AiPrise

6 mins read

September 3, 2025

Why KYB for Companies is Essential: Ensuring Compliance and Mitigating Business Risks

Key Takeaways

If you manage compliance, onboarding, or risk checks, you're likely feeling the pressure. Regulatory demands are growing, and fraud is more complex. Failing to recognize a red flag can result in significant financial and reputational consequences.

According to PwC's Global Economic Crime and Fraud Survey, 42% of companies either lack a third-party risk management program or don't conduct risk scoring. These gaps often expose businesses to risk through the use of shell companies, fake vendors, or other fraudulent entities.

In this blog, we'll explore what Know Your Business (KYB) means, how it protects your company, and why it's more than just a regulatory formality. We'll cover the KYB process, its challenges, and how technology can improve your verification efforts. We'll also examine how different industries approach KYB and why it's so crucial.

Key Takeaways

- KYB verifies the legitimacy of a business, ensuring it meets legal standards and preventing fraudulent activities.

- The KYB process includes confirming ownership, verifying legal status, and screening for potential risks like sanctions or PEPs.

- Companies face challenges like manual verification, incomplete data, and compliance complexity when conducting KYB checks.

- Automated tools, such as AI and machine learning, can enhance the KYB process by improving speed, accuracy, and monitoring capabilities.

- AiPrise simplifies KYB with automated workflows, case management, and intelligent document analysis, reducing manual effort.

What KYB Means for You (And How It Differs From KYC)

Know Your Business (KYB) is the process of verifying a company's legitimacy and transparency. It involves checking business details, ownership structures, and risks. This differs from Know Your Customer (KYC), which focuses on verifying an individual's identity and background.

KYB ensures a business operates legally and transparently, preventing fraud and money laundering. KYC focuses on verifying the individual's background and identity.

