AiPrise

11 min read

September 29, 2025

Top KYB Companies: Choosing the Best Business Verification

Key Takeaways

You’re growing your business, working with vendors, partners, maybe cross-border clients. But how can you really trust that the companies you deal with are legitimate? You don’t want to wake up one day to fines, bad publicity, or financial losses because your partner was fake, shady, or non-compliant. That’s where KYB (Know Your Business) comes in, today more important than ever.

In this blog, I’ll walk you through what KYB means, why your business can’t skip it, and which companies are doing it best in 2025. By the end, you’ll be able to pick the right KYB provider for your needs and know why AiPrise could be a smart choice.

Key Takeaways

- KYB (Know Your Business) means verifying a company’s legitimacy, ownership, and compliance, similar to KYC but for businesses.

- It’s essential for preventing fraud, meeting AML/CFT regulations, building trust, and scaling operations efficiently.

- Top KYB companies in 2025 include AiPrise, iDenfy, Vespia, Persona, Middesk, Ondato LTD, and Veriff, each with unique strengths.

- When choosing a KYB provider, consider factors like global coverage, accuracy, automation speed, monitoring, compliance, integrations, and cost scalability.

What is KYB?

You might already know what KYC (Know Your Customer) is: it’s verifying individual customers. KYB is like that, but for businesses.

KYB (Know Your Business) means verifying that a business is real, its legal status, ownership, directors, UBOs (ultimate beneficial owners), its registration, and whether it’s compliant with regulations.

It also means ongoing checks. Is the business still valid? Do any people associated with it show up in sanctions lists? Has ownership changed?

KYB helps you make sure the business you’re working with is who they say they are, and stays that way.

Importance of KYB for Your Business

Before you pick a KYB partner, it helps to understand why KYB is more than just legal paperwork.

You need KYB because:

- Regulatory compliance: Many countries have laws about anti-money laundering (AML), combating financing of terrorism (CFT), and transparency in business ownership. Failing KYB requirements can mean heavy fines, blocked operations, or worse.

- Fraud prevention: Fake businesses, shell companies, misrepresented ownership, these expose you to risk. Having a strong KYB system helps catch fraud early.

- Trust & reputation: You want your customers, investors, and regulatory bodies to believe that you take risk seriously. KYB helps build that credibility.

- Operational efficiency & scaling: Without KYB, every partner or vendor check becomes manual, slow, and inconsistent. With a KYB provider, you automate much of this, saving time and avoiding errors.

KYB isn’t just another box you tick to stay compliant; it acts like a protective shield for your business, helping you avoid fraud, meet regulations, and build trust with every partner you work with.

Also Read: Why KYB for Companies is Essential: Ensuring Compliance and Mitigating Business Risks

Now, let’s take a closer look at the top companies providing this protection in 2025.

Top KYB Companies in 2025

Here are some of the leading business verification / KYB providers this year. First, let’s see a comparison table, then understand in detail what makes each of them good (and when they might be less ideal).

Let’s understand these in more detail.

