AiPrise

February 5, 2026

Top 5 KYB Providers with AI for Faster Business Verification

Key Takeaways

Ever wondered why your business onboarding still feels like it’s stuck in slow motion when every competitor is promising instant verification?

If you’re responsible for compliance, risk, or growth at a bank, payment provider, or crypto platform, you’ve likely lost revenue and frustrated partners because KYB workflows took too long or missed critical risk flags. With fraud techniques accelerating, from synthetic identities to deep-fake document attacks, legacy KYB approaches are proving costly and unreliable.

In fact, the U.S. identity verification market, which encompasses business verification like KYB, is projected to be valued at roughly USD 4.3 billion in 2025. This is due to escalating demand for secure, automated onboarding solutions across financial services and regulated industries.

Understanding how AI-enabled KYB reduces human bottlenecks, tightens compliance, and delivers decisions faster puts you in control of customer experience and risk outcomes.

That’s exactly why exploring the top KYB providers with AI matters for your business verification strategy today.

Quick Overview

- AI-driven KYB replaces manual checks with real-time business verification, ownership clarity, and continuous risk monitoring.

- Strong KYB platforms combine registry coverage, UBO intelligence, explainable risk decisions, and seamless onboarding integrations.

- Comparing providers shows clear differences in AI depth, pricing transparency, global reach, and KYB-first capabilities.

- AiPrise stands out by unifying global KYB, risk-based decisioning, and compliance automation in a single scalable platform.

How AI Is Transforming KYB Verification?

AI is reshaping KYB verification by replacing slow, manual business checks with real-time, intelligence-driven risk decisions built for regulated scale.

Here’s how AI-powered KYB verification directly solves the compliance, speed, and risk challenges you deal with every day.

- AI automates business identity verification by instantly validating registration data across U.S. federal, state, and global corporate registries.

- Machine learning models map complex ownership structures, accurately identifying UBOs even across layered entities and cross-border jurisdictions.

- Natural language processing scans filings, licenses, and adverse media to surface hidden compliance risks missed by rule-based systems.

- AI-driven KYB platforms flag high-risk entities early, reducing downstream AML escalations and costly manual investigations.

- Continuous monitoring replaces periodic reviews, alerting you when ownership, sanctions status, or business activity changes in real time.

- Automated risk scoring aligns KYB decisions with U.S. regulatory expectations, including FinCEN customer due diligence requirements.

- API-first AI KYB tools integrate directly into onboarding flows, minimizing friction for legitimate businesses while blocking risky entities.

- Intelligent decisioning reduces false positives, helping compliance teams focus on real threats instead of low-value reviews.

- AI shortens onboarding timelines from days to minutes, accelerating revenue without compromising regulatory defensibility.

- Scalable AI KYB systems adapt as transaction volumes grow, supporting expansion into new states, markets, and regulated products.

Once you understand where AI removes friction in KYB, the next step is knowing how to separate real capability from marketing claims.

