AiPrise

10 min read

January 7, 2026

How KYC AML Blockchain Protocols Can Transform Compliance in 2026

Key Takeaways

Banks, fintechs, and payment platforms face rising pressure to securely onboard customers, quickly detect suspicious activity, and maintain compliance across increasingly complex AML (Anti-Money Laundering) rules. Yet most institutions still rely on siloed, repetitive KYC (Know Your Customer) checks and fragmented compliance tools that slow onboarding and increase operational overload.

A KYC AML blockchain protocol promises to change that model. Instead of each institution performing redundant identity verification and maintaining isolated customer records, blockchain enables a shared, tamper-resistant, privacy-preserving network where verified identity data, risk signals, and AML events can be exchanged securely across trusted parties.

This guide breaks down how KYC AML blockchain protocols work, why financial businesses are evaluating them, and how modern platforms integrate blockchain with AI-powered risk analysis to raise compliance accuracy.

Key Takeaways

- KYC AML blockchain protocols enable shared, tamper-proof identity records, reducing repeated verification and speeding up onboarding across institutions.

- Immutable blockchain data strengthens AML compliance, prevents document tampering, detects synthetic identities, and builds audit-ready trails.

- Smart contracts automate AML rules, risk scoring, sanctions checks, transaction limits, and alerts for suspicious activity in real time.

- Privacy-preserving tools like zero-knowledge proofs and encrypted storage ensure identity verification without exposing sensitive customer data.

- AiPrise integrates with blockchain KYC/AML to provide real-time fraud detection, behavioral analytics, device monitoring, and risk-based controls.

What Is a KYC/AML Blockchain Protocol?

A KYC AML blockchain protocol is a permissioned blockchain system designed to handle identity verification (KYC) and anti-money-laundering (AML) checks in a secure, reusable, and tamper-proof way.

Instead of every institution running KYC separately, the protocol lets verified identity data be stored once, secured on a shared ledger, and reused by multiple authorized institutions.

Here are some of its key features:

- Shared identity network: All participating institutions access a common, permissioned blockchain that stores verified identity data or cryptographic proofs of it.

- Tamper-proof records: Once verification data is written to the blockchain, it cannot be altered without detection.

- One-time KYC: A customer completes KYC once; other trusted institutions can check and reuse the verified profile.

- Real-time updates: If a user’s details change, updates can be recorded and instantly shared with all authorized participants.

- Supports AML controls: Immutable logs and traceable events help detect suspicious activity and maintain compliance.

How it works: A customer submits their identity documents to Institution A. Institution A verifies the documents and writes a proof/record to the blockchain. Institution B later checks the blockchain and sees the customer is already verified.

The user doesn’t have to repeat KYC, since the verified profile is reused. Any updates (new ID, new address, etc.) are added and shared across the network.

It’s a standardized, blockchain-based way for institutions to share verified KYC data securely, reduce duplication, and improve AML monitoring.

Suggested Read: How to Spot a Fake Identity: A Guide to Combating Synthetic Fraud

AiPrise helps financial institutions strengthen AML compliance with real-time Fraud and Risk Scoring solution. Its platform analyzes customer behavior, transaction patterns, and high-risk events as they occur, enabling teams to spot suspicious activity early, prevent compliance breaches, and reduce financial crime exposure.

Why Blockchain Fits KYC & AML Use Cases

Traditional KYC and AML systems struggle because every institution operates in isolation. Identity verification is repeated, data is fragmented, tampering is possible, and investigations slow down due to limited visibility.

A blockchain-based KYC AML protocol directly addresses these issues through decentralization, immutability, and shared verification logic:

Immutable, Tamper-Resistant Identity and AML Records

In a permissioned blockchain network, once a KYC verification, identity proof, or AML event is written to the ledger, it becomes part of an immutable audit trail. This integrity is guaranteed by:

- Consensus mechanisms that prevent unauthorized modifications

- Cryptographic hashing that exposes any attempt to alter historical data

- Append-only data structure that preserves the full sequence of onboarding and compliance actions

This level of data integrity reduces common fraud risks such as:

- Altered or forged identity documents

- Synthetic identities created across multiple institutions

- Manipulated onboarding histories

Regulators and participating institutions can trust that the underlying KYC and AML data has not been tampered with.

Shared, Reusable KYC Records Across Institutions

In conventional systems, each institution must independently collect and verify customer documents. A blockchain protocol replaces this with a shared KYC trust framework:

- The first institution performs the KYC verification

- A cryptographic attestation or verification hash is recorded on the ledger

- Other authorized institutions can instantly validate the customer’s verified status

- The customer avoids repeated submission of the same documents

This reduces:

- Redundant manual checks

- Onboarding delays

- Compliance team workload

- Operational costs tied to repeated verification

Because data is harmonized across the network, institutions also maintain higher consistency in risk profiles and identity records.