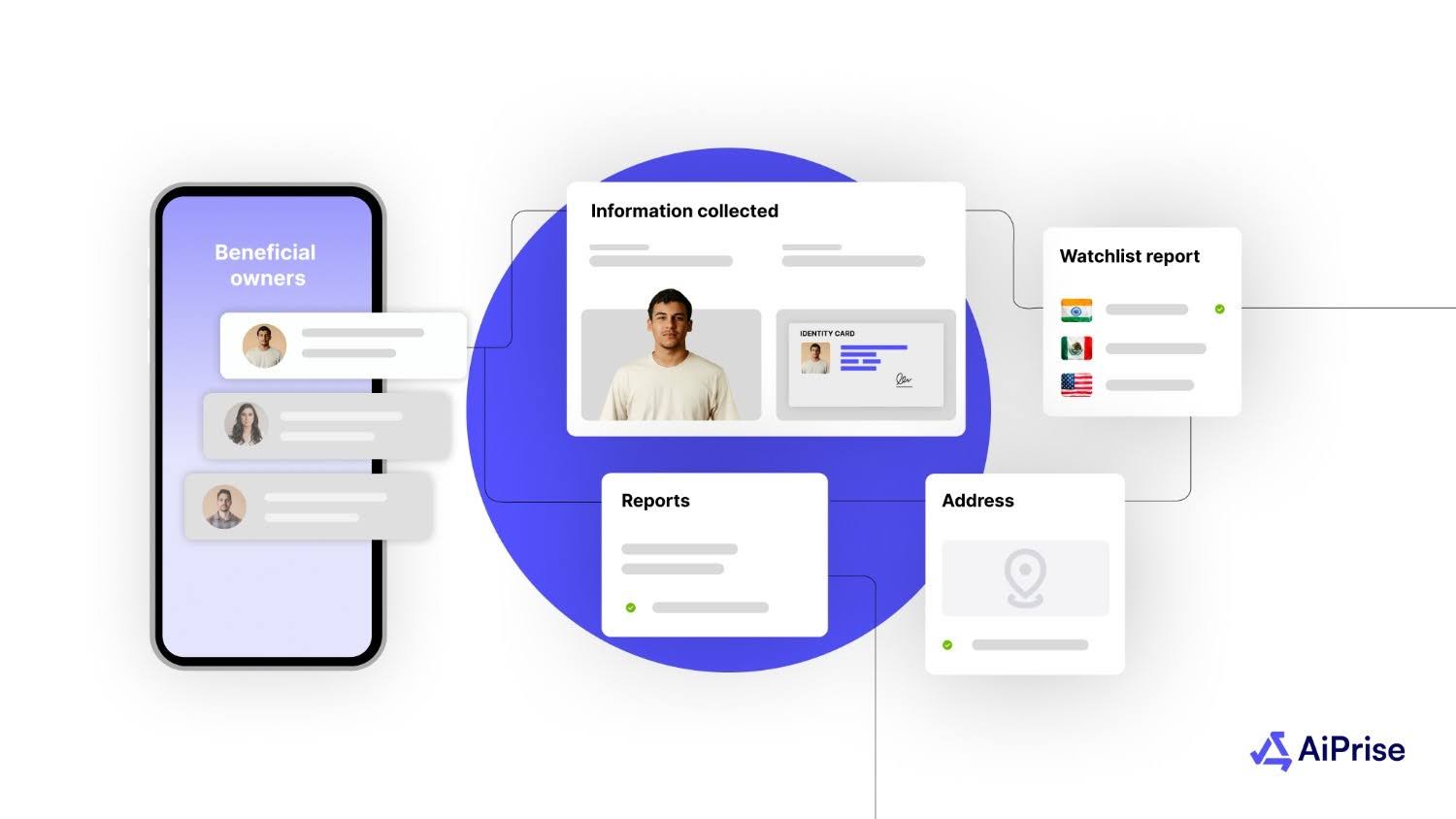

The KYB process involves gathering information about a company's structure, verifying its beneficial owners, and screening for risks such as sanctions or politically exposed persons (PEPs). Identifying the actual ownership and operations of a business ensures protection from potential financial crimes.

With the basics of KYB covered, it's time to look at the reasons why this process is more than just a regulatory formality.

Also Read: Understanding KYC and KYB Challenges in Emerging Markets

The Importance of KYB for Business Compliance and Risk Management

KYB is crucial not only for compliance but also for managing risks and preventing fraud. It helps safeguard your business and build trust with clients and partners. As financial crimes become more complex and regulations tighten, KYB helps ensure your business remains both secure and compliant.

Here's why KYB matters for your business:

- Protects Against Fraud: Verifying business legitimacy reduces the risk of engaging with fake vendors or fraudulent companies.

- Ensures Compliance: Meets regulatory obligations across different regions, including KYC, AML, and counter-terrorism laws.

- Reduces Risk: Identifies complex ownership structures and high-risk individuals, preventing future liabilities.

- Builds Trust: Demonstrates to clients and partners that your business prioritizes security and is committed to transparency.

- Prevents Reputational Damage: Avoids associations with illicit businesses, protecting your company's reputation.

- Safeguards Financial Integrity: Helps prevent financial losses and regulatory fines through proper verification.

With a clear understanding of its significance, let's now explore the detailed steps involved in the KYB process.

