AiPrise

11 min read

November 24, 2025

KYB Due Diligence: Proven Ways to Cut Compliance Risk

Key Takeaways

What if one missed verification lets a fraudulent company infiltrate your onboarding pipeline and trigger regulatory red flags overnight?

You’re juggling stricter AML mandates, unpredictable audits, and rising costs from manual business checks that slow customer onboarding. Every compliance slip risks penalties, license suspensions, and long-term damage to your institution’s credibility with investors and customers alike. In June 2025, the U.S. Department of Justice filed a $225 million forfeiture case linked to crypto money laundering. Understanding KYB AML compliance helps you prevent such exposure, maintain seamless operations, and build lasting trust in a tightening regulatory climate.

Quick Overview

- KYB compliance helps verify business legitimacy, ownership, and transparency, protecting financial institutions from fraud, money laundering, and costly regulatory penalties.

- Ineffective KYB practices lead to compliance fines, fraud exposure, and lost revenue, making continuous monitoring and structured reviews essential.

- Strengthening KYB involves defined risk policies, automation, document validation, and collaboration between compliance, operations, and tech teams.

- Integrating KYB with AML processes ensures early detection of illicit entities, accurate monitoring, and complete audit trails for regulatory confidence.

What is KYB Compliance?

KYB compliance, or Know Your Business compliance, is the process of verifying that the companies you work with are legitimate, transparent, and not tied to financial crime. Unlike KYC, which focuses on identifying individual customers, KYB goes deeper into validating a business’s registration, ownership structure, and source of funds. It’s a critical part of any AML (Anti-Money Laundering) framework, ensuring that your institution isn’t unknowingly enabling shell entities or fraudulent enterprises.

You need KYB compliance if you operate as:

- A bank onboarding business clients or corporate accounts

- A payment provider facilitating merchant or vendor transactions

- A crypto platform verifying wallet owners or institutional partners

- A lender or fintech assessing risk before issuing credit

- A high-risk merchant dealing with large or cross-border payments

A strong KYB program means faster onboarding, fewer false positives, and complete, auditable verification trails that keep regulators confident and your business protected.

Knowing what KYB is is only part of the challenge; understanding the consequences of poor execution highlights why thoroughness is even more important.