Enhanced Data Security and Controlled Privacy

Blockchain does not require storing raw identity documents directly on-chain. Instead, a well-designed protocol uses:

- Encrypted data storage (on-chain or off-chain)

- Selective disclosure mechanisms, allowing the customer or institution to share only what is necessary

- Zero-knowledge proofs (ZKPs) to confirm validity without exposing sensitive data

- Role-based and permissioned access controls for institutions and auditors

This ensures:

- Institutions only view the data they are authorized to access

- Sensitive documents are protected from unauthorized exposure

- Verifications remain provable without compromising privacy

This model strengthens security while meeting regulatory expectations around data protection.

Real-Time AML Monitoring Through Automated Logic

Smart contracts (or automation logic integrated with the blockchain) can support continuous AML oversight by triggering checks when certain events occur. These may include:

- Threshold and velocity checks for transactions

- Sanctions and watchlist queries when identities or counterparties change

- Risk score updates based on behavior patterns

- Beneficial ownership verification workflows

- Flagging unusual activity across multiple institutions

Because all AML-related events are written to a shared ledger, participating institutions have broader visibility into suspicious patterns while still respecting privacy constraints.

This improves:

- Detection accuracy

- Early intervention against high-risk behaviors

- Audit readiness

- Reduction in manual review cycles

If you want, I can also create a diagram, comparison table, or condensed version of this section for your blog.

Also Read: How AI is Transforming AML Compliance

Next, let’s look at how KYC AML blockchain protocol can be used for cryptocurrency.

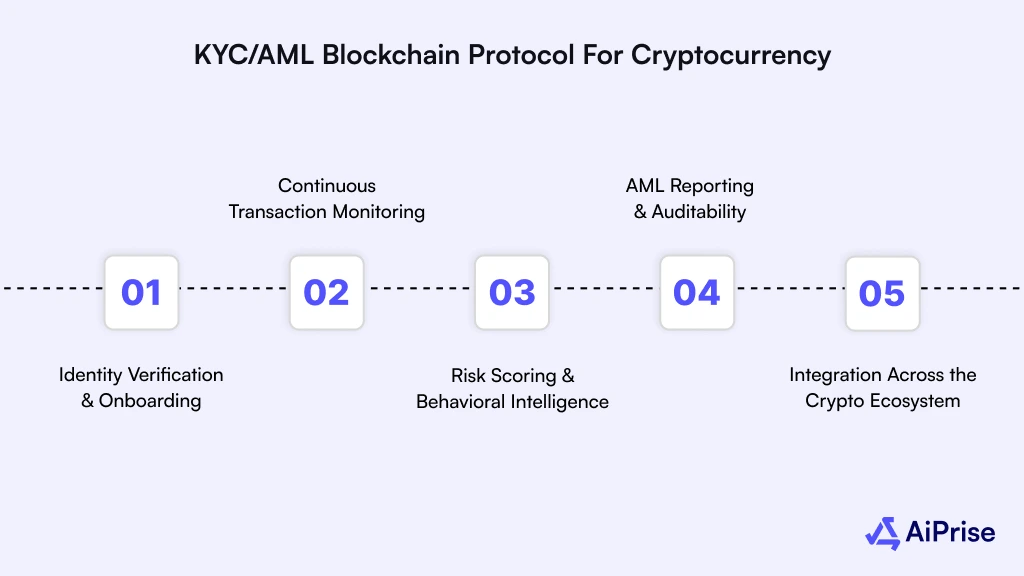

KYC AML Blockchain Protocol for Cryptocurrency

In cryptocurrency, KYC and AML compliance are more than regulatory obligations; they are essential for platform security, trust, and legitimacy. Digital assets operate in a pseudonymous, cross-border environment, making it critical for crypto exchanges, wallets, and Virtual Asset Service Providers (VASPs) to implement robust compliance frameworks.

A KYC AML blockchain protocol enables crypto businesses to verify identities, monitor transactions, and detect suspicious activity while leveraging the transparency and immutability of blockchain technology.

Identity Verification and Onboarding

Crypto platforms can streamline KYC by using blockchain-based identity attestations:

- Verify a user’s identity once and reuse proof across compliant platforms.

- Use encrypted, zero-knowledge proofs to protect sensitive personal data.

- Screen users and wallets against sanctions lists, Politically Exposed Persons (PEPs), and high-risk entities.

Advanced KYC solutions may also include biometric verification, document authentication, and proof-of-address checks. This ensures compliance from the first interaction while reducing onboarding friction.

Continuous Transaction Monitoring

Blockchain protocols allow real-time oversight of on-chain activity to spot suspicious behavior:

- Unusual fund flows between wallets or cross-chain transfers.