Also Read: Understanding Regulatory Compliance: Definition And Requirements

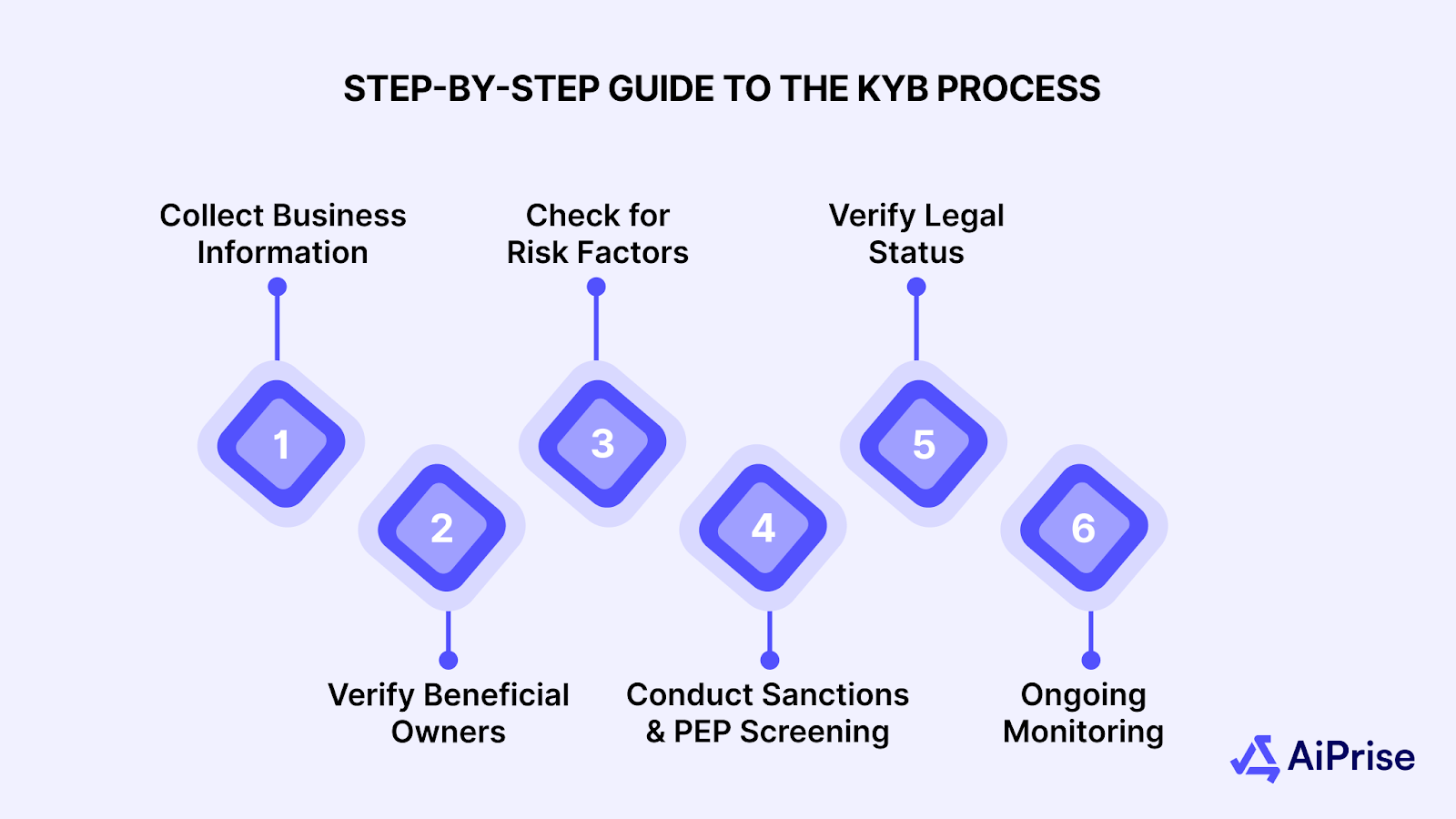

Step-by-Step Guide to the KYB Process: How to Verify Business Legitimacy

The KYB process involves verifying the legitimacy and transparency of a business. It ensures compliance with legal and regulatory standards while protecting your company from potential risks. Understanding the process helps you implement effective verification practices.

Here are the key steps in the KYB process:

- Collect Business Information: Gather essential company details, such as its registration number, legal name, and business address.

- Verify Beneficial Owners (UBOs): Identify the individuals who own or control the business and match their identities with public records.

- Check for Risk Factors: Screen for potential red flags, including connections to high-risk countries or industries.

- Conduct Sanctions and PEP Screening: Use global databases to verify whether the business or its owners are listed on any sanctions or PEP lists.

- Verify Legal Status: Ensure the company holds the necessary licenses and certifications to operate legally and comply with all applicable regulations.

- Ongoing Monitoring: Continuously track business changes, including ownership and legal status, to maintain compliance.

Understanding the process is vital, but it's also essential to recognize where things can go wrong. Let's look at the pain points.

Also Read: Essential Steps for KYB Onboarding Success: A Guide for Digital Merchants

6 Common Challenges in KYB Company Verification

Despite its importance, the KYB process presents several challenges that businesses frequently encounter. These obstacles can lead to inefficiencies, compliance gaps, and missed risks, which can be costly if not addressed.