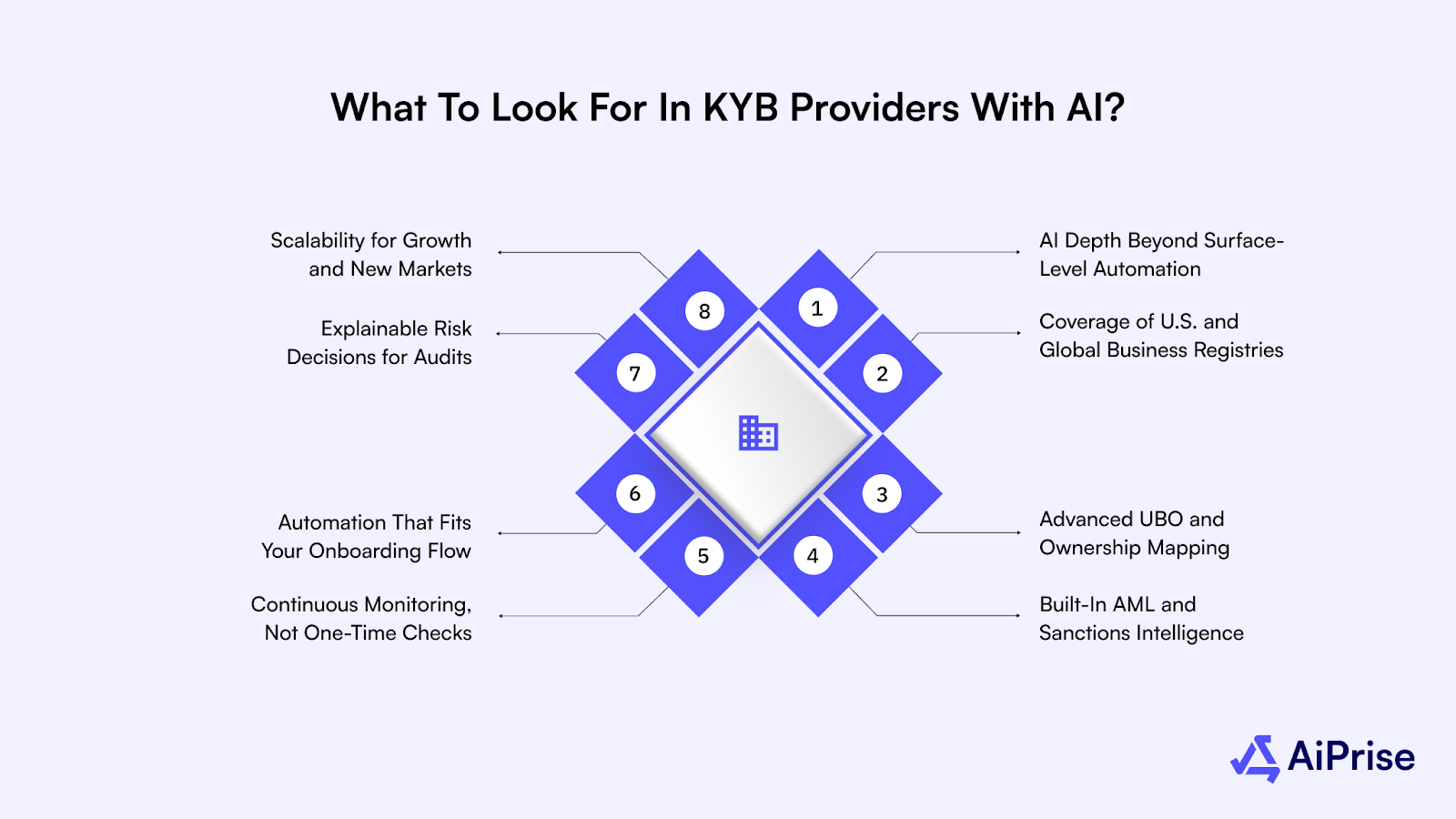

What to Look for in KYB Providers with AI?

Choosing the right AI-powered KYB provider determines whether your verification process scales smoothly or becomes a long-term compliance bottleneck. Before comparing vendors or pricing models, here are the specific capabilities that matter most for regulated businesses operating in the U.S. market.

1. AI Depth Beyond Surface-Level Automation

A strong KYB provider applies AI across ownership analysis, risk scoring, and monitoring rather than limiting it to document parsing. This matters because superficial automation still leaves your team exposed to manual reviews and inconsistent risk decisions.

2. Coverage of U.S. and Global Business Registries

The platform should verify entities using federal, state, and international registries relevant to your onboarding geography. Without broad registry coverage, your KYB checks may miss shell companies or improperly validated cross-border entities.

3. Advanced UBO and Ownership Mapping

Look for AI that accurately traces indirect ownership across subsidiaries, trusts, and layered corporate structures. This capability is critical when onboarding complex businesses where manual UBO verification often fails or slows approvals.

