Antoine Kotran

11 min read

December 18, 2025

Comprehensive Guide To Sanctions Checks For Compliance

Key Takeaways

Ever worry about missing a risky customer, a flagged business, or a hidden connection that could put your organization under regulatory fire? For teams handling constant onboarding flows, whether at financial institutions or any business facing strict compliance rules, those concerns can feel very real. And with regulations tightening worldwide, the margin for error keeps shrinking.

That’s why understanding how a sanction check 5 works, and how it fits into your broader compliance process, matters more than ever. The stronger your screening foundation, the easier it becomes to protect your organization without adding friction to daily operations.

In this blog, we’ll break down how sanctions screening works, the challenges you may face, and the best practices that help you stay compliant. Let’s get started.

Key Takeaways

- Sanctions checks help organisations verify individuals against global watchlists to prevent financial crime and ensure compliance.

- Key international lists include OFAC, UN, HMT, and EU sanctions databases used by letting agents.

- Checks can be done manually or through automated tools, with automation offering speed, accuracy, and scale.

- Common issues include false matches, outdated data, name variations, and inconsistent internal processes.

- Strong practices like risk-based screening, updated lists, integrated controls, and regular audits create a reliable compliance framework.

What Exactly Is A Sanction Check?

A sanction check helps you confirm whether a person, business, vessel, or country appears on any restricted list. You compare customer or transaction details against official records to make sure you are not working with a prohibited party.

These checks are used during onboarding and throughout ongoing monitoring to support regulatory compliance. It reduces the chance of missing high-risk profiles and protects your institution from legal and financial trouble.

Sanction Checks In Compliance Frameworks

Sanction screening supports several compliance requirements, especially KYC, KYB, and AML processes.

- Helps your team strengthen AML controls

- Supports ongoing customer risk review

- Reduces the chance of accidental violations

- Ensures smoother audit trails across compliance operations

Now that you know how these checks fit into compliance, let's explore why these checks matter so much for your organization.

Also Read: AI Powered Enhanced Due Diligence for Risk Management

Why Are Sanction Checks Important?

Before moving ahead, think about how much risk sits behind a single missed match. A simple oversight can affect your institution’s reputation and legal standing. Sanction checks protect your institution from multiple risks, creating a direct impact on your compliance posture and day-to-day operations:

- Legal protection: Keeps your institution aligned with US and global sanctions rules, reducing the chance of accidental violations.

- Reputation safety: Minimizes the risk of being linked to restricted or suspicious entities, which can harm public trust.

- Cost control: Helps you avoid expensive penalties, regulatory action, and investigation costs tied to non-compliance.

- Operational safety: Prevents exposure to financial crime, including money laundering, terrorist financing, or similar threats by blocking high-risk individuals or transactions early on.

As you can see, a sanction check 5 supports both regulatory and operational stability. With that in mind, your next step is understanding the lists you must monitor.

What Are the Major Global Sanctions Lists?

Before you start screening, you need clarity on the major sanctions lists used across different regions. Each list carries its own rules, restrictions, and enforcement powers. To help you stay organized, here is a simple table that gives a quick snapshot:

1. UN Security Council Consolidated List

The United Nations maintains a global list covering individuals and entities linked to threats such as terrorism and weapons proliferation. Member states follow these restrictions through asset freezes and travel limitations. You must check this list when operating across international markets.

2. OFAC Sanctions Lists, United States

OFAC enforces US sanctions with strong financial restrictions. This list affects anyone dealing with US-based transactions or connecting to the US financial system. Its global reach means most institutions treat it as a mandatory reference point.

3. OFSI Sanctions Lists, United Kingdom

The UK’s sanctions list covers individuals and businesses linked to activities against national interests. It includes asset freezes, investment prohibitions, and payment restrictions. Institutions working with UK partners must monitor this list closely.

4. SECO Sanctions List, Switzerland

Switzerland publishes the SECO list to restrict financial dealings with entities involved in harmful activities. It covers asset freezes, travel limits, and trade restrictions. Many European institutions reference this list during due diligence.

5. DFAT Sanctions List, Australia

Australia enforces sanctions through DFAT, which includes restrictions such as payment bans and asset freezes. Institutions dealing with Australia or Australian customers should screen against this list.