Here are common challenges in the KYB process:

- Manual Verification: Relying on manual checks can lead to mistakes and slow down the entire process.

- Incomplete Data: Missing or inaccurate company records can make verification difficult, leading to gaps in compliance.

- Compliance Complexity: Managing multiple regulatory requirements across regions can complicate the verification process.

- False Positives: Automated tools may incorrectly flag legitimate businesses, increasing the number of false positives.

- Lack of Ongoing Monitoring: Without continuous checks, changes in ownership or legal status can go unnoticed, increasing risk.

- Limited Automation: Manual processes miss opportunities for time savings and error reduction through automation.

Considering the challenges we've addressed, it's evident that technology can significantly enhance the KYB process and make a tangible difference.

Also Read: Why KYB is Broken: Global Challenges, Costs, and the Path Forward

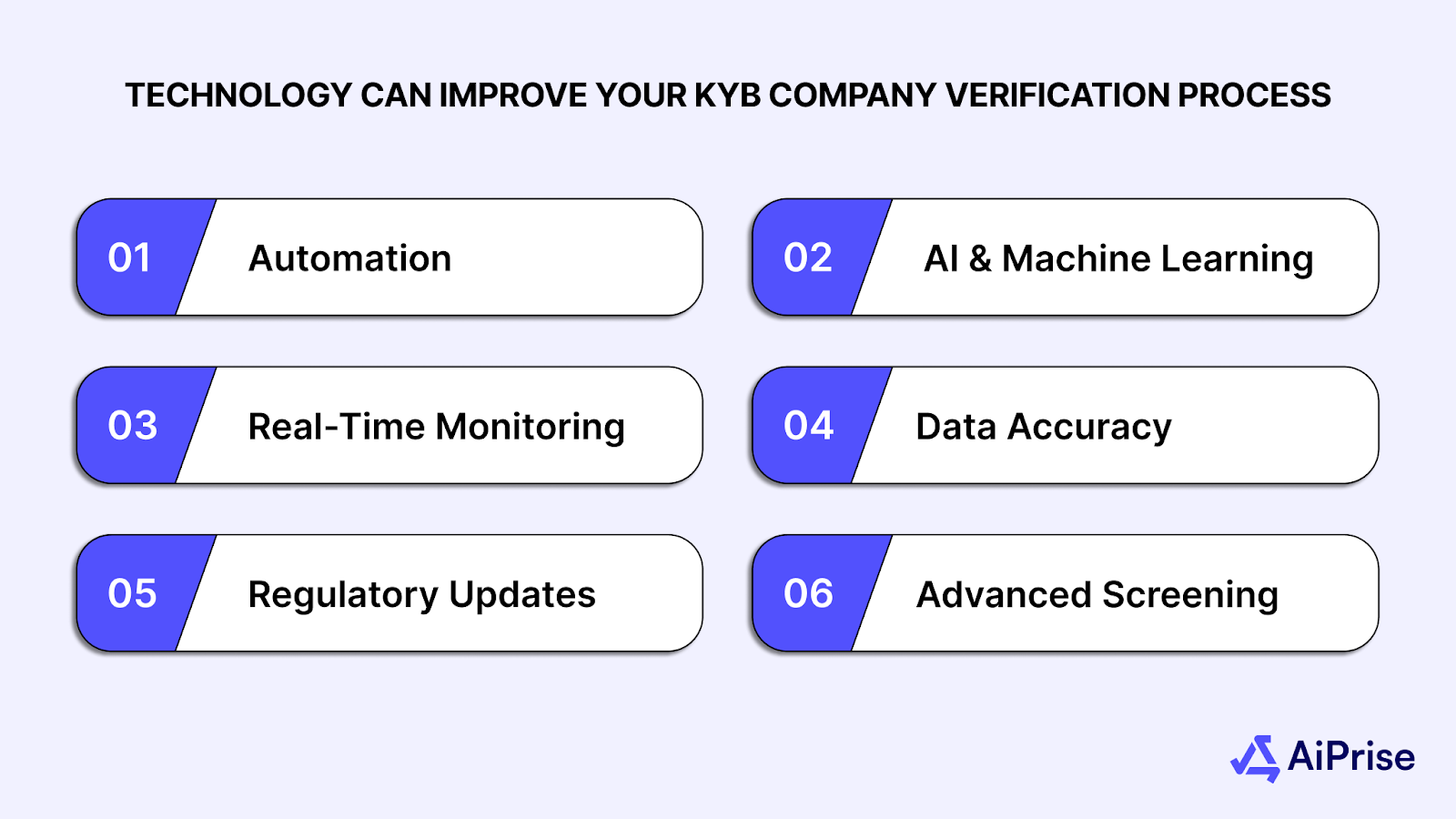

How Technology Can Improve Your KYB Company Verification Process

Technology plays an important role in enhancing the KYB process by making it faster, more accurate, and less prone to errors. Automated solutions help businesses collect data, verify information, and monitor compliance with minimal human intervention. Technology reduces the workload while increasing reliability.

Here's how technology enhances your KYB process:

- Automation: Automating data collection and verification reduces human error and speeds up the process, ensuring consistent results.

- AI and Machine Learning: AI tools can analyze large datasets to identify patterns and spot risks that may be missed manually.

- Real-Time Monitoring: Automated systems track business changes in ownership or legal status, providing ongoing risk management and mitigation.

- Data Accuracy: Technology ensures that business records are up-to-date, thereby reducing the risk of outdated or inaccurate information.

- Regulatory Updates: Automated systems stay updated with the latest regulations, ensuring your processes comply with changing laws.

- Advanced Screening: Technology enables thorough screening against global sanctions, PEP lists, and adverse media.

Technology plays a key role in optimizing KYB, and AiPrise brings these tools together to make the process even more effective.

