AiPrise

7 min read

September 23, 2025

How to Choose the Right KYB Vendor for Effective Business Verification and Compliance

Key Takeaways

Selecting the right Know Your Business (KYB) vendor is essential for businesses aiming to meet compliance standards and verify the legitimacy of their partners, clients, and suppliers.

The global KYB market reached approximately $2.1 billion in 2024 and is projected to expand further due to rising compliance demands. With increasing regulations globally and a rising need to combat financial crimes like money laundering and fraud, having the right KYB solution in place is non-negotiable.

This blog explores key factors to consider when choosing a KYB vendor, ensuring your business is equipped with a reliable, efficient, and scalable verification solution. Read on to find out.

Quick Glance

- Choosing the right KYB vendor is essential for ensuring compliance and verifying the legitimacy of your business partners.

- A compliant KYB solution should include customer due diligence (CDD), sanctions and PEP screening, and real-time transaction monitoring.

- AI and machine learning are crucial in enhancing the accuracy and speed of risk assessments and fraud detection.

- Effective KYB solutions require integration with existing systems like CRM, ERP, and financial platforms for effortless operations.

- Vendor expertise and industry-specific experience are key to addressing compliance challenges and offering tailored solutions.

- AiPrise offers a comprehensive KYB solution with global regulatory compliance, AI-powered fraud detection, and integration capabilities.

The Growing Need for Robust KYB Solutions

Ensuring the legitimacy of your clients, vendors, and business partners is more critical than ever in a highly interconnected and regulated business environment. Fraud, money laundering, and other financial crimes have become increasingly sophisticated, putting organizations at significant risk. KYB solutions have become an integral part of due diligence and regulatory compliance, especially in industries like financial services, e-commerce, fintech, and insurance.

As financial crimes evolve, so too must the tools used to combat them. A compliant KYB solution helps businesses adhere to local and international regulations and safeguards their reputation, mitigates risk, and improves operations. Given the rising importance of AML (Anti-Money Laundering) and CFT (Counter Financing of Terrorism) measures, choosing the right KYB vendor that aligns with your business needs is critical.

It is time to learn about how to choose the right KYB vendor for your business. Let’s start with the role of regulatory compliance in choosing a KYB vendor.

The Role of Regulatory Compliance

Meeting regulatory requirements is critical for maintaining your organization’s operational integrity and avoiding legal penalties.

Global regulatory bodies, such as the Financial Crimes Enforcement Network (FinCEN), the European Union’s 5th Anti-Money Laundering Directive (5AMLD), and the 6th Anti-Money Laundering Directive (6AMLD), impose strict requirements on businesses to perform customer due diligence (CDD) and monitor transactions to combat money laundering and terrorism financing.

A compliant KYB solution must ensure that:

- Customer Due Diligence (CDD) is conducted to assess the risks posed by clients and verify the identity of all business entities.

- Sanctions and Politically Exposed Persons (PEP) Screening are incorporated into the solution, helping businesses avoid doing business with high-risk individuals or entities involved in criminal activities.