4. Built-In AML and Sanctions Intelligence

KYB tools must natively integrate sanctions screening, watchlists, and adverse media monitoring into business verification workflows. Disconnected systems increase operational risk and make regulatory audits harder to defend.

5. Continuous Monitoring, Not One-Time Checks

The right provider continuously monitors businesses for ownership changes, sanctions updates, and emerging risk indicators. This ensures compliance does not degrade after onboarding, especially for long-term or high-volume business relationships.

6. Automation That Fits Your Onboarding Flow

AI-powered KYB should integrate via APIs or SDKs directly into your existing onboarding and compliance infrastructure. Poor integration forces workarounds that slow approvals and frustrate legitimate business customers.

7. Explainable Risk Decisions for Audits

AI-driven KYB platforms must provide clear reasoning behind risk scores and verification outcomes. Explainability protects your organization during regulatory reviews and internal compliance audits.

8. Scalability for Growth and New Markets

Your KYB provider should support higher onboarding volumes without increasing manual workload or compliance headcount. This becomes essential when expanding into new states, products, or regulated financial services.

Also read: Performing KYB Verification and Risk Assessment

These evaluation points set the foundation for comparing providers that claim to offer AI-driven KYB at scale.

Top KYB Providers with AI For Verification

The right KYB providers with AI combine speed, regulatory depth, and intelligent risk detection to support compliant business growth at scale.

With the evaluation criteria in mind, the following providers stand out for delivering AI-driven KYB capabilities tailored to both enterprise and fast-growing fintech needs.