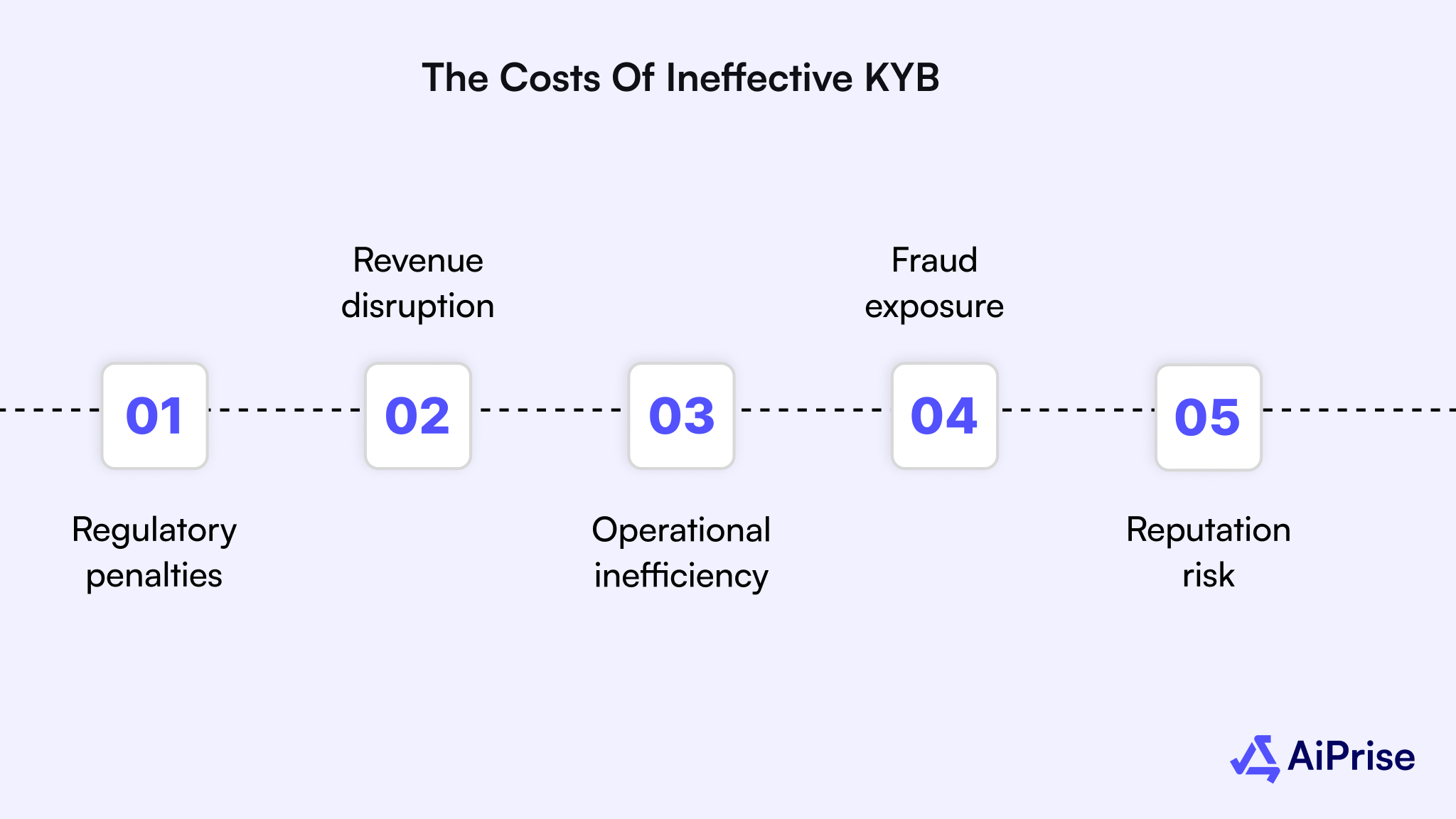

The Costs of Ineffective KYB

Ignoring KYB due diligence doesn’t just risk compliance penalties; it opens the door to financial losses and long-term reputational damage.

Here’s how ineffective KYB can silently drain your organization:

- Regulatory penalties: Non-compliance with AML and FinCEN rules can lead to hefty fines and enforcement actions that cripple profitability.

- Revenue disruption: Unverified or high-risk businesses often trigger account freezes, leading to lost transactions and delayed settlements.

- Operational inefficiency: Manual checks consume staff hours, reduce onboarding capacity, and create bottlenecks in customer acquisition.

- Fraud exposure: Shell companies or synthetic identities can slip through, causing direct financial losses or chargeback fraud.

- Reputation risk: Even one association with a fraudulent entity can destroy brand credibility and erode customer confidence.

Understanding how KYB connects to broader AML expectations helps you see the bigger picture of risk management and compliance integrity.