6. MOF Sanctions List, Japan

Japan’s Ministry of Finance enforces sanctions under its foreign trade laws. The list applies to international and domestic entities engaging with Japanese institutions.

7. HKMA Sanctions List, Hong Kong

Hong Kong issues sanctions through the HKMA to limit dealings tied to money laundering or terrorism financing. The list is widely used across Asian financial markets.

Now that you have seen the range of lists, let’s look at how the screening process works inside a compliance program.

Also Read: Steps to Know Your Customer (KYC) Compliance and Reducing Fraud

How Are Sanction Checks Performed?

As you move forward in your compliance process, you need a clear view of how sanction screening works. The process should be structured and repeatable to reduce your risk of errors. This helps you pick the right approach for your organization.

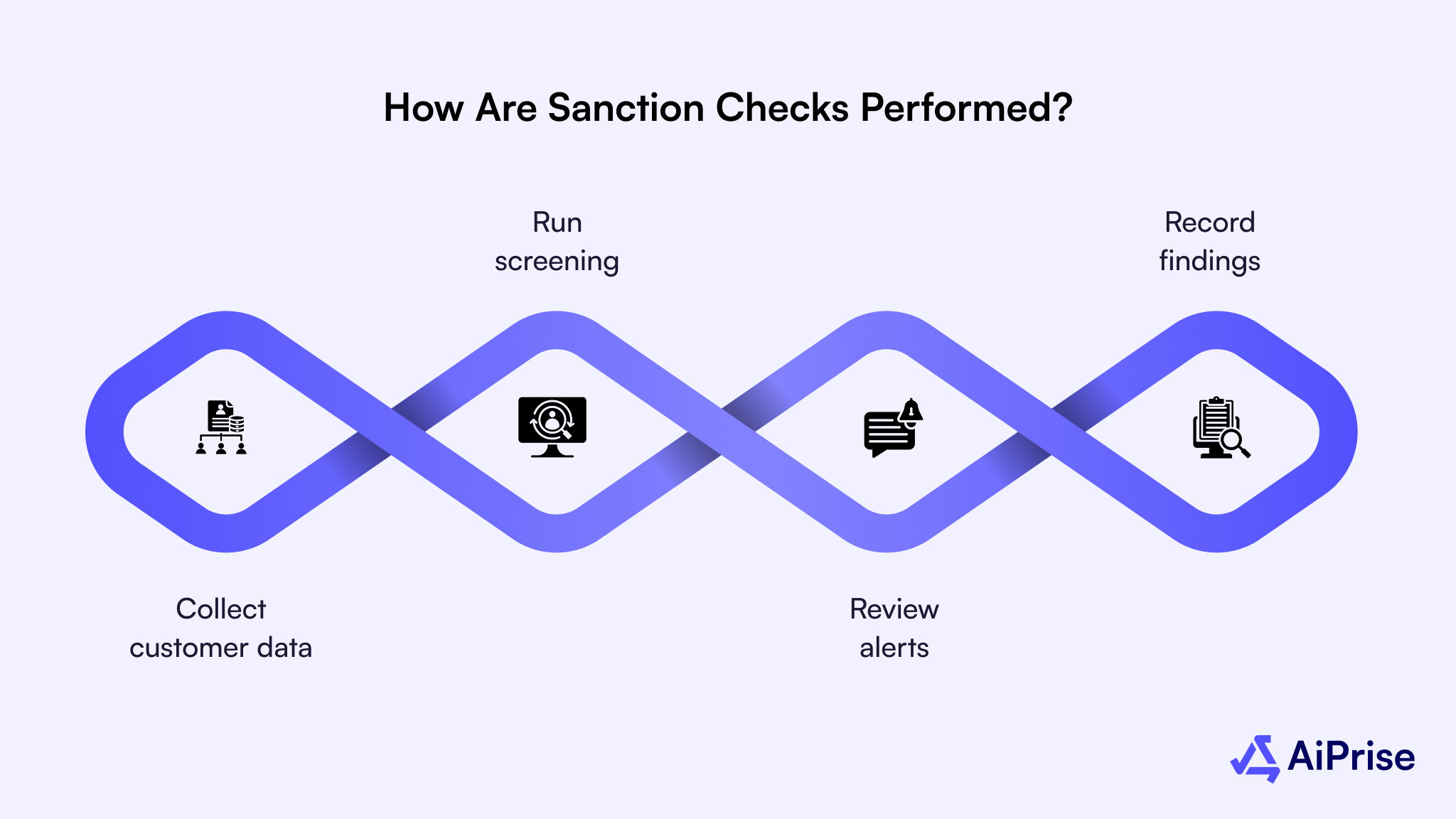

Here are the main steps involved:

- Collect customer data: Gather accurate names, birth details, addresses, and transaction information for clean input. Reliable data reduces screening errors later in the process.

- Run screening: Compare this information against global sanctions lists using automated or semi-automated tools. These tools help you detect matches more quickly and consistently.

- Review alerts: Look into potential hits to understand whether they’re genuine or false positives. This step ensures decisions are based on context, not just system flags.

- Record findings: Document the action taken on each alert, along with notes and outcomes. This gives you a solid audit trail for future reviews or regulatory checks.

With these steps in place, you can continue building a strong compliance flow.

Looking for a smoother way to manage checks across global lists? AiPrise brings identity data, business verification, and automated screening together so these steps stay consistent and accurate from the start.

Manual vs Automated: Which Screening Works Better?

When you start building a reliable sanctions screening workflow, you often need to decide how to handle checks. Should your team review names manually, or is it time to switch to an automated system? Both methods serve the same purpose, but they differ in approach:

Manual screening may fit very small firms, but most businesses outgrow it quickly. Automated systems support high-volume onboarding and give teams the level of accuracy regulators expect.

When Should Businesses Perform Sanction Checks?

Sanctions risk shifts with customer behavior, global events, and new regulatory updates. Because of this movement, sanction checks need to function as more than a single checkpoint. So, when should you run these checks? Let’s look at the most common stages:

- At onboarding: Screen every new customer, partner, or vendor before granting access to products or services.

- Periodically: Repeat checks as sanctions lists update or when regulations introduce new requirements.

- On behavior triggers: Re-screen customers making unusual transactions or interacting with high-risk geographic regions.

- During new product use: Apply extra screening when customers start using services that have higher compliance exposure.

- Before high-value transactions: Run checks on large or complex transfers that could involve sensitive markets or third parties.

Screening at these moments helps you maintain ongoing compliance without slowing down operations. As you apply these checks consistently, a few practical issues can show up, so it helps to understand what they look like.

Common Screening Issues and False Matches

Even with well-designed systems, sanctions screening can be difficult to manage. Many alerts do not represent real threats, but they still demand time and careful review. As a result, compliance teams often face large workloads and frequent interruptions.