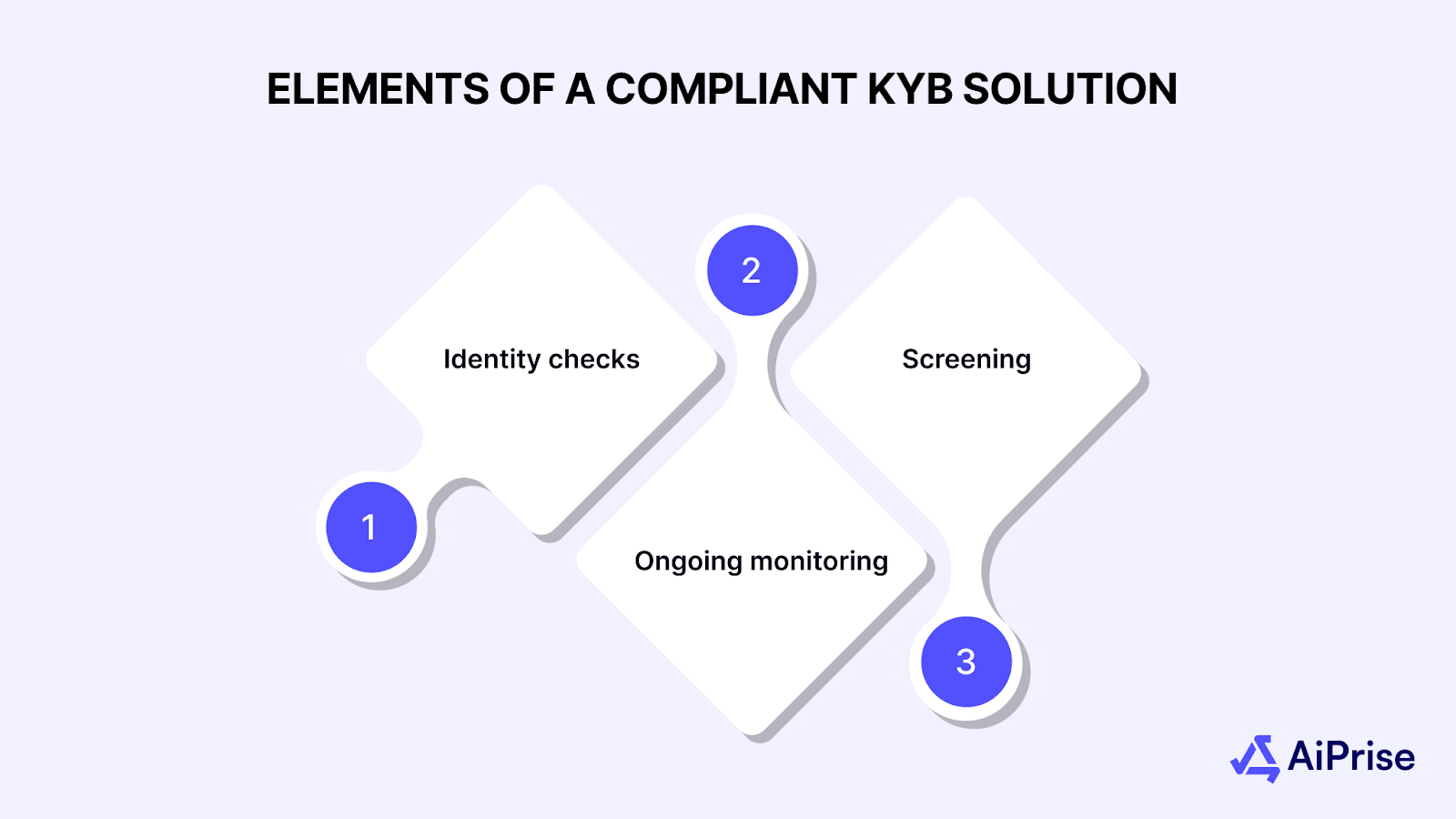

Elements of a Compliant KYB Solution

A compliant KYB vendor should offer comprehensive verification capabilities, including:

- Identity checks for businesses, including ownership structure and registered details.

- Ongoing monitoring of the client’s activities, ensuring continued compliance with AML and CFT regulations.

- Screening against global sanction lists and PEP databases to ensure that no business is engaged with sanctioned entities or individuals with potential criminal backgrounds.

With regulatory compliance in mind, let's now examine the potential of Artificial Intelligence (AI) and how it is an essential criterion in choosing your KYB vendor.