Also Read: AI-Powered KYB Solutions for Streamlined Business Verification

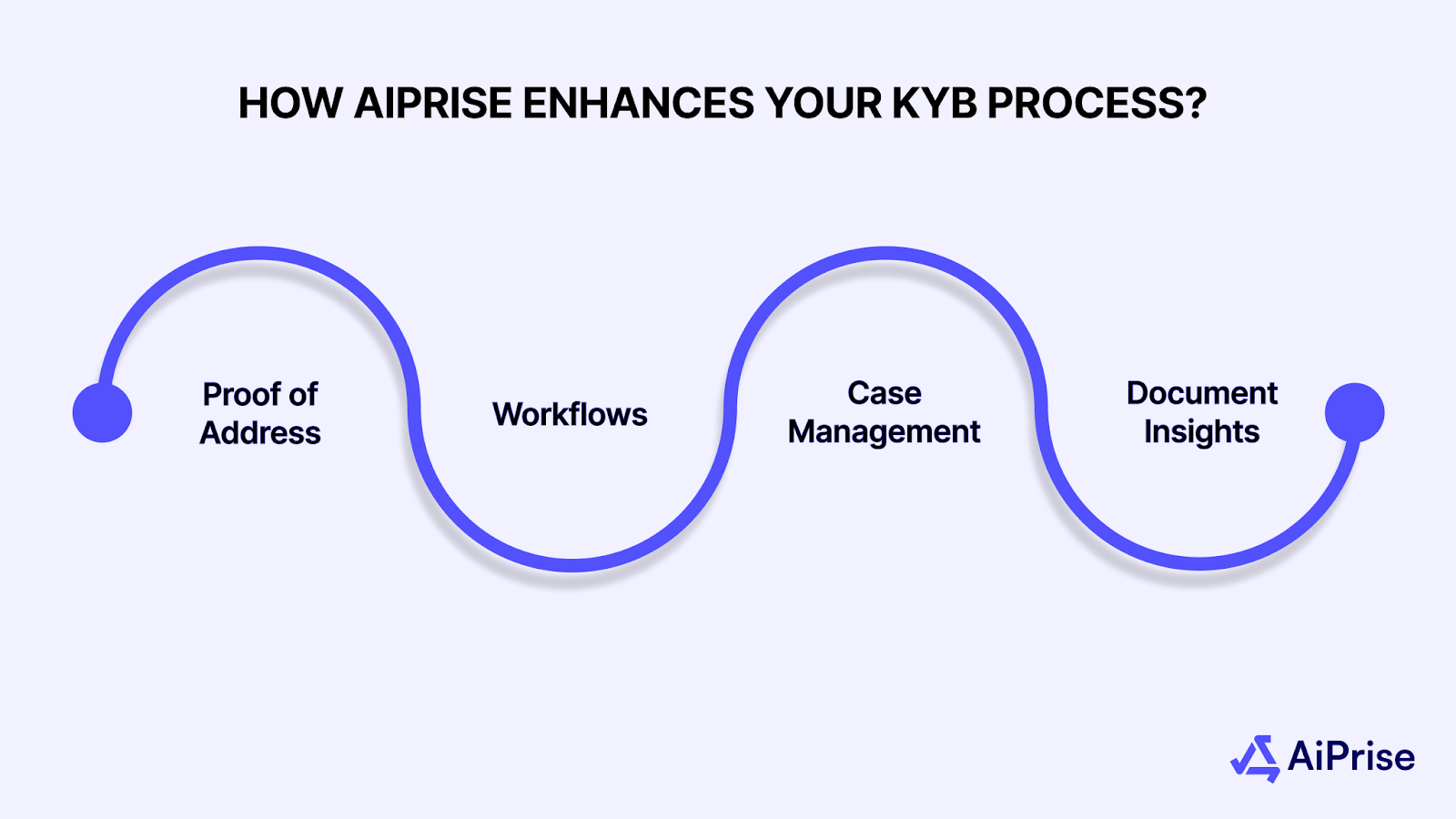

How AiPrise Enhances Your KYB Process

AiPrise offers a comprehensive suite of solutions designed to simplify and improve the KYB process. With its advanced tools, AiPrise enhances compliance, reduces fraud risk, and automates key verification steps. It helps businesses meet regulatory standards while boosting efficiency.

Here's how AiPrise can enhance your KYB process:

- Proof of Address: AiPrise verifies customer addresses quickly and accurately, improving KYC/KYB compliance and reducing fraud risk.