1. AiPrise

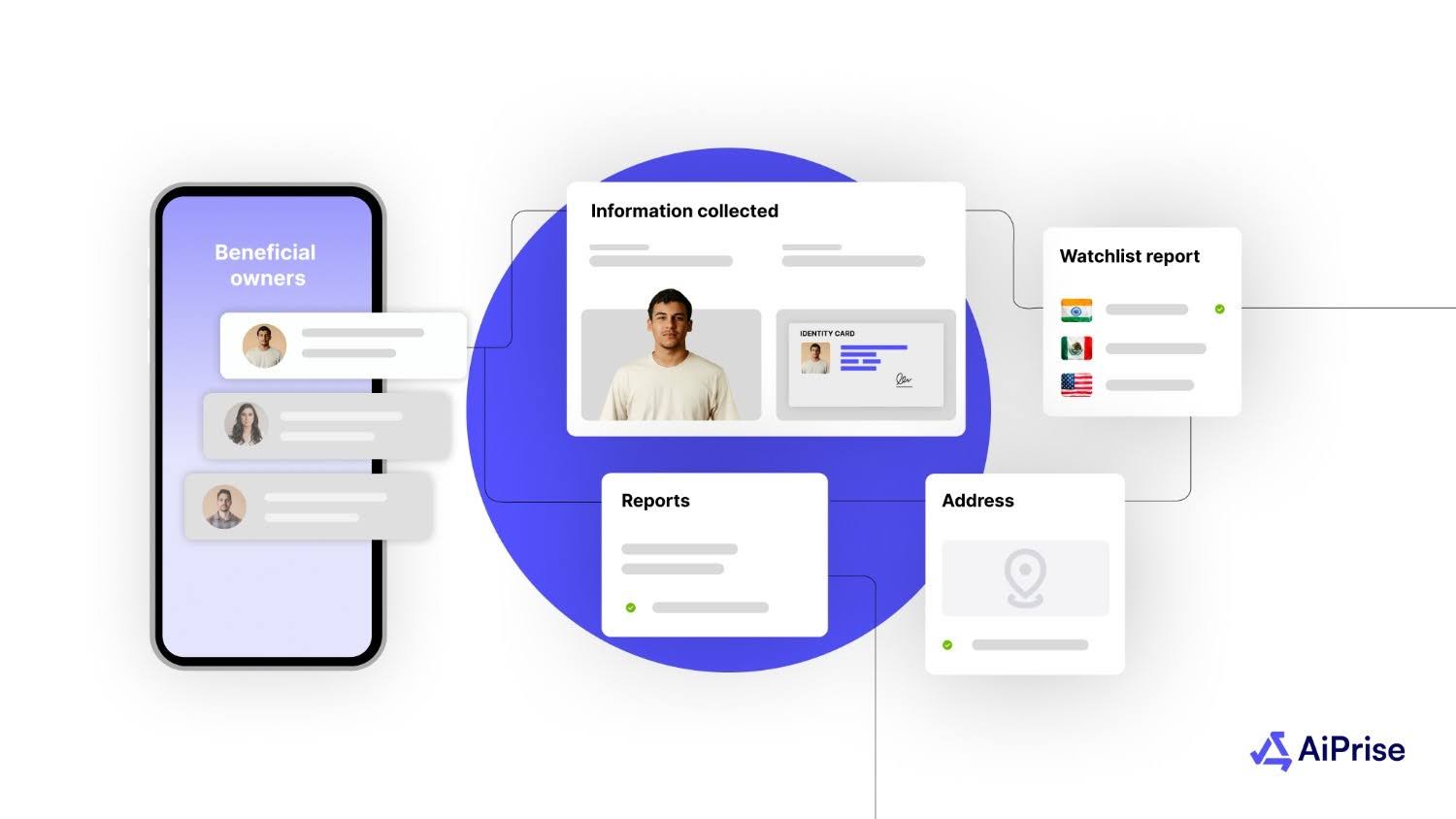

AiPrise is a unified AI-driven verification platform that helps you verify businesses and individuals while mitigating risk and meeting global compliance requirements. It enables you to scale across markets without operational complexity by combining KYB, KYC, fraud detection, and compliance automation into a single system.

Key KYB Features That Support High-Risk, High-Growth Businesses

- Global business registry validation across 200+ countries using reliable legal entity data

- Comprehensive UBO and stakeholder verification beyond minimum regulatory thresholds

- AI-powered ownership mapping to uncover hidden relationships and complex structures

- Social and online presence analysis to strengthen business risk profiling

- Risk-based decisioning using customizable rules aligned with your risk tolerance

- Continuous business monitoring to detect changes in ownership or risk status

- Seamless KYB workflows integrated through a single API and onboarding SDK

- Case management with complete audit trails for regulatory readiness

- Coverage of 500M+ verifiable businesses using 100+ authoritative data sources

AI-Powered Features That Differentiate AiPrise

- Compliance Co-Pilot uses AI agents to reduce manual case review time by up to 95 percent.

- Smart Document Analysis extracts and validates critical information from complex KYB documents instantly.

- Automated Sanctions Screening checks businesses and individuals against global watchlists in real time.

- Dynamic Risk Scoring adjusts decisions continuously using behavioral, registry, and contextual data signals.

- Explainable AI outputs ensure every KYB decision is auditable and regulator-ready.

Why Businesses Choose AiPrise?

Fast-growing regulated platforms choose AiPrise because it replaces fragmented compliance stacks with a single, scalable KYB engine. In one global AR platform case, AiPrise reduced verification timelines dramatically, improved accuracy, and removed the need for manual reviews, even with a lean compliance team. As the Compliance Officer noted, AiPrise’s global coverage, flexible risk rules, and modern technology stack made it a long-term partner for scaling KYB and risk-based decisions confidently.

Pros

- Extremely fast KYB and onboarding decisions

- Strong global registry and data coverage

- Advanced AI-driven risk and fraud detection

- Highly customizable workflows and rules

- Built for enterprise and fintech scale

Cons

- Best suited for regulated, growth-focused businesses

2. Sumsub

Sumsub is a global identity verification platform offering KYB, KYC, AML, and fraud prevention capabilities through a configurable, all-in-one system. It supports AI-assisted business verification workflows designed to help you onboard companies faster while maintaining regulatory compliance across jurisdictions.