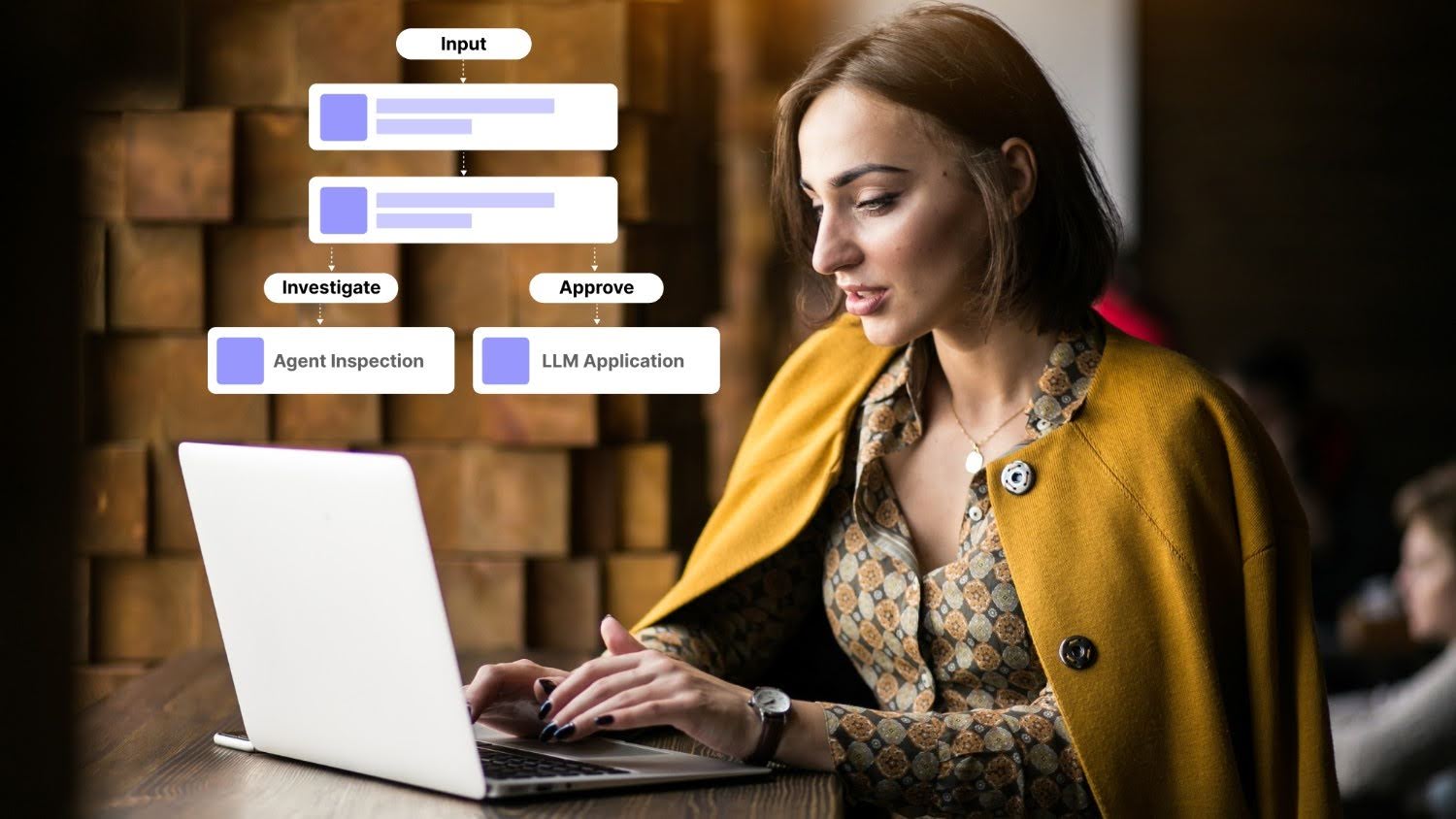

Artificial Intelligence for Enhanced Verification

Artificial Intelligence (AI) and Machine Learning (ML) are transforming business verification and compliance, making it easier to identify fraud, assess risks, and comply with global regulations. AI algorithms can analyze large volumes of data in real time, providing businesses with timely and accurate insights into the identity and risk profile of their clients.

While AI helps automate document verification by detecting signs of forgery or manipulation, ML models continuously learn and improve by analyzing past data to detect emerging fraud patterns, enhancing the accuracy of risk assessments.

Benefits of Dynamic Risk Scoring Using AI

AI-powered systems can assign dynamic risk scores to businesses based on various factors such as industry, geographical location, and transaction history. This continuous risk assessment allows businesses to do the following:

- Detect high-risk entities early in the onboarding process

- Implement tailored risk mitigation strategies based on an entity’s risk profile

As we continue, let’s examine the importance of data coverage and accuracy in verifying business legitimacy.

Ensuring Data Accuracy and Comprehensive Coverage

An effective KYB solution must have access to comprehensive data sources to ensure that the business entities being verified are legitimate. This includes checking against public and private registry data, government databases, and international sources that contain up-to-date, verified information about businesses.

KYB vendors must also be able to verify Taxpayer Identification Numbers (TIN) and Employer Identification Numbers (EIN) by cross-referencing them with government-issued databases such as the IRS (Internal Revenue Service). This ensures that the business is registered with the relevant authorities and complies with tax regulations.