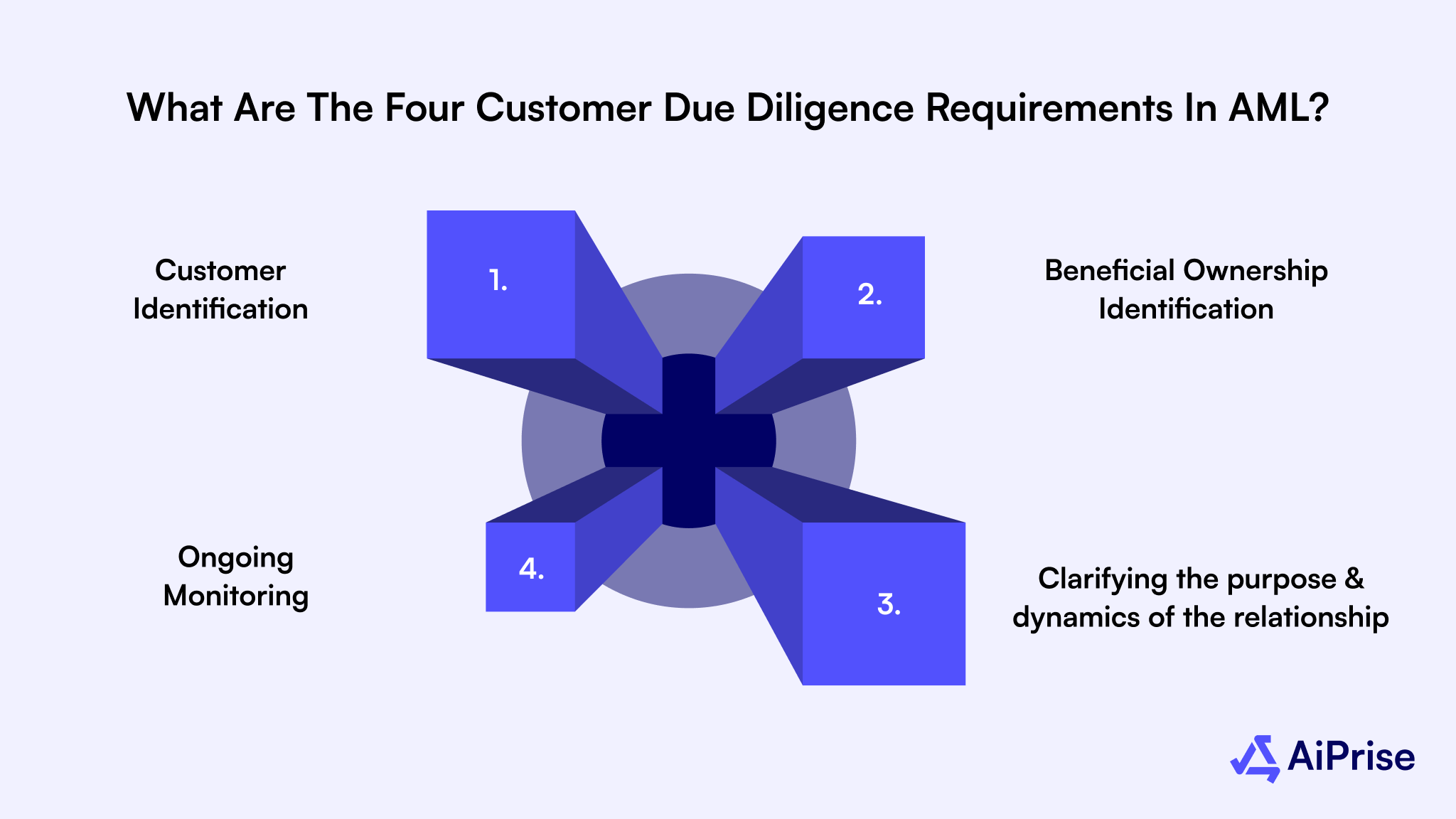

What are the four customer due diligence requirements in AML?

The four Customer Due Diligence (CDD) requirements in AML are designed to help financial institutions identify, verify, and monitor their customers effectively. They ensure that businesses understand who they are dealing with and can detect suspicious activity early. Here’s a breakdown of each requirement:

- Customer Identification: You must collect and verify key identity details, such as name, address, date of birth, and identification numbers, before establishing a relationship or providing financial services.

- Beneficial Ownership Identification: Determine the individuals who ultimately own or control a legal entity. This step prevents criminals from hiding behind shell companies or layered corporate structures.

- Understanding the Nature and Purpose of the Relationship: Assess why the customer is engaging with your institution, whether for personal, commercial, or investment reasons, to establish a baseline for expected behavior.

- Ongoing Monitoring: Continuously review transactions and account activity to identify anomalies, detect potential money laundering, and update customer information when circumstances change.

Each of these pillars forms a direct link to KYB practices, and failing to uphold them often leads to preventable mistakes within compliance workflows.

Also read: Why KYB for Companies is Essential: Ensuring Compliance and Mitigating Business Risks

Top Mistakes During KYB Compliance

Even with robust compliance teams, a few recurring mistakes often undermine the effectiveness of your KYB program.

Below are the most common mistakes you must avoid to stay compliant and efficient:

- Relying on outdated registries: Many firms depend on old or unverified databases, increasing the risk of onboarding inactive or fraudulent entities.

- Overlooking beneficial ownership checks: Missing Ultimate Beneficial Owners (UBOs) leaves major gaps in AML due diligence.

- Neglecting ongoing monitoring: A one-time verification approach misses later risks like ownership changes or new sanctions.

- Inconsistent escalation policies: Without standardized escalation thresholds, teams make subjective decisions that increase compliance inconsistencies.