Key Features Supporting KYB and Compliance Workflows

- AI-assisted business verification using global registries and corporate databases

- UBO identification and KYB screening aligned with AML requirements

- Configurable workflows for placing KYB checks at different onboarding stages

- Integrated AML screening with watchlists, PEPs, and sanctions monitoring

- Transaction monitoring to detect suspicious activity post-onboarding

- Device, email, and phone intelligence for additional fraud context

- Case management tools to investigate alerts and manage reviews centrally

- APIs, SDKs, and no-code options for faster implementation across platforms

Pros

- Broad global compliance coverage

- Flexible workflow orchestration

- Strong fraud and transaction monitoring

Cons

- KYB depth varies by geography

- Ownership mapping can require manual review

- Risk scoring less customizable than advanced platforms

- Business verification workflows can feel complex

- AI capabilities are not KYB-specific

- Scaling KYB often needs multiple configurations

Also read: How Fintechs Automate KYB Checks To Cut Verification Time And Risk 2026

3. ComplyAdvantage

ComplyAdvantage is a financial crime compliance platform focused on AML-driven customer and company risk screening for regulated enterprises. It is primarily designed to help you detect sanctions, PEP, adverse media, and transaction risks at speed using AI-powered intelligence.

Key KYB-Relevant Features

- Company screening to assess entity risk using sanctions, watchlists, and adverse media intelligence.

- AI-powered customer screening to support onboarding risk decisions for individuals linked to businesses.

- Ongoing monitoring to track changes in risk status across customers and companies.

- Sanctions and watchlist screening covering individuals, entities, and corporate networks.

- PEP and RCA databases to evaluate political exposure and indirect risk relationships.

- Adverse media monitoring using natural language processing across multiple languages.

- Transaction monitoring using rules, machine learning, clustering, and graph-based analysis.

- Payment screening to reduce sanctions exposure and false positives during transaction flows.

Pros

- Strong AML and sanctions intelligence coverage

- Advanced adverse media detection capabilities

- Trusted by large, regulated enterprises

Cons

- KYB focuses more on risk screening than verification

- Limited depth in business registry validation

- UBO verification requires external data sources

- Onboarding automation is not end-to-end

- Less flexible for custom KYB workflows

4. Trulioo

Trulioo is a global identity verification platform offering KYB, KYC, and AML capabilities with extensive international data coverage. It is commonly used by enterprises expanding into multiple regions that need broad registry access and standardized verification results.

Key KYB Features

- Business verification using global and local registries across 195 countries.

- Access to 700M+ verifiable business entities through aggregated data sources.

- KYB workflows are designed to support regional regulatory requirements and audits.

- UBO and business owner verification aligned with KYB and CDD obligations.

- Sanctions, PEP, and adverse media screening are integrated into entity checks.

- Modular API architecture supporting KYB customization by geography.

- Proprietary machine learning to route checks to optimal data sources by region.

- Support for complex, cross-border onboarding use cases.

Pros

- Exceptional global coverage and data reach

- Suitable for a multinational enterprise onboarding

- Strong compliance alignment across regions

Cons

- KYB workflows can feel rigid for fast-moving fintechs

- Ownership mapping lacks deep contextual risk analysis

- Custom rule configuration is limited

- Higher operational complexity during setup

- Less focus on end-to-end KYB automation

5. Middesk

Middesk is a U.S.-focused business identity verification platform built to help you validate companies, licenses, and registrations during onboarding. It is commonly used by fintechs and lenders operating primarily in the United States that need fast access to domestic business data.

Key KYB Features

- U.S. business verification using Secretary of State records and official filings.

- License verification to confirm industry-specific permits and registrations.

- EIN and business identity checks to validate entity legitimacy.

