportunities. Banks will need to implement systems for ESG data collection, reporting, and auditing to meet these new regulatory demands and ensure long-term sustainability.

While ESG compliance is rapidly becoming a key challenge, banks must also consider how they’ll stay ahead of the curve in managing the future of compliance through innovation and technology.

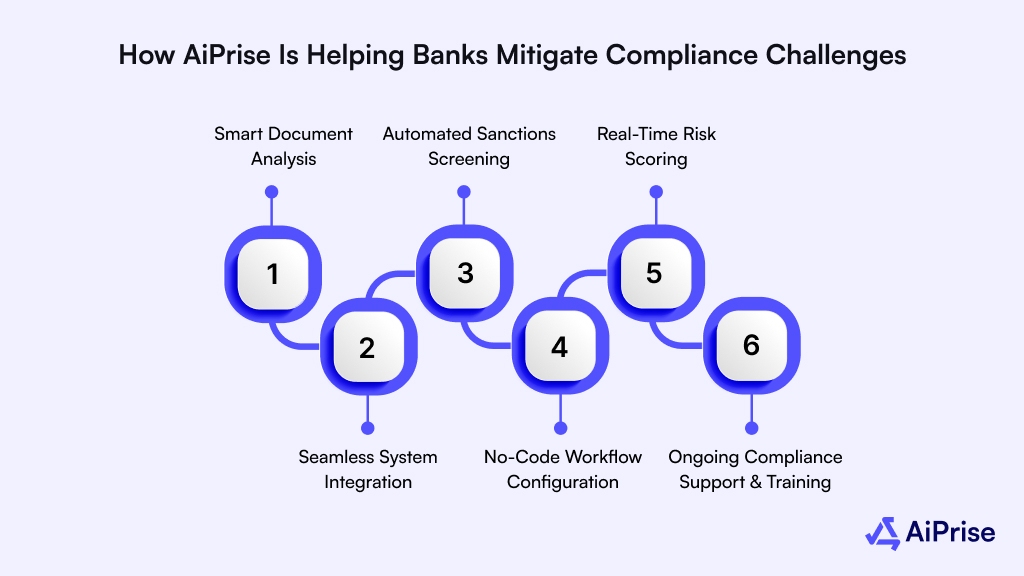

How AiPrise is Helping Banks Mitigate Compliance Challenges

As banks face increasingly complex compliance challenges in 2025, AiPrise, an AI-powered compliance automation platform, is empowering financial institutions to streamline their compliance processes. Designed to address the evolving needs of modern banking, AiPrise’s flagship solution, the Compliance Co-Pilot, enables banks to manage regulatory requirements with speed, accuracy, and efficiency.

Here’s how AiPrise helps banks overcome the key compliance challenges:

Smart Document Analysis

AiPrise automatically scans and extracts relevant data from compliance documents, such as KYC, AML, and ESG reports, significantly reducing manual review delays and the potential for errors. This allows banks to speed up compliance workflows while ensuring greater accuracy.

Automated Sanctions Screening

AiPrise instantly checks names against global watchlists and applies intelligent scoring to flag relevant matches while minimizing false positives. This helps banks remain compliant with AML regulations and avoid the risks associated with financial crimes.

Real-Time Risk Scoring

AiPrise continuously monitors transactions and behaviors across all systems, issuing real-time alerts as soon as risk indicators or anomalies are detected.

Seamless System Integration

AiPrise integrates directly with existing systems, such as CRMs, onboarding tools, and governance platforms, to centralize compliance workflows without disrupting your infrastructure. This ensures smooth operation across all departments and helps banks stay ahead of evolving regulations.

Low-Code/No-Code Workflow Configuration

With AiPrise’s low-code/no-code platform, compliance teams can easily build, test, and modify custom rules and workflows without relying on engineering resources. This empowers banks to stay agile, adapting quickly to regulatory changes while maintaining compliance standards.

Ongoing Compliance Support and Training

AiPrise offers continuous training and updates to ensure compliance teams stay informed about regulatory changes. By using AiPrise’s automated systems, banks can minimize manual tasks, reduce errors, and focus on strategic decision-making.

Overall, AiPrise empowers financial institutions to stay compliant, secure, and future-ready.

Conclusion

As we approach 2025, banks must navigate a complex web of regulatory challenges, from evolving laws to rising risks of fraud and cybercrime. With new technologies like AI and blockchain, banks must stay agile while ensuring compliance with AML, KYC, data privacy, and ESG regulations.

To tackle these challenges, banks need smart compliance solutions that can adapt to regulatory changes, improve efficiency, and reduce risks. AiPrise’s AI-powered platform helps banks automate compliance tasks, detect fraud in real-time, and ensure data privacy—all while staying compliant with ever-changing regulations.

Book a Demo today to streamline your compliance processes, reduce manual errors, and stay ahead of the regulatory curve in 2025 and beyond.

Frequently Asked Questions(FAQs)

Q1. Why is compliance so challenging for banks in 2025?

As regulations evolve and new risks like fraud and cybercrime emerge, banks must stay agile and adopt advanced compliance technologies to meet AML, KYC, and ESG standards.

Q2. How can banks manage the increasing risks of financial crime?

Banks need to invest in AI-driven fraud detection systems and real-time monitoring tools to detect suspicious activities and comply with AML and KYC regulations.

Q3. What is AiPrise's role in helping banks with compliance?

AiPrise offers an AI-powered platform that automates compliance tasks, enhances fraud detection, and ensures data privacy, helping banks stay compliant with evolving regulations.

Q4. How does AiPrise support banks with ESG compliance?

AiPrise simplifies ESG reporting, enabling banks to track sustainability goals and ensure compliance with EU SFDR and other global standards.

Q5. Can AiPrise integrate with a bank’s existing systems?

Yes, AiPrise integrates seamlessly with existing platforms like CRMs and onboarding tools, ensuring smooth implementation without disrupting operations.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.