AiPrise

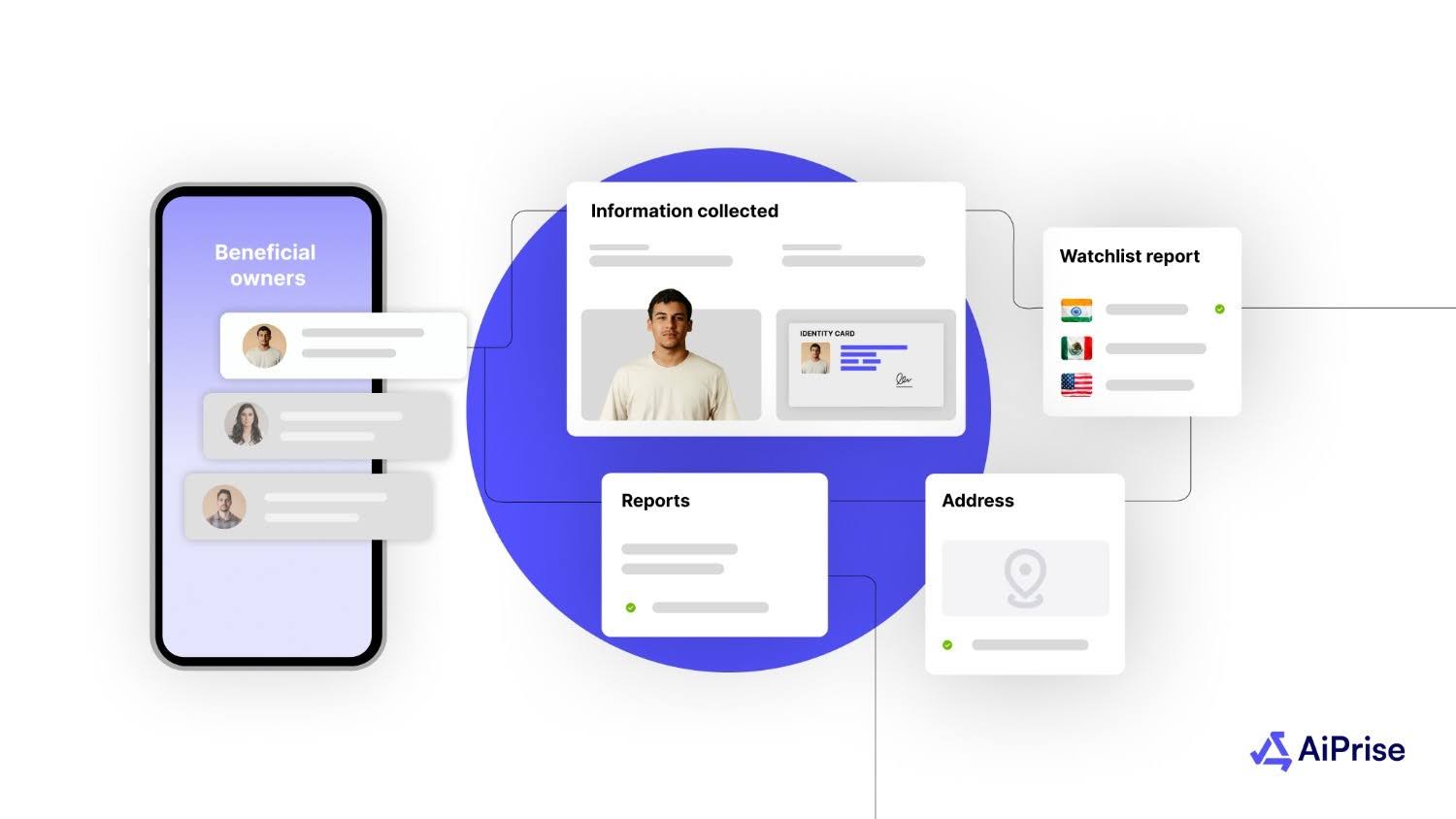

AiPrise is built to serve businesses that want global reach, tight fraud protection, and flexible workflows. From its documentation: it supports KYB coverage across many countries, with features like document insights, proof of address, tax / VAT number verification, risk scoring, and customizable workflows.

Strengths:

Very wide KYB coverage. For example, it supports many countries in Africa, requiring things like registration number, directors/shareholders, document proofs, tax ID, etc. If a country isn't explicitly listed, AiPrise still allows verification via incorporation documents or other proofs. AiPrise

- Workflows are customizable; you can set different verification thresholds, escalate edge cases, and control manual vs automatic reviews.

- Strong fraud & risk scoring built in; watchlist screening, document & identity checks, address verification.

Considerations:

- As with many comprehensive platforms, deeper customization or very niche regulatory requirements may require specific setup.

- Costs may be higher for very high-scale or extremely low-risk industries where slim verification is acceptable.

AiPrise helped a fintech platform serving the African diaspora in Europe automate its KYC process, significantly reducing manual review time, improving fraud prevention, and doubling conversion rates, all while maintaining compliance at scale. Read the full case study here.

If you’re aiming for global coverage and fraud-proof KYB, AiPrise is hard to beat.

iDenfy

iDenfy excels at providing a flexible KYB + KYC stack. It supports many types of corporate documents and works in many jurisdictions. It lets you adjust levels of verification (e.g. how deep ownership needs to be checked). iDenfy+1

Strengths:

- Good global registry access.

- Options for manual review when needed (good for edge cases).

- Transparent pricing and distinct modules.

Considerations:

- Deep ownership / shareholder tracing in some countries can still be limited depending on data availability.