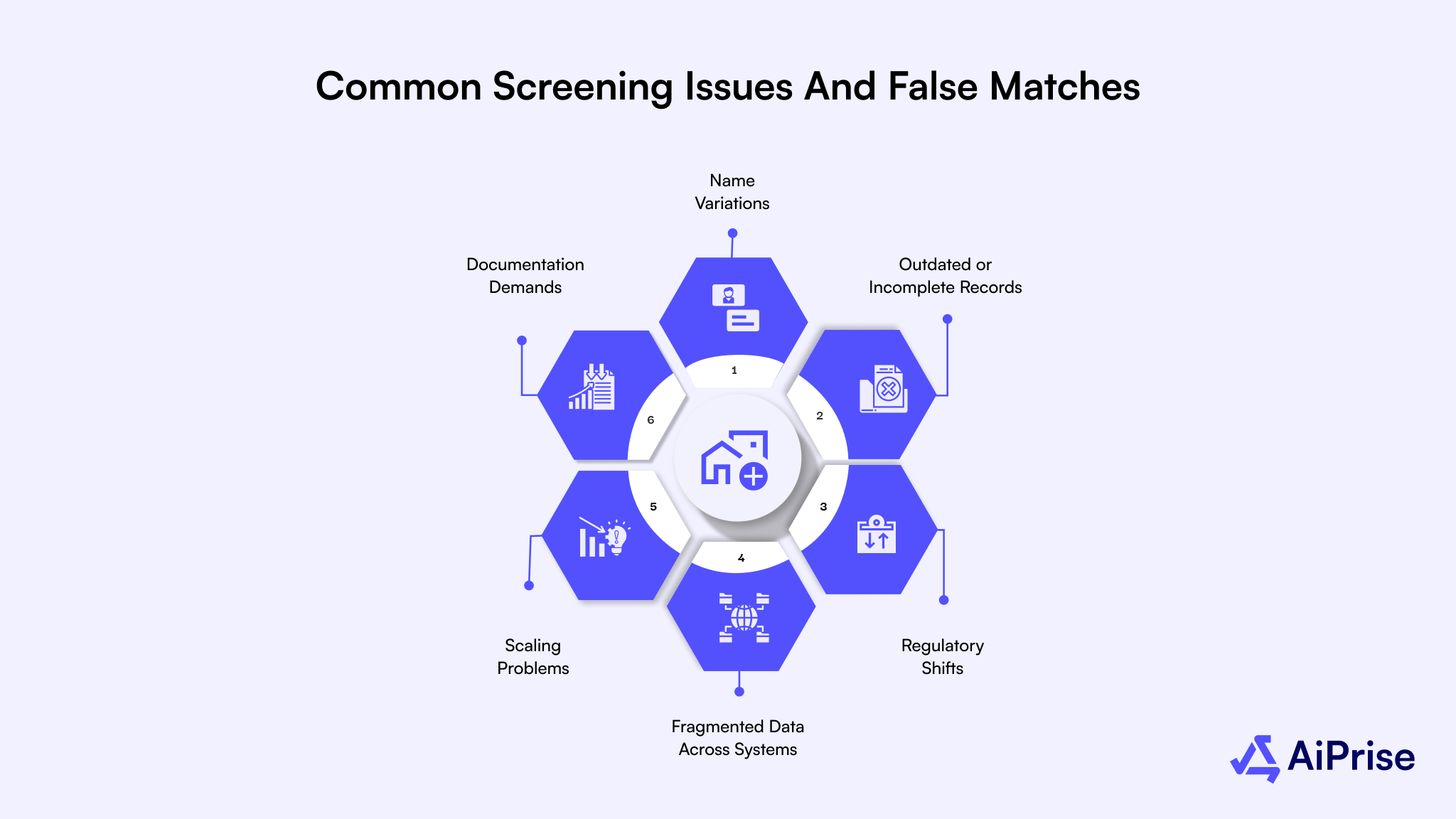

Here are some common issues:

- Name Variations

Names can appear in dozens of spellings, especially across different regions or languages. Slight differences in spacing or transliteration often trigger unnecessary alerts.

- Outdated or Incomplete Records

Customer details may change over time. Old addresses, updated names, or missing identifiers limit match accuracy and increase noise in your system.

- Regulatory Shifts

New or modified sanctions lists create sudden spikes in alerts, especially when updates happen without warning.

- Fragmented Data Across Systems

When information sits in different tools, your team has to jump between platforms to review alerts. This slows down your workflow and adds pressure to your compliance staff.

- Scaling Problems

As your business enters new jurisdictions, the number of required lists grows. Without a streamlined tool or workflow, screening becomes harder to manage.

- Documentation Demands

Regulators expect clean records, clear reasons for decisions, and complete audit trails. Many teams struggle to meet these standards while juggling large queues.

These challenges highlight where many teams struggle during screening. Luckily, there are a few practical habits that can make the entire process far easier to manage.

Frequent mismatches slow reviews and create unnecessary workload. AiPrise helps limit false positives with clearer data signals, AI-driven insights, and real-time watchlist updates for more confident decisions.

5 Sanctions Screening Best Practices to Reduce Risk and False Positives

Effective sanctions screening works best when your process is clear, steady, and easy for your team to follow. When you combine the right habits with the right tools, your checks become faster, more accurate, and far less stressful to manage. Follow the practices below to build that kind of workflow from day one:

1. Risk-Based Approach Screening

A risk-based method helps you prioritize high-risk customers, relationships, and transactions. Instead of screening every scenario at the same intensity, you assign levels based on exposure. This helps your team focus on what matters most while still maintaining compliance with regulatory expectations.