- Patterns indicative of layering or mixing, commonly used in laundering schemes.

- Repeated micro-transactions or rapid fund movements that evade traditional monitoring.

Integrating AI-driven analytics, platforms like AiPrise can flag high-risk transactions automatically, providing actionable alerts to compliance teams.

Risk Scoring and Behavioral Intelligence

By combining blockchain data with behavioral analytics, crypto businesses can:

- Assign dynamic risk scores to wallets and accounts.

- Detect synthetic identities, deepfake attacks, and compromised users.

- Identify coordinated fraud rings and suspicious behavioral patterns.

This layered approach strengthens AML compliance while reducing false positives that could hinder legitimate users.

AML Reporting and Auditability

Immutable blockchain records support comprehensive audit trails:

- Simplify Suspicious Activity Report (SAR) filings.

- Provide regulators with verifiable compliance evidence without exposing raw personal data.

- Ensure transparency for both centralized and decentralized platforms.

Integration Across the Crypto Ecosystem

KYC AML blockchain protocols can seamlessly integrate with exchanges, wallets, DeFi platforms, and smart contracts to:

- Verify counterparties in trading, lending, or staking operations.

- Monitor multi-chain transactions and cross-border transfers in real time.

- Enhance due diligence and AML compliance across the crypto ecosystem.

By using blockchain’s transparency, AI-powered monitoring, and robust KYC procedures, cryptocurrency platforms can prevent money laundering, reduce fraud risk, and maintain regulatory compliance without compromising decentralization or user experience.

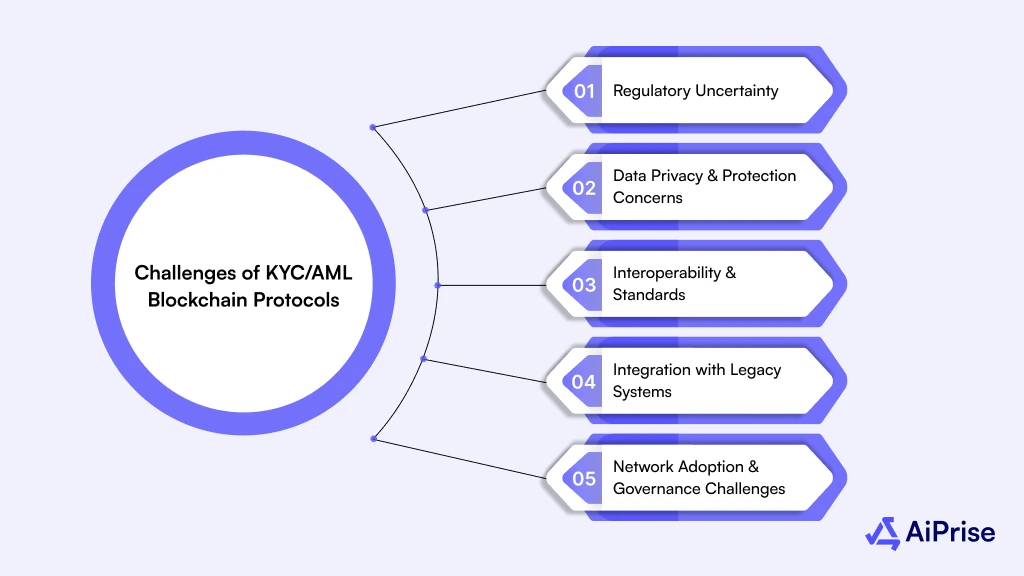

Challenges of KYC AML Blockchain Protocols in 2026

While blockchain offers major benefits for KYC and AML compliance, implementing a blockchain-based protocol in financial institutions comes with its own set of challenges.

Understanding these obstacles helps institutions plan realistic adoption strategies and achieve operational efficiency:

- Regulatory Uncertainty: KYC and AML regulations vary across jurisdictions, and many regulatory bodies have not yet provided explicit guidance on blockchain-based identity verification. Cross-border operations increase complexity, and some regulators may not accept blockchain attestations as standalone proof.

- Data Privacy and Protection Concerns: Blockchain’s immutable nature can conflict with privacy regulations such as GDPR, which require the ability to correct or delete personal data. Even off-chain storage of sensitive documents may raise privacy risks if metadata or hashes on-chain can be traced.

- Interoperability and Standards: Different financial institutions may adopt different blockchain platforms, data formats, or KYC/AML levels, creating fragmentation. Lack of standardized attestation formats and governance can limit cross-institutional usability.

- Integration with Legacy Systems: Banks and financial institutions often operate complex legacy systems that are not natively blockchain-compatible. Integrating blockchain-based KYC/AML workflows may require extensive re-engineering or middleware solutions.