- Fragmented documentation: Failing to maintain a central audit trail makes regulatory reviews time-consuming and error-prone.

Avoiding these errors requires a forward-looking monitoring process, one that never stops working after onboarding is complete.

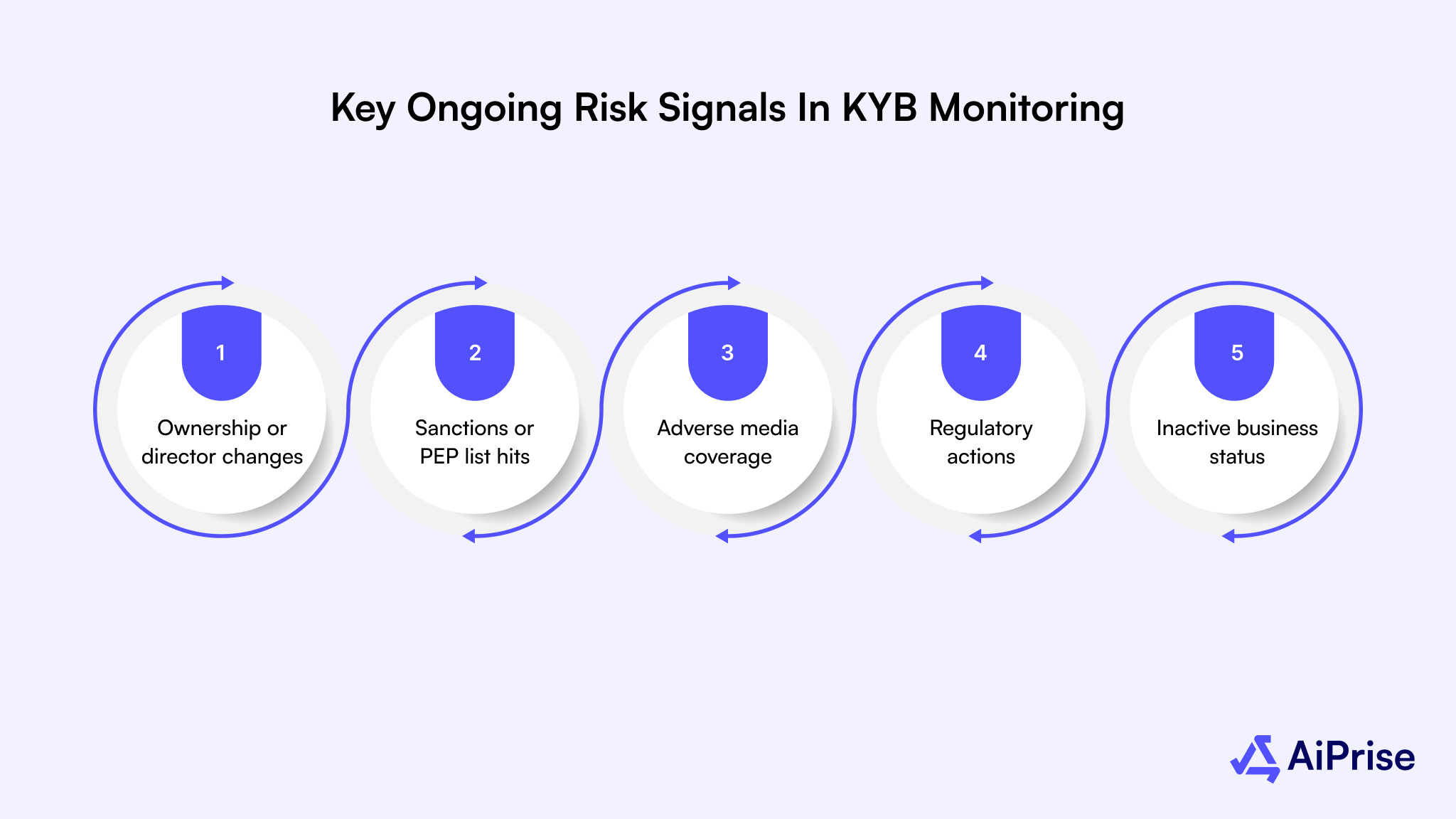

Key Ongoing Risk Signals in KYB Monitoring

Your work doesn’t end after onboarding; continuous KYB monitoring is crucial to stay ahead of evolving risks.