- Set screening rules for higher-risk regions

- Assign different review levels for different customer types

- Balance thorough checks with reasonable onboarding speed

2. Data Quality and Presentation

Screening accuracy depends on how clearly you can view customer details. When teams work with scattered or outdated records, false positives increase.

- Centralized customer profiles

- Clean data with updated identifiers

- A simple interface that organizes relevant alerts

3. Relevant Lists For Your Business

You don’t always need to screen against every list in the world. You only need the ones that apply to your customers, jurisdictions, and services.

- Identify mandatory lists for your region

- Add additional lists based on customer behavior

- Use software that updates lists automatically

- Introduce interval-based screening for high-risk groups

4. Strong Controls For Faster Case Management

Compliance work slows down when analysts switch tools or wait for data from different teams. Integrating your systems can solve this.

- Pulling customer data from one place

- Reducing manual lookups

- Improving case review speed

- Creating a smooth onboarding experience

Platforms like AiPrise support faster case resolution through centralized data, integrated workflows, and built-in audit trails.

5. Thorough and Scheduled Audits

Regular audits keep your screening workflow aligned with regulatory expectations. They also help you catch operational gaps early.

- Documenting your screening process

- Reviewing your software’s performance

- Checking the quality of your data

- Evaluating your team’s training and escalation process

- Running a gap analysis to highlight weaknesses

- Creating a remediation plan with timelines

When these practices work together, sanctions screening becomes more predictable and easier to manage at scale. The goal isn’t to add more checks, but to create a system where risk is identified early and handled consistently without slowing operations.

This is where having the right infrastructure in place starts to matter.

Also Read: Strategies for Third-party Due Diligence: Screening, and Risk Management