- Network Adoption and Governance Challenges: Blockchain protocols rely on multiple institutions participating to realize the benefits of shared KYC. Without broad adoption, efficiency gains and risk reduction are limited. Poor governance can also lead to disputes over attestation trust, revocation, or updates.

Financial institutions can use KYC/AML blockchain protocols to reduce redundant verification processes, improve compliance efficiency, and enhance data security and trust, detecting suspicious activity across institutions early.

Also Read: How Banks Utilize Machine Learning For Fraud Detection

Financial institutions, fintechs, and payment processors need systems that accurately verify customer identities, detect suspicious activity in real time, and flag high-risk transactions before regulatory or financial risks escalate.

How AiPrise Supports KYC AML Blockchain Protocol Adoption

Financial institutions, banks, and fintech platforms using KYC/AML blockchain protocols need tools that verify identities accurately, monitor risk in real time, and ensure compliance across multiple institutions. While blockchain provides immutable, shared KYC records, institutions still need actionable insights to make the data operational for AML and risk teams.

AiPrise complements blockchain by integrating identity verification, risk scoring, and behavioral analytics into a unified compliance layer, helping teams spot suspicious activity early and prevent regulatory or operational issues.

With AiPrise, institutions leveraging blockchain KYC/AML protocols can:

- Fraud & Risk Scoring: Evaluate customer and entity risk using 100+ signals, including on-chain attestations, device intelligence, behavior patterns, IP data, corporate registries, and adverse media, detecting high-risk clients and synthetic identities early.

- Device & Session Intelligence: Identify compromised devices, browser spoofing, VPN use, emulators, and remote-access tools attempting to bypass KYC or transaction monitoring.

- Behavioral Analytics: Monitor session behavior and interaction patterns to detect anomalies, coordinated fraud, or suspicious activity across institutions on the shared KYC ledger.

- Transaction Risk Controls: Apply checks including source-of-funds validation, counterparty scoring, velocity limits, circular-flow detection, and automated holds for suspicious transfers, leveraging blockchain audit trails.

- Flexible Rule Engine: Configure automated workflows and detection rules aligned with AML policies, internal risk thresholds, and regulatory requirements—without slowing onboarding or legitimate transactions.

AiPrise gives financial institutions end-to-end visibility and adaptive controls across identity attestations, behavior, devices, and transactions on blockchain networks, helping teams use shared KYC efficiently while maintaining strong AML compliance.

Book a Demo to see how AiPrise strengthens blockchain KYC/AML adoption, reduces regulatory risk, and ensures operational resilience.

Wrapping Up

As financial institutions adopt blockchain-based KYC/AML protocols, compliance is increasingly complex. Shared identity records, cross-institution onboarding, and high-volume transactions create challenges in verifying customers, assessing risk, and detecting suspicious activity early.

AiPrise complements blockchain KYC/AML by combining automated identity verification, continuous risk scoring, and behavioral monitoring in one platform. By surfacing risk signals in real time, it helps institutions strengthen compliance, reduce exposure, and improve operational confidence.

Talk to Us Today to see how AiPrise supports blockchain KYC/AML adoption, minimizes regulatory risk, and ensures secure, efficient monitoring across the customer lifecycle.

FAQs

1. How does blockchain reduce onboarding time for high-risk customers?

By storing verified identity attestations on a shared ledger, blockchain eliminates the need for repeated KYC checks across institutions. High-risk customers can be flagged automatically through risk scoring and smart contract rules, allowing teams to prioritize verification and accelerate onboarding while maintaining compliance.

2. Can blockchain KYC/AML protocols prevent fraud across multiple institutions?

Yes. Shared, immutable records provide cross-institution visibility, so suspicious patterns detected by one bank or fintech can alert others in the network. This early-warning mechanism helps prevent coordinated fraud, synthetic identities, and mule networks from exploiting gaps between isolated KYC systems.

3. How are smart contracts used in KYC/AML blockchain protocols?

Smart contracts automate compliance checks by executing predefined rules such as identity attestation validation, sanctions screening, transaction limits, and risk-score updates. They reduce manual intervention, ensure consistency across participants, and provide audit-ready, tamper-proof enforcement of AML policies.

4. What role do zero-knowledge proofs play in blockchain-based KYC?

Zero-knowledge proofs (ZKPs) allow a financial institution to verify a customer’s identity or attributes without revealing sensitive data. This ensures privacy while maintaining regulatory compliance, enabling institutions to confirm KYC/AML compliance without exposing full identity documents.

5. How scalable are blockchain KYC/AML protocols for large transaction volumes?

Modern permissioned blockchains designed for KYC/AML can handle thousands of onboarding events and transaction verifications per second. Layered solutions using off-chain storage, optimized consensus mechanisms, and parallel validation ensure the protocol scales with institutional growth while maintaining real-time compliance monitoring.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.