AiPrise

13 min read

May 20, 2025

How to Verify Businesses from Angola

Key Takeaways

Doing business in Angola offers valuable opportunities for financial institutions, payment providers, cryptocurrency platforms, and other industries. However, it's essential to make sure these businesses are legitimate and adhere to both local and global regulations. This is key to preventing fraud, staying compliant, and maintaining a trustworthy business environment.

In this blog, we'll walk you through the key steps and resources needed for Angola company verification.

Why Business Verification is Important in Angola

Verifying businesses before engaging in transactions is critical, especially in Angola, a country rich in resources and growing rapidly in the global market. However, Angola faces challenges such as fraud, non-compliance, and illicit activities.

For financial institutions, payment providers, and cryptocurrency platforms, the risks of engaging with unverified businesses are high. Fraudulent companies can lead to significant financial losses, reputational damage, and regulatory penalties. Additionally, working with companies that fail to comply with Anti-Money Laundering (AML) regulations can result in serious legal consequences.

To begin the verification process, it's important to familiarize yourself with the key documents that serve as proof of a company's legal and financial standing

Key Verification Documents for Angola Businesses

When verifying a business in Angola, reviewing the key documents is essential to ensure its legitimacy and compliance with local laws. These documents provide a clear indication of the company’s legal standing, financial health, and operational structure. Below are the most important documents to check when verifying an Angola-based business:

Knowing which documents to verify is just the beginning. Let’s now focus on the specific steps and resources that will ensure a thorough business check.

Key Steps and Resources for Verifying Businesses in Angola

Angola company verification can be a challenging process, especially due to limited access to public databases. Below, we outline the primary steps you should take and the resources available for thorough verification.

- Check Business Registration

The first step in verifying any business in Angola is checking its registration status. The official registry for companies is managed by the Direcção dos Serviços de Empresas (DSE) under the Ministry of Justice and Human Rights. However, the site is in Portuguese, so it may require translation or the help of a local expert.

When verifying a business, it's essential to ensure that it is properly registered and holds the necessary legal documents, such as commercial registration certificates and statutes. Confirming registration through the DSE ensures that the business is legitimate and complies with Angolan law.

- Investigating Tax Identification Databases

Businesses in Angola are required to have a Tax Identification Number, Número de Identificação Fiscal (NIF), issued by the General Tax Administration (AGT). However, there is no publicly accessible online database for easy verification of businesses via NIF, which can complicate direct validation.

Although third-party services may offer NIF validation, these often come at a cost. Therefore, businesses need to rely on official certificates and additional verification methods to obtain a full picture of a company's legitimacy. Using NIF in conjunction with other verification steps provides a more comprehensive understanding of the business.

- Verify the Business's Legal Standing

Ensuring that a business is free from legal disputes or sanctions is essential. Angola's legal environment is regulated by various bodies and entities that govern commercial law. If you are unsure about a business's legal standing, consulting local legal firms or experts can provide valuable insights into any potential issues.

You can also check with the Angolan Ministry of Justice or the Angolan courts to gather more information about ongoing legal matters involving the business. Local experts can assist with navigating the legal complexities and ensuring the business is operating within the law.

- Validate the Business's Financial Health

To assess the financial stability of a business, reviewing its financial records is crucial. Many businesses in Angola are required to file annual reports or tax returns that provide insights into their financial status. These reports usually cover the company's balance sheet, income statement, and cash flow, offering a clear view of its financial health and helping spot signs of poor management or potential insolvency.

Although financial records may not always be publicly available, local accountants, auditors, or due diligence firms can help obtain this information. Engaging with trusted third-party services that specialize in financial checks can offer deeper insights into the company's financial viability, helping you make more informed decisions.

- Check for Industry-Specific Certifications and Licenses

Depending on the sector a business operates in, it may require specific licenses or certifications. For instance, businesses in the oil and gas sector are regulated by the National Agency for Petroleum, Gas, and Biofuels (ANPG), while companies in mining fall under the oversight of the National Agency for Mineral Resources (ANRM). Financial institutions are required to adhere to the regulations set by the Bank of Angola (BNA) and the Capital Markets Commission (CMC).

Ensuring that a business holds the necessary industry-specific certifications and licenses guarantees compliance with both general laws and sector-specific regulations. Verifying this through the relevant industry regulators will help confirm that the business operates within legal boundaries.