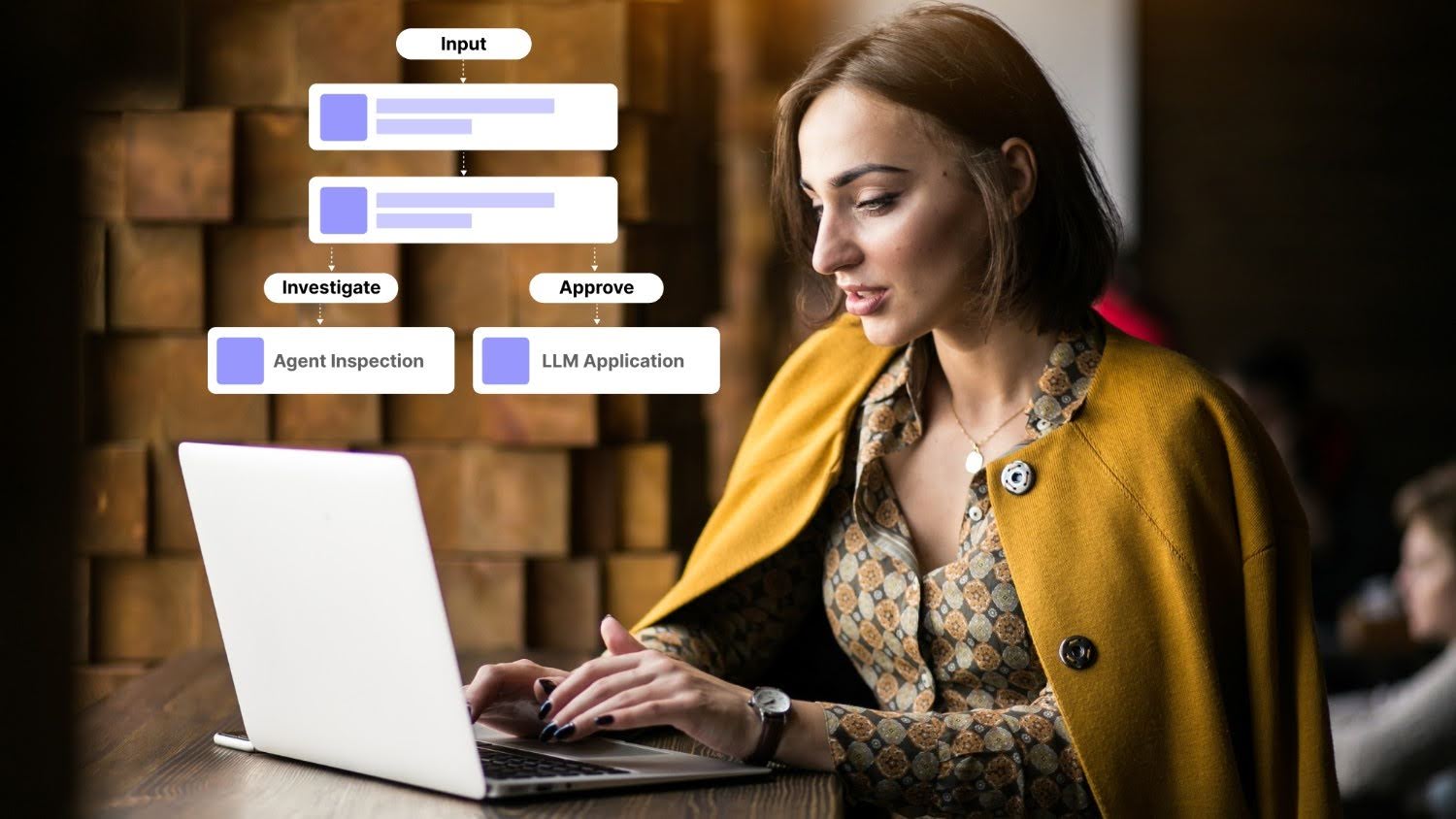

- Workflows: AiPrise allows businesses to design custom workflows, adapting verification steps to risk profiles and ensuring consistent, compliant processes.

- Case Management: AiPrise simplifies case management by enabling efficient tracking, escalation, and resolution of verification cases.

- Document Insights: AiPrise automatically extracts key data from documents, speeding up the verification process and reducing human error.

With AiPrise, businesses can ensure that their KYB process is not only compliant but also more efficient. By integrating automated tools, you can significantly reduce manual effort and focus more on decision-making and risk management.

Wrapping Up

KYB is essential for ensuring your business operates legally, reduces risk, and maintains trust with clients and partners. With fraud becoming more complex and regulatory standards tightening, a solid KYB process is not just necessary, it's critical. Effective KYB practices help protect your business and ensure compliance with minimal risk.

AiPrise offers the tools and features to improve your KYB process. From automated workflows and case management to intelligent document analysis, AiPrise helps you stay compliant while saving time and reducing fraud.

Ready to enhance your KYB process? Book A Demo with AiPrise today and see how we can help improve your verification efforts.

FAQs

1. Why Is KYB necessary For Businesses In High-Risk Sectors?

KYB is essential for businesses in high-risk sectors to prevent financial crime, verify legitimacy, and meet regulatory requirements while maintaining operational integrity.

2. What Common Obstacles Do Businesses Encounter When Setting Up A KYB Process?

Some challenges include manual data verification, incomplete business records, and managing compliance across multiple jurisdictions, leading to delays and inefficiencies.

3. How Does Ai Assist In Improving The Kyb Process?

AI helps by automating data collection, identifying risk patterns, and ensuring accurate verification, which reduces human errors and speeds up the process.

4. How Frequently Should Businesses Update Their KYB information?

Businesses should regularly update KYB information, especially when there are changes in ownership or regulatory requirements, to ensure ongoing compliance.

5. What Industries Benefit Most From Automated KYB verification?

Financial institutions, payment providers, and crypto platforms benefit most from automated KYB verification, as it ensures faster processing and reduces manual review time.

You might want to read these...

AiPrise’s data coverage and AI agents were the deciding factors for us. They’ve made our onboarding 80% faster. It is also a very intuitive platform.

.jpg)

%20Can%20Improve%20Your%20Compliance%20Strategy.png)