- More customization tends to mean slightly more complexity in setup.

iDenfy offers flexibility and affordability, making it attractive for growing companies.

Vespia

Vespia’s strong point is speed + jurisdictional breadth. They claim business verification/UBO data from over 300 jurisdictions, fast AML compliance checks, and automated monitoring when things change. vespia.io+2vespia.io+2

Strengths:

- Very fast onboarding: their system aims to handle verification and checks in seconds or under 30 seconds in many cases. vespia.io+1

- Continuous monitoring (e.g. UBO changes, shareholder changes) and risk scoring built in.

- Dashboard + API + SDK integration; good support for customizing according to risk levels.

Considerations:

- For very tightly regulated sectors (banks, insurance), you may need heavier manual validation.

- If data in a jurisdiction is weak or registries are not updated, coverage or accuracy may drop.

With speed and scale at its core, Vespia is great for fast-moving businesses.

Persona

Persona offers unified KYB / KYC flows: that means businesses and the people behind them can be verified together. They also provide fraud signals (many data points), dynamic flows (so you only ask for what you need), and automation with human backup for special cases. iDenfy+3withpersona.com+3withpersona.com+3

Strengths:

- Good for minimizing friction for users: dynamic & conditional workflows (you don’t ask for more unless needed).

- Strong fraud prevention signals; built-in KYC + KYB helps catch issues earlier.

- High customizability and good UI/UX.

Considerations:

- Some features (ownership structure depth, UBO visibility) may vary by jurisdiction or depending on data sources.

- More advanced fraud detection features might come at a higher cost.

Persona shines for companies wanting smooth workflows and fraud prevention.

Middesk

Middesk is especially strong in the U.S. business verification space. If your operations, partners, or clients are U.S.-based (or you need U.S. registrations, EIN/TIN, etc.), Middesk is a top choice. middesk.com+3middesk.com+3vespia.io+3

Strengths:

- Direct connections with official U.S. data sources: Secretary of State, IRS, etc. Fresh data (many records updated recently). middesk.com+1

- Ability to do bulk lookups and automate business verification workflows.

- Fast/manual fallback for hard cases.

Considerations:

- Less global coverage compared to companies like Vespia or AiPrise (outside the U.S., registries vary).

- For companies needing frequent international KYB, may need to combine with other vendors.

If your focus is the U.S., Middesk is among the strongest options.

Ondato LTD

Ondato focuses on a hybrid verification + strong compliance posture. Good for regulated sectors (fintech, banking) where you need stronger oversight. They offer biometric AI verification, document checks, sanctions/PEP/adverse media screening, and manual review when needed. Ondato+1

Strengths:

- Highly compliant: they support active & passive liveness detection, human oversight, and strong further checks.

- Good for edge cases or high risk jurisdictions.

- Strong reputation in regulated markets.

Considerations:

- More manual work means possibly slower turnaround in some cases.

- Price for “premium” verification flows may be higher.

Ondato is ideal for compliance-heavy industries where strict checks are non-negotiable.

Veriff

Veriff is known for strong automation, large document library, speed, and global coverage. Founded in Estonia, it grew to support many languages, document types, and operate across jurisdictions. hyperverge.co+3Wikipedia+3Veriff+3

Strengths:

- Very high automation rates (many checks can be done automatically).

- Large document / country / language support.

- Strong fraud/identity verification features, including device & network signals.

Considerations:

- Some users report that support or UI/UX in edge cases could be better.

- Deep ownership / registry data might vary by country, like with others.

Veriff’s automation and global reach are strong, making it a solid choice.

Each of these companies brings something unique to the table, and understanding their strengths will help you decide which fits your business best.