- Investigating Ownership and Management

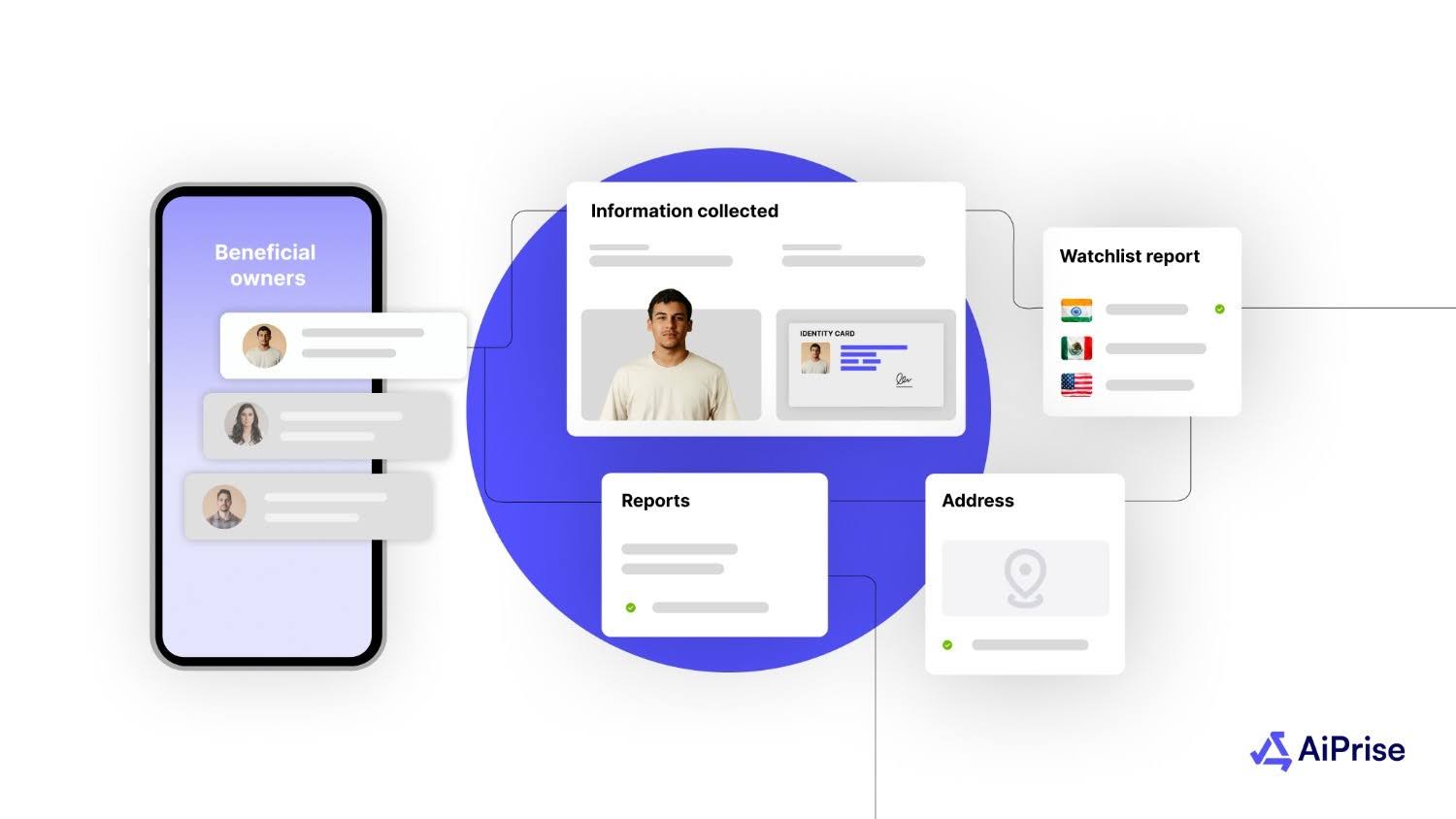

Understanding the ownership structure of a business is vital for transparency and risk mitigation. In Angola, it is especially important to verify the Ultimate Beneficial Owner (UBO) of a business. This process helps identify the individuals who ultimately control or benefit from the business, a key factor for complying with Anti-Money Laundering (AML) regulations.

Verifying the UBO is an essential step in preventing money laundering and fraud. Financial institutions and payment providers must ensure that the individuals behind a business are not linked to illicit financial activities. This verification process often requires public records or third-party services to gain deeper insights into the company's ownership structure and identify potential red flags.

- Utilizing Local Business Associations and Chambers of Commerce

Local business associations and chambers of commerce, such as the Angola Area Chamber of Commerce, can be useful resources for verifying businesses. These organizations have a deep understanding of the local market and can provide valuable insights into the reputation of businesses operating in the country. They also provide access to informal networks that may not be available through official channels.