With the importance of data accuracy and coverage established, let's explore the integration capabilities of KYB solutions with existing business systems.

Integration Capabilities with Existing Systems

For a KYB solution to be effective, it must integrate smoothly with existing business systems such as customer relationship management (CRM), enterprise resource planning (ERP), and financial systems. API-driven solutions enable this integration by providing businesses with easy-to-use connections to KYB vendors.

An API-powered system ensures:

- Seamless data transfer between systems.

- Real-time verification that does not disrupt business workflows.

- The ability to scale up verification processes as the business grows.

Advantages of Integrating KYB Solutions with Existing Business Systems

Integration with business systems allows for:

- Automated compliance workflows, reducing manual input and the chances of human error.

- Faster customer onboarding, as automated checks ensure that only legitimate businesses are approved quickly.

- Centralized management of compliance activities, providing easier oversight and reporting for auditors and regulators.

As we move forward, let’s look at how vendor expertise and industry experience can affect your decision when selecting the right KYB provider.

The Importance of Vendor Expertise and Industry Experience

When selecting a KYB vendor, it is essential to consider their expertise in your specific industry. Vendors with experience in sectors such as financial services, e-commerce, or fintech are more likely to offer tailored solutions that meet the unique challenges faced by businesses in those industries.

Industry-experienced vendors understand sector-specific regulations and compliance needs, providing more effective and relevant verification features.

Ensure that the KYB vendor has worked with businesses of a similar size, scope, and geographical reach as yours. A vendor with experience handling businesses in your specific market will be more adept at addressing regional compliance challenges and risks.