Also Read: How to Avoid and Detect KYC Fraud

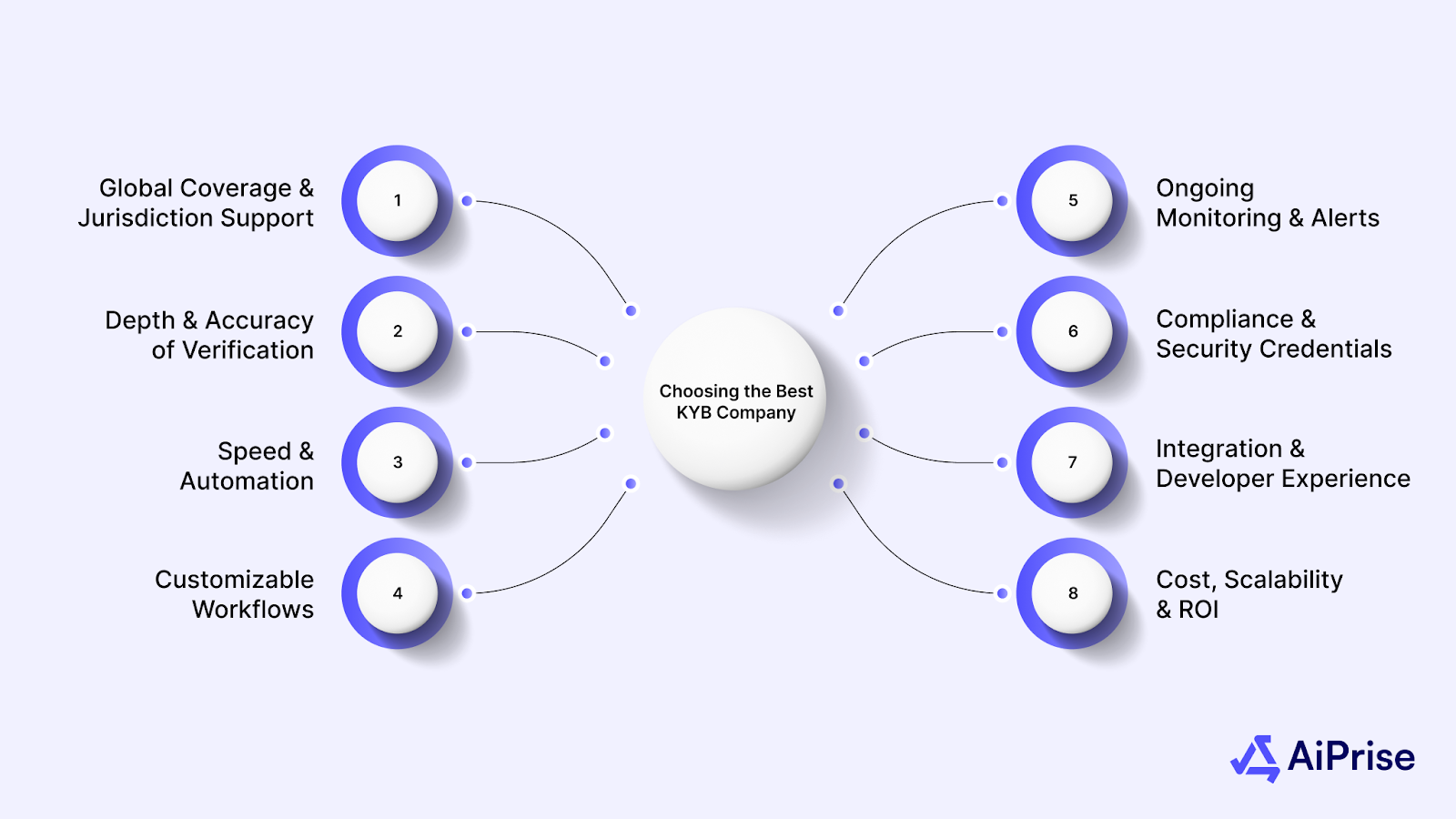

Factors to Consider While Choosing the Best KYB Company

Here are key things you should consider when choosing the right KYB partner. And yes, AiPrise has a distinct feature among these, which you’ll see.

1. Global Coverage & Jurisdiction Support

You’ll want a provider that can verify businesses in the places where you do business (or plan to). If you plan to expand, verify that they support not just country registration but also ownership data, UBOs, etc.

2. Depth & Accuracy of Verification

It’s not enough to check whether a business is registered; you need to know who owns it, whether they are on sanctions lists, and whether documents are valid and up-to-date.

3. Speed & Automation

The longer your verification takes, the more drop-offs, delays, and costs. Look for strong automation, fallback human review, and real-time risk scoring.

4. Customizable Workflows

Not all partners are equal. Maybe you want stricter checks for some industries, lighter ones for others. The ability to tailor the flow, ask for extra documents for some cases, and skip for others, is valuable.