Engaging with these associations can help validate a business's credibility and standing in the local community. By combining their insights with formal verification methods, you can build a more precise picture of the company's operations and trustworthiness.

Before you start, it's worth knowing the common roadblocks you might encounter along the way.

Common Challenges in Verifying Angolan Businesses

Angola company verification comes with specific hurdles that can slow down or complicate the process. While the right tools and strategies help, certain limitations are unavoidable. Here are some of the most common challenges companies encounter:

- Limited Online Access to Key Databases: Many government resources, including tax and business registries, are not fully digitized or publicly searchable. This makes remote verification time-consuming.

- Language Barriers: Most official websites and documents are in Portuguese. Without local language support, understanding legal and financial documents becomes difficult.

- Lack of Centralized Ownership Data: Information on Ultimate Beneficial Owners (UBOs) is not always publicly available, requiring deeper investigation or the use of paid services.

- Fragmented Regulatory Oversight: Businesses may be subject to multiple regulators depending on their sector. Verifying across various agencies adds complexity.

- Risk of Shell Companies or Fronts: Without on-the-ground checks, it can be hard to confirm whether a company exists physically or operates legitimately.

Even with these hurdles, there are practical ways to keep your business verification efforts on track.

Best Practices for Ongoing Verification

Despite the challenges, businesses can maintain a strong compliance posture by adopting proactive verification habits. These practices help ensure that existing partnerships remain secure and trustworthy. Here are proven ways to keep your verification efforts effective over time:

- Schedule Periodic Rechecks: Review registration, licenses, and legal status at regular intervals, quarterly or annually, to stay updated.

- Monitor for Ownership Changes: Keep an eye on shifts in company structure or UBOs that could introduce new risks or non-compliance.

- Track Regulatory Updates: Stay informed about changes in Angolan laws or sector-specific requirements that could impact existing business relationships.

- Use Continuous AML Screening: Implement automated tools that flag new risks, sanctions, or legal issues tied to the business or its owners.

- Engage Due Diligence Partners: Maintain relationships with trusted firms that can perform verification and provide reliable insights.

Implementing these best practices is essential, but using a platform like AiPrise can offer even more robust security and compliance for your business verification needs.

Seamless and Secure KYB Solutions with AiPrise

For companies looking to simplify the business verification process, AiPrise offers an AI-powered platform designed to simplify Know Your Business (KYB) checks. AiPrise provides comprehensive verification with speed, accuracy, and compliance as its foundation.

- AI-Driven Risk Assessment: AiPrise uses advanced algorithms to assess fraud risks and identify potential threats before engaging in business transactions.

- AML and Data Protection: The platform ensures full compliance with Anti-Money Laundering (AML) regulations, helping businesses remain aligned with evolving legal requirements.

AiPrise helps businesses stay ahead of any emerging risks or regulatory changes, providing peace of mind throughout the verification process.

Conclusion

Verifying businesses in Angola is essential for ensuring compliance with local laws and protecting against risks such as fraud and financial loss. While challenges like limited access to public databases and language barriers may arise, taking the right steps, such as confirming registration, reviewing key documents, and consulting with local experts, can lead to more effective verification. By staying proactive with regular checks and using tools like AiPrise, companies can maintain security and build reliable, compliant business relationships in Angola’s growing market.

To see how AiPrise can enhance your verification processes, Book a Demo today and experience the benefits of a secure, compliant solution.

FAQs:

- What documents do I need to verify a company in Angola?

To verify a company in Angola, you should obtain the commercial registration certificate, articles of incorporation, and tax identification number (NIF). You may also need to confirm industry-specific licenses based on the business sector.

- How can I verify the ownership of a business in Angola?

Verifying ownership, including identifying the Ultimate Beneficial Owner (UBO), can be challenging due to limited access to public data. AiPrise helps by automating the process, providing you with clear ownership details to ensure compliance with Anti-Money Laundering (AML) regulations.

- Are there any online resources for verifying businesses in Angola?

While public databases are limited in Angola, AiPrise offers an easy solution. It provides a comprehensive platform that consolidates business information, allowing you to perform thorough business checks and get up-to-date data on registration, ownership, and financial status.

- Why is it hard to verify companies in Angola?

The difficulty lies in limited online access to official records, language barriers, and fragmented ownership data. AiPrise helps overcome these challenges with an efficient platform that provides reliable verification while ensuring compliance with legal requirements.

- How can AiPrise help in verifying a company in Angola?

AiPrise offers an AI-driven solution for company verification. It helps you access important business documents, verify ownership structures, assess financial health, and ensure compliance with regulations—all in one platform.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

.jpg)

%20Can%20Improve%20Your%20Compliance%20Strategy.png)