How AiPrise Supports Stronger Sanctions Checks

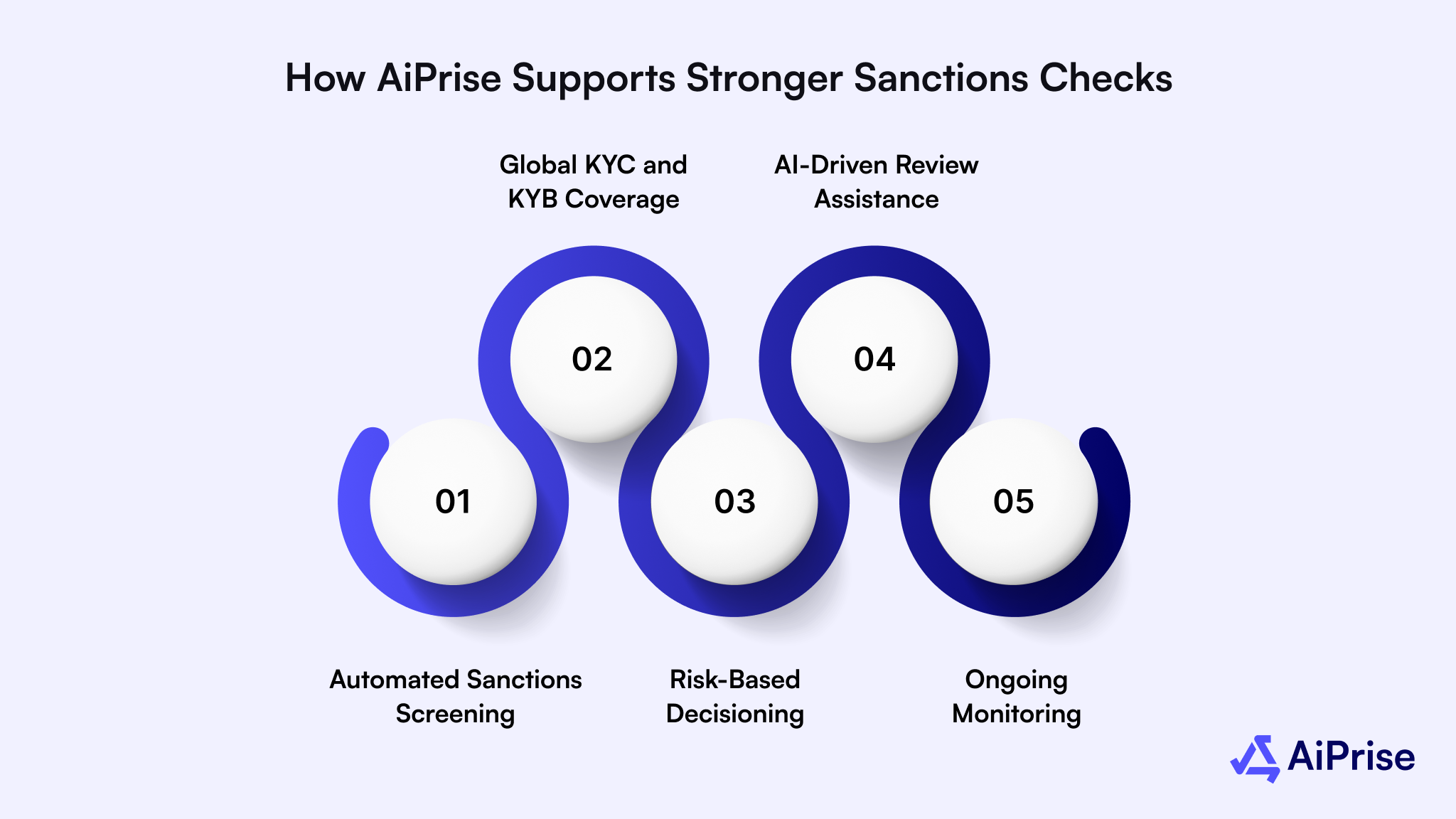

Strong sanctions screening depends on accurate data, consistent monitoring, and tools that can adjust as regulations shift. AiPrise supports this process by bringing identity verification, business validation, and automated risk checks into a single platform. This approach helps compliance teams maintain steady oversight without adding extra operational strain.

AiPrise combines global data sources, AI-driven screening, and flexible workflows to help organizations manage sanctions checks more effectively. Key features include:

- Automated Sanctions Screening

AiPrise offers continuous checks against global sanctions lists, PEP profiles, and adverse media to keep high-risk entities visible.

- Global KYC and KYB Coverage

Identity and business details are verified across worldwide sources, helping teams maintain consistency in onboarding and ongoing monitoring.

- Risk-Based Decisioning

Customizable rules allow teams to apply tailored risk thresholds, supporting faster and more confident case handling.

- AI-Driven Review Assistance

Document insights and automated case summaries reduce manual pressure, making sanctions review more efficient.

- Ongoing Monitoring

Alerts to changes in user risk profiles so your sanctions program remains current and responsive.

This combination helps you maintain reliable compliance standards while adapting to evolving regulatory demands.

Wrapping Up

Sanction checks are essential for protecting your institution from financial, legal, and reputational risks. Performing them consistently and accurately ensures that high-risk individuals and entities are flagged before they impact your business.

Understanding how and when to run a sanction check 5, combined with best practices, helps reduce errors and false positives. Using automated tools alongside structured processes makes screening faster, more reliable, and easier for your compliance team.

To simplify sanctions screening while maintaining strong compliance, AiPrise offers real-time verification, risk-based decisioning, and automated alerts. Book A Demo today to see how smarter screening can protect your operations and enhance efficiency.

FAQ’s

1. What are the 5 types of sanctions?

The five common types of sanctions include financial sanctions, trade restrictions, travel bans, arms embargoes, and sectoral sanctions. Each type limits specific activities to reduce risk tied to targeted individuals, entities, or countries.

2. What is a sanctions watchlist?

A sanctions watchlist is an official list of individuals, entities, vessels, or countries restricted by governments or global regulators. Compliance teams screen customers and transactions against these lists to prevent dealings with prohibited parties.

3. Is there a simple way to check if a vessel has a sanctions risk?

You can review vessel names and IMO numbers against maritime sanctions databases or use automated screening tools that track ownership and links to high-risk regions. This helps identify any potential compliance concerns quickly.

4. What is the 14th May sanction check?

The 14th May sanction check refers to regulations that came into effect on 14 May 2025. Since then, letting agents have been required to run financial sanctions checks on all parties involved in a tenancy, including tenants, guarantors, and landlords.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

Speed Up Your Compliance by 10x

Automate your compliance processes with AiPrise and focus on growing your business.