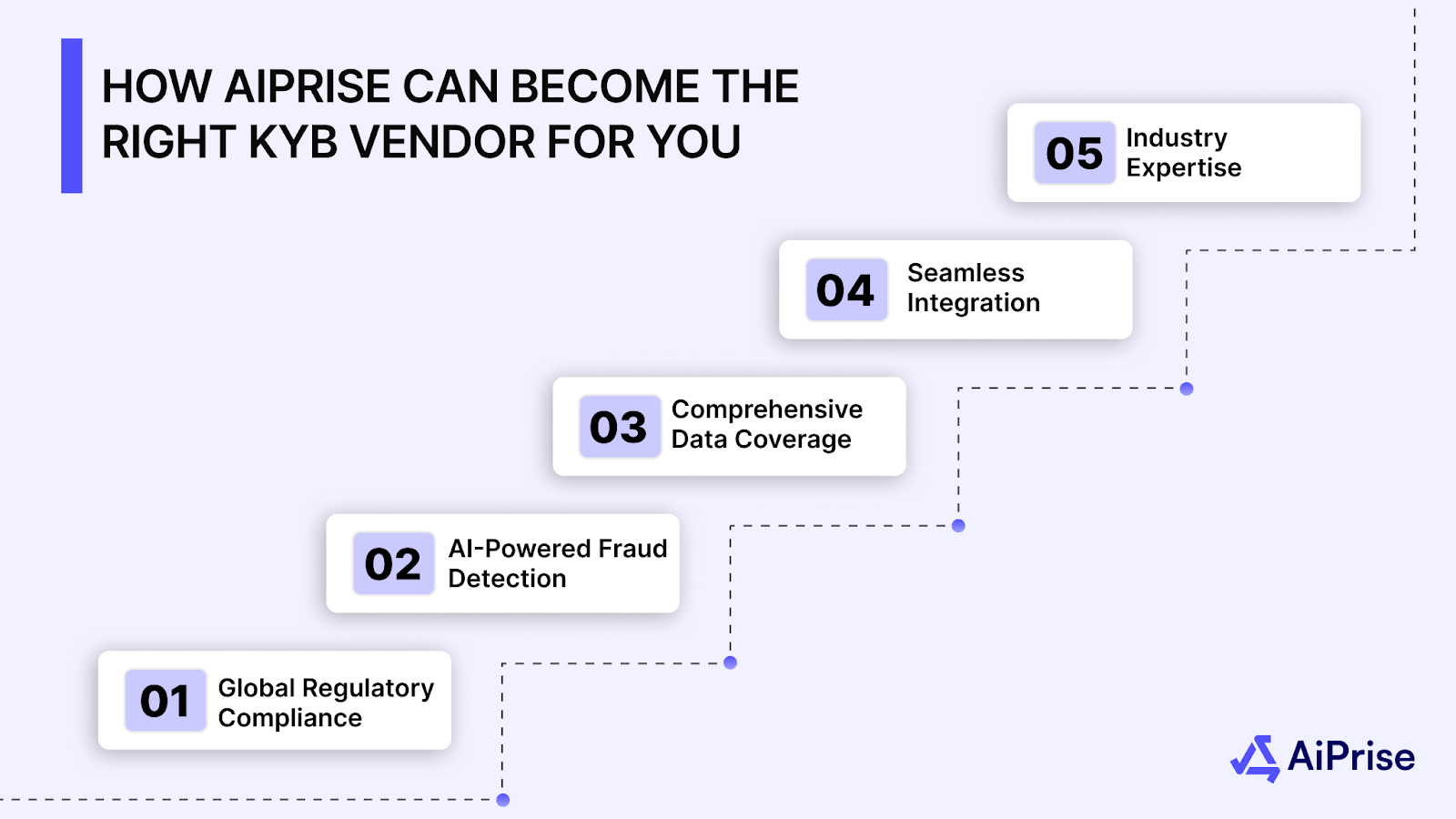

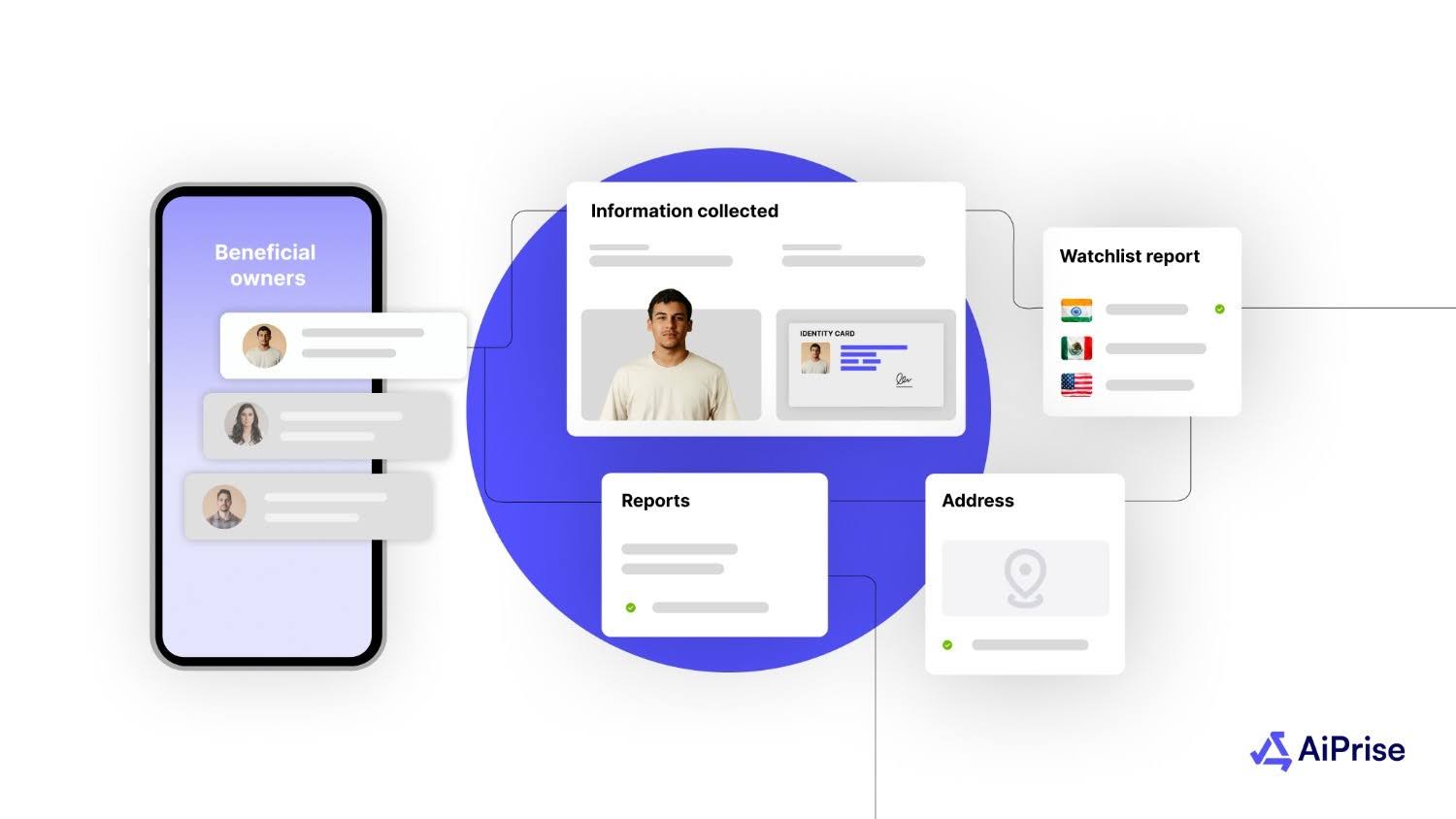

How AiPrise Can Become the Right KYB Vendor for You

AiPrise is a leading provider of comprehensive KYB solutions designed to meet the needs of businesses across various industries. By choosing AiPrise as your KYB vendor, you gain access to:

- Global Regulatory Compliance: AiPrise’s KYB solutions ensure compliance with the latest regulations, including 5AMLD, 6AMLD, and FinCEN’s CDD Final Rule, helping businesses stay ahead of regulatory requirements globally.

- AI-Powered Fraud Detection: With AI and machine learning (ML), AiPrise continuously analyzes business risks in real time, providing dynamic risk scoring and enhancing AML and CFT measures. This ensures that businesses can detect and mitigate fraud effectively.

- Comprehensive Data Coverage: AiPrise offers access to extensive databases for verifying Taxpayer Identification Numbers (TIN) and Employer Identification Numbers (EIN) with IRS records and other trusted sources, ensuring data accuracy and up-to-date business verification.

- Effortless Integration: AiPrise provides API-driven solutions that integrate easily with your existing systems, whether it is your CRM, ERP, or financial systems, offering a smooth and automated verification process.

- Industry Expertise: With experience in industries like fintech, insurance, and e-commerce, AiPrise’s solutions are tailored to meet your business’s unique needs and regulatory challenges.

Conclusion

Choosing the right KYB vendor is crucial to ensuring your business’s verification processes are both effective and compliant with global regulations. By selecting a vendor that aligns with your specific business needs, you can streamline your verification process, reduce risk, and stay ahead of emerging fraud threats.