5. Ongoing Monitoring & Alerts

Business info changes: UBOs change, registries update, and sanctions lists get updated. A good KYB provider gives you continuous monitoring and alerts.

6. Compliance & Security Credentials

Certifications, legal compliances (GDPR, local privacy laws), data handling, audit trails, all matter. You want a partner you can rely on in case stuff goes wrong.

7. Integration & Developer Experience

APIs, SDKs, dashboards, ease of onboarding for you (not just for your partner). If it's tough to integrate, you’ll pay more in development time.

8. Cost, Scalability & ROI

Cheaper isn’t always better. Look at pricing models: pay per verification, subscription, tiers. Make sure the platform can scale with you (more volume, more jurisdictions) without exploding cost.

Considering these factors will help you choose a KYB partner that not only meets today’s compliance needs but also supports your business as it grows and faces new challenges.

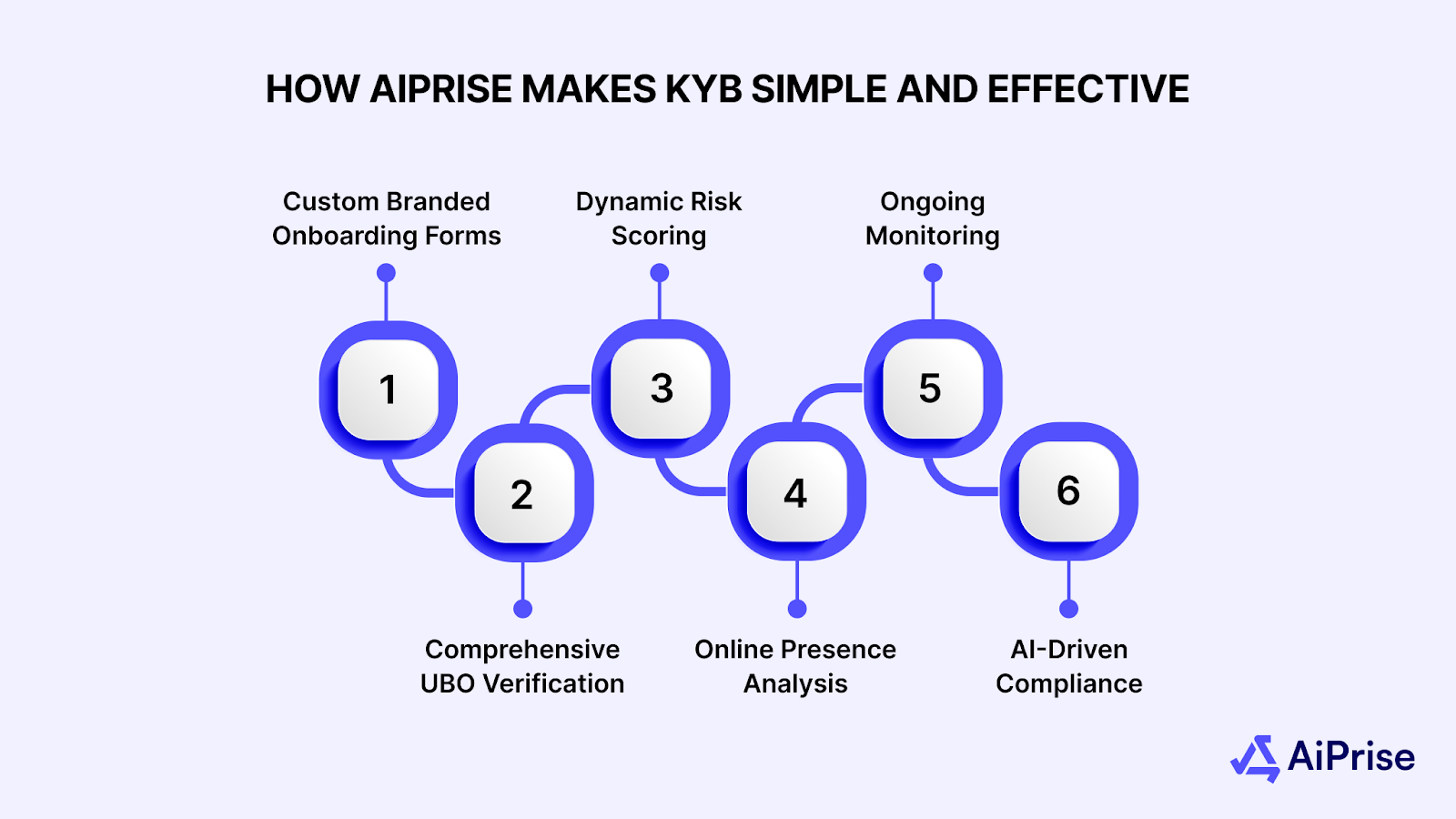

How AiPrise Makes KYB Simple and Effective

If you’re searching for a KYB partner that combines speed, depth, and ease of use, AiPrise stands out. Here’s how it can support your business verification needs:

1. Custom Branded Onboarding Forms

Create smooth, professional onboarding experiences for your partners and clients with forms that carry your brand. This not only builds trust but also makes the process seamless for everyone involved.

2. Comprehensive UBO Verification

AiPrise digs deep into business structures, giving you clear visibility into ultimate beneficial owners (UBOs) and shareholders. That means fewer surprises and more confidence in who you’re working with.

3. Dynamic Risk Scoring

Every business relationship comes with risk, but AiPrise makes it easy to measure and manage. With real-time risk scoring, you can quickly decide whether to approve, review, or reject a business.

4. Online Presence Analysis

Beyond official documents, AiPrise reviews a business’s digital footprint. This added layer of insight helps you spot red flags early, like suspicious activity or inconsistent information.

5. Ongoing Monitoring

Compliance isn’t a one-time job. AiPrise keeps monitoring businesses after onboarding, alerting you to changes in ownership, sanctions, or other compliance factors.

6. AI-Driven Compliance

With automation at its core, AiPrise reduces manual checks and speeds up the entire KYB process. You get faster decisions, lower costs, and the ability to focus on growing your business instead of drowning in paperwork.

With AiPrise, you can speed up your compliance processes by up to 10x while staying fully protected against fraud and regulatory risks.

Final Thoughts

KYB is no longer optional if you run a business that deals with other businesses, works across borders, or operates in regulated industries. Choosing the right KYB provider can protect you from fraud, regulatory penalties, and reputation harm, and can speed up your operations dramatically.

We’ve seen 7 strong providers in 2025: AiPrise, iDenfy, Vespia, Persona, Middesk, Ondato LTD, Veriff, each with their strengths. If global coverage, strong fraud protection, and flexible workflows matter most to you, AiPrise deserves a serious look.

If you're ready to strengthen your business verification strategy and avoid risks, why not Book A Demo with AiPrise today? You’ll be able to see how their KYB product works in your specific context.

Frequently Asked questions (FAQs)

1. What does KYB stand for, and how is it different from KYC?

KYB means Know Your Business; it’s about verifying entities (companies, organizations), ownership structure, registration, etc. KYC (Know Your Customer) is about verifying individuals. Both are important, but focus on different subjects.

2. Which industries most need strong KYB?

Fintech, payments, banking, crypto, marketplaces, supply chain, B2B platforms. Essentially, anywhere you are trusting or making financial commitments to other businesses.

3. How do KYB providers check ownership/UBO data in difficult jurisdictions?

Good providers use publicly available company registries, commercial registers, sometimes legal documents like incorporation certificates, and sometimes third-party business databases. When yardstick registries are unavailable, they may use document evidence and/or risk scoring to determine how much “certainty” is possible.

4. Can I have different levels of KYB depending on risk or geography?

Yes. Most strong providers (including AiPrise) allow you to customize verification flows: more documents or checks in high-risk countries or industries; lighter flow in low-risk cases. That helps balance cost vs assurance.

5. What are common pitfalls when choosing a KYB partner?

- Assuming coverage without checking ownership / UBO depth.

- Ignoring ongoing monitoring (ownership or sanctions changes).

- Choosing a provider without strong fraud detection.

- Underestimating integration / developer effort.

- Focusing only on price, ignoring risk and legal liability.

6. What is a KYB solution?

A KYB solution is a tool or platform that helps you automatically verify the identity, ownership, and legitimacy of businesses you work with. Instead of manually checking documents or digging through registries, a KYB solution collects data from trusted sources, screens for risks like sanctions or fraud, and keeps monitoring for changes over time. This saves you effort while ensuring your business stays compliant and secure.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

.jpg)

%20Can%20Improve%20Your%20Compliance%20Strategy.png)