Here are the key warning signals your system should actively detect and flag in real time:

- Ownership or director changes: Track structural shifts that may introduce high-risk stakeholders or new shell-layering patterns.

- Sanctions or PEP list hits: Immediately review and halt transactions if any entity appears on updated watchlists.

- Adverse media coverage: Negative press involving fraud, corruption, or tax evasion signals potential integrity risks.

- Regulatory enforcement actions: Monitor government filings for lawsuits, suspensions, or license revocations tied to your business clients.

- Inactive or dissolved business status: Watch for changes in corporate registry data that indicate business closure or false reporting.

Detecting these signals is only part of the process; the real challenge lies in how effectively your teams act on them.

Also read: Top 5 KYB Software Providers in 2025

Proven Ways to Strengthen KYB Compliance

Building an effective KYB compliance strategy means defining responsibilities, automating workflows, and maintaining audit-ready documentation. Here’s how each core function in your organization contributes to a compliant, streamlined KYB framework:

For Compliance Leads

You set the tone for accountability and risk awareness across the organization. Establishing strong governance and adaptive oversight keeps KYB consistent and defensible under scrutiny. Here’s what you can focus on:

- Define and document a clear KYB policy that aligns with FinCEN, OFAC, and FATF expectations.

- Set measurable KYB KPIs, such as verification turnaround time and false-positive rate.

- Implement a tiered review framework for low-, medium-, and high-risk entities.

- Conduct quarterly internal compliance audits and maintain regulator-ready audit trails.

- Introduce periodic UBO revalidation when ownership or corporate control changes.

- Use integrated sanctions screening with automated updates from global and domestic lists.

- Build a feedback loop between compliance and product teams to refine verification thresholds.

- Maintain a regulatory change tracker to instantly update internal KYB policies.

- Create escalation templates for high-risk cases to ensure consistent decision-making.

- Benchmark your internal KYB program against peer institutions annually to spot process gaps.

For Onboarding Operations Teams

You bridge compliance rules with customer experience, ensuring business verifications are seamless yet thorough. Operational precision at this stage can drastically reduce compliance exposure and processing delays.

To make your process more resilient:

- Use OCR-enabled tools to capture and verify documents instantly without manual data entry.

- Validate incorporation details against U.S. Secretary of State databases and IRS EIN records.

- Collect at least two corroborating proofs of business legitimacy for every new entity.

- Flag mismatched addresses, inactive business statuses, or expired licenses for review.

- Establish “first 48-hour” onboarding SLAs to prevent pipeline backlogs.

- Create a shared repository for storing all KYB documents and evidence for cross-team visibility.

- Automate duplicate detection to prevent re-onboarding the same business under multiple aliases.

- Conduct spot checks on 5–10% of onboarded businesses every month to ensure process adherence.

- Collaborate with compliance on enhanced due diligence (EDD) workflows for high-risk entities.

- Train onboarding specialists on recognizing red flags like nominee directors or offshore incorporations.

For Product & Engineering Teams

You’re responsible for embedding compliance intelligence into the technology stack. Smart automation reduces errors, accelerates reviews, and strengthens long-term monitoring. Here’s how to build smarter, audit-ready systems:

- Integrate KYB APIs for instant verification and risk scoring during onboarding.

- Design modular workflows so new regulatory checks can be added without major reengineering.

- Use AI-based matching algorithms to detect anomalies in company names and filings.

- Build configurable dashboards for compliance teams to review real-time onboarding metrics.

- Enable role-based access controls to safeguard sensitive verification data.

- Automate case creation when risk scores cross predefined thresholds to avoid human oversight delays.

- Conduct load tests to ensure your KYB system scales smoothly during high-volume onboarding spikes.

- Use audit logs that automatically capture every verification action for traceability.

- Incorporate fraud detection signals, such as device fingerprinting and IP reputation checks.

- Partner with compliance early in development cycles to anticipate regulatory shifts and adapt fast.

All these elements ultimately reinforce one objective, strengthening AML compliance from the ground up.

Strengthening AML Compliance Through KYB

When you verify a business, you’re not just confirming its existence; you’re safeguarding your AML ecosystem from hidden risks. KYB acts as the front line of AML compliance by ensuring that every entity you onboard is legitimate, transparent, and traceable. Without it, even the most advanced AML tools can fail to detect suspicious activity buried beneath complex ownership layers.