To help meet these needs, AiPrise offers a comprehensive and customizable KYB solution designed to enhance your business's verification capabilities and ensure regulatory compliance.

Book a Demo today to explore how AiPrise’s advanced KYB solution can enhance your business’s verification process and keep you compliant with the latest regulatory requirements.

FAQs

1. How do I know if a KYB vendor is compliant with global regulations?

Ensure the KYB vendor complies with major global regulations, such as FinCEN’s CDD Final Rule, 5AMLD, and 6AMLD. They should offer features like sanctions screening, PEP checks, and real-time customer due diligence (CDD) to meet compliance standards.

2. Can KYB vendors help with the verification of Taxpayer Identification Numbers (TIN) and Employer Identification Numbers (EIN)?

Yes, many KYB vendors verify TIN and EIN by cross-referencing them with trusted sources like IRS records, ensuring the business is properly registered and compliant with tax regulations.

3. How can a KYB vendor integrate with my existing business systems?

Look for API-driven KYB solutions that easily integrate with your existing CRM, ERP, or financial systems. This ensures automated verification processes and improves operational efficiency without disrupting existing workflows.

4. Why is vendor expertise important when choosing a KYB vendor?

Vendor expertise ensures that the KYB solution is tailored to meet your specific industry needs. A vendor with experience in your sector, whether it’s fintech, insurance, or e-commerce, will understand your unique requirements.

5. What are the benefits of dynamic risk scoring in KYB?

Dynamic risk scoring uses real-time data to assess the risk associated with a business entity. This allows businesses to detect high-risk entities early in the verification process and tailor their compliance measures accordingly.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

.jpg)

%20Can%20Improve%20Your%20Compliance%20Strategy.png)