- Ownership insights based on available U.S. registry data.

- Sanctions and watchlist screening through third-party integrations.

- API-based KYB checks embedded into onboarding workflows.

- Ongoing monitoring for changes in business status and filings.

Pros

- Strong U.S. business registry coverage

- Simple setup for domestic KYB use cases

- Useful for early-stage fintech onboarding

Cons

- Limited support for global KYB requirements

- Ownership data can be incomplete for complex entities

- AML capabilities depend on external integrations

- Less suitable for high-risk or cross-border businesses

- Scaling internationally requires additional vendors

A strong domestic focus works for some teams, but cross-border growth quickly changes KYB requirements.

KYB Providers with AI Compared: Pricing, AI Capabilities, and Market Trust

When you’re evaluating KYB providers with AI, comparing pricing alone is not enough.

What truly matters is how deeply AI supports KYB workflows, how trusted the platform is by peers, and whether it scales with regulatory complexity.

Below is a comparison of five AI-driven KYB providers, focused on pricing transparency, AI depth for KYB, and real user sentiment.

Also read: Streamlining Business Onboarding with KYB: Ensuring Compliance and Efficiency

Seeing these platforms side by side highlights how pricing, AI depth, and trust signals vary widely across providers.

How to Choose the Right KYB Provider with AI for Your Business?

Selecting the right KYB provider with AI determines how effectively you balance onboarding speed, compliance confidence, and long-term scalability.

With multiple platforms offering overlapping capabilities, these decision factors help you identify the solution that truly fits your regulatory and growth needs.

- Evaluate how deeply AI supports KYB workflows, not just surface-level screening or document checks.

- Assess business registry coverage, especially across U.S. states and high-risk international jurisdictions.

- Verify whether UBO and ownership mapping handle complex, multi-layered entity structures accurately.

- Prioritize continuous monitoring to detect post-onboarding changes in business risk or ownership.

- Review integration flexibility to ensure KYB checks fit seamlessly into existing onboarding systems.

- Confirm pricing transparency to avoid hidden costs as verification volumes scale.

- Examine audit readiness, including explainable risk decisions and complete compliance trails.

- Choosing AiPrise gives you end-to-end AI-powered KYB, global coverage, transparent pricing, and scalable automation in one platform.

With the right criteria in place, the final decision becomes less about features and more about long-term fit.

Wrapping Up

Choosing the right KYB provider with AI is no longer just a compliance decision; it directly impacts onboarding speed, fraud exposure, and your ability to scale confidently.

By understanding how AI-driven KYB works and comparing providers on real capabilities, you put your business in a stronger position to reduce risk and accelerate growth. AiPrise helps you unify KYB, KYC, fraud prevention, and compliance automation into one AI-powered platform built for global scale.

If you’re ready to modernize business verification and remove KYB bottlenecks, Book A Demo and see how AI-powered KYB can work for your compliance strategy.

Frequently Asked Questions (FAQs)

1. What is KYB, and why is it important for businesses?

KYB, or Know Your Business, is the process of verifying business entities, ownership structures, and risk exposure to prevent fraud and comply with regulations.

2. How does AI improve KYB verification?

AI automates registry checks, ownership mapping, and risk scoring, significantly reducing manual reviews and onboarding delays.

3. Are there free KYB providers with AI?

Some KYB providers offer free trials or limited free checks, but full AI-powered KYB capabilities typically require paid plans.

4. What documents are required for KYB verification?

KYB usually requires business registration documents, UBO identity details, proof of address, and relevant licenses, depending on jurisdiction.

5. How long does AI-based KYB verification take?

AI-powered KYB can reduce verification timelines from days to minutes, depending on business complexity and data availability.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

Speed Up Your Compliance by 10x

Automate your compliance processes with AiPrise and focus on growing your business.

.jpg)

%20Can%20Improve%20Your%20Compliance%20Strategy.png)