Effective KYB practices make your AML program stronger in three major ways:

- Preventing illicit entry: By validating registration data and beneficial ownership early, KYB blocks shell companies before they access your financial network.

- Enhancing transaction monitoring: Verified business data feeds into AML systems, improving the accuracy of alerts and reducing false positives.

- Supporting regulatory audits: A complete KYB trail provides documented proof that every business relationship started with proper due diligence.

And when conflicts or mismatches arise during this process, your team needs a consistent, transparent way to make the right call.

Also read: How to Build Effective KYB Workflows for Seamless Business Compliance

Decision-Rubric for Conflicts & Red Flags

When your data sources show inconsistencies or alerts, a clear decision framework helps teams act fast and confidently.

Here’s a simple risk rubric you can apply across departments to standardize reviews:

While a structured review framework ensures objectivity, automation can make it faster and more dependable; that’s where technology like AiPrise comes in.

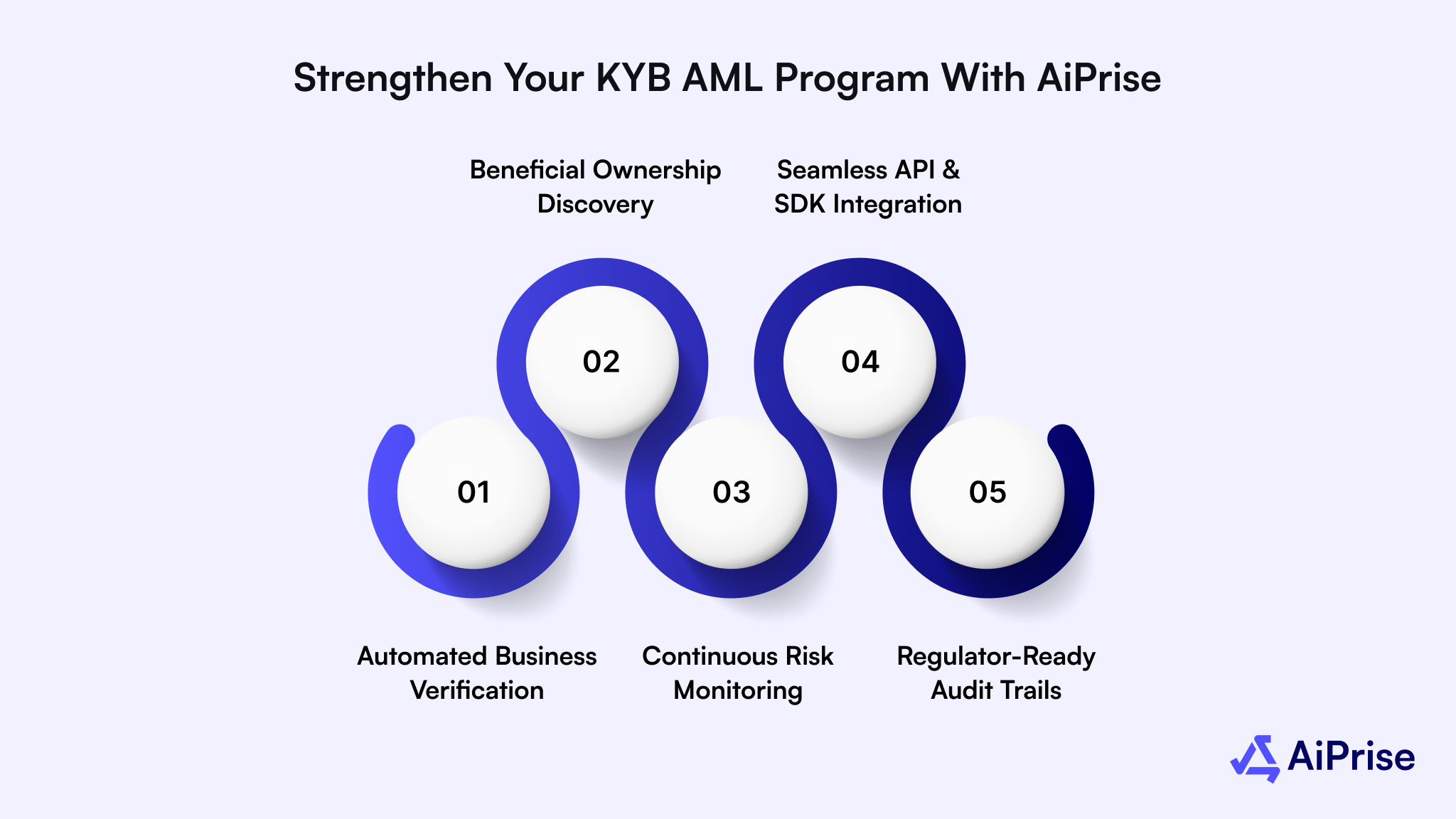

Strengthen Your KYB AML Program with AiPrise

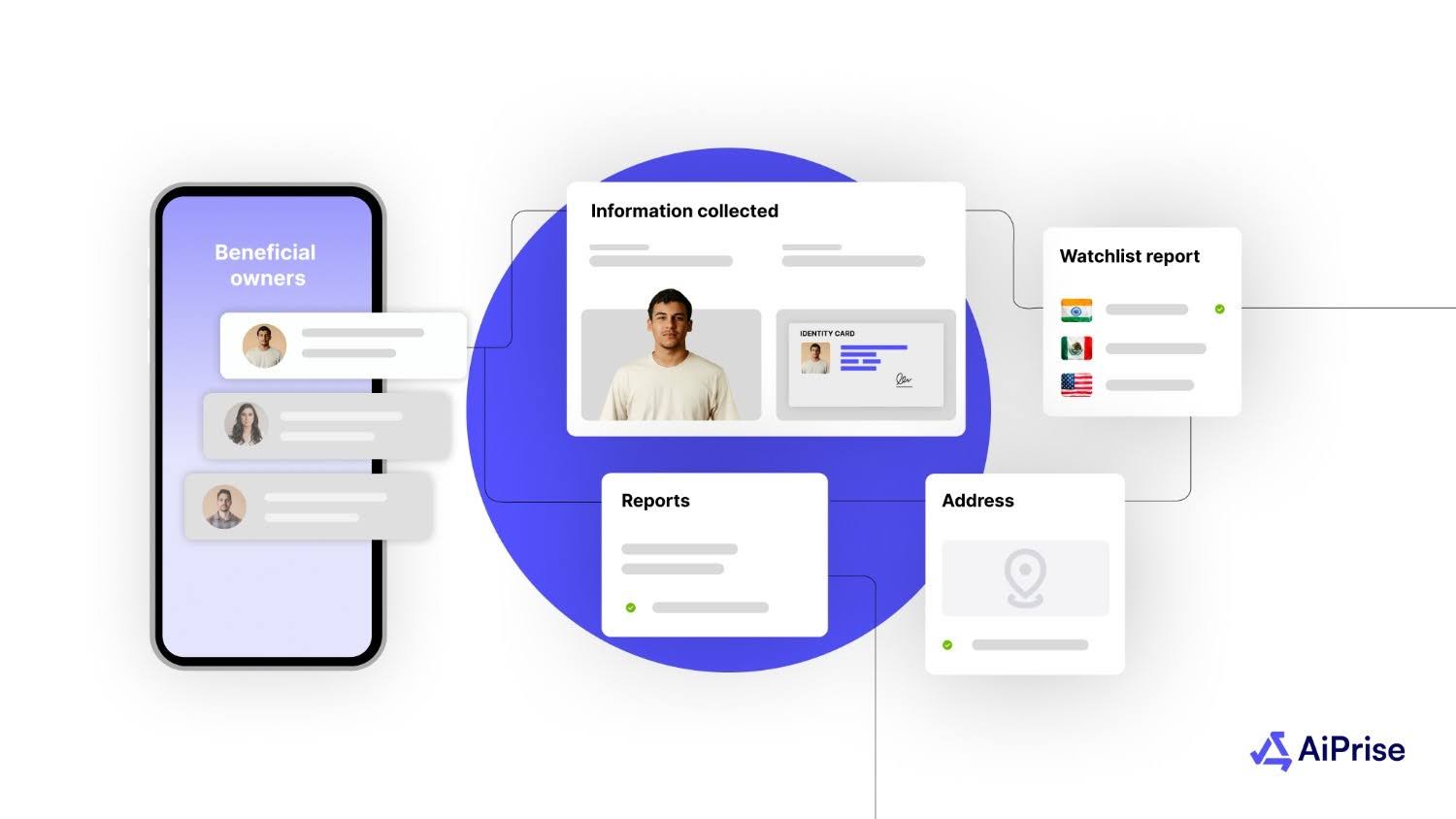

AiPrise empowers you to verify businesses faster, detect hidden risks earlier, and stay compliant without slowing down operations. Here’s how AiPrise makes KYB due diligence faster, smarter, and more reliable:

- Automated Business Verification: AiPrise runs KYB checks across 100+ trusted data sources, including registries, tax authorities, and sanction lists. By combining AI and machine learning, it eliminates manual lookups, helping you confirm a company’s legitimacy in minutes instead of days.

- Beneficial Ownership Discovery: The platform uncovers hidden corporate hierarchies and identifies Ultimate Beneficial Owners (UBOs) even in complex, multi-layered entities. This ensures you don’t miss indirect ownership ties that could expose your institution to AML violations.

- Continuous Risk Monitoring: AiPrise doesn’t stop at onboarding; it constantly monitors business clients for new sanctions, ownership changes, or adverse media. Automated alerts allow you to respond immediately before a minor issue escalates into a compliance breach.

- Seamless API & SDK Integration: You can embed AiPrise’s verification tools directly into your existing onboarding systems with minimal engineering effort. This ensures a smooth customer experience while maintaining rigorous compliance in the background.

- Regulator-Ready Audit Trails: Every verification, document check, and risk update is automatically logged for audit visibility. You can generate comprehensive KYB AML compliance reports on demand, proving diligence to regulators without scrambling for evidence.

AiPrise helps you simplify KYB AML compliance while protecting your business from fraud, financial crime, and reputational damage.

Conclusion

KYB compliance safeguards your business from hidden fraud, regulatory penalties, and costly reputational setbacks. A clear, well-structured verification process creates trust between partners and strengthens overall financial integrity. Maintaining consistent diligence builds operational confidence and ensures every relationship stands on verified, accountable ground.

AiPrise brings precision and speed to your KYB AML process through AI-powered automation and real-time data intelligence. Its platform simplifies onboarding, uncovers hidden ownership links, and monitors ongoing risk with unmatched accuracy.

Enhance compliance efficiency and protect your organization’s credibility. Book A Demo with AiPrise to see how it works.

FAQ

1. What is KYB, and how does it differ from KYC?

KYB, or Know Your Business, focuses on verifying the legitimacy of companies and their ownership structures, while KYC targets individual customers. KYB ensures that businesses you engage with aren’t shell entities or linked to financial crime. It’s a critical layer of AML compliance for financial institutions and fintechs.

2. Which documents are required for KYB verification in the U.S.?

Commonly required documents include Articles of Incorporation, Employer Identification Number (EIN) letter, Certificate of Good Standing, and business licenses. Proof of address and identification for Ultimate Beneficial Owners (UBOs) is also essential. These documents confirm both legal existence and operational authenticity.

3. How often should I update or review KYB records?

KYB records should be reviewed at least annually or whenever there’s a major ownership, registration, or operational change. High-risk entities may require quarterly reviews. Continuous monitoring tools can automatically flag updates, reducing manual oversight and compliance delays.

4. What counts as a beneficial owner (UBO) under U.S. regulations?

A beneficial owner is any individual who owns or controls 25% or more of a company, or exercises significant managerial control. Identifying UBOs helps prevent criminals from hiding behind complex corporate structures. The FinCEN CDD rule defines this threshold for financial institutions.

5. What triggers Enhanced Due Diligence (EDD) in KYB?

EDD is triggered when a business is linked to high-risk jurisdictions, politically exposed persons (PEPs), or inconsistent documentation. Adverse media findings or sanctions hits also prompt escalation. EDD involves deeper investigation, more verification sources, and closer oversight before approval.

6. How does KYB help with AML compliance?

KYB supports AML programs by confirming that business clients are genuine and financially transparent. It prevents the onboarding of entities involved in money laundering or tax evasion. Strong KYB procedures demonstrate proactive risk management and compliance readiness during audits.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

.jpg)

%20Can%20Improve%20Your%20Compliance%20Strategy.png)