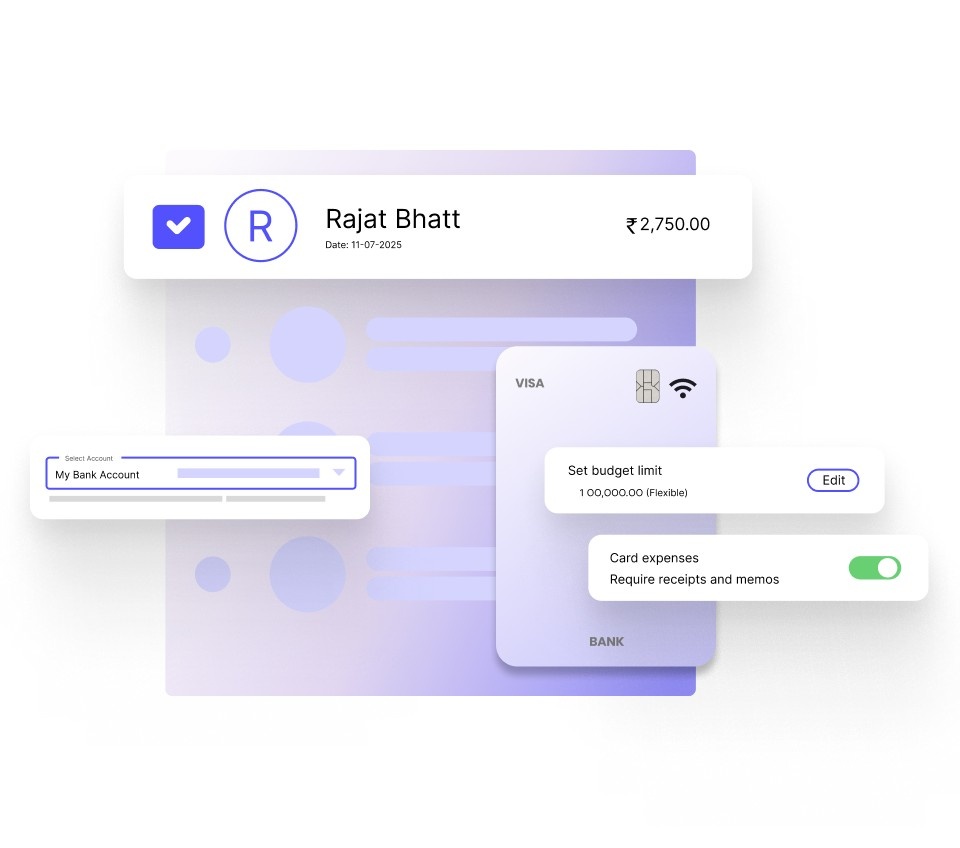

Digital Account Opening Software for Banks

Help customers open accounts faster with secure digital checks, reduced manual reviews, and a smooth onboarding experience designed to boost trust and completion rates.

Keep Fraud Out of Your Digital Account Opening Flow

Protect your bank from risky applicants with fast, reliable checks that let real customers through and stop fraud before it hurts your business.

Identity Verification That Builds Trust

Make sure every applicant is who they claim to be, without slowing them down. Instant checks help you block stolen identities early and reduce guesswork for your team. Customers get a smoother start, and you stay confident in every approval.

Document Checks That Catch Fakes Instantly

Spot altered or forged IDs the moment they’re uploaded. Your team won’t need to second-guess blurry images or questionable documents. This means fewer manual reviews and a safer onboarding pipeline from day one.

Liveness and Face Match for Real People Only

Confirm that the person applying is physically present and not using someone else’s photo. You stop impersonation attempts before they enter your system. Genuine customers move forward quickly, without extra steps that frustrate them.

Risk Flags That Reveal Hidden Threats

Get early visibility into suspicious behavior like repeated attempts, unusual patterns, or device changes. These insights help your bank avoid high-risk accounts that lead to future losses. You focus on safe customers while cutting time spent investigating bad ones.

Sanctions Screening That Keeps You Compliant

Check applicants against global watchlists and PEP databases in seconds. You avoid onboarding high-risk individuals without slowing down everyday users. Compliance becomes effortless, helping you pass audits with confidence.

Behavior Monitoring to Prevent Future Fraud

Track early signs of mule accounts or synthetic identities right after onboarding. Spot changes that indicate risky behavior long before it becomes a problem. Your bank stays protected while genuine customers enjoy a secure experience.

Upgrade Your Account Opening Experience

Help customers complete their applications with less friction while giving your team faster, clearer information at every step.

Verify Applicants Confidently From Any Region

- Wide ID Acceptance

Support applicants using local and international IDs, so no one gets stuck because their document isn’t recognized.

- Faster Review Times

Checks complete in seconds, helping your team approve genuine users quickly and reduce long backlogs that slow down onboarding.

See the average Approval Rate in any country

Approval Rate

ID Type

Deep ID Matching for Safer Approvals

Crosscheck ID details against trusted sources, helping you catch mismatches early and avoid onboarding risky profiles. Your customers move through the process with confidence, and your bank gains a stronger, more dependable verification flow.

Essential Features for KYC

Build a complete risk profile of the business using website, and other social media signals

Stay Informed Before Documents Expire

Get automatic reminders when a customer’s ID is nearing expiry, so your team can request an update early. This prevents account disruptions and avoids frustrating last-minute follow-ups.

.png)

Flexible KYC Levels Based on Customer Risk

Begin with simple checks for low-risk applicants, adding more steps only when their profile calls for it. This keeps the process stress-free for most users while giving you added reassurance where it matters.

Quick Identity Confirmation When Activity Changes

Ask customers to reverify only when key details change or unusual actions appear on the account. This protects against unauthorized access without overwhelming users with constant checks.

Frequently Asked Questions

Ready to Get Your Heat Pump Running Right?

Schedule your service today and experience professional HVAC care you can actually count on.

Essential Features for Digital Account Opening

Equip your bank with the tools that help customers complete applications faster while giving your team the clarity needed to approve accounts confidently.

Fast Identity Verification

Confirm customer identities within seconds using verified data sources. This reduces manual review time by up to 40 percent and helps your bank approve genuine applicants without slowing down the process.

Accurate Document Analysis

Detect incomplete, altered, or suspicious documents the moment they’re uploaded. Your team avoids repeat reviews, cutting document handling time significantly.

Unified Application Management

Track, review, and resolve onboarding cases from a single dashboard. This helps your team collaborate better and reduces context switching during peak periods.

Automated Watchlist Checks

Screen applicants against global sanctions, PEP lists, and adverse media in real time. Your bank gets an added layer of protection without extra manual steps.